Stagflation ahead? Deflation? Inflation? Will stocks hit new highs or new lows? What about gold? Are bonds safe going forward? These are the big market questions.

Below, we give you the blunt, informed answers.

But first things first…

A Special Memorial Day

Despite all the insanity, uncertainty and even policy folly which currently impacts our world, we can all agree on this Memorial Day that our first order of business is to simply pause and acknowledge the men and women who have served our country from the opening shots at Bunker Hill to the latest deployment overseas.

A friend sent me this piece as well on the Doolittle Raiders. Click here and try to keep your eyes dry.

To all of you who served in uniform, Tom and I therefor nod in solemn gratitude, and that includes a personal salute to my own colleague, Tom Lott, who walked from Yale to Vietnam in the same year without hesitation to serve his country.

I raise my glass.

Turning from those in uniform to those making headlines from Congress to the Fed, or from the stock market to Main Street, the history currently being made is also memorable, but with a lot less heroics and a great deal more controversy.

So, let’s look at those big market questions.

The Stock Market—Up or Down?

As peak COVID infection seems hopefully behind us, many are wondering if the stock market is now ready for new, all-time highs.

April, for example, saw massive surges from the March lows on every major exchange and in nearly every asset class.

Bulls are pointing to such surges with greater confidence.

We at Signals Matter, however, won’t join the bulls.

Why? Because experience, data, history and blunt-speak won’t allow us to sling the BS that often follows large packs of bulls…

Looking at the same market in which the bulls sell their hope, we are seeing extreme daily price moves of greater than 200 points (18 such days since April) which are NOT signals of a new bull trend, but are in fact the classic symptoms of a confused market signaling toward a decidedly bearish horizon.

Folks, recessions, such as the one in which we now find ourselves, are not the ideal settings for bull markets, even if Jay Powell’s itchy trigger finger on the money printer makes Ben Bernanke’s money bazooka seem like a pea-shooter in retrospect.

As we’ll discuss below, the Fed can’t stop a bear market, it can only temporarily reduce tail-risk extremes. At Signals Matter, we won’t risk current dollars on temporary surges.

Sure, the Fed can print trillions in a matter of weeks to buy commercial mortgage-backed securities (CMBS), corporate credits, muni bonds and even (embarrassingly) junk bonds (HYG).

Soon, we might even see Powell turn Japanese and buy stocks as well. (But ask those living in Japan how well that worked…)

And equally soon enough, the current counter-trend rally off the market’s March lows will run out of juice and the recession data ahead will not be kind to stocks, unless a vaccine for COVID is imminent, herd immunity is achieved or the Coronavirus simply dissipates naturally.

Failing such a welcome scenario, there can be no V-shaped recovery in either the markets or the economy.

The bulls, of course, can naturally argue that the “all-powerful” Fed has their back, joined by the ECB, BOJ, BOE and PBOC watching the backs of their own flock. Fair point. Central bank support IS massive.

But as our readers know, our longer-term faith in central bank magic is less gullible.

This stance is based partly upon the fact that Powell suffers from the same disease of “double-speak” which spread virally from Greenspan, to Bernanke to Yellen and then directly to him.

Remember when Bernanke said no recession ahead on the eve of the 2008 crisis, or when Yellen famously forecast that she’d never see another recession in her lifetime?

As for Powell, the day he took office, he famously declared that “the Fed is not in the business of bailing out asset markets.”

Well, as anyone who knows the history of our rigged to fail markets from the day Greenspan bowed to Wall Street in 1987, you also know that such a grand statement was just, well, another grand farce…

Furthermore, when one considers the historically unprecedented amount of money Powell has just handed to Wall Street, it is fairly clear that Powell is indeed “in the business of bailing out asset markets…”

Folks, simply look at all those junk, corporate and commercial real estate bond issuers who just got bailed out.

Why the bailout?

Simple: Since 1987 in particular (i.e. when Greenspan took over the Fed), the leadership at the Eccles Building immediately decided that the stock market was the real economy.

Their rationale was that Wall Street largesse leads to a trickle-down wealth effect on the rest of the country, despite all the contrary-proof from our dying middle class that such a policy simply doesn’t work.

Thus, instead of acting as a liquidity provider for banks, the Fed has become a Wall Street solvency-savior and tailwind for the top 10% of a country whose wealth gap is now the largest in its history.

These are just facts, not opinions.

Regardless, however, of where you sit (be it in the top 10% or elsewhere), and regardless of where your opinions as to the Fed may lean, many could still argue that unlimited Fed support (love it or hate it) for the market will at least act as permeant “floor” below which the stock market will never fall.

We disagree.

Again, and unless an immediate cure to the viral crisis is found, the tissue damage already done to supply chains, employment levels, productivity and economic growth is simply too severe to justify such faith in a “Fed put.”

In other words, with double-digit unemployment likely to continue and GDP poised to fall by 30% this quarter (and likely by negative 10% for the fiscal year), it simply defies sanity to expect markets to reach new highs in such a backdrop.

Fed Hall Pass?

Nor should one be too quick to grant a hall pass to Powell or the bi-partisan policymakers in a deficit-spending Congress due to the blameless arrival of a global pandemic.

As we’ve argued elsewhere, our economy and markets were already made grotesquely debt-fragile by those same actors well before the virus hit our markets and lives.

In short, our so-called “saviors” are the very same players who dug the hole in which we now find ourselves.

The Real Danger: A Virus or the Policy Reaction to the Virus?

Furthermore, many credible financial analysts are now acknowledging that it was not COVID-19 which sent the markets crashing in 2020, but rather it was the policy reactions to that virus that did the real damage.

Unlike FDR’s New Deal which aimed to create jobs in a crisis, the lockdowns around the world in the wake of the COVID crisis was designed to shut down over 70% of the non-essential jobs in our country, a policy which looks more and more misguided with each passing hour, despite the daily and macabre death-watches promulgated by the MSM.

Again, Tom and I are not virologists, but given the now public profile of those most vulnerable to this virus, it seems that the “experts” behind the decision to lock down the entire economy (as opposed to a specific profile of at-risk citizens) may have missed the mark…

Yes, indeed, COVID-19 is awful, but more and more credible voices are now confessing that the bigger risk facing our nation is the government’s reaction to the virus, not the virus itself.

Inflation or Deflation?

Regardless of where your own opinions fall on this admittedly touchy subject, we can all agree that $2 trillion per week in fiscal stimulus (at its height) plus unlimited QE does make one wonder if such measures ought to lead to inflation or even hyperinflation; and if so when?

The great inflation vs. deflation debate, as we’ve discussed many times, is less of a matter of debate than it is a matter of sequence.

Based purely upon price measurement, deflation (declining prices) typically precedes inflation (rising prices). Thus, the issue is not deflation vs. inflation, but deflation prior to inflation.

Deflation First

Despite the historically unprecedented amount of COVID-related fiscal stimulus (deficit spending) and monetary stimulus (money printing), the declining GDP, growth and employment numbers off the bow indicates that the “stimulus” is merely an attempt to fill a gaping hole, not stimulate new market and economic highs.

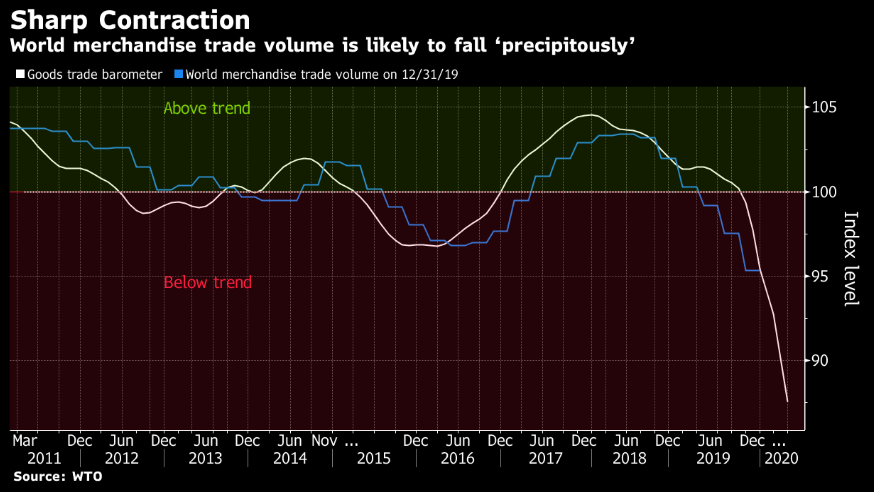

First, deflation, as world trade simply tanks.

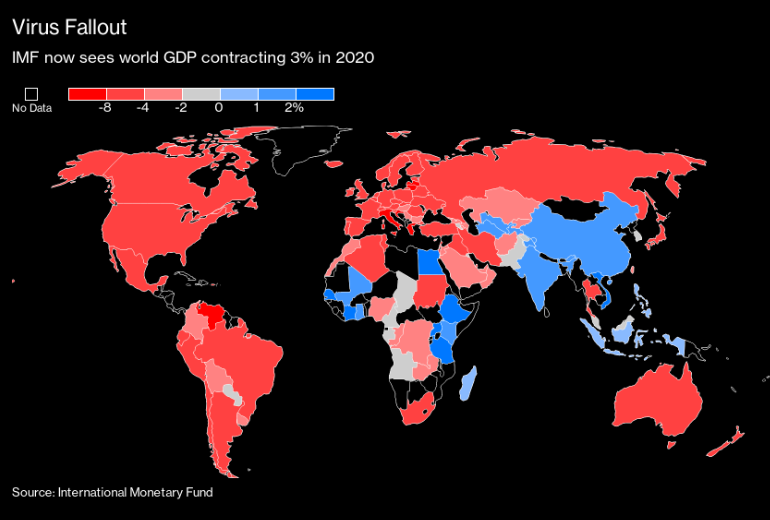

The International Monetary Fund (IMF) sees global GDP contracting 3% in 2020, across countries that matter the most.

Given these realities, stimulus measures will encourage less direct investing/spending and more savings at the business and private level.

With less spending comes less demand, and with less demand comes lower pricing in most assets, including stocks.

Thus, we foresee a significant deflationary shock in the next 1-3 years based purely on diminished demand due to falling GDP and excess capacity in the business sector and likely double-digit unemployment.

Again, deflation goes hand-in-hand with diminished demand, which is typical of a recessionary period.

Inflation Second

After this deflationary period, at some point demand (aided by insane levels of DC support) will eventually stabilize.

But what about supply metrics?

Unfortunately, and as we learned in school, the flip side to demand forces are supply forces, and we anticipate a massive slow down/crunch on the supply side of the equation due primarily to an inevitable slowdown in labor productivity and supply-chain disruptions.

And as we also learned in school, when supply shrinks, prices rise—hence the inflation to come.

Even before the COVID crisis, the almost forgotten tensions of the Chinese Trade War were already pointing toward increased protectionism and supply chain disruption.

The pandemic only made this bad situation much worse.

Post-COVID, it’s equally obvious today that nations are turning even more inward as the globalization of yesterday is slowly being replaced by the more localized, “my nation first” mood of today.

What I’ve seen from DC, to New York to Paris in just the last week of travel are hints of a future trend toward increased populism, nationalism, isolationism, protectionism and even socialism.

Heck, and as far as the numbers coming out of DC now confirm, Wall Street socialism is already a reality, as it has been for years.

For those who know their history, each of these inward-leaning forces leads toward a shrinkage in globalized supply chains—and hence inflation down the road.

Hyperinflation? Not Likely.

But what about the hyper-inflation that so many are naturally asking about?

After all, with central banks poised to print trillions and trillions more to “stimulate” their already debt-sick economies, won’t that lead to possible hyper-inflation—i.e. wheel barrels of increasingly debased currencies reminiscent of Weimar?

This seems like a reasonable assumption, but as I argued recently here, in the ironic case of the United States, the high demand for US dollars from the Euro Dollar, Repo and SWIFT exchanges allows the US to print massive amounts of dollars without otherwise tipping toward hyperinflation.

Stagflation? More Likely.

Instead, we are currently anticipating stagflation to follow the current period of deflation. That is, 3 years out, expect rising inflation levels combined with stagnating economic growth—i.e. STAGFLATION, no fun at all.

Gold’s Time to Shine

Central banks will continue to print more fiat currencies around the world, debasing their currency values with each passing second.

Needless to say, this is why investors should think ahead and seek out assets that serve as inflation hedges.

That’s why gold is finally making headlines, despite our foresight in this asset years ago.

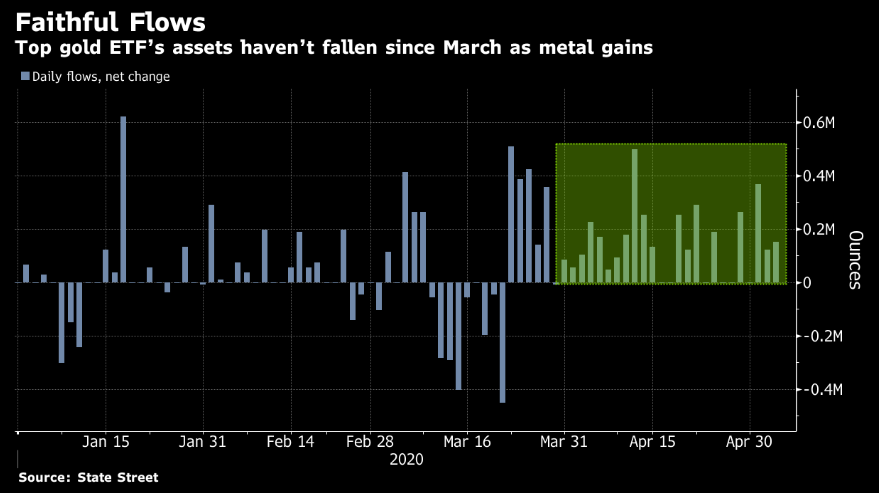

Holdings in SPDR Gold Shares, the largest bullion-backed ETF, last fell in late March, marking the longest run without a decline since 2012.

Although the gold bugs were hoping for $3000 gold by now, we are more patient though no less high-conviction about gold, and for many reasons.

First, gold is already up 11% year-to-date, and we like that. It’s clearly a better performing asset than many others.

We’ve also argued elsewhere that gold will continue to rise even in a deflationary setting, which was traditionally seen as “bad” for gold.

This is because gold also thrives when distrust in central banks, currencies, governments and future stability rises; and we all sense such rising distrust and uncertainty.

In addition, we feel the gold-tailwinds of inevitable money printing to come will greatly outweigh the deflationary gold-headwinds.

This, combined with declining trust issues in a now openly destabilizing economic cycle will add to gold’s appeal and rise.

Furthermore, and despite the Fed’s post-March 22 efforts to bail out just about every “fallen-angel” asset under the sun, from junk bonds to commercial real estate, it would be naïve to believe this can continue forever without eventually seeing a rise in corporate loan defaults and delinquencies.

In short, the Fed can’t bail everyone out, and many of those “angels” were just debt-dead “zombies” poised for impending default.

The eventual rise in such defaults and delinquencies will create more investor instability, and as stressed above, gold will rise not just as an inflation hedge, but as a hedge against recurring instability in the bond and stock markets.

Other Inflation Hedges

In addition to gold, inflation-savvy investors will eventually be turning their portfolios more toward other inflation hedges such as commodities, real estate (especially farmland), consumer staple and health care stocks and TIPS.

As inflation data eventually rises, even cash, which we use now to hedge market volatility risk, will be less attractive, as the purchasing power of cash will increasingly erode as we pivot from a deflationary to inflationary backdrop.

And don’t worry, we at Signals Matter will be tracking this evolution from deflation to inflation for you, as well as positioning your portfolios to prepare for the inevitable.

If that sounds reasonable to you, simply join us here and be ahead of the cycle rather than too late.

Credit Markets—Is There Any Yield Left?

As to where the bond portion of your portfolio is heading, we admit that there’s not a lot to be excited about in the low yield Twilight Zone handed to us from years of extreme central bank intervention in the global bond pits.

With central banks in Europe and Asia already seeing negative yields on 10-Year sovereign bonds, it’s possible the same could happen to our US Treasuries, though at least the risk of default there is zero.

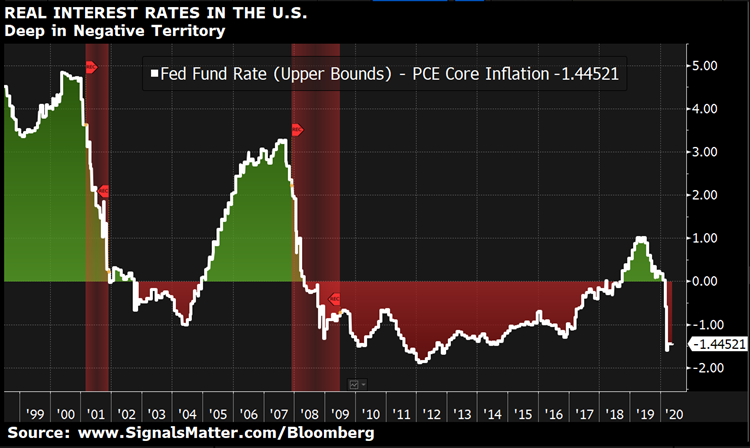

Negative yields means you are paying to lose money. Sound crazy? Well, …Subtract PCE Core Inflation and we’re already there.

Furthermore, the Fed has already admitted that it will directly support state and local governments in the coming/current recession, as these parties are a critical component to our already dying GDP, and thus support for such bonds—i.e. muni bonds– is all but guaranteed going forward.

Of course, CCC distressed credit and junk bonds, as their titles suggest, are heading for eventual defaults and delinquencies and should be avoided by all but the most risk-averse.

The paltry yield for such junk risk is simply not a good trade.

That said, there are some single-A corporate bonds that can offer some yield with relatively low default risks which smart investors can add to their portfolios.

Again, our subscribers will be safe, as we know where to look and when and how to allocate, for the simple reason that we track facts not headlines.

For a look at our portfolios and how we construct them, if not already a Subscriber, you can Sign Up here.

For today, however, let’s track those who deserve the highest praise and remember our veterans with gratitude and praise.

Sincerely, Matt & Tom