Small businesses, like the middle class who comprise them, are dying.

This is not fable, but fact, and the implications this will have on your portfolios are serious.

Having recently broached the topic of the “New Feudalism” which has openly yet subtly replaced classic capitalism in the U.S., below we look at further symptoms of a rigged financial system right where it hurts—at the heart of American small businesses.

As always, we support the sad yet overt decline of American capitalism with objective data rather than theoretical bromides.

Fair Play—Another Polo Metaphor…

Polo is anything but a Main Street sport and is easily (and sometimes fairly) seen as the sport of snobs rather than just “kings.”

But even polo, whatever one thinks of it, involves rigorous rules of fair play and a rigid handicap system in which players are ranked from 0-10.

10-goal players are rare, the equivalent of a Tiger Woods/Tom Brady-level professional; most experienced players are ranked from 2-5, and it can take years and years to reach a 2 or 3-goal handicap.

In short: 10-Goal players are the big-boys.

For this reason, polo matches never involve two teams playing in which all 4 players on one team are 10-goalers and all 4 players on the other team are 2-goal players. That would be like a high school baseball team squaring off against the Yankees.

It would simply be unfair—far too lopsided, and totally rigged.

For fun, my son and I (modestly ranked as 1 and 2-goalers) recently played an unofficial “match” against two 8-goal players and were immediately down 7-0 in the first 6 minutes. In short, a foreseen but fun massacre.

But what we are seeing in the playing fields of current “capitalism” is no fair game at all, and certainly no fun– the equivalent of giving all the advantages to 10-goal players (who don’t need any help), and telling all the low-goal players to ride donkeys rather than thoroughbreds.

As we’ll see below, the current pitch on which American capitalism is played foresees the winners (Mega-cap companies) and losers (small businesses) well before the match even begins.

Survival of the Biggest

In its purest form, capitalism requires a fair playing field, not a rigged pitch in which the big players are accommodated and the smaller players are taken off the field all together.

Current market competition has been regulated and administered (i.e. corrupted) into a system wherein survival and victory hinge less upon defined advantages and more upon engineered rules and bad policy measures.

Over the years, for example, governments, treasury departments, central banks and regulatory bodies have created barriers to entry, lop-sided tax schemes, capital controls and other subtle yet egregious paradigms in which one group (the big-boys) is favored/protected while the other group (the 2-goalers) is left without a saddle.

The political response to the COVID crisis has only heightened and accelerated this media-ignored distortion of fair competition.

Caught in a genuine dilemma of balancing the lives of humans against the lives of small businesses, the national shut-down policies have not only risked a mass extinction of certain small businesses, they’ve created it.

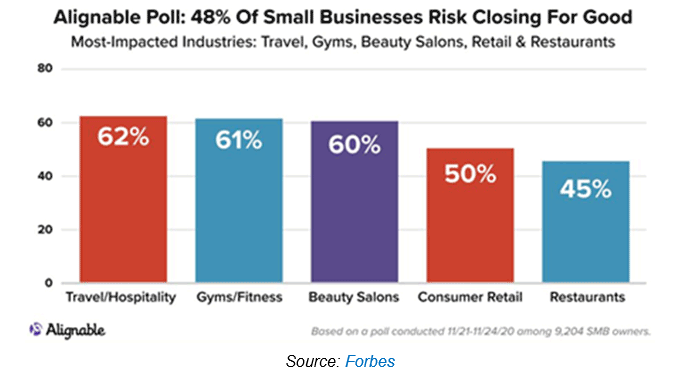

Small businesses in personal-contact areas like retail, travel, hospitality, spas, gyms, hair salons, day care, distinctive health care providers and specialty shops etc. have been destroyed by lockdown measures while 10-goal-level mega businesses have enjoyed a revenue bonanza from the same pandemic.

This imbalance is neither random nor related to the talent of the players. Instead, much of it boils down to size, not skill and policy advantage not fair play.

Of course, policy makers initially (or superficially) sought to help the little guys—i.e., the 2-goal small businesses–in the form of PPP loans (8 weeks of salary and defined fixed expenses) and other targeted relief from the Cares Act.

Unfortunately, even for those small businesses who received such aid, the wells are dry again. Far more importantly, hundreds of thousands of small businesses saw no aid at all.

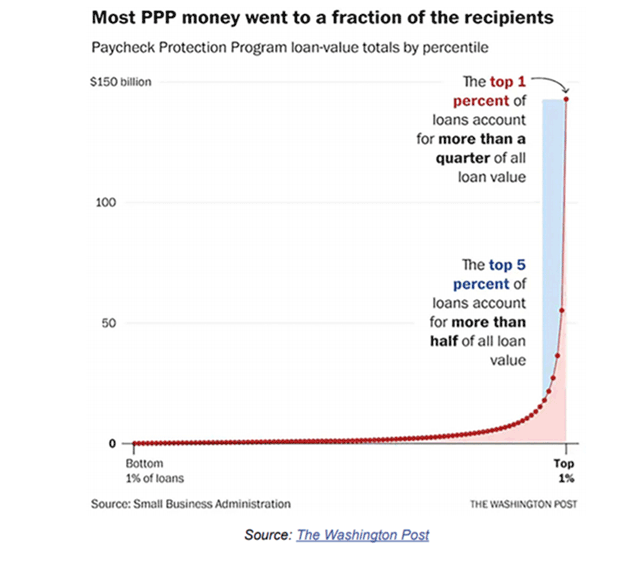

Even more troublesome, is the quantifiable fact that the biggest beneficiaries of these initial relief measures were the big boys, not the little guys.

As the graph below makes objectively clear, almost all of the relief money went to a very small minority of the biggest players.

But it gets worse.

More Evidence of a Rigged Game

In the wake of helter-skelter, make-it-up-as-they-go COVID policy confusions, the forced shutting down of small businesses failed to balance human risk with business risk.

Instead, the pandemic policies merely added (and will continue to add) more risk to both.

Despite the best (or worst?) of intentions, the result has been a quantifiable disaster for U.S. small businesses, many of which are either dead on the field, or mortally wounded, with potentially 50% about to shut their doors for good.

The evidence further confirms, however, that as most businesses are dying, a select minority are thriving.

Stated otherwise, as small businesses are carried off the field on their shields, the big-boy, 10-goalers are now poised, as Austan Goolsbee recently noted, “to swallow the world.”

The pandemic, in short, has exacerbated a clear split in the U.S. economy.

The big, large-cap names are seeing massive growth as small businesses, once the backbone of capitalism, are disappearing at record pace.

This may explain, in part, an appalling stock rally in the midst of a pandemic, which as I wrote here, has greatly favored the big boys in tech, namely Amazon et al.

ETF Favoritism

But the tech sector is not the only beneficiary of a rigged game.

Almost all large-cap and publicly traded companies will benefit, as they are all bundled together in dangerous index ETF’s passively bought (inflated) by pension funds, IRA accounts, defined benefit plan managers etc.

In short, index ETF’s are passively riding a common investment wave, regardless of the poor surfing skills (i.e. balance sheets) of the vast majority of the companies on the S&P.

As inflated stock markets and ETF’s rise un-naturally, their share price (rather than profit) inflation allows them to swallow up (or price out) most smaller businesses—again, like 10-goalers playing my son and I in polo: no chance to win…

Flush with Unfair Cash

Big companies, even bad companies with lots of debt (see below), are still flush with liquidity (i.e. cash) compliments of a market-accommodating Fed, whose policies literally mimic the legal definition of fraud.

Meanwhile, the ignored mass of small businesses can’t make their lease payments, let alone a profit, in a lockdown year.

As the pandemic unfolded in 2020, the big boys on the public exchanges were already sitting on top of years of post-08 stimulus and post-08 cash in a rigged game (pre-Covid) which I explained in detail here.

Flows of funds from the Fed to these big-boy balance sheets stood at $4 trillion in cash in Q1, even before the Corona Virus was making its first headlines.

Tax and Sector Advantages

In addition to direct Fed support, the large-cap big-boys on the S&P, DOW and elsewhere were the primary beneficiaries of the 2017 Tax Cut, as well as, of course, the all-too generous CARES Act of 2020, which again, primarily favored the 10-goalers, not the 2-goalers to the tune of $5 trillion in loans to big businesses.

Such massive resources have left larger businesses at an openly unfair advantage over smaller ones.

It’s just a simple matter of open (yet largely ignored) math and policy.

The convergence of all these unfair advantages has given a particular tailwind to digital tech and communication companies as well as big pharma, consumer credit, fast-food juggernauts and discount retail names, all of whom had already been enjoying unlimited liquidity and hence market support from the Fed.

Monopoly Money & Monopoly Powers

Today, these same big boys are gaining increasing pricing power and hence monopoly-like powers in rents, acquisitions, innovation, and cost of (as well as access to) capital that ought to make an anti-trust lawyer blush.

Unfortunately, these lawyers aren’t too busy when it comes to helping small businesses thrive.

Federal spending on anti-trust enforcement at the Dept. of Justice and FTC has fallen dramatically as big business has been rising even more so.

Giving New Life to the Walking Dead—The Big-Boy Zombies

If that doesn’t bother you, the unfair competition facts get even worse when one just considers the equally appalling rise in the number of big-boy zombie companies masquerading as viable enterprises in this twisted new backdrop of broken capitalism.

By zombie company, I am referring to an enterprise that has infinitely more debt than available cash, yet due to its size, has a unique access to low-rate debt/capital.

These zombies stay “alive” by no other means than a debt roll-over scheme of borrowing today to pay yesterday’s interest on that debt, and then borrowing tomorrow to pay today’s debt interest.

Of course, the principal on the debt is not (and never will be) repaid.

Instead, “accommodating” bankers engage in a rigged re-fi game of loan extend-and-pretend that is not available to small businesses, whose smaller size makes them “riskier credits” than the too-bog-to-fail large-cap borrowers.

Thirty years ago, zombie companies were non-existent, yet based upon pre-COVID data from the BIS and OECD in 2018, more than 12% of all listed firms in the world are classified as zombies.

Such companies are effectively allowed onto the polo field with no handicap or balance sheet skills at all.

They are allowed to “play” on the current market pitch only because they are unfairly advantaged by their large size.

This is particularly shameful, as zombie companies quantifiably suck rather than stimulate the economic growth out of their host economies.

Rigged to Fail—The Corporate Bond Market

All rigged games, however, eventually fail. We wrote a best-selling book to explain this.

The question now boils down to this: Is your portfolio prepared?

A large number of those zombie companies are hiding in a monstrous bond ETF near you.

Debt experts who track these and other debt-ravaged enterprises are forecasting a wave of corporate defaults once COVID relief measures run out of steam in a current bond bubble where corporate debt to GDP has spiked to an all-time high of 57%.

Folks: That’s appalling.

Of course, we’ve been tracking this broken bond and securities markets for years, and have been building portfolio solutions to prepare informed investors for all conditions, from the sublime to the ridiculous.

We’ll be seeing more of the same for 2021.

As always, just click here to learn more.

Best,

Matt & Tom

Do I ever agree with you. What are your solutions? You can’t just be “debby downers?” I am helping a small business make interesting decisions. Some players can pivot quickly and not only survive but thrive. This one is one of the backbones of the economy, not to mention pays the taxes. Lynn

In a nutshell, solutions will come from good people making sound decisions, but as I indicated, we need leadership solutions (red or blue, red and blue) based on sound economics rather than rhetorical promises and a woeful lack of economic understanding.

As consistent, the data analysis of Signals Matter is compelling, as further continuing to inform my dynamic perspective reliably defining the primary global macroeconomic issues it pertains to.

…. And as further assisting reliable informing of my global parameter macroeconomic perspective, and projections, I observe this information invaluable.

Further, relative to such global macroeconomic perspective, the empirical definition these economic dynamics indicate I find further compelling.

…. For if we reflect upon the empirical record of how we got here, I contend the primary dynamics revealed, defining the primary economic issue,

…. do not observe conclusion of their analysis in any way rocket science.

The trading construct of capitalism is only as productive of its pursuit as its measure of balance can be demonstrated, as defining,

…. balanced distribution of its economic equity, as comprehensively defined by management science.

…. This is why its practice is defined economic management as I comprehend, not economics alone.

…. And I contend its requirement of scientific management application, is that which delivers,

…. the required balance of capitalist pursuit, that ensures its measured productivity outcomes, as further defining,

…. its equitable economic distribution delivering economic management performance outcomes for the prosperity of all as inclusive.

…. That’s what management science defines as differentiated from socialism.

And then if we observe the empirical record of global economic dominance over the last 500 years, we observe its Western dominance,

…. as further dominated by the culture of feudal conquest, culminating in,

…. the development of its culture of feudal colonial industrialism, that defined,

…. its true global economic dominance as absolute over the period, until,

…. the late 20th Century.

I contend it further defines the Western existential crisis we are currently observing;

http://blogs.lse.ac.uk/politicsandpolicy/developed-economies-are-not-suffering-from-the-consequences-of-a-financial-crash-but-from-a-structural-crisis-of-neoliberal-capitalism/?utm_content=buffer1b03b&utm_medium=social&utm_source=facebook.com&utm_campaign=buffer

And I contend with its peaking, came Western cultural adoption of narcissistic tunnel visioned economic thinking, as observed common to the culture of feudalism,

…. as effectively intending the entrenching of its global economic dominance defining its Western form of feudal colonial industrial capitalist construct, that delivered,

…. its current global economic performance outcomes, as epitomised,

…. by the dysfunctional economic management performance outcomes we are observing in the US, as further defining,

…. the US a waning global economic leader, et seq.

For confirmation, one need only observe the known dynamics of monopoly as comprehensively defined;

Ref: Marketing Myopia – circa 1960s,

– now observed a standard of scientific management literature,

by the late Emeritus Professor, Theodore [Ted] Levitt,

Harvard School of Business.

And I contend where this economic saga ends is entirely predictable, as the known cultural dynamics of the decline of empires clearly defines.

…. And it further defines the economic management reform required, revealed of its constructive dynamic application, as entirely obvious.

…. For the economic management of capitalism that delivers balanced distribution of equity, simply translates to the competent cooperation of sharing,

…. of which the barbaric cultural pursuit of feudalism will always intend its denial.

“Fanaticism consists in redoubling your effort when you have forgotten your aim.” – George Santayana

“Those who do not remember the past are doomed to repeat it.”

– George Santayana

“Insanity – doing the same thing over and over again, and expecting different results.” – Albert Einstein

“You don’t solve problems with the thinking that created them.”

– Albert Einstein

Hoeroa, as always, an extremely well thought series of observations, from management to culture, all points I respect and continue to think about daily.