Precious metals are increasingly becoming the subject of necessity rather than debate in the backdrop of the great “taper debate.”

Basel III Tightens the Precious Metals Derivative Belt

On June 28, the much-anticipated Basel III “macro prudential regulation” to make so-called “safe” banks “safer” officially kicked off in the European Union (July 1 for the U.S. and January of 2022 for the UK).

As we explained in June, this would mean short-term volatility for precious metals followed by a steady price climb, which is precisely what followed as gold recovered from its recent “flash crash.”

This requires no crystal balls nor market-timing manuals, just a candid understanding of gold reserves, the simple math of inflationary forces and an equally simple understanding of market history.

As for Basel III, it was a long-delayed, controversial and internationally agreed-upon banking regulation which, inter alia, requires commercial banks to change their “net stable funding ratio” for physical gold held as a tier 1 asset on their balance sheets from 50% to 85%.

Translated into simple English, banks hitherto accustomed to trading billions in derivative-levered “paper gold” must clean house by treating paper derivatives on their balance sheets as “unallocated liabilities” (i.e., bad stuff) which need to be “matched” by more physical gold “allocated assets” (i.e., good stuff).

After five decades of using levered paper to manipulate a near permanent “short” on precious metal pricing, the bullion banks must henceforth show more physical gold and silver on their books.

Basel III ostensibly marked a much-needed change in the over-use of highly levered paper contracts to artificially impact (i.e., impinge) natural gold and silver prices.

Explaining the “Flash Crash”

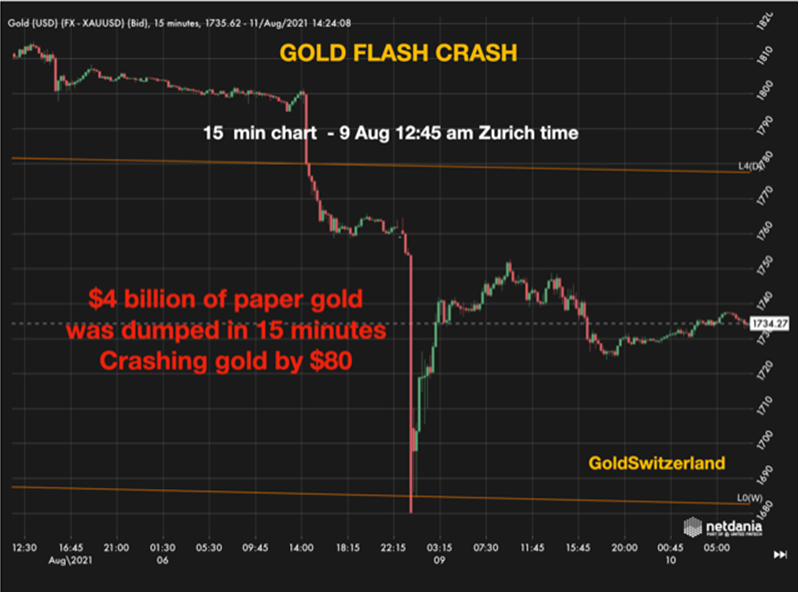

Just over a month after Basel III, however, gold saw a flash crash rather than an un-impinged rise, falling by $100 in just 2 trading days.

In short, the volatility we anticipated in June came on cue.

But how and why could gold fall so precipitously at such rapid speed (before recovering in price just days later)?

The answer boils down to simple math.

When 24,000 sell contracts valued at over $4B suddenly hit the overnight (1:00 AM Europe) markets with no bids in sight, the price takes a dramatic dive.

But who would make such a deliberate, levered and frankly unsupported (i.e., guaranteed to lose) bet against gold? And why?

Old Price Tricks

Sadly, the answer is as simple as it familiar: The very bullion banks that Basel III intended to “clean” were up to their old tricks, deliberately selling gold contracts into a bid-less pool (i.e., black hole) to once again artificially suppress precious metal price direction.

But why? And wasn’t Basel III designed to keep such tricks at bay?

Well, yes and no.

Basel III’s regulatory push to force commercial banks to hold more reserves of “allocated physical gold” on their books as matching assets against paper gold liabilities had only one glitch, namely: Commercial and central banks didn’t have as much physical gold on their balance sheets as they said they did.

This would explain why the Fed and other commercial banks won’t show their vault audits to the public, as large swaths of the precious metals they otherwise claim to own have been leased, levered and hypothecated out to other players rather than sitting in their vaults.

This is fact not fable.

In need of more precious metals to meet the Basel III’s regulations, the banks deliberately dumped gold contracts en mass to push the price down so they could re-stock their reserves with gold on sale rather than at a premium.

This, of course, amounted to price-fixing 101 and is nothing new to the gold and silver trade in those murky currents of the COMEX or OTC markets.

The Old Excuses Don’t Float

Despite this open secret (i.e., price fix) in the gold and silver derivative trade, the pundits came out with the standard explanations that gold was falling due to rising rates, a strengthening dollar and strong jobs reports out of the U.S.

Unfortunately, none of that is entirely accurate.

Even if the much-hyped rate hikes were to transpire in the coming years, this would only be due to the fact that inflation is rising at a much faster pace than rates, which is a tailwind for precious metals.

Negative Rates & Inflation

Critical to understanding gold and silver trends is their relationship to negative real rates.

That is, the further inflation adjusted rates go negative (i.e., when one subtracts inflation rates from interest rates), the higher the gold and silver price.

Stated even more simply, when inflation rates grossly outpace interest rates, gold and silver shine brightest.

Looking ahead, all the hype about potential central bank tapering and rising rates is frankly a clever ruse, for it ignores the far more critical issue of rising inflation, which, again, greatly favors gold in the years ahead.

The Deflationist Camp

Despite months and months of central bankers denying inflation or describing the same as “transitory,” the evidence of increasing inflation, which always follows expanding money supply and fiscal spending, is getting harder to deny.

Deflationists, of course, will argue that supply-chain related inflation is fading or that COVID related slowdowns will continue to place deflationary pressures on the economy.

What they are missing, however, is the fact that inflation is defined by the money supply, not the pundit noise, and of this we are certain: The money supply will only expand further, and with it, so too will inflation and hence the price for gold and silver.

Why so certain?

Desperate Sovereigns “Inflating Away” Their Debt

History and math tell us so.

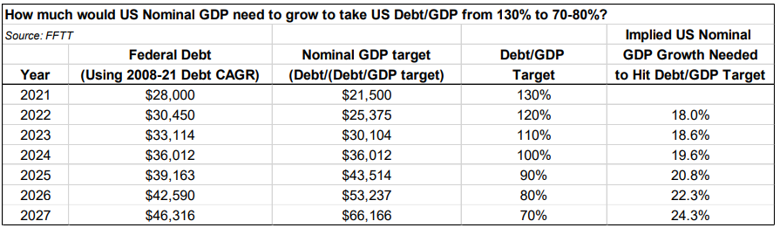

Whenever debt to GDP ratios pass the 100% Rubicon, economic growth stalls, and thus so does GDP. We wrote of this extensively here.

At greater than 130% today, US debt to GDP means hard days ahead for Uncle Sam and his real economy, which has nothing to do with the Fed-supported and grossly bloated stock market.

With growth, GDP and hence national income slowing, debt-soaked sovereigns have no choice but to survive by issuing more debt paid for with mouse-click created fiat currencies.

Such monetary policy, combined with trillions more deficit-spending to pay for highly controversial lockdowns means only one thing: Greatly expanded money supply, and hence greater inflation ahead, which means greater currency debasement as well.

Should, however, the much-debated “taper” come out of Jackson Hole’s forked tongues, bond support would tank and hence bond yields, as well as interest rates would soar, effectively killing every asset but the U.S. dollar.

Note, even Michael Burry sees bonds taking rather than being further supported by the Fed. He’s shorting long-term Treasuries to the tune of $280M in TLT put options. Perhaps he expect a taper?

He may be right, and he’s certainly smart and has been right before. But we still don’t expect a taper anytime soon.

As we’ve said elsewhere, the Fed has put itself in a corner, either they taper and kill the risk asset bubble, or they continue printing trillions and spur greater inflation ahead. So there you have it: Either inflation or a market implosion.

Despite valiant efforts to deny or downplay inflationary forces, policy makers in debt-soaked nations realistically (and at a whisper) engage in pro-inflationary policies for the simple reason that this helps them inflate-away an otherwise unpayable, unprecedented and unsustainable ($280T) global debt burden.

In other words, inflation is not a sovereign fear, it’s a sovereign policy. In this backdrop, real (i.e. inflation-adjusted) rates could fall from -1% to higher than -10%, which would be an obvious tailwind for precious metals.

In case you think such negative rates seem crazy, be reminded that in times of war, from the Civil War of the 19th century to both World Wars of the 20th century, the U.S. saw -14% real rates. During the Vietnam era, real rates sank below -7% to help inflate Uncle Sam out of debt.

Today, the “war on COVID” is being exploited to create a similar pretext for greater inflation and hence deeper negative rates—all very good for precious metals. We’ll write more about this next week.

Lower Rates—A National Prerogative

Equally critical to nations drowning in debt (which they now and conveniently blame on COVID despite fatal debt levels existing long before the first virus headline), is the need to keep the cost of their debt cheap rather than expensive.

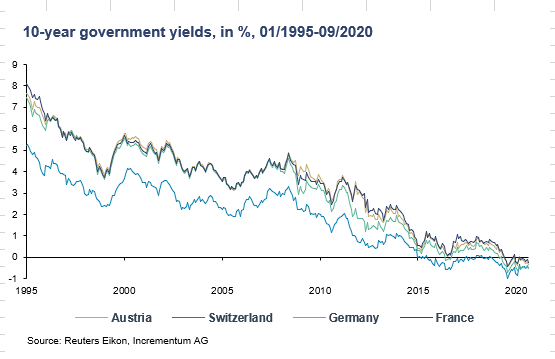

Interest rates represent the cost of debt, and nations now way over their skis in historically unprecedented levels of debt literally have no choice but to keep those rates artificially low.

How is this done?

Well, it’s as simple as it is tragic.

Given that bond yields determine interest rates, the central banks engage in buying their own sovereign bonds in order to keep their yields (which move inversely to price) artificially repressed.

In short, low yields = low rates, and low rates = economic survival for sovereigns unable to sustain their debt obligations via economic growth or rising GDP.

And where do the trillions of dollars needed to buy those bonds come from?

That too is as simple as it is tragic: Thin air.

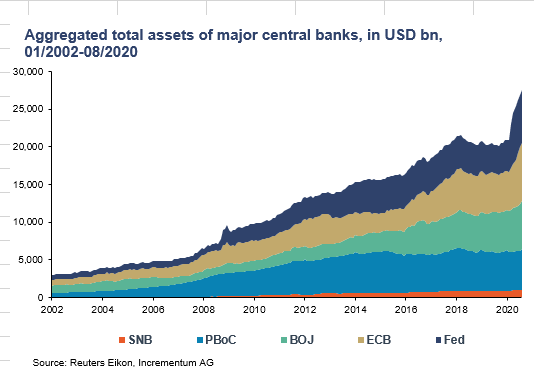

Global central banks (following the Fed’s lead) are literally expanding their money supply at just staggering levels with a mouse click to pay their own IOU’s.

Again, such monetary expansion (excess) is inherently inflationary, which is inherently favorable to precious metals.

Thus, as pundits, investors and nervous policy makers fret over rising rates, Fed tapering or dollar strength, they are ignoring the inflationary elephant in the room.

Deflationists or market cheerleaders will say that the U.S. can “grow” it’s way out of debt at normal rather than negative rates. But as the chart below reminds, the only way to “grow” our way out of debt would be to see 20% GDP rates for the next 5 years:

We don’t believe that is possible, and nor does anyone else, to be blunt. Instead, inspect more money printing as the most likely path forward.

Yield-Less Gold vs. Negative Yielding Bonds

Bond yields, when adjusted for inflation, are negative, which means bonds offer no real return. By the way, a negative sovereign bond is effectively a defaulting bond.

Until the bond market implodes under its own weight, central banks will deliberately pursue further rate repressive policies while simultaneously engaging in inflationary measures to get themselves out of debt with increasingly debased currencies.

As stated above, this combination of deliberately rising inflation and repressed rates creates the perfect backdrop for negative real rates and hence gold’s positive rise.

But gold and silver, their critics argue, offers no yield?

Yet think about this: Sovereign, corporate and even most junk bonds offer negative yield.

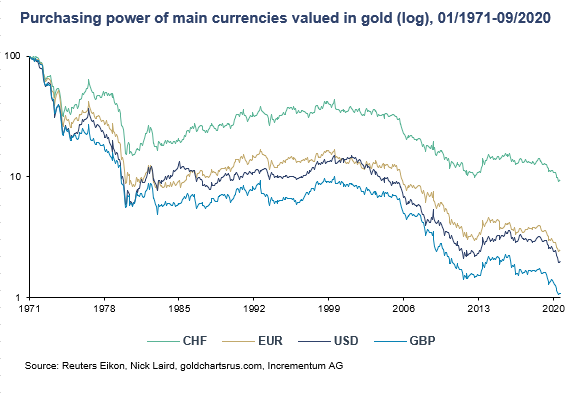

Far more importantly (and worth repeating again and again), that otherwise yield-less and “barbarous gold relic” is infinitely more powerful than any global currency, whose purchasing powers against gold are falling by the week, day, hour and second.

As pro-inflationary forces (expanding money supplies to pay for expanding deficits) gain in windspeed, so too does the debasement of the currencies.

It’s just that tragic as well as simple.

This, once again, explains why sophisticated precious metal investors look to physical gold and silver as insurance against dying currencies. Full stop.

Given the inflationary math and debt history set forth above, gold is no longer a “debate” but a blunt necessity.

As for the great “taper” debate, we will continue to look for more signs from the Fed, which is effectively the market’s true directional signal.

A taper would mean dramatic dives for traditional portfolios. A non-taper will mean more short-term market support, though not without continued volatility and fear, even among the bulls, that at some point markets can’t run forever on printed dollars.

That’s why portfolios need constant attention, constant management and constant diversification outside of just stocks and bonds.

Hence SignalsMatter.com.

I consider myself a deflationist, just not aligned with the ideology of deflation as differentiated of contrast to inflationist ideology.

…. For that’s exactly what such differentiation defines – ideology – as defined by the rigour of competent management application,

…. observing once the dynamics of an issue are accurately defined, competent management analysis doesn’t project its primary outcome as further defined by what’s going on in the ‘skirmishes,’ nor the ‘battles,’

…. but the inevitable outcome of the war – parameter analysis.

And by any competent measure of the excellent market and economic analysis SM defines in these reports, the inevitable outcome projected reliably defines a global debt deflation crisis.

…. And that’s how I define myself a deflationist.

…. For if such a crisis is where all the indicators are predictably leading, the further projection it begs is the proportionate potential of the debt deflation crisis it portends.

And that such debt deflation potential is defined by the level of debt, then,

…. by even a conservative estimate that potential defines a debt deflation crisis with the capacity to render The Great Depression of the 1930s-40s to the status of ‘a warm up event.’

My investments have been heavily weighted in gold bullion since I ‘did the math’ in 2019, observing the information from SM reports I followed, although not exclusively.

…. As a very small investor my investment position could be improved, but what’s more significant,

…. is the losses I could have sustained if I had chosen a conventional investment path and had attempted to ‘play’ the market.

And as SM keeps reconfirming as the predictable market outcomes keep emerging, precious metals,

…. are reliably projected to prevail when, not if, a debt deflation crash of the proportion further indicated by the evidence defining its projection, comes to pass.

For instance, with the economic recklessness observed defining the building of such potential economic crisis, including the culpability of central banks within it,

…. there is little doubt their submission to the regulation of Basel III would not have been contemplated unless they determined its requirement as manifestly unavoidable.

Then I suggest the bottom line of the issue defines the profligacy of the neoliberal economic experiment now ‘coming home to roost.’

…. It recalls for me a quote of another reckless ‘swashbuckling’ ideology pursued by a former icon of the silver screen;

“My problem is reconciling my gross habits with my net income.”

– Errol Flynn