Many understandably feel that the Fed has saved us; after all, portfolios are enjoying the greatest percentage rise ever seen in modern markets. Below, however, we look at a more dangerous read on the dangerous Fed.

40 shares

Even after last week’s much-anticipated rate cut, Powell has been getting hammered by White House tweets for not cranking rates “competitively” faster and lower at levels equal to those of Europe and Asia – which is to say, zero or below.

Such pressure is the logical equivalent to: “If our neighbors are jumping off a bridge, we should, too.”

Sending interest rates to the bottom of history (and then below that) has done nothing for the countries who have pursued this suicidal policy except buy more time, kick more cans, and fatten the size of the debt land mines buried beneath their teetering economies.

This is not an opinion; it’s a mathematical and historical fact. A Fed that pursues (and will pursue) such a policy is ultimately a dangerous Fed.

Let’s explore…

Risk-Free Return or Return-Free Risk?

In Europe, where I sit today, German and French investors can purchase a 10-year sovereign bond in their respective countries and be guaranteed to lose money by the time those bonds mature.

In Austria, if you’re willing to wait 100 years, you can be guaranteed a 2% return. Wunderbar…

Yep, the markets have lost their minds. Time has no monetary value, and negative debt returns are in fact just a nicer way of describing defaulting bonds. The only aim today is to keep the market party going, despite the fact that the only ones enjoying this tired party are the top 1-10% of the world’s wealthiest.

I never thought capitalism would turn this upside down or the dangerous Fed would ever be forced into such a self-made corner. I never thought bond markets could go negative ($15 trillion and counting) as part of intentional monetary policy.

In fact, the books I read in the fancy schools (whether in Germany or the U.S.) never contained a single chapter on negative rates, for the simple reason that such a scenario was unthinkable.

In the good ol’ days, investors flocked to 10-year sovereign bonds like the U.S. Treasury or Ten-Year Bund because these bonds guaranteed what was peddled by the Financial Advisory Complex as a “risk-free return.”

In those days, an investor could buy a bond and get a risk-free return of at least 5%.

Fast forward to the “new abnormal” here in Europe (or the soon to be revealed policies of our dangerous Fed).

Investors in 10-year sovereign bonds can get a guaranteed return of below zero, turning the notion of “risk-free return” upside down into the current absurdity of “return-free risk” – that is, no return for greater risk.

Think about that for a second. It’s true. Investors are paying to take greater risk for a guarantee of no return.

Almost no one actually grasps how absurd this is. But YOU do.

Yet now the White House is asking the dangerous Fed to do the same dangerous thing – to “competitively” crank rates to zero or below for “return-free risk.”

And the dangerous Fed, as of last week’s rate cut, seems to be reluctantly heading in that direction.

Why reluctantly?

Glimmers of Sight in a Blind World

Because even the highly educated “boneheads” at the dangerous Fed, most notably Powell, know all too well the dangers of going to zero or below.

If yields on the infamous U.S. 10-year Treasury get to zero, who will buy our bonds, float our debt, and keep our national debt rollover, can-kicking monstrosity of a “recovery” going?

Furthermore, if rates hit the zero-bottom, what rate-cutting tool will the Fed have left in the next recession? (Assuming we agree that recessions have not been outlawed despite over a decade of dangerous Fed steroids. “Recency bias” has never been so biased…)

History confirms that for rate-cutting to have any effect at all in a recession, then the Fed must be able to cut rates by at least 4% to stimulate a reeling market economy.

But if we get to zero, what more rate-cutting can the dangerous Fed do?

Powell knew this. He’s known it all along.

That’s why he desperately tried to raise rates in 2018, so that he’d have something to lower when the crap hit the fan.

The only problem was that our debt-dependent markets (made into low-rate addicts by short-sited “visionaries” and “heroes” like Greenspan and Bernanke) could not stomach such careful rate hikes, and hence the markets promptly began to unfold in late 2018…

We’ve all heard the expression, “damned if you do, damned if you don’t.” Well, that’s our central bank in a nutshell. They can’t raise rates without triggering a meltdown, and they have no rates to lower in the next crash.

In short, the dangerous Fed has nowhere to go but damnation…

The Dangerous Fed Is Stuck and So Are We

Frankly, even at the current Fed funds rate of 1.75%, the Fed has almost no ammo left for a “rate-cutting salvation.”

They’ve gone too far. The only other tool left is the money printer, and we’ve seen the return of that in the last couple months – big time. Get used to it, for there will be more money creation, and in the near-term, more skyrocketing U.S. stocks. But this leads to an equally amazing fall in prices when the rocket runs out of fuel.

In short, the dangerous Fed and those of us who rely upon it are screwed. It’s now just a matter of time before we feel it.

Again, Powell actually knew this – which is why he tried to tighten the Fed’s balance sheet and raise rates from the moment he got into D.C. and through 2018.

But now he can’t loosen his bloated balance sheet nor raise rates without triggering the very recession for which he was trying to prepare.

He’s stuck, which is why, again, I almost feel sorry for Powell.

But “almost” is as far as I can go.

The Dangerous Fed Is the Problem

Because the Fed itself is the problem and thus Powell is, too.

Why?

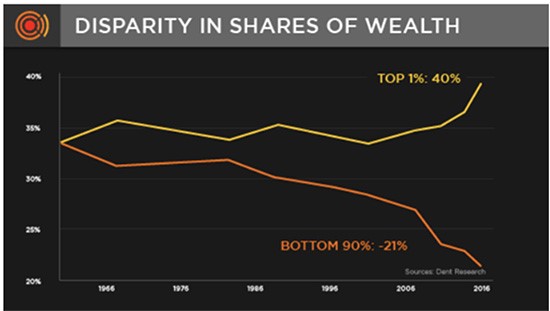

Because within this system totally rigged to fail since the Fed’s unnatural birth in 1913, the dangerous Fed is a co-conspirator in an insider trade with Wall Street to benefit one class (the top 1-10% which own 86% of the market) while crushing the middle class savers with no-yield bonds – i.e. the rest of America.

I’ve talked about the real math behind the real America, you know, the one on Main Street, at length here and here, and I further unveiled the harsh truth behind the so-called “unemployment sham” here, a fact which Trump himself recognized during his campaign.

The dangerous Fed works for one master, which is Wall Street, and its low-rate policies benefit the C-suites and hedge fund class (like myself) because it allows 1) executives to buy back their own stocks at cheap borrowing costs, and 2) hedge fund managers to lever their carry trades practically for free.

How does any of that help the average American with less than $1,000 in his/her savings account and three credit cards maxed out in his/her wallet or purse?

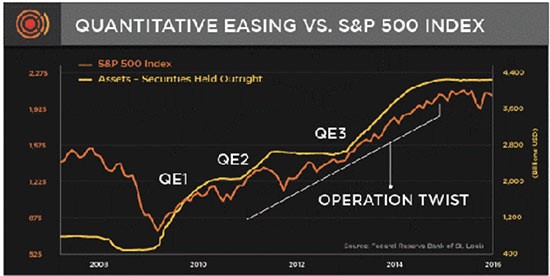

Furthermore, the post-Greenspan Fed’s consistent policies of stapling rates to the zero-bound and printing trillions of dollars are the only reasons markets have reached nosebleed highs, and hence the top 10% of America nosebleed lifestyles.

Do more people like Adam Neumann really make America a better place?

There’s simply no denying the direct correlation of the Fed’s policies and the market’s rise since 2008.

But a rising stock market is NOT the same thing as a rising economy, and in this fog of post-’08 Fed corruption and rigged market manipulation, the media, politicos, and pundits have carefully confused the stock market with the economy.

Yet if you’re one of those who are trying to scrape by in a middle class family faced with the difficult balancing act of tuition, rising medical bills, or even a normal retirement, you know differently.

The stock market is not the economy or reality; life is harder, not easier, for most of America, despite the undeniably spiked punch party on Wall Street.

Wealth disparity in the U.S. is now at record, embarrassing highs, and most Americans are feeling difficult lows, as 90% of them are today at equally record peak debt.

What is the Fed, Really?

Perhaps this gross wealth imbalance is why President Andrew Jackson described our central bank as the “prostitution of the few at the expense of the many,” for there is sadly no better way to describe the dangerous Fed other than as Wall Street’s harlot.

Even Woodrow Wilson, who signed the Fed into existence in December of 1913, knew as much, describing that very day as not only the darkest in his life, but the darkest in American history.

Now how’s that for irony or just plain bad PR? Even Wilson himself knew that a banking cabal had pressured him into a Faustian deal with his own conscience and country. And yet he signed the Fed into law anyway.

What a guy…

It’s also worth noting that America was doing far better for itself before the dangerous Fed existed, despite many painful (i.e. natural) bear markets born of investor greed and punished by a natural (and necessary) market butt-kicking.

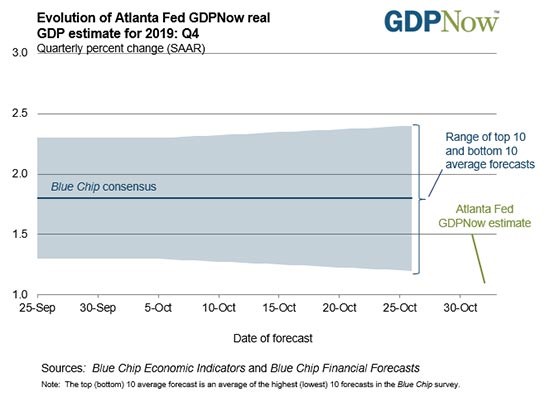

In the 43 years between 1870 and the Fed’s 1913 “birth,” U.S. GDP grew by upwards of 4.5% per year, a span of growth we have never seen since. Never.

In fact, the Atlanta GDPNow Forecast for Tuesday, November 5 has GDP growth pegged at 1.1% for Q4 2019. That’s down from the already anemic 1.5% forecast for Q4 on October 31! And a far cry from that pre-Fed average of 4.5%.

And the stock markets are up? This is indeed a Twilight Zone folks.

No Pity for Powell

So no, I don’t feel sorry for Powell. The dangerous Fed is not only rigged, but it was never even needed.

Sure, Powell’s getting a lot of heat, and sure, he tried in 2018 to bring some “balance” to the Fed’s balance sheet and offer some rate “normalization,” but there’s nothing normal at all about the Fed or anyone who sits in the dunce chair that runs it.

Again, the dangerous Fed is part of a rigged game, and YOU are not its primary player – Wall Street is. But even Wall Street will suffer from its own Fed-supported excess, as all bubbles–even those directly driven by the Fed–pop.

As of today, interest rates are once again racing toward zero and quantitative easing is once again in mode, just like during the “temporary” emergency measures of 2009 and beyond.

The current QE/rate-cramming extension simply confirms that we are still in an “emergency measure mode” despite the countless “all is good” lies handed to us from the Eccles Building.

And yes, markets are at all-time highs, as I said they’d be here and here if the Fed resorted to more “stimulus.”

But rigged games based on lies and fake money, no matter how powerful the players, eventually end badly, as all lies and fakes inevitably do.

This means we can expect a few final gasps from the Fed and a few final surges from its co-conspirators on Wall Street and the S&P C-suites.

Volatility Ahead – Uncertainty vs. Risk

But with these final gasps will come increased volatility and market swings, which means for less-experienced investors, a greater sense of realism and caution is in order, which means Storm Tracker consistent allocations to cash, as so prescribed, even when markets are rising.

No one can predict how long these Fed steroids can last. There’s simply no precedent.

We are now in uncharted Fed waters, and we’re faced with more uncertainty (which can’t be measured or forecasted) than mere risk (which can be individually measured). That means prudence should be a stronger impulse than the fear of missing out – especially for those with less market experience and risk measuring tools.

For those of you, however, with more trading experience, risk tolerance, and resources, we say “party on”–as these Fed-driven markets are gonna soar into year-end.

Sincerely,

Matt Piepenburg

Comments

8 responses to “Why I Don’t Feel Sorry for the Fed”

- Franksays:

Thanks for all your great common sense research and reporting.

- Alibabasays:

I don’t think the fact that Americans have no 1000 dollars in their saving accounts, have three max out credit cards, and cannot pony up 400 bucks for an emergency is anybody’s fault other their own. After all personal finance is well… personal. Nobody forced Joe Sixpack to keep it up with Johnesses!

- Gilbert Holguin says:

Thank you for your common sense message , so please continue with your very welcome information!

- Walter E. Abegglen says:

A comment/question from Switzerland : Are you sure this is capitalism’s doing rather than the result of more than a decade of statist intervention by ideologically driven politicians and central bankers unaware ( I hope ) of the consequences of their monetary/currency and interest rate activities ?

- Anthony Gallegossays:

Thank You for the amazing analysis of what is really going on. I myself feel a very uneasy and almost sinking feeling about what is about to transpire in our country, and there is a quiet fog of fear that I see in others. The calm before the storm, so to speak. When You mention cash, what exactly are You saying, as far as investments. How about gold and silver IRA’s. Is there anything else we can be looking at. I think this is the time to find a lifeboat, for our families, before the ship sinks. Thank You for the eye opening facts.

- JOHN SPITZKY says:

I am reminded of a remark by President Thomas Jefferson=”If we ever

turn the Management of our Money over to the Banks, it will be the end

of America.”

- John Spintzky says:

That is not my comment ,it is a direct Quote as I remembered it all my life. I have seen a lot in 89 years. also PM Margaret Thatcher said=” Sooner or later you run out of other peoples Money”

- John Pipersays:

Thank you for being the watchmen on the tower and pointing out the enemy. God help the honorable and just citizens and the rest go to hell in a handbasket they created for others too be trapped in.