These are, well…Twilight Zone markets. Below, we explain why.

25 shares

Last week was crazy in the markets, and this one will likely be no less so – if not crazier.

When you add up all the irrationality out there, and whimsical behaviors on the part of investors, we’re definitely in twilight zone markets of monstrous proportions.

Last week, the equity markets showed both their sane and insane sides: sane for dipping on sagging macroeconomics and insane by rallying at week’s end on a bet (frankly, a guarantee) that the Fed will lower rates again this month, and then again and again…

But it’s these low rates (now negative in Japan and Europe) that got us into this pickle in the first place.

Sure, in the near-term, low rates buy time and a rationale for dip-buying and a 2019 rally in stocks, even for Tesla…

Longer-term, however, the debt bomb they create will eventually explode and money will burn.

When will the insane get sane? That is, when will markets stop rising on bad news?

Again, we saw a smidgeon of that last week, until the insane reappeared, almost on cue.

Let’s discuss…

Here’s the Deal

You’ll recall that famous T.V. series, The Twilight Zone, introduced by Emmy Award-winner Rod Serling back in 1959.

It served up a strange mix of horror, science fiction, drama, comedy, and superstition – all in, a pretty good description of where we are today.

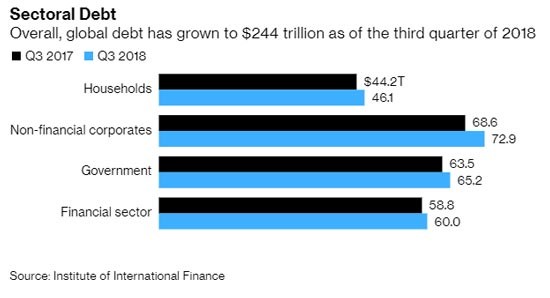

Here’s the horror: Global debt is now (2019) greater than $250 trillion, across financial and non-financial corporates, governments, and households.

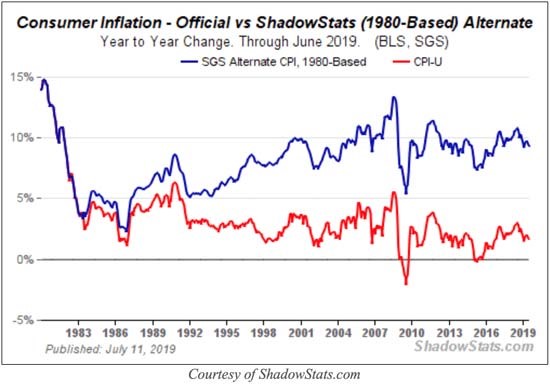

Here’s the science fiction: Reported CPI inflation Y/Y of 1.7% is actually closer to 10%.

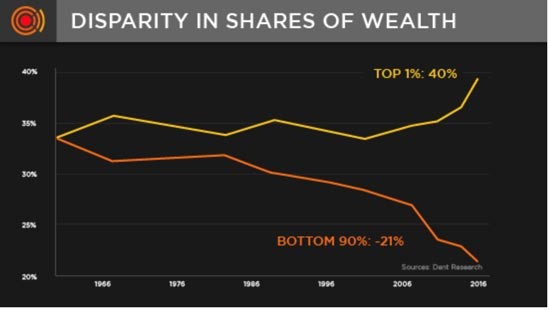

Here’s the drama:The top 1% are ridding these rigged-high Twilight Zone markets , while most of Main Street America doesn’t have $1,000 bucks in their savings account.

Here’s the comedy:The Fed tells us everything is fine, despite emergency-mode desperation in the rate markets and over $1 trillion in printed money to bail out our recently dried-up repo markets.

And here’s the superstition: The Fed has your back despite a 0 in 9 record for recession forecasting.

Roll it all up, and that’s where we are now: Twilight Zone markets where fundamentals have nothing to do with stock pricing.

In the near-term, the Fed can continue to drop rates and print money all day, week, or year long to keep investors seduced.

At least until it can’t or they are no longer credible…

And on that score, it sure looks like we’ll get some more Fed steroids this October in the form of a third rate-cut, with more by year-end given the way things are not going. That is, the worse the news, the more “acommodative” the rate cuts:

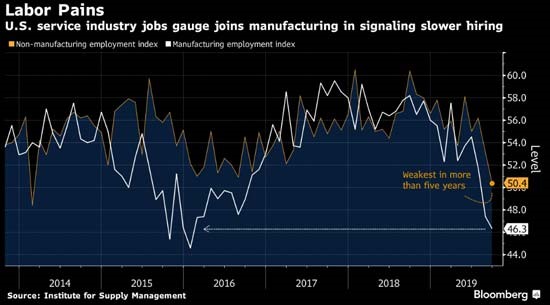

The Fed rate cuts this time will be targeted to solve the mounting problems in the service and manufacturing industries, charted below. Hiring is down:

The key here going forward as labor pains mount, is whether household income will hold up enough to keep the consumer spending, for without that trusty consumer, growth will slow. And we all know what that means… it means demand slides off the rails.

But then again, who needs rising demand at all in Twilight Zone markets where the Fed trumps reality?

Let’s think about that, deeply. Is a third, 25-basis point rate reduction going to encourage weakening jobholders to spend more, or borrow, or spend more to save our economy? We don’t think so. But the Twilight Zone markets will rally nevertheless.

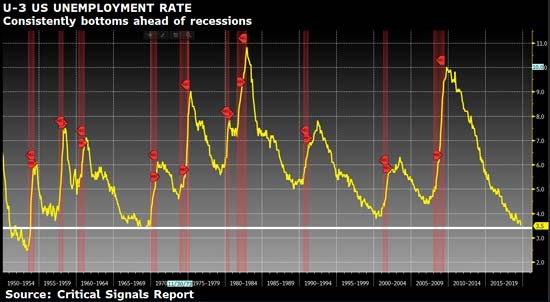

What we do know is that weak hiring is the normal precursor to rising unemployment, and when unemployment begins rising (off alleged, yet nevertheless reported record lows), that’s historically been a bad sign:

But in Twilight Zone markets, such hard facts don’t matter anymore…

So, what bucket do we put this in – the idea that a Fed rate cut will somehow rescue the economic slowdown in hiring, keep folks employed, buoy demand, and therefore create actual growth just in the nick of time?

Would you put this line of reasoning in the (1) horror, (2) science fiction, (3) drama, (4) comedy, or (5) superstition bucket?

These are all valid choices.

Introducing the “Twilight Zone Markets Poll”

We’d like your view. Please take a moment to pick and place in the Comment Box below just one of these five bucket labels, or a sixth – “none of the above.”

We’re calling this the “Twilight Zone Markets Poll.” There’ll be more like this, so please chime in. We’ll post poll results in next Monday’s What’s Happening Now.

Back to Basics

Let’s just remember the basics as we charge ahead into Q4 2019. Stocks are up, thanks to questionably unethical stock buybacks and tumbling interest rates, which Wall Street loves, because it brings cheaper leverage to the casino and more debt-driven “earnings” to the c-suite.

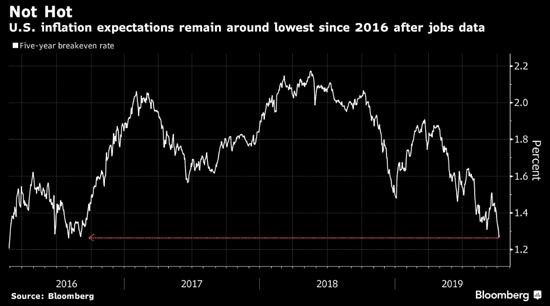

A little inflation would be helpful, too, but it seems not to be in the cards with wages gains abating in the backdrop to these Twilight Zone markets.

Then again, we already know that inflation, as reported by the labor department, is far more fictional than even the best Twilight Zone episode. After all, if inflation were honestly reported (at 10%), who would buy U.S. Treasuries with negative 8% real (i.e. inflation-adjusted) returns?

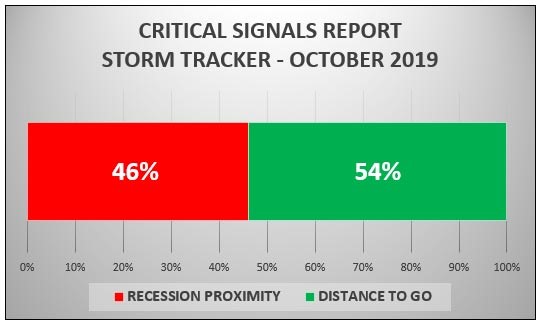

Update on Storm Tracker and Déjà Vu

Heading into the final quarter of 2019, Storm Tracker (which tracks nearly 100 leading indicators for stormy weather ahead) has remained consistently in the 45%-47% range for several months now.

While individual indicators within our defined groups of indicators (GDP, yield curves, trend, and other leading indicators) have moved around a bit, the total score has remained consistently high – 46 knots of wind off our bow.

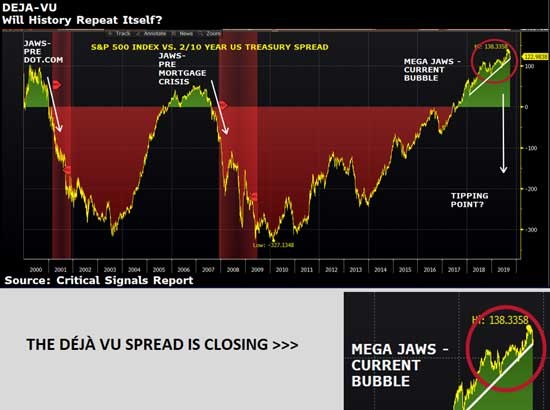

The one worrisome change though is in the Déjà Vu indicator, the spread between equities and interest rates

Thanks to recent market activity, the Déjà Vu spread (i.e. its “jaw”) is beginning to close, pictured below. And to remind, Déjà Vu is our timing indicator for stormy weather ahead and carries a 20% weight within Storm Tracker.

See that red circle in the upper right corner of the graph below, enlarged beneath?

That circle highlights a closing spread between the S&P 500 Index and interest rates. The sloping white line within the circle marks support.

And that’s where Déjà Vu is at the moment – at key support. If it breaks through that supportive trendline, the oncoming storm we are predicting is likely to gather steam. This occurs when bond yields spike and stocks fall–alas “closing the jaws” of the Deja Vu spread.

On the other hand, remember… we’re in Twilight Zone markets. Nothing is as it seems or as it used to be, thanks to markets driven by Fed action rather than natural price action – i.e. actual market forces of human supply and demand.

If the trendline holds and the spread widens in the days and weeks ahead (as it has three times since late 2017 and will likely continue as stock prices rise), then we’ll get a little more borrowed time…

And we mean “borrowed” because it will be payback time when Déjà Vu breaks trend and hits zero–i.e. when stocks one day crash along side bonds.

In other words, a melt-up from here would put us deeper into those fictional Twilight Zone markets of risk, but down the road (one we are tracking for you), natural market forces will get the last dark laugh over Fed manipulation, which is slowly losing its prior punch with each interest-rate cut and dollar printed.

In short, the Fed and Wall Street should be careful what they ask for; once they get to zero rates (or below), who will buy our bonds?

Entering October, Déjà Vu has traveled 15% of the way to the critical support line. Once it breaks through, look out below…

This Week

It’s a busy week ahead. Be on the lookout for gobs of the inflation-related “data” headed your way this week, namely producer, consumer, and import prices – along with inflation expectations.

Inflation is key… and we’ll need more of it soon, as continued deflation would put us in the “horror zone.” But no immediate fears there, as the fiction writers at the Bureau of Labor Statistics (BLS) can conjure up a little inflation whenever needed.

The BLS is a master at making 2+2 = whatever they want, and whenever an emergency so requires it.

More Fed speak this week as well and more on China trade talks, a resolution of which would immediately send markets out of the Twilight Zone.

Small business sentiment and jobless claims are also on the docket.

As for politics and political risk, well that’s an entirely different topic, one we’ll have to address once the partisan war in D.C. sends a clear signal.

As for now, stay careful, stay patient, and stay informed.

Sincerely,

Matt Piepenburg

Comments

21 responses to “You’re Now Entering the “Twilight Zone” – Here’s What to Watch Out For”

- dougsays:

Horror, so perfect timing with up coming Halloween.

- Greg Oleansays:

#7 – all of the above is my vote!

I have never witnessed a market that disregards so much bad news. It is similar to the Chinese people that think that the Government will never let the housing implode, until it finally happens. Stock market investors in the US now think that the FED has their back no matter what, until they don’t.

Good luck to all of us. I am now positioned for the worst due to a limited 10% upside and a 70+ % downside. I am ready for a test of the 2009 lows.

- Tom Hartigansays:

(2) science fiction,

- Mikesays:

The King and his new clothes come to mind. However it would only take a boy with pea shooter to cause the king to re-evaluate his position.

For some or us it is a plain as writing on the wall but it seems the “financially educated” have the greatest need of glasses to read the writing.

For me the greatest hurdle is how long it takes to collapse and I suspect that the longer it takes the great er the speed of the collapse. I expect that when it does happen 3 days would see 90% of the collapse.

- Raymond J.says:

(2) science fiction

- Larry F. Silbaugh says:

October 7, 2019 at 9:09 pm

My vote is – “ALL OF THE ABOVE” – but if I am limited one it would be “HORROR”.

- Thomas Cardsays:

Science Fiction

- william simmonssays:

As baby boomers continue to retire and were relying on an interest return on retirement savings to supplement income, they will cut back on spending to try and stretch their available income.So the lower the rates of return, the lower their disposable income.So where is the increased demand going to come from to boost the economy and employment.Did they never lear that savings = investment. Dont expect the students with record school debt to contribute to demand after getting their degrees and working in Macdonalds.Dont expect corporations to invest in expansion when they can simply borrow to do buybacks and push share prices higher.The end is closer than most are expecting.

- Kevin Rosesays:

Superstitious

- ez scott says:

Well I know the rates are low for bonds. The consumer will probably have a harder time actually receiving the low rates. Doubtful the average home buyer will get a home loan with negative interest rates. Would be nice to buy a house then let the mortgage company pay me each month like a reverse mortgage!

The problem is that the interest rate is artificially being manipulated. Like price fixing for gasoline, the pump stops because the gas stops flowing. The price per gallon is fixed too low so the seller can’t sell for a profit.

Quantity supply can’t meet quantity demanded so everything comes to a halt.

Sure you can get a cheap mortgage

But you have to wait in line to close the deal so you can pay more points and hidden fees and wait and wait for the funding to come through.

You can bet there will be more hoops to go through, and it will come to a halt as the rates come down- if they can go any lower. If the rates continue to fall and the transactions are already halted, then what?

My guess is that home prices will have to become discounted to meet a smaller quantity of money supplied. (like in the gas example… )

It is more likely that long term rates will just go up. The real-estate market will crash. It will “crash” because of the lower short term rates suggest big inflation is heading our way somewhere within the longer 30 year term. What do you think?

- Timsays:

superstition

- Roland Alanizsays:

You left off one other alternative: All of the above

- Efren Anchondosays:

#3. Drama…

- Nicolas Mazziottisays:

Great write up.

- David Derrsays:

Now is the time to get into precious metals…..best bet for maintaining wealth.

Get ready for the slide off the cliff!!!

- Frank Gainessays:

#2 Science Fiction. I think some of us know that the fed doesn’t know you know what. And after reading the book “Fed Up” by Danielle Booth I am even more convinced that the fed is even more unethical and dishonest than I previously thought. They don’t have a clue and are really a detriment to our business and economic climate. They need to go away like John Kennedy wanted to do.

- Jay Kleesays:

Horror. We’ve had two rate cuts in a row and stocks have fallen after each one. A third cut isn’t likely to take this market higher. Even with the fed talking about buying treasuries today (while claiming it won’t really be QE), stocks closed lower. That should scare market bulls.

With a market cap to GDP ratio of about 144 percent, the stock market is a big part of the economy. By that I mean, people are willing to rack up debt and spend because their 401s look so healthy. But I believe when stocks finally tank, the economy will quickly follow suit.

- mikesays:

I believe it is deflection they are trying to stop

- Edouard d’Orangesays:

I hope y’all didn’t sell your stocks, as you indicate you would, because the market has steadily risen with little interruption since the article.

- Thomas Cardsays:

Horror Show.

- Signals Matter Infosays:

That’s why we told you on October 18th to buy stocks–because the market only went up (as we screamed it would) when the Fed starting printing money a week after we posted this. Remember: This is not a stock market, it’s a Fed market. We also hope you are buying with caution rather than crazy–i.e. that you are balancing cash protections/allocations as we recommend, even in a melt-up (Nov 29th)