Ever since Signals Matter first began reporting on the topic of gold investing in 2017, many subsequent reports have followed, including the two most seminal reports HERE and HERE.

As with most informed investing, the far-sighted, patient money moves well ahead of the headlines, and since our first gold investing reports, we’ve stuck to our convictions. Our take on gold investing has done exceptionally well.

As expected, however, the financial media is just now beginning to give gold investing some mainstream attention.

However, perhaps no other figure, as well as fund, deserves more credit for being far ahead of the crowd when it comes to gold investing than Incrementum’s fund manager, Ronni Stöferle.

His annual “In Gold We Trust” reports over the last 14 years have grown to become the industry standard in gold research, straight-talk and exceptional data support.

This thorough 350-page report, available in English, German, and Mandarin, is highly recommended to those with a serious and long-term approach to precious metals and can be downloaded for free HERE.

For a less lengthy analysis, however, I have promised our own readers another update on gold investing and have distilled some key themes for your consideration.

First—The Bear Market Rally

With stocks in the US now crossing 200-day moving averages (and passing other technical resistance lines), the robotic (i.e. macro-indifferent) quant trading systems (that make up greater than 90% of the stock market’s daily trade volume) are taking their software signals from a totally Fed-supported market rather the honest macro fundamentals—at least for now.

In short, this “terminator market” of algo’s and computers is largely blind to the human, all too human realities of a now totally artificial securities market.

This means markets move on printed money, repressed interest rates, and machine-driven thinking.

Such a QE/Debt-driven and Fed-supported market, of course, is horse crap and has nothing to do with natural supply and demand or Adam Smith, but whatever one wishes to call this new Twilight Zone market of open Fed Fraud, we can only confess that “it is what it is.”

At Signals Matter, we may feel disgust for such artificial markets, but our highly risk-managed portfolios won’t fight them.

That said, we can’t just “ride the Fed wave” with 100% enthusiasm. Far too many risks and rocks lie just below the surface.

Again, we are agnostic to bull or bear theories and trade on signals and realism, not opinions, despite my deep supply of opinions…

Nor, however, do we blindly ignore the fundamentals, because despite this Fed “surge,” we still believe that they (and risk management) matter. Eventually, market realities will get the last, dark laugh over this current, central bank rally.

Meanwhile, the crazy continues. Notwithstanding…

- Absolutely sickening macro data,

- Record-breaking unemployment (40 million Americans out of work),

- Tanking GDP,

- Negative real yields on 10 Year Treasuries,

- Massive Fed balance sheet bloating,

- Tensions with China,

- A trend toward negative interest rate policy, and

- A Fed openly buying US securities (including junk bonds) while cities and tempers burn across the US…

…stocks are racing toward new highs.

Such a blatant disconnect between economic reality and market fantasy is all the proof one should now require to recognize that these markets are as rigged as we said they were last June.

But as I’ve written elsewhere, so long as the Fed wants to dope the markets with printed money and grotesquely unthinkable debt levels, a nuclear bomb could go off in Cleveland and nothing would phase this totally “accommodated” market…

In short, when it comes to stupid stock valuation, nothing much matters (for now) but more “faking it” at the central bank level, and gobs more debt to come.

This, of course, is not a natural market, and has prompted straight-talking market experts like Chris Cole and Ronni Stöferle to declare that capitalism has almost died.

Frankly, I’ve taken this a step further, declaring last year (even before COVID-19 triggered a recession which was already on its way), that capitalism IS dead, and I explained why in this report HERE as well as throughout the pages of our Amazon #1 Release, Rigged to Fail, available HERE.

Again, even before the pandemic gave central banks a global license to kill natural price discovery and good ol fashioned capitalism, a recession was clearly right off our bow as evidenced previously by yield curve inversions, 70% of global PMI’s in the negative, and mega-economies like my dear Germany already an eyelash away from recession.

So, what do these fundamental market facts have to do with gold investing?

Actually, a whole lot. So, let’s dig in.

Capitalism Out, Centralized Economies In: More Tailwinds for Gold Investing

The 2020s will mark a golden era of long-term gold investing for a number of converging reasons.

Trust Erosion

As I previously indicated here, one key reason to consider gold investing is simply based upon the massive erosion of trust in the major currencies of the world as central banks from DC to the EU and Tokyo to Sydney continue to print money to buy their own debt, thereby debasing their currencies with each passing second.

Stöferle correctly calls this “COVID socialism,” I call it “Wall Street socialism,” and it has been going on for years, not months…

Such currency dilution is inevitably a tailwind for precious metals in general and gold investing in particular.

The COVID crisis only exacerbated this horrific trend of currency murder, as central banks around the world printed over $10 trillion in a matter of weeks this year alone to prop up their otherwise dead bond pits.

Gold is already up 14% in dollar terms, and last year it rose by 19%.

In Australia, the rise of gold against the Australian dollar is already up 20% this year, which is a direction we called last summer in my report to the Ozzies on the currency risk ahead.

Macro Realities—Debt Gone Wild

On top of currency distrust, more investors are catching onto the harsh macro and debt realities, which only a drunken US stock market, for now, seems to be ignoring.

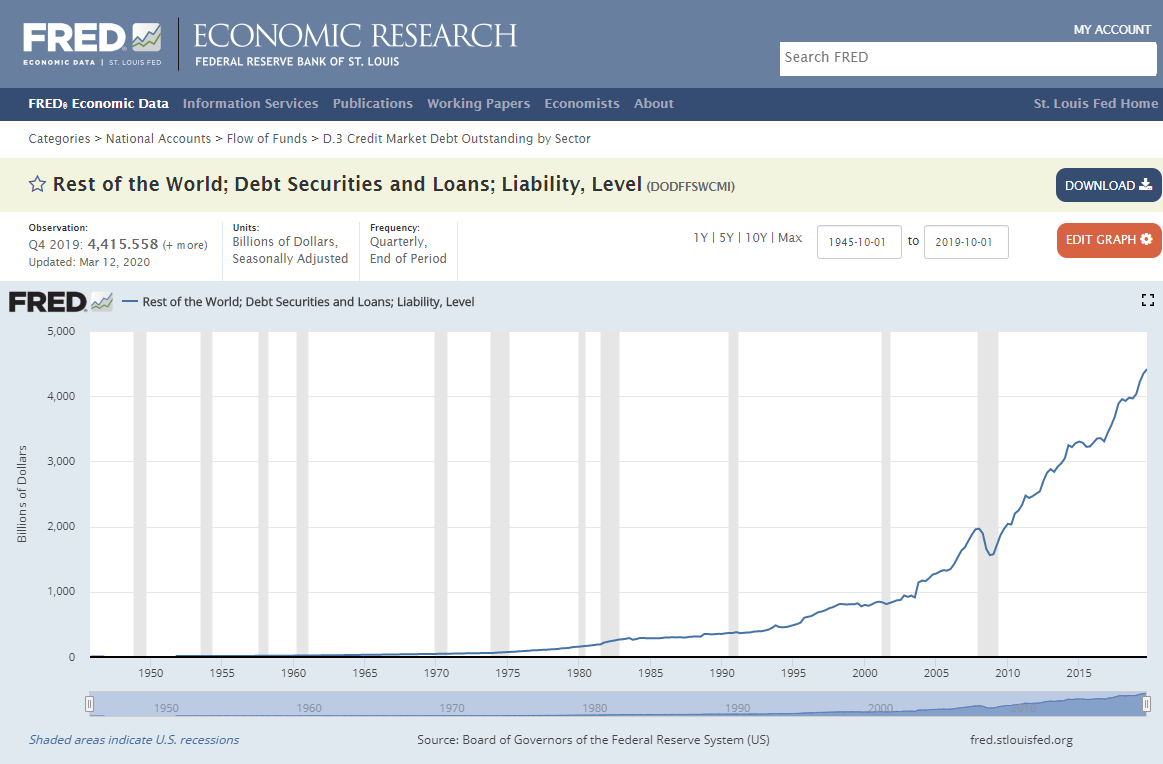

When one considers (i.e., tacks on) the trillions more in fiscal stimulus (i.e., deficit spending, or DEBT binging) alongside the currency-killing monetary stimulus added this year, global debt levels have gone from the horrific to the just plain absurd.

Already, the forecast for global debt to GDP for 2020 is expected to climb to 125%, a figure pointing dangerously to a moment in time in wherein debt simply becomes unsustainable at worst or non-yielding at best.

Again, investors are catching onto these debt realities and losing trust in their currencies as well as their yield-less bond markets.

Here, again, is where gold investing steps in, as it has already broken new highs against every currency in the world except the US dollar, for reasons I’ve explained elsewhere.

But even the strong US Dollar, driven by a global dollar shortage (and hence rising demand) from the dollar-thirsty repo and Euro Dollar markets, can’t stay this strong forever, including against gold.

Furthermore, a strong dollar is fatal to US exports, which explains why Trump wants a weaker rather than stronger dollar going forward in the coming years of rising trade tensions.

We see something akin to another “Plaza Accord” to recalibrate the dollar in the years ahead. When it comes to gold investing (as opposed to day trading), our patient gold outlook is precisely that: Years ahead.

In simplest terms, gold investing is a critical insurance policy against burning currencies.

Meanwhile, gold inflates at a rate of 1.6% per year, while the money supply is growing by greater than 7% per year ever since Nixon took the US off (i.e., welched) the gold standard in 1971.

With money printing gone wild, the trending rise in gold investing (with obvious corrections here and there) is all but inevitable, to the extent one can be sure about anything in this surreal “new abnormal.”

Critics of gold have long argued that gold yields nothing, but in a world of negative real yields on just about every sovereign and corporate bond under the sun, can anyone honestly say that bonds yield anything at all?

In 2008, yields on the US 10 Year Treasury were 3-4%, today they are effectively zero in nominal terms and well below zero in inflation-adjusted, real terms.

As for the US Treasury bond, what was once considered a bond of “risk-free-return” has now become a bond of “return-free-risk.” The ironies do abound.

We, therefore, anticipate gold slowly replacing bonds as both a risk hedge and store of value in the years ahead for the simple reason that the bond market, thanks to decades of central bank “support” (aka: intervention, aka: “faking it”), is effectively a centralized zombie rather than a natural credit market.

In short, with bond markets yielding nada, nichts, rien, zero, bubka, and with stock markets totally past the point of natural sanity, gold emerges as one of the few and historically consistent safe havens left in a global economy otherwise completely reliant upon central bank respirators which destroy currencies and feed cancerous debt tumors with each passing day.

The Technicals & The Big Names

Just last June, gold was hitting resistance at the $1,380 range, and since then has simply skyrocketed into a new trading range with technical support at the $1,680 level.

Given such macro, trust and technical signals, more generalist advisors and even the latent mainstream financial media are now catching on to the gold investing narrative with greater speed, increasing their allocations and headlines to gold ETF’s, whose trade volumes are increasing rapidly in 2020.

The institutional and “bigger” names are also openly discussing gold investing with greater consistency and effort, including such well-known hedge-fund managers as Paul Tudor Jones, Druckenmuller, Zell and Dalio.

Gold, of course, is not the cure-all, but the smart and far-sighted money clearly sees what we’ve seen for years, namely that gold should be a part of a long-term, sophisticated portfolio.

In recent weeks, for example, gold performed as a portfolio stabilizer, especially during the volatility of Q1.

We are now seeing more institutional players catching on and considering gold as an equal, if not better, portfolio stabilizer than yield-less bonds.

The Deflation/Inflation Debate

Most gold investors in particular, or even commodity investors in general, recognize that commodities tend to underperform in deflationary settings and rise in inflationary settings.

Recently, there’s been much public debate as to “inflation or deflation.” Still, as we’ve consistently argued for years, there really is no debate at all, as deflation precedes rather than out-laws inflation.

In other words, be ready for both deflation and inflation.

For now, the deflationary forces are obvious.

In a world forced into a financial lockdown following the COVID hysteria, consumer demand tanked along with supply-chain disruptions making production and consumption low, which weakened global demand and fanned deflationary pressures.

As Stöferle has quoted elsewhere, usually there are three stages of inflation: First) the safe period when we see an increase in money supply with no dramatic rise in the price of goods (i.e., happy deflation).

Secondly, is the phase when asset prices start “inflating”—which we’ve seen in the 350% rise in stocks since March 09 (i.e., the drunken phase).

The third phase is when the public loses faith in their currency and rigged-low inflation data and starts looking seriously at currency alternatives like gold and bitcoin, itself up 27% year to date.

When that third stage arrives, inflation replaces deflation slowly but surely. As I’ve written elsewhere, this may not immediately lead to hyper-inflation, but it does lead to stagflation—i.e., tanking growth and rising prices.

No one sees this 3rd stage of stagflation coming, including the Fed and the mass of retail investors.

For years, central banks have been getting drunk on martini after martini (Stöferle uses the tequila analogy) of printed money and cheap debt, as if drunken highs were a permanent solution.

Unfortunately, the central banks and Keynesian-mad masses have forgotten one simple and historical fact: A market hangover always follows a debt and money-printing binge.

For now (and likely a few years to come), however, the velocity of money so critical to inflation has been held in check by trillions of dollars still kept in Fed reserves rather than washing over the real economy.

But as I (and philosopher/economist David Hume) warned us here, once central banks start becoming direct spenders (rather than borrowers) of that printed money, the velocity picks up, as does inflation.

With the Fed now making direct investments in bonds, and likely stocks next, that velocity/inflationary shift “comes slowly at first, and then all it once,” just like Hemingway’s description of poverty.

For now, however, lower productivity, increasing populism, declining loan growth from commercial banks, and less globalization post-COVID will act to delay this velocity and the pressure of inflation, something the majority of today’s financial advisors have never experienced.

Despite these deflationary facts and a strong dollar (normally headwinds for precious metals), gold keeps rising. In short, gold is telling us that inflation is coming.

Commodities in General

Gold is a commodity, but a very special kind of commodity. It acts differently for all the reasons expressed above and elsewhere at Signals Matter.

But there are still compelling reasons to think of commodities as a viable asset class when it comes to those readers who play the long game rather than just the market putting green.

Commodities, in general, have been weak performers for a while and are relatively weak now. The CRB is down 30% this year, which is 70% below its all-time highs.

Rather than see this a concern, value investors can smell an opportunity to be smart—namely: buy low and sell high.

Commodities as a class are at their lowest levels vis-à-vis the DOW since the 1960s. For me, that signals a great value buy for those with the stomach and patience to play the long game rather than the day-trade.

Today, for example, oil, copper, and silver are good values even if your friends on the golf course laugh at you.

Furthermore, as the real economy slides into a recession despite a rising stock market (for now), the world will soon “turn FDR” and commence all kinds of “New-Deal-like” infrastructure and public works projects, which will be an eventual catalyst for commodities.

Silver

As for silver, it follows gold’s lead and tends to race higher (and faster) when gold conditions are good.

Already, the gold/silver ratio has fallen from 125 to 100, as silver’s rise toward 25 seems highly inevitable.

Silver is still trading relatively low, but picking up. Silver, unlike gold, is a byproduct of copper and zinc production, so industrial demand, now subdued, is a key part of the current silver story.

With productivity now in a slump, this can be seen as bearish for silver; however, this is offset by the fact that the supply of silver is now in contraction, so in the near-term, silver will be vacillating between lower demand (bearish) and tighter supply (bullish).

Precious Metals Mining Stocks

Mining stocks are trailing the metal price now, though the mining sector has seen moments of outperforming even tech stocks because the good miners (admittedly a minority), exercise better capital discipline, margins, and cash flow.

Today, as many name-brand stocks are canceling dividends, the miners are actually raising dividends.

That said, mining stocks are not for the faint of heart or the weak of analysis, as many mining companies suffer from notoriously bad management, M&A deals, and other operational risks.

In short, one miner is not the same as all miners. Be warned.

The smarter money, including the generalists, and particularly in places like Canada and Australia, see that certain mining stocks (Newmont, Barrick) and key royalty companies will rise with gold’s longer-term rise.

The Crypto Question

I wrote about my preference for gold over crypto’s here. Still, frankly, the debate is both academic and ironic, as both Bitcoin buyers and gold investors are equally correct in their distrust of traditional currencies, and the 27% rise year-to-date in Bitcoin is nothing to laugh at.

In short, digital assets are no longer to be openly discredited; they have received increasing regulatory controls and acceptance by the markets for a reason.

Both gold and cryptos are valid antidotes for a global currency system galloping toward a crisis. So, which approach will you take?

I’m currently reading a book on the battle of Gettysburg in the summer of 1863. Both opposing generals, Lee and Meade, knew that a victory required both cavalry and artillery.

I think of gold and cryptos in the same “commanding” way: There’s nothing wrong with using both.

In the end, however, one needs strong and tested foot soldiers (infantry) to carry the day, and for me, this means gold.

Signals Matter, of course, is a portfolio service, not a commodity platform.

My thoughts on gold are not necessarily part of our industry-leading portfolio service, but are relayed here for those readers who are looking to allocate longer-term cash positions into an asset outside of their Signals Matter portfolio, which is designed to actively track current markets.

For a look at our current Subscriber Portfolio and to track our current analytics and thinking, you can sign up here. Have a look. Here’s what our Subscribers are saying.

Bottom Line: For those with the means and willingness to place some of your funds into gold, my views are clear: gold investing is a long-term insurance investment, not a short-term speculative trade.

Of course, the decision on gold investing is yours alone, but I hope this and other gold-related reports give you plenty to consider.

Sincerely, Matt & Tom

Matt, once again, this is just exceptional work/analysis. Taken individually, or in conjunction with your other gold reports, you paint an honest and succinct picture for precious metals. I can’t tell you how grateful I am for the work you put behind these reports–they are infinitely superior to what I’m getting from other sources.

Curious if the Fed will ever raise rates again? Do you think negative rates are indeed coming soon?

Thanks! I’m glad you’re getting more perspective on this special commodity.

As for the Fed raising rates, I wouldn’t hold my breath. They literally can’t afford to at these debt levels. Those days are long gone, despite Powell’s efforts to do so in 2018-19, but we all know how that ended by Christmas, 2019…

As for negative rates in the US, check on my report in May on precisely that matter. Hope it helps!