Credit crunch ahead?

Looking back on a long market history of boom-and-bust cycles, we’ve shown how bust after bust always boils down to a lack of money to keep the boom going. The fancy lads call this a “liquidity crisis,” and as we discuss below, the warning signs of such a crisis are currently flashing red from the banking system.

In short, the credit binge which markets have been enjoying in the longest (Fed-supported) credit cycle in U.S. history is stumbling toward a credit crunch—which can take a big bite out of risk assets and unprepared portfolios.

Nervous Banks

Unnoticed by many, Wells Fargo, JP Morgan and the Fed are literally signaling the markets (and informed investors) that they are concerned about a credit crunch—i.e., a lack of dollars to make more loans and extend the current debt—and hence stock—bubble further down the road.

In our book, Rigged to Fail, we outlined the insider relationship between central banks and commercial banks in great detail rather than just broad accusation.

We’ve also made many prior warnings regarding the objective evidence of banking risk in the global financial system, and despite Basel III’s virtue signaling, we also warned that those risks, like inflation, were anything but “transitory.”

In fact, even the big boys in the big banks are getting nervous—as well as ahead of—the credit crunch they see coming after years of benefiting almost exclusively from a credit binge which they themselves engineered.

In short, the liquidity (i.e., flowing dollars) they once relied upon is gradually drying up. This makes the banks nervous, which is why investors should be paying attention.

Shutting Down Credit Lines

Thinking of themselves first and clients second, Wells Fargo just announced that they are permanently suspending/closing all personal lines of credit (from $3k to $300K) in the coming weeks.

Yes. That’s a big deal…

Wells Fargo is effectively confessing that they are worried (seriously worried) about inevitable credit/loan defaults on their consumer credit lines for which they charge interest at anywhere from 9% to 21% (and who thought usury was dead?).

Why the sudden change of heart at that oh-so generous bank?

Because Wells Fargo is worried about a crisis ahead—namely a liquidity crisis.

Nor is Wells Fargo alone, many insider businesses (i.e., publicly-traded companies) who benefit from the best loan terms are taking on less debt.

Why?

Because their massive debt exposures have effectively gotten too big to ignore, and they have no choice but to borrow less rather than more.

Of course, less borrowing means less lending, and less lending means tightened credit, and tightened credit means a credit crunch (i.e., liquidity crisis), and a credit crunch in a world/market addicted to credit (i.e., debt) means ”uh-oh” for risk assets like stocks, bonds and real estate.

Meanwhile, as Wells Fargo hunkers down for the pain ahead, JP Morgan, one of the smartest insiders in the entire (rigged) banking system, is beginning to carefully hoard and stockpile cash ($500B) and moving more to the safety of short-term bonds.

Why?

Well, they’d like to have some dry-powder when risk assets tank and rates rise, for the best time to buy is when there’s blood in the streets; and the best time to lend is when inflation and rates are rising, not falling.

But more to the point, JP Morgan (like Wells Fargo) sees a liquidity crisis on the horizon…

But what suddenly tipped them off?

Let’s talk about the Reverse Repo market…

The Reverse Repo Market—Banks Losing Trust in Each Other

Signals from that esoteric (and hence media-misunderstood) corner of the banking system known as the repo market have been making neon-flashing warning signs.

Traditionally, the reverse repo market is where banks went to borrow from banks, typically exchanging collateral (US Treasuries) for some short-term liquidity—i.e., money at low rates.

But as we warned in September of 2019, those rates spiked dramatically for the simple reason that banks began distrusting each other’s credit risk and collateral. That’s a bad sign.

What is happening today is that the Fed, rather than the commercial banks, are taking a much greater role in back-stopping this increasingly fractured intra-bank repo (credit) market.

In short, banks don’t trust each other’s collateral, so the Fed has to step in to act as a lender of last resort.

And unlike retail clients paying double-digit rates for credit lines, the Fed has lifted the interest (IER) they pay to banks (no shocker there) as banks are parking more (lots more) money at the Fed where they are exchanging cash for Treasuries in a now unignorable flight to safety.

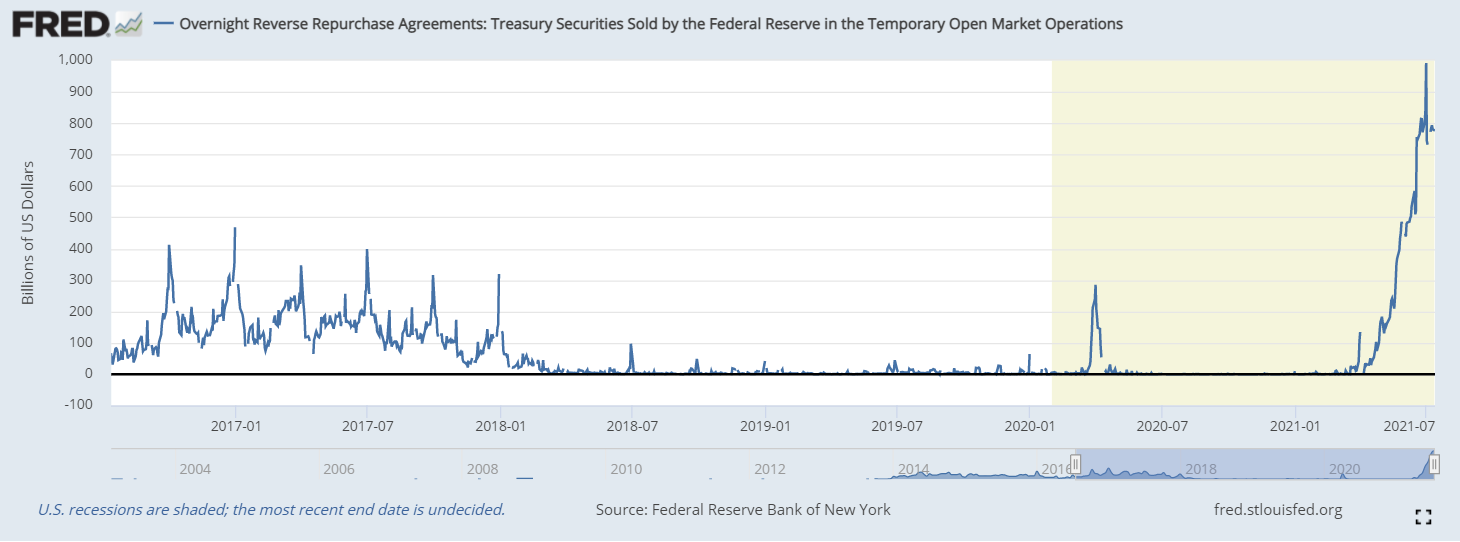

As a result, the repo market has skyrocketed as banks are parking nearly $1T per day at the Fed, which is 3X the normal operational amount.

The graph below is frankly shocking.

This is a screaming sign of counter-party risk among the banks themselves, whose last hope is the Fed, not each other.

And why are the too-big-to-fail banks looking for low-rate handouts and T-bills from these grotesquely bloated (and Fed-supported) repo markets?

Because they see a credit crunch and hence market crash coming. In short: They are bracing for the transition from credit addiction to credit crunch—i.e., less “liquidity” to grease the broken wheels of an overheated credit system.

Risk Assets Facing Real Risk

What does this mean for the great inflation-deflation debate? Markets? Your portfolios?

Well, a liquidity crisis is never good for risk assets like stocks, which will see a price decline and hence “deflation;” but don’t confuse that with the real-world notion of inflation—namely rising prices for the things most mortals need to live.

As more banks are swapping T-bills as collateral from the Fed rather than each other for cash, this means massive amounts of money (“liquidity”) is coming out of the system.

The money markets are moving massive amounts of dollars to the Fed, which means bank reserve accounts are moving from the banks themselves to the Fed itself; this, in turn, means less bank reserves and hence less bank lending—i.e., a credit tightening rather than credit binging.

Such reduced “liquidity,” as mentioned above, is a very bad omen for risk asset markets and traditional portfolios, the risks of which we’ve warned here and here and elsewhere.

Fantasy Solutions?

Many, of course, can argue that liquidity can be easily created through more money printing and that the Fed can make market implosions extinct.

After all, the Fed has taken markets from QE1-QE4 to unlimited QE with no shame or long-term pain, as every dip is a buy and every risk indicator a kind of cute relic of the past as our financial leaders telegraph the fantasy of MMT to make otherwise broke markets seem credible.

Meanwhile, others can argue that even if the Fed got hawkish and “tapered,” markets addicted to more liquidity can simply turn to fiscal rather than monetary “stimulus” for more dollars.

That is, we can replace one addiction to money printing with a new addiction to deficit spending—i.e., more debt to keep debt binges going.

Yet if either of those options strike you as comical bordering upon the absurd, then the foregoing warning signs of a looming credit crunch should be signals to be prepared rather than bemused.

Real Solutions

In every credit crunch and liquidity crisis, traditional risk assets are the biggest losers, which means portfolios top-heavy in stocks and bonds need to be reconsidered, actively managed, and appropriately diversified based on market action rather than passive tradition.

Our portfolios at SignalsMatter.com are designed to keep investors protected, prepared and profitable regardless of the headwinds and tailwinds that move through time and cycles.

And based upon the warning signs discussed above, those cycles—including credit cycles– pose problems for which we offer solutions.