Below we look at market stimulus, hope vs. fear and all the reasons investors need a plan rather than a fantasy to stay afloat.

Hope vs. Fear, Market Stimulus vs. Economic Reality

As of now, most of you are fairly resigned to the fact that markets (both credit and equity) are entirely over-bought, as well as entirely, and artificially supported by “market stimulus” from the Fed or deficit spending (i.e. debt) from DC.

As for bonds, I’ve explained the bloated bond market in monstrous detail elsewhere.

The fact that real yields are negative is all the proof one needs to recognize how the bond market is a bubble, plain and simple.

And as for stocks, their PE ratios scream equal “bubble” warnings by the day, and thus, as we recently warned, both stocks and bonds are sharing the same embarrassing profile as bubble assets.

That, of course, is not a good thing for risk-parity portfolios when thinking ahead or thinking about risk management.

Clinging to Hope in a Frozen Ocean of Risk

What’s far sadder, however, is that markets recognize these risks, yet cling like Kate Winslet in the Titanic to any hope that a life-raft of more debt, market stimulus or aid will keep this otherwise drowning market afloat.

Thus, any news about more debt, more aid or more fantasy sends markets up, and any headline which says otherwise sends markets down.

In short, the last indicator of an otherwise already-busted market is now hope and fantasy.

Hope & Fantasy Headlines—The New Market Indicators

Headlines, tweets and media influence have just as much (if not more) impact on these markets than anything resembling natural price discovery.

Months back, for example, I cringed at how the sell-side media was trying to cajole suckers into the markets by suggesting a COVID vaccine was just around the corner. That was hopeful, no?

Headlines, even bogus ones, can move scared markets.

In case you don’t believe me, I saved some of those headlines here. Read em and weep. It’s funny how even hope of a vaccine was almost as good for markets as an actual vaccine. Crazy how it all works.

But then again, vaccine or no vaccine, these markets were sick long before the virus arrived.

The current see-saw of market stimulus or no market stimulus is another example of headline driven market manipulation.

Like donkey’s fighting for scraps of hay, our topped-out securities market is begging for more deficit spending and money printing (i.e. “market stimulus”) to keep the keg party on Wall Street stoking past the 12-year marker…

“Market Stimulus” of course, is a nice word, but when you look deeper, it just means more debt we can’t afford, and more printed dollars whose intrinsic value is shrinking by the day.

In short, don’t be tricked by nice words.

Whenever talk of more “market stimulus” hits the news, investors flock from dangerous bonds into even more dangerous stocks.

Tea Leaves vs Bond Yields

This panicked and headline-driven sprint from hope to fear, and then fear back to hope, is in fact easily traceable by simply watching boring things like bond yields.

But hey, Tom and I love this boring stuff.

In the chart below, the white bond yield rises whenever investors sell out of bonds and run toward stocks when more hopeful “market stimulus” is announced.

Inversely, that yield line tanks when those same investors then get scared and run from stocks and back into the burning barn of the bond market because they actually think it’s safer there when the “market stimulus” subsides.

See how yields dove (as bond prices and fear rose) when market stimulus talks stalled:

What most investors fail to see, however, as they run back and forth between bonds and stocks depending on their market stimulus adjusted levels of hope and fear, is that both stocks and bonds are equally dangerous.

As we’ve warned here, most investors simply don’t know where to hide when their fears begin to peak.

Those who are relying on bonds to “hedge” stock risks are not diversified, they are “de-worsified.”

That’s why our Portfolio Solution is about meaningful rather than traditional diversification, and further explains why our Portfolio Suggestions were up 0.43% on the day, 1.83 percentage-points above a falling S&P 500.

Meanwhile, these nervous markets can go up or down depending on 50-character “market stimulus” tweets from the President. Will he stimulate, or will he not? Is there hope or is there fear?

In short, investors, much like the Federal Reserve, are looking more and more like nervous (or even headless) chickens running around the barnyard, not sure whether to panic, lay an egg, or jump for joy.

In the old days, before central banks, debt and market stimulus determined market pricing, one could measure risk and invest based upon actual market data rather than trying to speculate on the political caprice of more market stimulus or less market stimulus.

But markets as otherwise dead as ours, need that market stimulus to survive, as actual, free-market Capitalism died long ago.

Again, we are now at a time where fear and hope, market stimulus or no market stimulus, are what markets cling to.

Such desperate moods and reliance on market stimulus rather than market facts are always the last emotional cycle of a dying market and economy.

What Gold Has to Say about Fear & Hope

But based on the record number of inflows into gold ETF’s, I’d wager that the chickens are getting more nervous than usual. Fear is surpassing hope.

I’ve written many, many times about gold—i.e. here, here, here or here.

I highly recommend you revisit these reports, as their importance grows with each passing day as these rigged markets, discredited central banks, squawking politicians, falling economies and economic projections get more and more absurd and hence less and less trusted.

As I wrote here, gold is a measure of many things, but it’s also an emotional barometer as to fear and hope.

As fear rises, so too does investor interest in precious metals.

Hope Floats—as Do Tech Stocks

Speaking of emotion, we’ve also been tracking the euphoria and hope that tech stocks in general, and the FANG stocks in particular, have been enjoying as the rest of the global economy literally rots all around us.

I spoke at length in this August video about the dangers of a stock exchange whose primary value is concentrated into just a handful of mega-market-cap stocks.

Rather than celebrate the success of five or six tech stocks, we should be gravely concerned. The FANGs are a sector, not a market, a trend, not a salvation.

More importantly, the disconnect between their Free Cash Flow and stock prices is a warning sign I’ve seen before. These over-valued names will and can rise. I’ve never doubted that.

But folks, what goes up…

…will come down.

If investors are hoping technology will save the day, they are in for a surprise similar to what CISCO, Microsoft and Yahoo taught the markets some 20 years ago when the NASDAQ peaked, and then tanked.

That is, even good companies can be over-valued and sink like DiCaprio as Winslet floated away.

My play for the FANG’s is one of patience and shorting, not chasing tops. In other words, I’ve seen this movie before.

Trade Imbalance

Moving from tech fantasy to trade reality, remember those pesty little trade war headlines that made all kinds of noise before COVID took center stage?

Well, the trade imbalances and grave problems of yesterday have not gone away. In fact, they’ve gotten worse, as well as largely un-noticed, by most of the media bobble-heads.

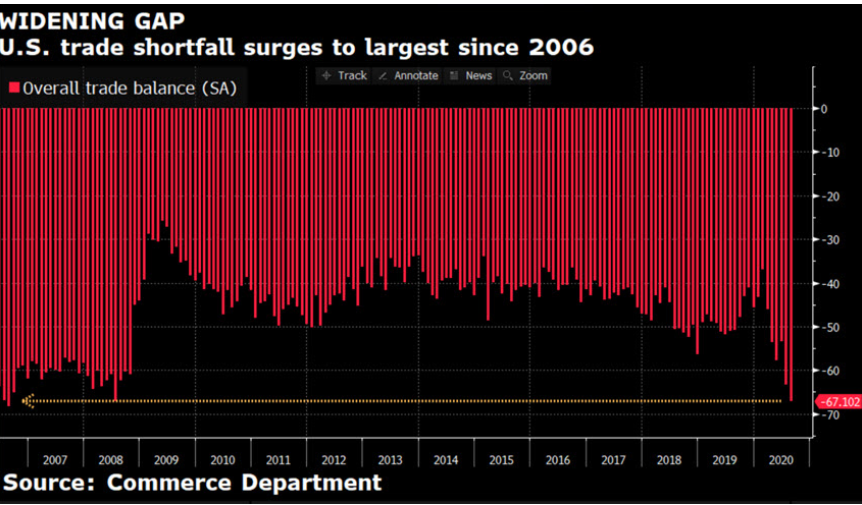

This week, the Commerce Department reported that the US trade gap is now at its widest in 14 years.

That is, our overall deficit in goods and services increased to a more-than-forecasted $67.1 billion in August from a revised $63.4 billion in July.

Total imports increased by 3.2% to $239 billion, while exports rose by only 2.2% from the prior month to $171.9 billion.

Long story short: Combining the trade and tariff wars with the coronavirus pandemic has completely upended global supply chains.

More Hope…

Of course, our rigged and Fed-supported stock markets remained buoyant, for now, thanks to unprecedented rapid-response from global central banks—i.e. more market stimulus

In other words, there’s no problem which free money created out of thin air can’t solve.

Nor is there no debt problem which more debt can’t solve—at least if you still believe in fairytales like modern monetary theory or just modern BS passing as a financial miracle.

Again, in times as twisted, volatile and irrational as these, blunt facts and meaningfully diversified portfolio solutions are needed now more than ever.

A Plan Is Better Than Hope

That’s where we step in. Replacing hope with a plan.

For more on how we help hundreds of informed investors navigate the ongoing Twilight Zone, simply visit us here and stay calm while others stare into the fear-vs-hope headlights of more volatility to come.

Have a great weekend.

Matt & Tom