Below we offer an example of how to cut risk by using volatility management (the SM Stop Loss) to exit a trade when the markets turn. Using the PSA trade, we remind you that a good trade is not about about winning or losing, but smart exiting.

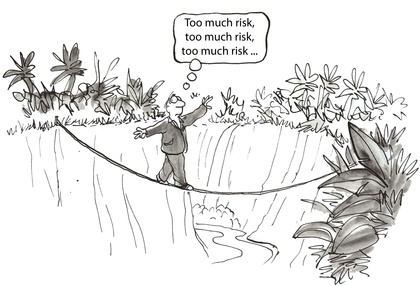

Let’s call the chap in the drawing above James (a.k.a. Jim, Jimmy, Jimbo). Why? Because James is the most common name in the United States today. According to census records, there are about 5 million James’s out there.

And according to the loss attributions of most novice traders, there are more than 5 million traders daily losing money in the markets by not cutting their losses—i.e. ignoring active risk management…

And that’s what Jimbo is doing. He is being common. He’s doing what the majority of investors do. He’s walking a tightrope.

When it comes to investing, Jimmy is simply taking too much risk. He knows it, he’s thinking about it … yet he just keeps walking the walk, hoping to win without loss protection, without a safety net beneath him, or at least a balancing bar.

In this article, we recoomend that investors like James leave the tightrope walking for the circus, so as not be eaten alive by the dancing bear when the markets flip or a trade goes against them.

Money is made in two ways: 1) by winning and 2) not losing.

In the investment world, ‘not losing’ has a far greater implication than ‘not-winning,’ as it did in 2008 when global stock markets fell by half.

James got lucky in the Great Recession. His tightrope morphed into bungy cord, thanks to the V-shaped recovery of an artificial FED stimulus, and snapped back—and then some.

As we’ve written elsewhere, the steroid effect of that Fed “snap-back” has no precedent in history nor any chance of being repeated.

In short, the Fed is out of drugs—so don’t expect any circus magic to save you in the next downturn.

Going forward, James needs to get off his tightrope because the equity and bond markets are at all-time highs, investors are way too complacent and (as worth repeating and metaphor mixing): the FED is out of bungy cords.

The rope is tight now. Next time, it could fray badly or even break.

Here’s how Signals Matter stops the losses—be it during a global crisis/correction or just a bad stock move.

First, let’s define stop-loss. Stopping losses is a pretty easy concept to understand … but rarely executed well or consistently.

As a market term, a stop-loss is basically an order to sell a long position (or buy back a short position) once the stock hits a predetermined price.

Stop-loss orders can be placed by you with your broker. “Mr. Broker, XYZ is trading at $105 today. Take me out if the stock if drops to $99.” When the market price hits $99, your stop order becomes a market order and out you go on the very next trade, at the then market price.

That’s the easy part.

The hard part is knowing how to determine your stop-loss price and how often to revise it. Stop-loss placement should be left to professionals like Signals Matter. We are here to stop the losses for you, on every trade, every day.

Second, plan for losses before placing the trade by calculating your expected loss on each trade. Here at Signals Matter, we are very stingy. We hate losing money.

On average, we gear our Signals to not lose more than 2% per trade, whether it be a long trade or a short trade. And we do it dynamically, not by simply hoping off the tightrope at 2%.

Third, get to know your expected return. Let’s think about this. When we win here at Signals Matter, we make about 10% on average per trade. When we lose, we lose 2% on average. That’s a win/loss ratio of 5x (5 times) – pretty good.

If we can make 5x on our losses, over and over again, our cumulative gains get to be pretty large. In fact, since April of this year, we have posted 60 Signals with cumulative gains of 245%, which annualizes to 468% – pretty good as well.

The math is simple. That’s an expected return of 4.08% per trade. Crazy? No … reasonable. Very reasonable. We just need a bunch of trades at an average win of 4.08% each, which requires stop-lossing the losers! If we don’t win, fine. But if we lose, not so fine.

We use a range of techniques to stop our Subscribers’ losses. How did we get so good at it? Because we’ve been doing this for a long time.

And Tom, whose hair is the greyest, has been doing it even longer …

Much of our stop-loss work centers around the concept of volatility management, an approach the U.S. Army came up with a long time ago with their notion of VUCA.

Tom, being a Navy guy, may have resisted at first, but the Army won him over with some undeniable common sense.

VUCA was introduced by the U.S. Army War College to describe the more volatile, uncertain, complex and ambiguous general conditions that were prevalent at the end of the Cold War.

Your guides here at Signals Matter have been students, teachers and practitioners of managing volatility, uncertainty, complexity and ambiguity for years upon years.

And we never mind borrowing useful analogies, even from West Pointers.

Signals Matter measures volatility by creating volatility bands that surround price. There is no shortage of ready-made volatility bands in the marketplace, from Bollinger Bands, Market Channels, Keltner Channels, auto-regression bands, momentum envelopes, trading envelopes … and many more.

These and other like analytics are described in the free Signals Matter’s Investment Primer that is provided to any prospective Subscriber of the Signals Matter website, launching mid-November 2017.

Each of these volatility measures have their advantages and disadvantage and thus none should be used in isolation. Instead, do as we do here at Signals Matter and make these a part, but by no means all, of your investment strategy.

Sticking with your choice is what counts, not what band you use. Better yet, just follow our lead.

At Signals Matter, we have modeled our own volatility band. We call it the SM Stop-loss.

The SM Stop-Loss is a proprietary algorithm that adapts to market conditions by measuring the standard deviation of a simple moving average to measure of price volatility.

Our algorithm plots lines above and below the moving average of trade price at a specified number of standard deviations that can vary by circumstance.

By using the SM Stop Loss, we identify periods of high and low volatility, as well as periods when price is at extreme– and possibly unstable– levels.

These variable-width bands become narrower during less volatile periods and wider during more volatile periods. In other words, the bands move dynamically with the market.

An example might help.

PSA is a real estate investment trust, or REIT , whose business activities include the acquisition, development, ownership, and operation of self-storage facilities in the United States.

Most of us have heard of/used a Public Storage facility to store far too much of our stuff at too high a price for far too long. No wonder PSA has perfomed so well … until lately.

The monthly candlestick chart below exhibits a stock well-bid from 2008 until late April 2016 when Public Storage’s good fortunes reversed on an earnings’ miss and a downgrade by Goldman Sachs.

Note the outside monthly reversal at the top – quite vivid with much predictive value.

The stock’s drop began to settle out in a sideways track as 2017 progressed. Our Signals Watch tool signaled an oversold situation and thus awaited a BUY signal on an upside volatility breakout.

The BUY Signal was triggered last August 8th, with a heart-warming upside breakout, pictured in the weekly chart below.

Good … but, unfortunately there was no follow-through. This happens.

The stock went sideways and then dropped back into the SM Stop-Loss volatility channel constructed for this trade, causing a stop-loss SELL signal on August 29, just 16 days later.

So that’s it. We exited the trade for a -1.98% loss. Fine. No problem.

After all, this was spot-on our expected loss – a picture-perfect, “fire-in-the-hold,” GET OUT moment.

What happened/happens next, we really don’t care. This trade is done. We’re gone … and are looking for something else to trade.

Low volatility begets high volatility; high volatility begets low volatility. Think of volatility as an accordion, which is played by compressing, then expanding the bellows. Expand … contract … expand … contract. You get the picture.

Probably not. A good accordionist is a practiced musician. (Although if you are a practiced accordionist, then you have a leg up on understanding on how to play volatility, for sure!)

Are you a practiced trader? If so, great. If not, we suggest you not play at this, but rather leave the loss stopping to Signals Matter.

This is what we do, every day. We’ve been stopping losses professionally for clients for over 50 years as a former Commodity Trading Advisor, as a former Commodity Pool Operator registered with the Commodity Futures Trading Commission (CFTC) and as a Portfolio Manager at Morgan Stanley.

At Signals Matter, we apply the artful science of risk management by constantly parsing each and every Signal for trend, volatility and other risk criteria, determining as often as weekly (and sometimes daily) whether to stay the course security by security, substitute other securities, or rebalance to cash.

Controlling loss is an important aspect of risk management and is essential to long term profitability. And risk management, as our video blog from Las Vegas reminds you, is what separates investors from gamblers.

Don’t be a gambler.

When volatility hits extremes, it reliably reverses and those reversals mark key opportunities to buy, sell, sell short or exit a trade.

That’s it. Once in a trade, if markets jolt against us, we’re gone, not doubling down or praying for snake eyes on hope, hunch, or delusion.

Because behind the scenes, we are investors, not dice-rollers, and thus artfully engineer each Signal to meet our selfishly-chosen expected return.

No worries. Signals Watch is a weekly publication of Signals Matter that showcases individual stocks and exchange traded funds that meet our rigorous technical and fundamental criteria for investment.

Why is Signals Matter important to you?

Smart investing is about living, not trading; about knowledge, not fear. That’s why we do the heavy lifting here at Signals Matter, why we signal the trade and why we manage the risk. All you do is pull the trigger, if you or your advisor are so inclined.

We built Signals Matter because we know that almost no one outside of a professional investment platform has the time, interest or resources to select, combine and derive sophisticated trade Signals as we do from our wide, essential spectrum of technical and fundamental filters.

Yet we know as well that anyone, including you, can deploy these tools if properly and simply condensed to an unpretentious and user-friendly dashboard of Signals.

To subscribe to Signals Watch (or to our Trend Watch and Recession Watch deliverables which keep an eye out for macro icebergs and opportunities ahead), visit our public Website which will go live in mid-November.

Thereafter, you can join our private community of investors eager to let their profits run, cut their losses short and generally navigate the choppy waters that lay ahead.

Be sure to visit our interim Blog site at www.SignalsMatter.com for candid talk about where we are, how we got here, where we are likely going … and why.

SIGNALS MATTER, LLC IS NOT A PROFESSIONAL OR LISCENSED FINANCIAL OR TRADING ADVISOR. NO INFORMATION OR OPINION HEREIN CONSTITUTES A SOLICITATION OF THE PURCHASE OR SALE OF ANY SECURITY. AS ALWAYS, PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

What are the typical losses in your signals trading system? On average? And the average gains? What percentage of the time are the picks correct? I’m assuming the gains are out-performing the losses, given the use of stop-losses?

It’s good you respect the stop losses, but if there’s a massive market correction, will your stops find a bidder? Isn’t there still that risk that you won’t get liquidity when you need it, no matter how disciplined your stops are?

Thanks, and please respond.