Since we first began sharing our market signals to the public in 2017, we’ve been transparently providing market out-performance by tracking carefully-developed market signals that very few know how to combine.

Signals do matter…market signals that is, signals that take the pain out of investing in these outlier, Covid-19 markets, treading water but running out of air.

What consistently bugs us, however, is that investors are not getting honest, clear advice from whatever their sources, and thus are not adequately forewarned of the visible and the obvious when it comes to navigating these markets.

If one knows what signals to track, market out-performance is not that hard.

But what’s easy is not always simple. It takes decades of market experience to do this correctly. That’s where we come in.

It’s a bummer that so few investors are actively managing their portfolios, given what’s going on.

It bothers us that many are passively-invested in dangerously outdated 60/40 pie-chart portfolios at increasing risk of getting crushed.

Even the fancy lads in the big hedge funds, as we prove below, are missing the boat.

How is that perceptions and reality are so far apart, and that market out-performance seems so difficult for novices and even the big boys?

Nowhere to Hide

Perhaps investors are just throwing up their hands, giving up, believing that there’s nowhere to hide.

To this point, they’re correct. There has been nowhere to hide for traditional investors lacking market signals and thus unable to calmly achieve market out-performance.

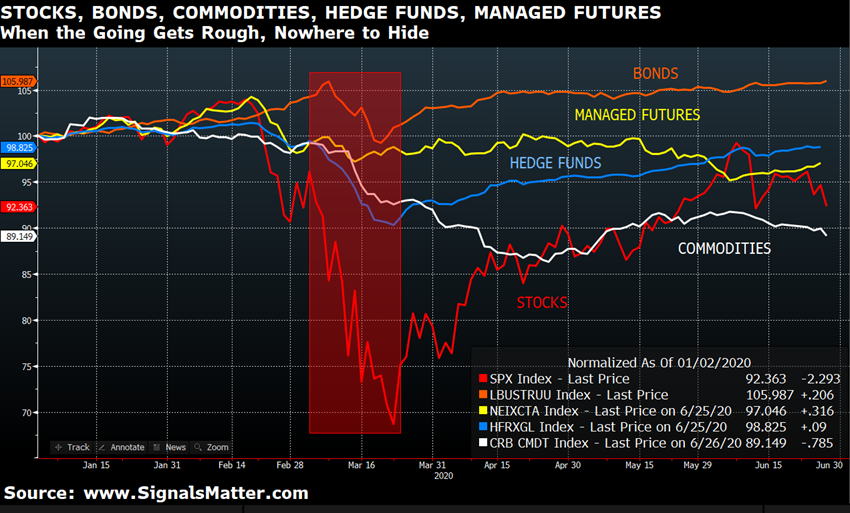

From March 4-24 this year, when the going got rough (red box below), there was indeed nowhere to hide for traditional investors, and even for the so-called “alternative” investors.

Outright long positions in stocks, bonds, and commodities all tanked in perfect synch.

Alternative investments (those hedge and managed futures funds assembled by the fancy lads that are supposed to zig when markets zag) totally failed in their mission and went straight to their respective bottoms, along with the markets.

More Than Luck

But we didn’t. Were we just lucky?

Au contraire…

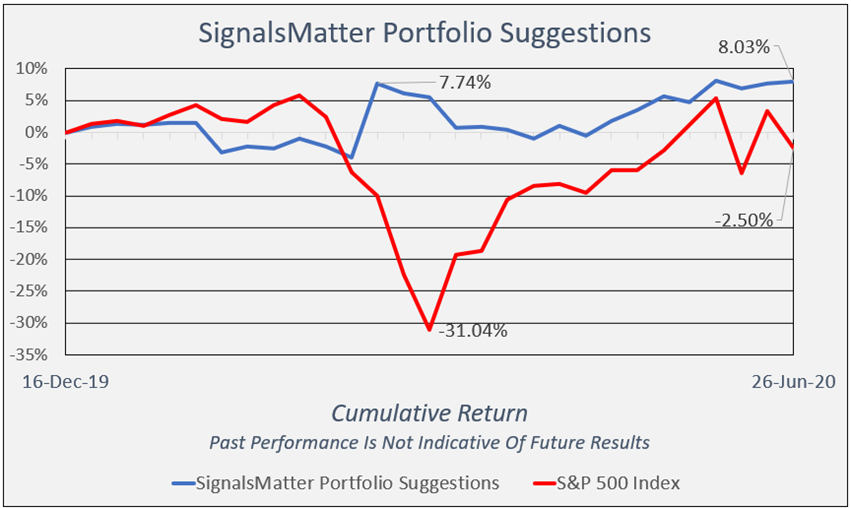

The March 2020 downturn and June’s equity swoon have successively generated new portfolio highs for Subscribers at Signals Matter, twice so far this year.

During the March market weakness, Signals Matter delivered a new equity high of up 7.74%.

Since June 8, stocks have been falling once again, yet we just posted another new high last week, up 8.03%.

By comparison, the Dow and the S&P 500 Index are respectively down -12.34% and -6.86% YTD, worse since mid-December, with horrendous downside volatility—i.e. lots of choppy descents.

There are two kinds of volatility investors need to manage, upside volatility and downside volatility. The idea is to solve for and book upside volatility (that’s the good stuff) and shun the downside volatility (that’s the bad stuff). That’s what we do.

How do we do it? From whence comes this market out-performance? Again: It ain’t luck.

Follow the Yellow Brick Road

We start by taking a page out of Dorothy’s book. We follow a yellow brick road assembled during over 50-combined years of investing in all manner of markets.

There were 44,000 custom-glazed bricks lining Dorothy’s road in the Wizard of Oz. We don’t have that many, but we do parse (and then simplify) hundreds of economic indicators and thousands of financial instruments, each day, in search of our proprietary signals that lead Subscribers to that Emerald City of consistent market out-performance.

Signals Do Matter

It’s true. Signals really do matter when it comes to market out-performance and informed investing.

But you need to know what signals to watch, and when, and how to react.

We founded www.SignalsMatter.com to do just that: Inform, educate, and make our Subscribers better investors. Namely:

- We inform with our very own Market School and weekly market reports, far blunter than anything in Barron’s, the WSJ or the FT…

- We inform by sharing with Subscribers the very signals we use to populate our own portfolios.

- We even display the portfolios we create, along with real-time performance—in other words, total transparency.

Signals Matter Subscribers have a choice. They can learn by our methods and pull the trigger themselves, or they can just cut and paste our portfolio into their own. Trust but verify.

Whichever way they go, they can trust it.

They trust us because they know why we’re taking the positions we take (we show them), and they can verify the results every minute, hour, day, week, and month by the full transparency we provide—real-time, not “back-tested.”

By Example—How We Make Money by Not Losing It

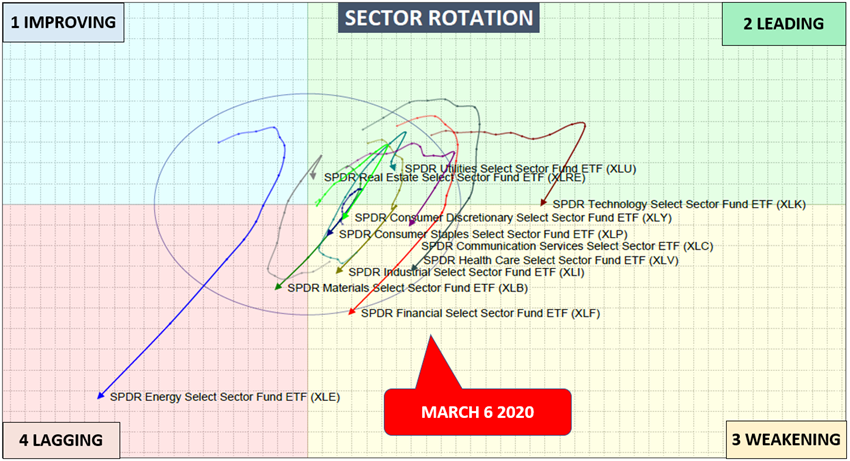

To miss the March 2020 plunge in equities, you would have wanted to know this: Stock sectors were fast-rotating from strength to weakness.

Without having to do the math, our Subscribers could see through the fog by viewing this simple visual of stocks rotating from leadership to weakness. It’s not that hard. We posted this before the markets tanked:

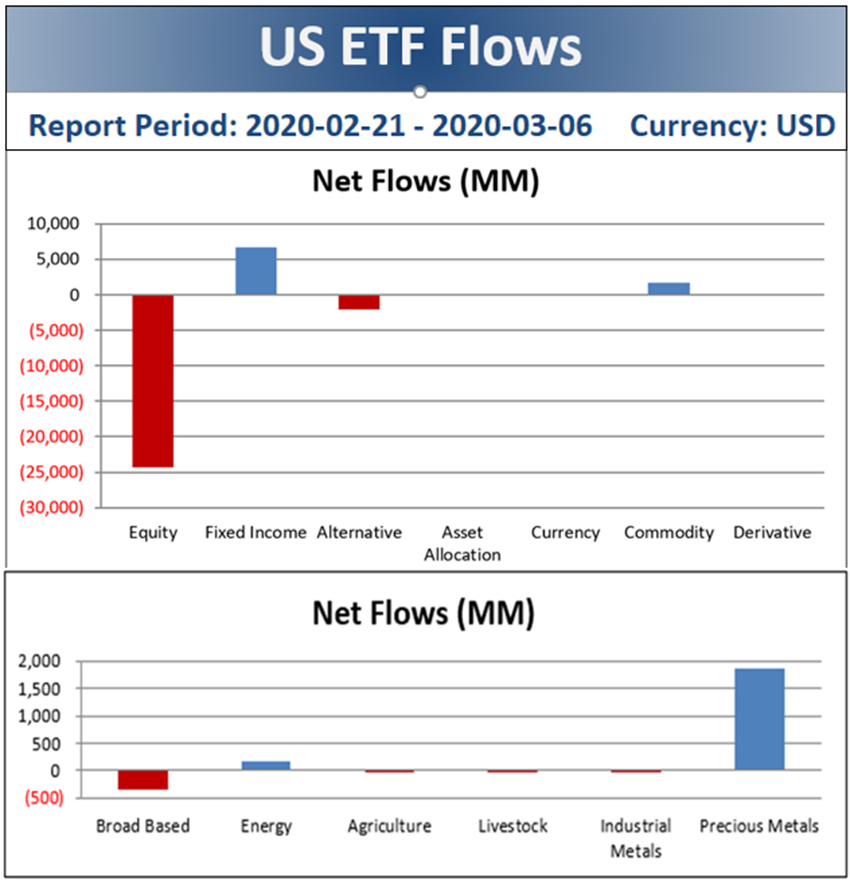

Our subscribers also knew that investor flows into the SPDR ETFs, a huge coal mine canary, were screaming “Sell!”

In the weeks before the March crash, investors were bailing from stocks in favor of fixed income and precious metals.

Again, our subscribers knew this because we simply showed them, with this simple funds-flow chart. Again: massive market out-performance is not that hard if you know where to look.

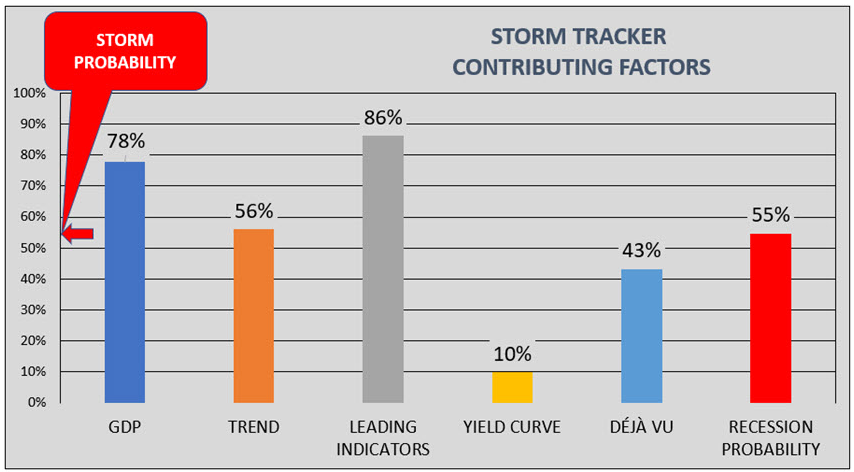

Our subscribers also knew why markets were turning from risk-on to risk-off, by taking a glance at the macro contributors that were spoiling the party, namely tanking GDP, southerly trends, horrific leading indicators, Fed-suppressed yields curves, and our own market timing indicator, Déjà Vu.

I’ll say it again: Market out-performance is not that hard if you know the signals. All Subscribers had to do was look at this one chart to know/confirm why the risk was rising.

On the technical side as well, we offered further confirmation of risk ahead.

Just before the markets tanked, our Daily Chart Service displayed this, backing up the macros. Sell signals and peaking oscillators were basically calling the February/March crash (left box), and, by the way, aren’t looking too rosy at the moment either (right box).

We make it simple. Just look at the charts (which we translate for you) that are updated each day.

Here’s another one below.

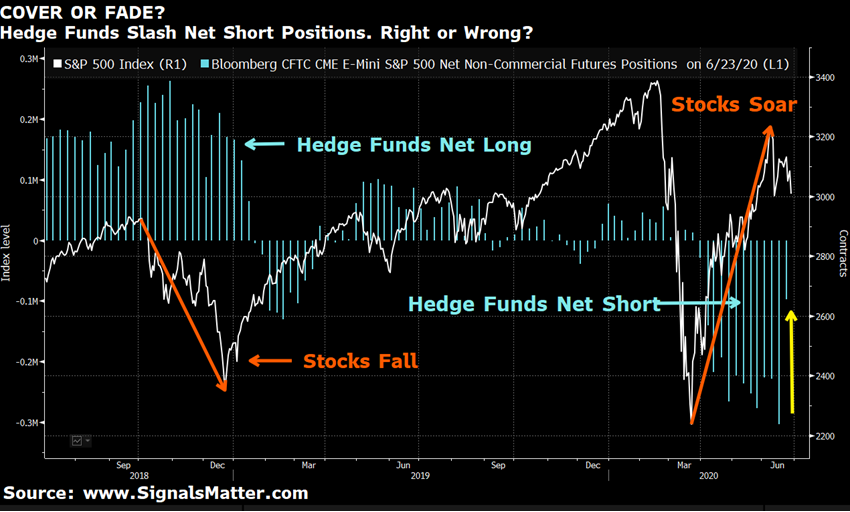

We shared the below hedge fund/SPX chart today with Subscribers, a way to fade (i.e. do the opposite of) the very folks stuck in back-testing and systematic formulae – yep, those fancy lads, the hedge funds. This one isn’t as complicated as it looks.

Even the Big Boys Were Missing the Signals

When hedge funds position net long, they lose, so we often do the opposite and think about going short. And when hedge funds position net short, they lose again, so we often think about going long—assisting market out-performance.

Why?

Because hedge funds have been getting it wrong since this whole mess started. So, we fade them, simple as that.

Whatever they do, we consider the opposite. Smart investing and consistent market out-performance is based in part upon our years of being on the inside of those so called “hedge” funds, which haven’t been “hedging” well at all.,,

Visuals Made Simple

Simple visuals make investing simple at Signals Matter. We translate the minutia into simple directives.

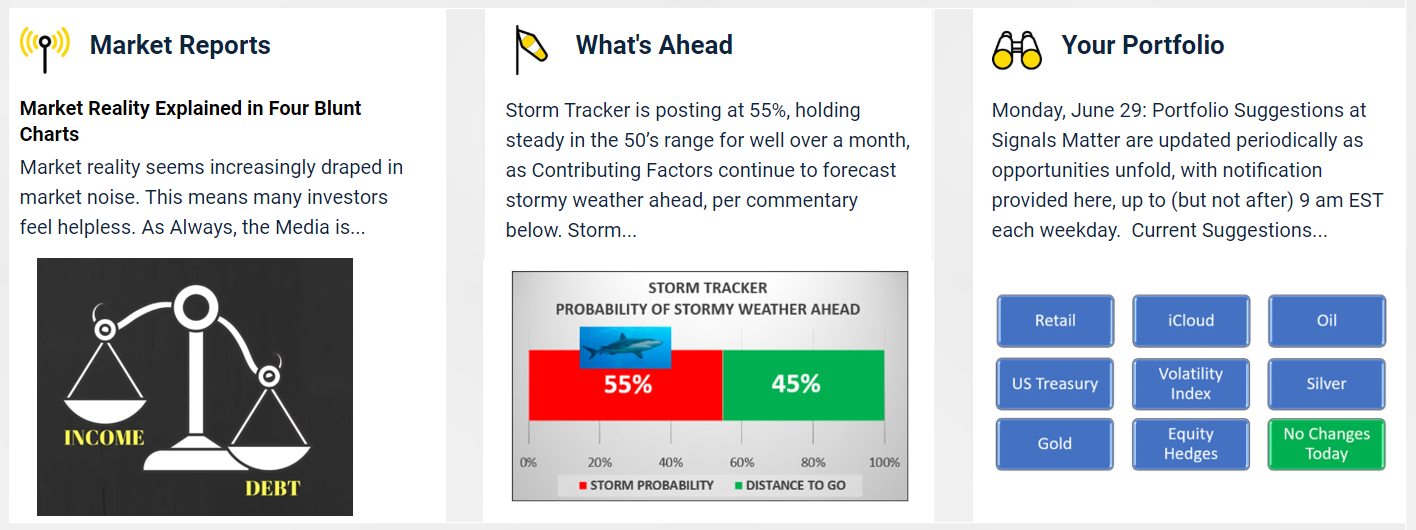

Our Subscriber’s daily dashboard informs at-a-glance by providing a re-cap of new Market Reports, a snapshot of What’s Ahead by way of risk, and what changes we may have made (or not made) to Your Portfolio, each and every day.

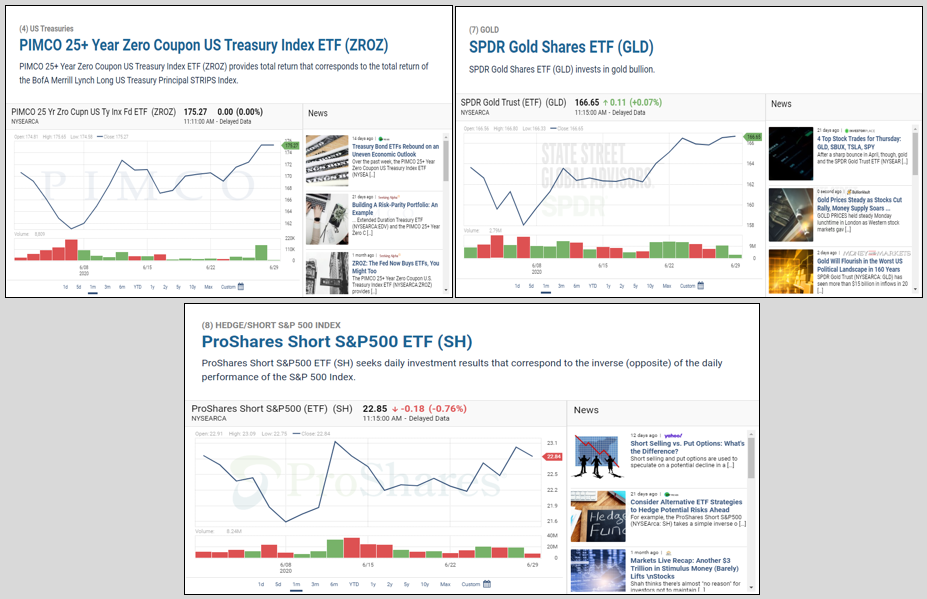

Portfolios Made Simple

Everything we’ve touched upon in this Market Report, and so much more that is shared behind the scenes, is geared to provide Subscribers with Portfolio Suggestions that actually work—market out-performance year after year.

Subscribers know exactly what we’re looking at from a macro/fundamental/technical viewpoint; they understand how we make our decisions, why they work, and how they are performing, with real-time tickers that update and display each time their browser is refreshed.

It’s like having their own Bloomberg screen and team of analysts right before them, yet without all the confusing lingo and market talk—just simple market out-performance.

Handy news links to each recommended position also provide far more current and uniform information on portfolio picks than any on-line broker tool we’ve seen.

Subscribe to SignalsMatter.com

Subscribing to SignalsMatter.com is as easy as using the website. Just Click Here.

If you’re a novice at investing, we’ve got you covered.

If you’re a dabbler, we’ve got the tools to help keep you growing.

If you’re an experienced investor, we’re your new in-house analysts.

And if you’re an auto-pilot investor, we’ll give you the tools to challenge your advisor and get back at the controls.

Just one portfolio suggestion, one trade, can easily cover the cost of an annual subscription. It’s that easy. Unlike just about everyone else, we’re not “fee collectors”—we don’t custody your money nor take a percentage of it. Our fee is the same regardless of how much you invest.

Learn More

To learn more about SignalsMatter, dial this number to schedule a call with one of us, or, much better, schedule a Zoom Meeting so we can walk you through the website. We’re here to inform:

Call 844-545-5050

Until next time, be well. Stay safe.

Sincerely, Matt & Tom