Below, we look at bond market secrets and how we track yields (which move inversely to price) to consistently beat the markets and protect our subscribers, time and time again, from market disasters.

Scary Times

There’s a famous expression, apparently (and ironically) based upon a Chinese curse, which reads: “May you live in interesting times.”

Given what we’ve all seen in the triple whammy of a 1) pandemic health crisis, 2) a global market collapse and 3) a repo market dollar shortage, we no longer live in “interesting times;” instead: We live in scary times.

And as for scary, perhaps the only market force even scarier than stocks, is the rising dorsal fin emerging from the deep and dark waters of the U.S. bond market.

And as for bond market secrets, tanking bond prices and rising bond yields are what we mean by shark fins approaching.

This week, moreover, saw a bond market full of shark fins, for whenever bond prices fall, bond yields (and rates) rise, and rising rates are to debt-soaked bond markets what shark fins are to surfers: Bad news.

Warning, After Warning, After Warning…

As I’ve written in countless market reports, dating from 2017 to now, as well as throughout the pages of our recent Amazon #1 Release, Rigged to Fail: If you want to know where the economy and stock markets are headed, just track the bond market secrets.

Junk Bonds—An Obvious Disaster in the Making

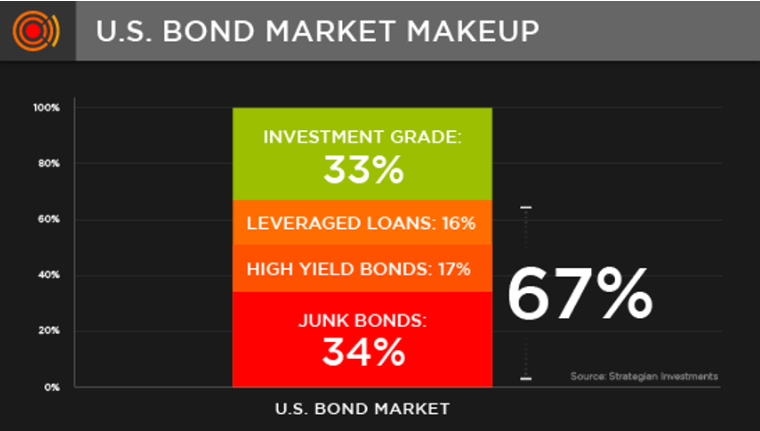

Exactly one year ago, for example, I warned otherwise complacent investors of the sharks (i.e. credit risks) swimming beneath the surface of the grossly inflated US Bond market, which was composed of mostly D- credits masquerading (i.e. priced) as A+ “safe.”

Such bottom-of-the-class companies with crappy credit scores are otherwise known as “high yield,” “levered loans” or “junk bonds. ”

In fact, these D- companies pretty much define(d) the near entirety of our so-called “bond market,” which was and is essentially just a junkyard of debt-soaked Frankenstein companies.

Such credit-risk data was full of bond market secrets and leading indicators that allowed informed investors to react to the bond market secrets before they became bond market disasters.

Months prior to that March, 2019 report, for example, I got so worked up that I even posted an ad-hoc video from Montauk in November of 2018, describing the absolute insanity of our junk bond markets in an effort to warn investors of what was coming.

One month later, I was back in France and the markets were tanking by 20% on New Years Eve.

Later, in another video released after the Christmas massacre, I further reminded investors that despite the rebound and Powell-pivot, a dangerous percentage of the US bond market was still composed of “zombie” companies who survive only by taking on (or rolling over) more debt.

These reports were filled with bond market secrets and warnings of what would happen when debt (i.e. yields) got too high to roll-over or pay back.

Bond Market Secrets—Match Meets Gas Can

In each and every written and video bond discussion since 2017, I bluntly reminded investors that whenever, however, and whatever the future held, it was only a matter of time until these grossly over-valued/priced bonds, drenched in a gasoline can of Fed-created debt, inevitably hit a market “flame” and burned to the ground.

Needless to say, and as of this infamous Q1 2020, that “flame moment” has arrived, thanks to a deadly combination of a COVID-19 black swan landing upon a market swamp made debt sick by 11 years of Fed-created low rate debt.

In this crisis moment, bond prices are now tanking and hence yields and rates rising—never a good thing in a market and economy supported by 11+ years of record-breaking, Fed-induced debt.

Bond-Fire of the Fed Vanities

As of this week, we are thus seeing this otherwise highly predictable and historically inevitable “Bond-Fire of the Fed Vanities” playing out with terrifying effect.

In short, by artificially supporting bond prices for too long, the Fed has merely been setting bonds up for a disaster playing out now in real-time.

As usual, of course, most investors and the totally bogus main-stream-financial-media, are looking only at stock prices, which are bouncing all over the place, much like the so-called “experts” who read prompts not bond signals.

But the bond market secrets and signals (i.e. artificially supported price highs and hence artificially suppressed yields) have been telling/warning us of this for years.

And as of this week, those bonds (and their price highs) are finally tanking, just as we warned they would.

Throwing the Bond Baby Out with the Bathwater

It is said that in a time of market panic, investors sell what they have to sell, not what they want to sell.

In short, bruised investors who need liquidity to cover their losses, are forced to sell their best and safest assets first.

This includes, for example, a predictable (temporary) sell-off in safe assets like gold. But investors also sell their investment grade bonds too.

The Good Bonds Fall with the Junk Bonds

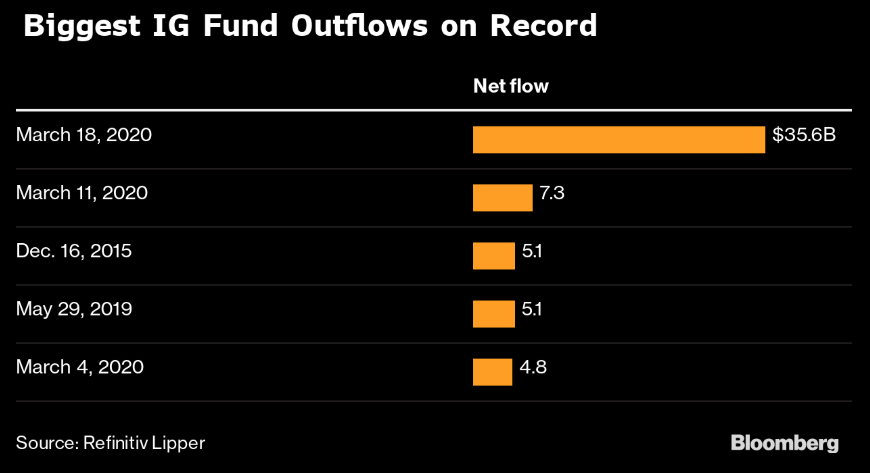

That’s why we are seeing a record-breaking sell-off in the few good bonds left in a broken bond market otherwise largely composed, of well, crappy bonds.

As for those good bonds, i.e. those known as “Investment-Grade Bonds,” this week saw an unprecedented sell-off, as investment-grade (IG) bond fund outflows saw a record-smashing $35.6 billion sell-off.

Stated otherwise, investors, beaten down by the >30% losses in stocks, were forced to sell their “good stuff” to cover margin calls and cash needs.

The magnitude of this investment grade bond sell-off embodies the magnitude of fear and pain spreading throughout the securities market.

Investment-grade bonds are now poised for one of the largest weekly losses on record.

Running to Cash Too Late…

Beaten and bruised, investors are now running (sprinting) to the safety of cash, or money market funds, to the tune of $249 billion of money market (cash) inflows this week alone.

Total assets in government money-market funds (i.e. “cash equivalents”) rose to an all-time high of $3.09 trillion in the week ending March 18, according to Investment Company Institute data that stretches back to 2007.

The last time we saw weekly inflows (i.e. panic mad dashes) to cash/money markets like this was in September 2008 during the financial crisis, and even then the figure ($176 billion) was a lot less than now.

In short, and as of this week, we’ve surpassed the fear levels and dashes to cash seen even during the Lehman crisis of 2008.

Thus, if you’re now asking, again, if this is our Lehman Moment, my simple answer this time is: YES.

That said, we can now expect more “bazooka” emergency measures in both monetary and fiscal policies to try and prevent this market Frankenstein from actually falling further.

The current dash for cash (i.e. money markets) is all the proof you need, however, that investors are scared of this horror show. Again, bond market secrets are whispering warnings all around us.

Of course, the best time to run to cash is BEFORE the carnage hits, not after, a point we’ve warned, made and signaled time and time again.

Ray Dalio, just a month ago, said “cash was trash,” but Dalio’s fund lost 20%, and we’re up past 5% as markets tank by greater than 30% this week. I bet Ray now wishes he had gone to cash sooner…

Fortunately, subscribers to Signals Matter knew this in plenty of time, which means their portfolios today are safely in the green, rather than bleeding red, for they simply followed our market signals (and cash recommendations) rather than the market hype.

For the rest of you, there’s just no easy way to say this, but please click here…, or better yet, just…

And how did we know of (and prepare for) this disaster, even before the COVID-19 trigger?

Again, the bond market secrets (and risks) where telling us all along.

Junk Bonds—Finally Some Real Yield for the Risk

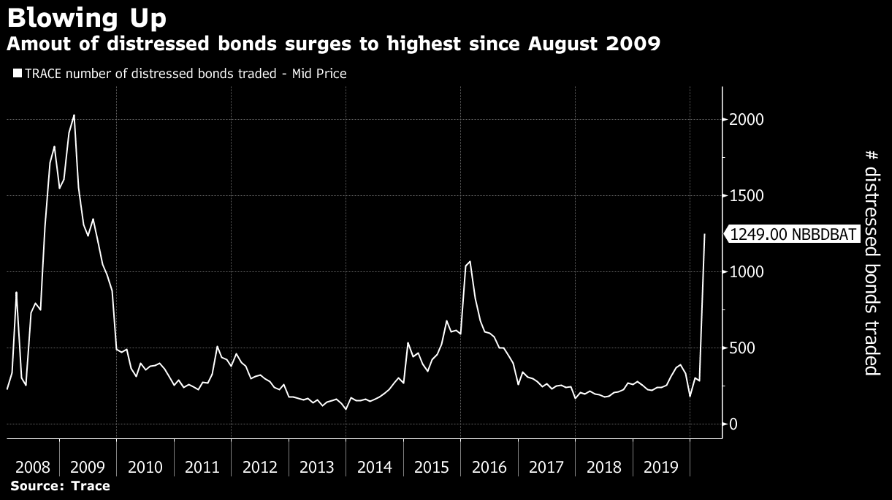

As for those pesky junk bonds, they too sold off in grand fashion this week, right on que, as previously duped junk-bond yield chasers finally (and painfully) realized that those over-priced junk bonds are now tanking in price.

Junk bond prices have been falling like rocks, and holders who bought those bonds a year ago for almost no yield (thanks to the Fed’s distortive yield-crushing intervention), are now getting slaughtered.

For patient and informed investors, however, at least the current sell-off in junk bonds has pushed junk bond prices to honest levels where new buyers of junk bonds can actually get high yield (return) for assuming the higher risk. (Remember: yields go up as prices tank).

For the first time in over a decade, those select few who had the patience to wait for (and the stomach to now buy) junky bonds are at least getting the yield they deserve, finally surpassing 10% and more.

Distressed debt (i.e. the level of junky bonds) in the U.S. has doubled to over $500 billion in just the last 2 weeks alone.

With oil prices hitting the basement, energy sector companies struggling when oil was at $60 to $80 are really struggling with oil at $20.

U.S. energy companies have been crushed by the all-out price war between Saudi Arabia and Russia. The capital-intensive industry is suddenly faced with the prospect of deep losses after oil plunged from $50 to $20 in the span of a month…

The amount of the oil and gas sector’s distressed debt now stands at over $128 billion.

Just consider Occidental Petroleum Corp., now a classic junk bond. Its bonds due in 2024 now yield 18.6% and trade at just 54 cents on the dollar.

Needless to say, there’s just tons of cheap, and now honestly priced junky bonds to sift through in the energy sector, and those bonds which don’t outright default can now be bought at basement lows with skyrocketing yields of 18% of greater.

Why?

Because the Fed no longer has its artificial grip over the bond markets by artificially supporting higher prices (and hence lower yields).

This week, we’ve seen that natural market forces are actually returning to send bond prices to the basement and hence yields to the moon, where they naturally and finally belong.

No surprise here.

As I’ve said over and over: Natural market forces (like the laws of gravity) will always get the last, macabre laugh over an arrogant Fed, who no longer artificially controls the credit market, despite years of low rate intervention and unforgivable price manipulation and deadly yield-suppression.

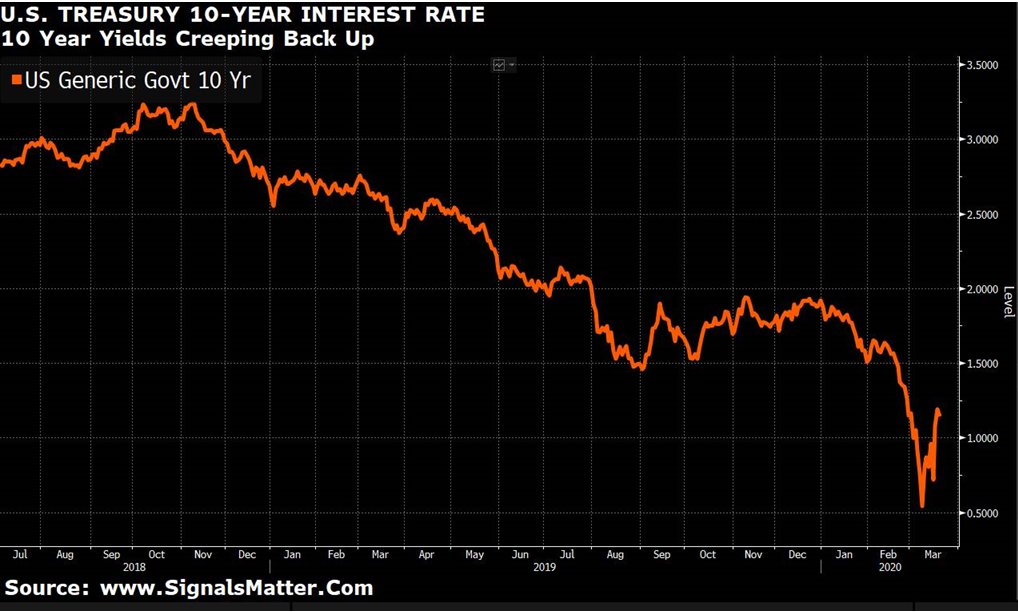

10-Year Treasury Yields—The Ultimate Tip-Off

As bond prices fall (and hence yields rise) in both the investment grade and junk bond sectors, the ultimate indicators (and bond market secrets) still center around the price (and yield) of the all-important US 10-Year Treasury bond.

Why? Because this is the IOU owed by Uncle Sam, not some junk bond oil company.

But when those Treasury bonds fall in price, their yields rise, and those rising yields mean rising rates, which is the rate (i.e. cost of debt) Uncle Sam (who is himself just a junk bond credit…) has to pay for its own debt.

And as we’ve said countless times, Uncle Sam can’t afford to pay its debts when those yields (rates) pass and hold 2.6%, for the simple reason is that our $23 trillion dollar debt bill simply becomes unaffordable at such levels.

As of today, yields (rates) on the critical 10-Year Treasury are still safely below that 2.6% pain threshold, but they are rising nevertheless.

Those slowly rising 10-Year Treasury yields are the shark fin we track daily, and they are getting closer.

Again, we know why and how to track the bond market secrets so you don’t get bitten.

Bond Market Secrets Tell You Everything—Let Us Protect YOU

Folks, I know bonds and yields may seem confusing or even boring, but they are immensely important for warning informed investors, which is why we track and translate bond signals so obsessively.

The bond market secrets and signals are the most important signals of all.

Such tracking of bond market secrets and signals is what allows us to protect investors time and time again from market disasters without being labeled “market timers” or just lucky.

Are we lucky today, for example, that due to bond market signals, we were well positioned before the current crash of 2020 and that our portfolios are profitable while the vast majority of US investors are suffering staggering losses?

And were we just lucky again during the great sell-off in December of 2018, when our subscribers were in the green as the market saw 20% sell-off’s by Christmas Eve?

Don’t believe me?

Just re-watch the video I posed from Malibu two months prior to the December 2018 crash, where I warned about a sell-off to come.

How did I know? Was I a genius?

Nope. I simply knew how to read the bond market secrets and signals (i.e. rising yields), and as a result, our subscribers were protected, time and time again.

We think it’s time YOU join our community of informed and calm portfolio solutions.

We avoid the pundit fog, stick to the lighthouse of simple market signals and deliver absolute returns in both bull and bear markets.

How?

Again, it’s pretty basic: We listen to the markets, not the hype. The bond market secrets, if one knows how to read them, are in fact not so secret nor so hard to employ, as long as one knows how to listen.

Once one knows the immense importance of (and signals to) the forces behind bond yields (and hence interest rates), it becomes much easier to forecast (and hence avoid) market risk.

If this makes sense to you, then join (and listen to) the hundreds of others who have enjoyed our service over the years. We translate the complex into simple portfolio signals so that you never get burned in a Bond Fire like this.

Yes, these are scary times. But you don’t need to be a scared investor, and we’ll keep you informed and prepared rather than guessing and nervous.

Genuine and informed calm is just a click away. We’d love to add you to our community.

Good prescient call (again), but defaults are coming big time. Buying distressed distressed debt without access to a Bloomberg terminal is tough when ratings or rating agencies can’t be trusted (a 2009 lesson learned). Better to let the Fed and China diseases run their course than gamble on where the bottom may be a la Das Boat. Will the value of currency emerge as a survivor or succumb to helicopter money bombs? A hint will be when the yield curve shows sensible risk premiums for duration.

Nicely said, John. Fully agree (total einverstanden) with the Das Boot metaphor 🙂 There’s still plenty of sinking left in the distressed credit ocean, and only those familiar with Bloomberg-like analysis should be toe-dipping into this space, as the winners and losers are hard to distinguish in the junkbond-yard. As a friend noted, the VIX is falling a tad bit, and tempered vol could bode well for a Monday bounce as vol calms due to NY and CA lock downs. That said, SM plays the slow and steady game rather than daily moves, and for now the trend remains long-term questionable. Time, and Fed bazooka’s, will tell, but currency purchasing power is at peril, despite the fall in the PAPER valuations of gold and silver, which are a far cry from the surge in the real value of the physical precious metals, whose true value is not at all the same as the futures contracts trading the same these days. Patience, common sense and prudence are key moves for now.