The global economy is riding a wave of debt that not even the World Bank can ignore. Meanwhile, global income (i.e. GDP) is drowning.

I and others often speak of the “global economy,” which is admittedly a rather generic, and often abstract term.

As always, I like to cut to the chase and let the facts sink in with simple visuals and basic math.

And when it comes to the condition of the “global economy,” let’s keep this clean and simple.

The World Bank & Global GDP

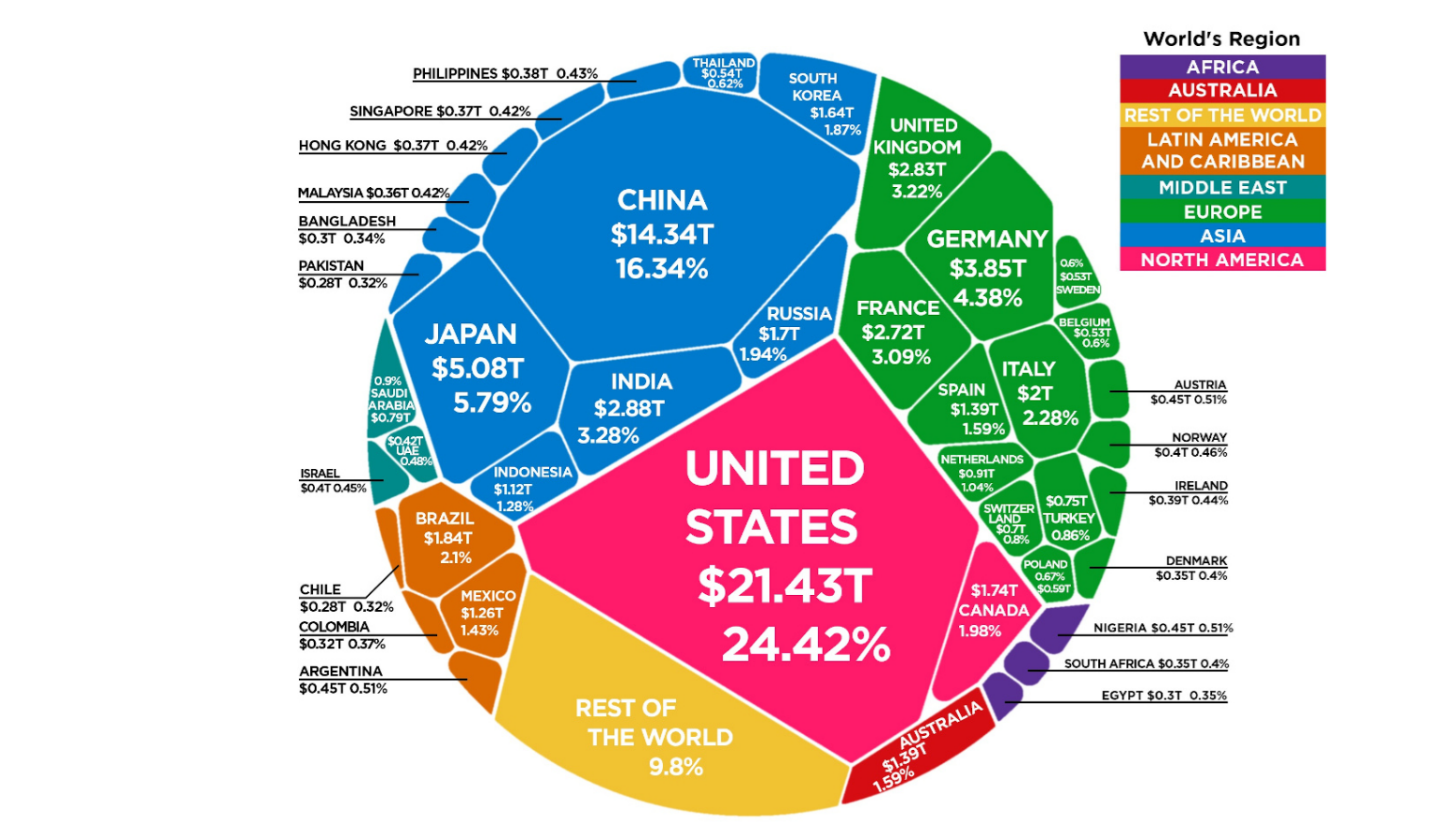

Tom’s alma matter at the World Bank, for example, recently (2019 data) prepared a soccer-ball visual which will help put the $88 trillion-dollar global economy into simple perspective:

Needless to say, the foregoing graph is a 2019 snap-shot as well as a lagging indicator, as it does not reveal the ongoing impact of the COVID data and the dramatic GDP contractions of 2020.

As of 2019, for example, the U.S. continued to lead the global economy in GDP-based income, despite this year’s dramatic (Year-on-Year) GDP decline of greater than 30%.

Ouch.

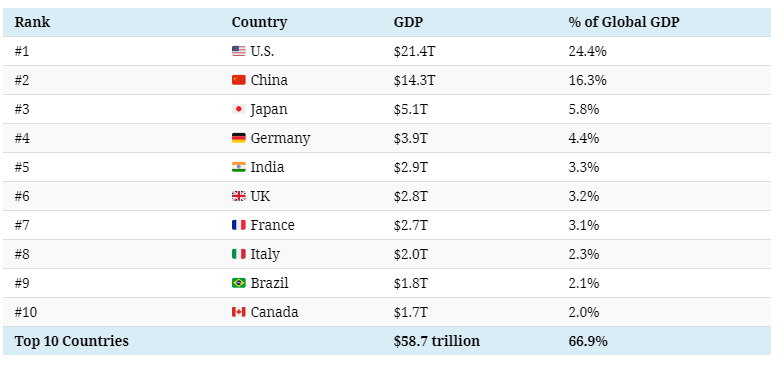

Nevertheless, the score-card as to the top-10 GDP-based global economy leaders (which account for 2/3rds of the global economy GDP) are as follows:

What’s worth noting as well, is that India had pulled ahead of both France and the UK in terms of its percentage of global GDP.

2020—Not a Glowing Year for the Global Economy

As we near the end of this admittedly awful 2020, the final global economy data for the year is incomplete.

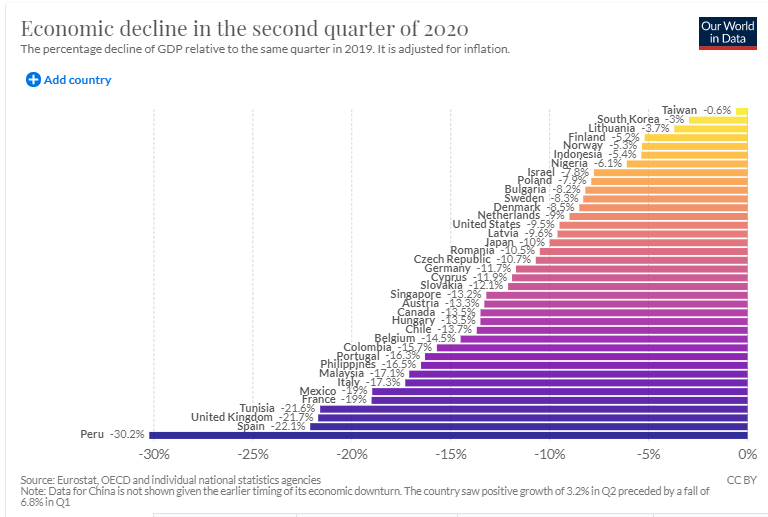

That said, we can already see a sizable decline in the prior year’s GDP data and hence global wealth:

Based upon a percentage decline, the data is beyond alarming, and not just for the hardest hit of all, namely Peru, but for some other key hits to Spain, the UK and France, all noticeably present at the bottom of this chart.

Over-all, the World Bank is anticipating a total, 2020 decline of 5.2% for the global economy, which would mark the deepest shrinkage since World War II.

Think about that.

But ask yourselves this: Is and was COVID-19 and the policy reactions which followed as large a threat to the world as say, the Second World War?

Nagasaki, Pearl Harbor, Normandy, Stalingrad, Iwo Jima, Dunkirk, or Berlin, London and Dresden in flames, millions and millions killed, displaced and missing. Economies shattered by years of open war.

And COVID?

The same thing?

I’ll refrain (eh-hmmm) from any personal opinion and let you decide for yourselves.

The Year Ahead—Reasons to Smile?

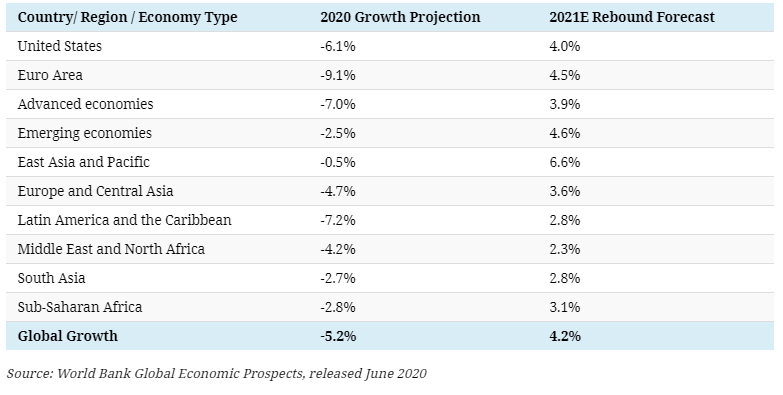

Meanwhile, the same World Bank is making optimistic forecasts for the future of GDP and hence the global economy.

It sees a 2021 “rebound” for the Top-10 nations as follows:

Hmmm.

That forecast for 2021 looks almost as optimistic as the recent CBO forecast for US tax revenues, of which I gave a cold, hard look last week.

Are such rebounds possible?

Sure. Anything is possible. Santa Claus, for example, might save us. It’s possible.

But here’s the rub: It doesn’t really matter anymore what kind of “rebound” we may see or what kind of sleigh Santa drives (likely a Tesla).

Why the Global Economy Is Already Screwed

Frankly, even if we double, triple or even quadruple the GDP optimism built into the World Bank’s forecast (or even those from the fiction writers at the Congressional Budget Office or the Bureau Labor Statistics), the data-dumpers above are ignoring the elephant in the room…

You guessed it: Debt.

The Best Lies Are Always Lies of Omission

Those familiar with psyops, be they from the murky world of clandestine services (i.e. spies) or the ignorant world of financial reporting (i.e. politicians or media outlets), come to understand that the best way to trick a population is not by what you reveal, but by what you don’t reveal.

In short, the most effective lies (or tricks) are often lies of omission.

And what’s omitted from reports like those from the World Bank above, or for that matter the NY Times, Barron’s, CNN, Fox News or just about everyone else bla-bla-blaing about the airwaves, is fairly simple.

Namely, what’s largely absent in our brain-numb media or openly socialist market system is a serious, consistent, blunt and informative discussion by so-called “investigative journalists” of the current global debt levels.

Equally ignored are the staggering implications such debt levels have on everything from central bank neurosis, currency wars, and inflation to Main Street decay, social unrest and Apple’s stock price.

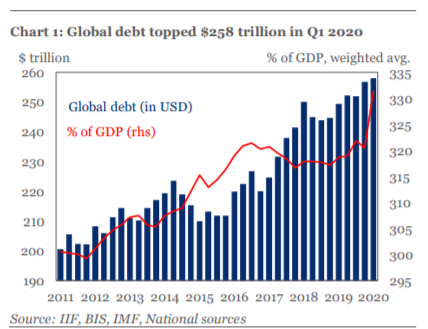

As media bobble-heads and politico’s squabble about supreme court vacancies, ignored gun laws, Presidential tweets, identity-politics, COVID data, mask rights, police funding, or the correct pronoun for trans-gender bathrooms, the foundation of our global economy, and hence security, is standing on a rotten foundation of debt, which now stands at $260 trillion:

Folks, this means that the ratio of global debt ($260 trillion) to global income –aka: GDP ($88 trillion) is at a staggering 2.95—and about to get even worse.

Please: Think about that.

Titanic Ironies, Big Waves, Dangerous Rocks

In short, all those headline-making squawk boxers (who daily distract global citizens from critical issues) are essentially akin to folks arguing about quale vs. filet mignon in the Titanic’s formal dining lounge while ignoring the ice-berg 10 feet off the bow of an arrogant economic ship about to sink.

Stated otherwise, while Facebook, pundits and click-baiters distract you, a debt iceberg is about to surprise you.

As global debt mounts by the day to levels which can never (and will never) be repaid, it’s clear going forward that central banks will continue to do the same thing (print and rate-repress) and expect a different end result; in short: Engage in the very definition of insanity.

This means more fiat currencies will be printed by the day in order to pay for more IUO’s issued by the minute at real interest rates that are below zero, which means they offer you nada in yield.

Needless to say, the totally predictable wave of sovereign bonds, printed currencies and ignored inflation heading our way is a wave which favors surfers who own gold as opposed to increasingly worthless paper money.

It also means that traditional portfolio’s expecting a smooth ride to the beach will get smashed against the rocks of increasing volatility ahead.

Don’t Worry, Be Prepared

Fortunately, for those who see these waves, risks and rocks with open eyes, we have a portfolio SOLUTION for realists, not dreamers.

For a safer ride, paddle our way by joining some seasoned market surfers HERE.

Hang Ten.

Matt and Tom