As promised, below we conclude our report on the dangers lurking beneath the current pension funds and hence pension fund risk ahead.

28 shares

Last Friday, we dove into the U.S. Pension Fund Disaster, where we set up the backdrop for how pension fund risk can trigger a massive sell-off.

Wall Street and pension funds’ trustees are asking more folks to double down rather than exit their high-risk stock recommendations, thus adding to pension fund risk.

We are concerned that such traditional advice will get this massive class of baby boomers slaughtered, and given the size of the baby boomer class, it will have devastating consequences for the larger markets and economy in general.

Today, investors and broken pension funds are going “all-in” on these dangerously overvalued markets and hence doubling (even tripling) down on stocks (and therefore stock and pension fund risk) to try and close the gap between what they need to retire and what they have today. This is great in a melt-up, and a life-changing disaster in a meltdown.

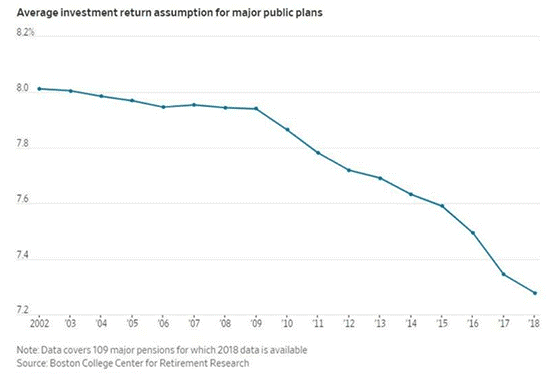

But at the same time, pension funds and Wall Street are asking suckers to go further and deeper into “miraculous” stocks, and their fund trustees are quietly muting their promised “return expectations.”

Many households and pension funds, like our very government, simply don’t have enough money. To stay afloat (and keep you afloat), this means they are taking crazy risks in an even crazier stock market. Pension fund risk follows in lock step.

Today, we’re going to dig even deeper as to why this pension fund risk is inevitable.

More importantly, we’ll address what you can do now to avoid the carnage ahead…

Not a Safe Bet–Pension Fund Risk Ahead

It’s crazy because by every metric – be it standard PE multiples, median PE multiples, cyclically adjusted PE multiples, or even market cap to GDP ratios – the U.S. stock market is currently at all-time record highs of overvaluation.

In short – not the safest bet, especially for wannabe retirees. Of course, no one sees this as stocks rip up on the back of a supportive Fed.

Meanwhile, and based upon pure math and demographics, we have a record-high number of baby boomers seeking to retire and draw upon their pensions from state pension funds and defined benefit plans that simply do not have the money in their funds to pay them. In fact, they are about to have even less money when these markets hit a recession.

That’s because these pension funds have been speculating, gambling, and falling short on their promises. According to recent data from Pension & Investments, average pension returns among 36 pensions tracked are down by 26% this fiscal year over last. That’s pension fund risk in real time.

Again, pension funds returns are simply not as good as they and Wall Street promised. Big shocker there, eh?

And again, what does Wall Street, the pension funds , an the “retirement advisory complex” tell you to do in the backdrop to such pension fund risk? Buy more stocks!

Big shocker there, too, eh?

But stocks are already at record high-risk levels based upon every credible measure. This means the “experts” are literally inviting you to walk over a cliff.

Today, this pension fund risk and scam system, like any Ponzi scheme, only has enough funds to pay out the early draws, not the later ones, which means baby boomers and markets are facing a demographic time bomb colliding with a recessionary storm front.

As for state pension fund risk and defined benefit plans, which are collectively trillions of dollars in the red, I will not have the time or room here to break this devastating data down state by state or pension by pension.

What I can say here is that these desperate, broken, and frankly unethical pension strategies are now at a point in history where the only solution they are “promising” for these duped baby boomers is that an ever-rising stock market or junk bonds will save them from now until 2027.

Time for a Reality Check on Pension Fund Risk

We now have millions of baby boomers massively overweight in high-risk equities and junky junk bonds and yet seeking to survive on a stock and bond market that is now at both an acme of record highs (and hence record pension fund risk) as the longest business cycle ever recorded nears its approaching end.

That is a perfect storm.

Meanwhile, Wall Street and broke pension funds (as well as fee-seeking advisors and clueless anchormen) duck in the corner pretending not to worry about tomorrow about pension fund risk because stock markets will never fall.

In fact, and notwithstanding the Fed’s monetary “doping” since 2008, normal business cycles contract once every 4-8 years, which means recessions and market crashes are as inevitable as thunderstorms and hurricanes.

Always Sunny in Wall Street?

Now 11 years into the most hated (and artificial) bull cycle in history, the majority of retirees are still being told market thunderstorms or hurricanes no longer exist.

As of this writing, Hurricane Dorian has wreaked havoc on the Bahamas and Carolinas.

The Bahamas and Carolinas, like the stock markets, are known for their sunny days. But as both Dorian and the above facts confirm, it’s not sunny every day in the Bahamas – or the stock markets.

Yet, Wall Street and its cadre of gambling pension advisors would still have you believe it never rains on Fed-supported markets.

I’m warning you now that a perfect storm is converging as broken, under-funded pension funds are no longer able to pay millions and millions of plan contributors who were recklessly placed in overweight stock holdings and index funds whose values are about to take a massive dive when the most overvalued (and hence most at risk) stock market in history reaches the end of the longest business cycle in history.

The market storm we are tracking is real, and our recommendations to protect you from such pension fund risk are as serious as they are sincere.

Blowing at 47 knots of windspeed as of September, our Storm Tracker is telling you to be 47% in cash. Of course, if the Fed prints more money and markets rise, we’ll adjust this percentage as needed.

And do remember this: Recessions are always date-stamped in arrears, which means it takes two down quarters of GDP (plus a month or so to figure that out) before the National Bureau of Economic Research (NBER) lets us know when the next recession actually began, which is effectively too late. We’ll do far better than that.

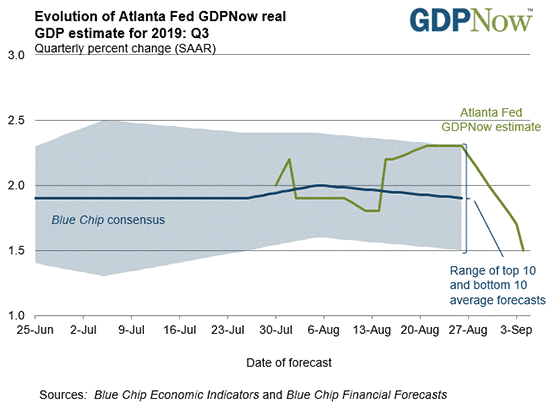

Below is the Atlanta Fed’s latest GDPNOW reading for Q3 GDP, published September 4, 2019. It’s falling fast lately, and it’s down to 1.5% in barely a week.

The Bureau of Economic Analysis pegged GDP in Q2 2019 at 2.0%. If the Atlanta Fed is right (and they’re actually pretty good at this), GDP could take a 25% hit this quarter.

At this rate of decline, we could see two negative GDP quarters beginning to form as early as Q4 2019 and that’s pretty nearby. But again: Good news is bad news in a rigged market, and thus the Fed will likely add more steroids in Q4 to postpone reality and send stocks much higher. Crazy? Yes. But that’s the new normal…

Are we already in a recession? If we are, the NBER won’t be letting on until mid-2020 – and that’s too late for you and pension funds alike to take action, for markets begin to slide way before we know we’re officially in a recession.

If you’re currently overweight in Index ETFs or similar mutual funds tracking S&P proxies, we suggest you cut your exposures now before the rain. If the markets hand us another fat pitch, we’ll adjust accordingly as well.

I’ll be back with you soon.

Sincerely,

Matt Piepenburg

Comments

10 responses to “How to Protect Yourself Amidst the Pension Hurricane”

- Patrick Jonas says:

These is some great advice to looking to here form you soon

- Stan Sextonsays:

No problem with state-sponsored CALPERS and CALSTRS California state pension plans. Just tax the citizens to death. These pensioners are a “protected class’ under the State Constitution. One of the reasons productive people are leaving California.

- Richard Comansays:

Why the current sell off in US Government Bonds?

- Mike Smithsays:

Your article, that at first sight appears to be excellent, might also be considered as part of ‘Project Fear’.

- Rod Belyeasays:

Hello Matt: You have referred to high risk equities in this article. How does one identify them? I don’t know if any of my holdings are high risk, and would like to know if they are.

Thanks

Rod Belyea

- Larrysays:

Excellent advice for self directed qualified investors. I feel sorry for the millions of pension members who are trapped and cannot heed your advice or do anything about their circumstances. You’re right, this next collapse is going to be devastating and these unfortunate members are going to be set back for years and years which will be very demoralizing and very bad for future market investing and future performance. It could possibly take years to recover just back to getting even.

- Tom says:

C.C. DEBT WENT UP TO 23 BILLION IN JULY AS PEOPLE CAN’T PAY THEIR BILLS.AS OF NOW GOLD & SILVER ON SALE WHEN THE PENSION GO BUST YOU NEED A LIFE BOAT .WHEN THIS IS ALL OVER 4 GENERATIONS WILL LIVE IN THE SAME HOUSE.WHAT I SEE IS THE GRAND PARENTS HAVE OLD SCHOOL PENSIONS THAT MONEY GETS FUNNELED DOWN TO THE KIDS AND GRAND KIDS.BECAUSE THE KIDS CAN’T MAKE AND EVERYONE WANTS NEW SUV, NICE TRIPS, BEST OF EATING OUT.WHEN THE PENSIONS GO SO WILL THE WHOLE GAME AND THAT IS SOON.

- Homer Feamster says:

What will the effects be of our fed just printing currency backed by no precious metals just our blind faith? Our government just allowed over one trillion dollars of this paper currency.

- Stephen K Grangersays:

You need the DNA recurrence of Thomas Jefferson. Time is money-pay your federal, state, county, and local government employees labor script for time on the job, every 2 weeks. Don’t go through the Fed anymore!

- Henk Leeuwenburgsays:

Crazy times, crazy heads of States. Fed,Chiefs will do whatever it takes.

They will keep printing money together with wage increases the market

might go on for longer. Pension crisis : yes, one just has to work until you

drop dead or a bit of charity or a lot ?