Whenever and however it hits, the next recession will be a global recession.

28 shares

Today, we’re going to look at one of the main recession indicators we track, namely globally declining GDP growth. It warns of a global recession.

“Global” is the operative word for this column, for it’s not just about U.S. growth and markets. Rather, it’s as much (even more) about global growth when it comes to forces impacting your dollars. A global recession, moreover, is not something anyone wants to consider, but informed investors must. This is not bearish, it’s just realistic and smart.

Hurricane Dorian (which ravaged Grand Bahama and the Abaco Islands and left 70,000 people homeless) developed from a tropical wave well off our shores in the Central Atlantic.

Our next market hurricane could similarly spawn from well off our shores, triggering the next global recession, never mind that we are currently the best horse in the global glue factory.

Let’s discuss…

Global Recession

There are country recessions, regional recessions, and global recessions, the last of which have the greatest impact for their size.

Let’s define a recession.

In the U.S., the National Bureau of Economic Research (NBER) officially calls a recession following two verifiable and consecutive quarters of declining GDP. That’s a country concept.

For a global recession, there is no official definition, although International Monetary Fund (IMF) weighs in, using broader measures of global economic decline such as a decrease in per-capita GDP worldwide along with coincidental indicators like trade, capital flows, and employment.

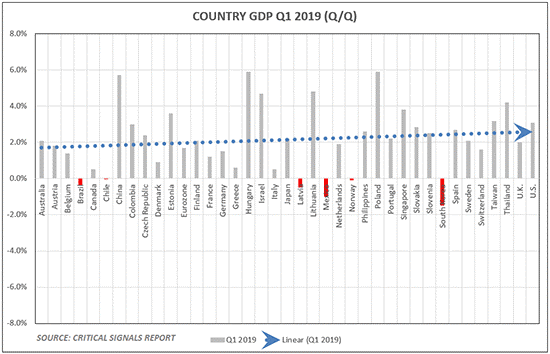

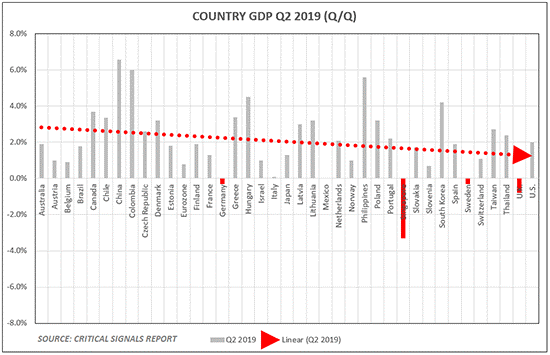

Let’s take a peek at recent global GDP performance as it relates to a global recession in three simple charts that date back to the start of 2019, namely a chart on Q1 Global GDP, another on Q2 Global GDP and, finally, a chart on the trend that emerges from the two.

Chart 1 (below): In Q1 of 2019, Global GDP trended up on average across the 39 countries and regions pictured below, with just six countries (those marked in red) dragging down the average.

Chart 2 (below): Fast-forward one quarter later to Q2 of 2019. In Q2, GDP trended down and was negative in four countries. In short, the overall trend had reversed, from GDP generally gaining in Q1 to generally falling in Q2.

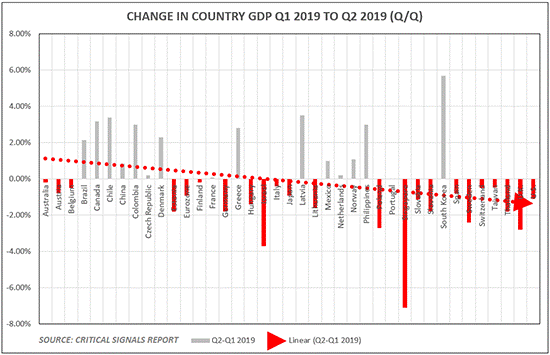

Chart 3 (below): Here’s the rub. Measuring the difference in GDP across these countries from Q1 2019 to Q2 2019, we see that GDP deteriorated between quarters across 23 countries/regions – nearly 60% of our sample size.

And these aren’t just any countries. Count them. They, too, are marked in red in Chart 3 below.

They include Australia, Austria, Belgium, Estonia, the Eurozone as a whole, Finland, Germany, Hungary, Israel, Italy, Japan, Lithuania, Poland, Singapore, Slovakia, Slovenia, Spain, Sweden, Switzerland, Taiwan, Thailand, the U.K., and, yes, the United States, too.

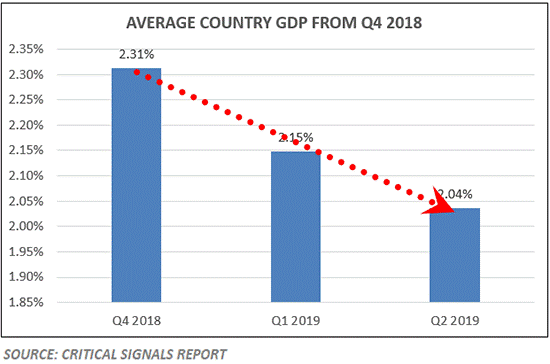

Bonus Chart (below): And here’s a bonus chart – one more way to gauge an offshore trend toward global recession. We’ve simply reached back one more quarter to track the quarterly trend across the same regions and countries since Q4 2018.

Hmmm… not so good.

We’re going to want to track any further deterioration in the current Q3 2019, which ends just two weeks from now. If we see more counties fall into negative territory and/or others clock two down quarters in a row, that could tip us into a deeper discussion as to a global recession – and inform us well before the NBER or IMF, which does so with a lag.

Like Hurricane Dorian that started small and spread like wildfire, these offshore countries can have as much if not more impact on triggering the next recession than the internal games we are playing here in the U.S.

Forget the cause for the moment and simply track the effect – that’s what matters. This falling GDP indicator is just one more canary gasping for air in the global market coalmine.

Bad is Good?

But before we get too worried, let’s not forget that in this entirely distorted, post-08 “new abnormal,” the worse conditions get in the real world, the more central banks around the globe start adding more steroids to keep these rigged economies and markets lumbering along like Frankenstein’s monster. That is, all these warning signs of a global recession could easily morph into a global rally, especially in the U.S. markets, to which all eyes turn first.

If things get messy in the bond markets in Q3 or Q4 of this year, as we expect they will, we can equally expect the Fed to roll out more rate cuts and even emergency money printing disguised as “credit support.” Ironically then, bad news in the near-term can mean new market highs. Crazy? Yep.

Storm Tracker

Like Hurricane Dorian, the next global recession could well spawn offshore, building to hurricane-force winds when it comes our way. But equally, if not more likely for now, we could also be looking at a market rally by year-end. That’s why we are forced to look at even the most obvious signals of a global recession with a jaded eye, and rather than make sensible predictions, we simply stick to tracking the central banks and the markets themselves to make our decisions.

Toward that end, our Storm Tracker is so urgently important to you and your money. It moves off current facts rather than macro opinions, and current facts change as the Fed changes.

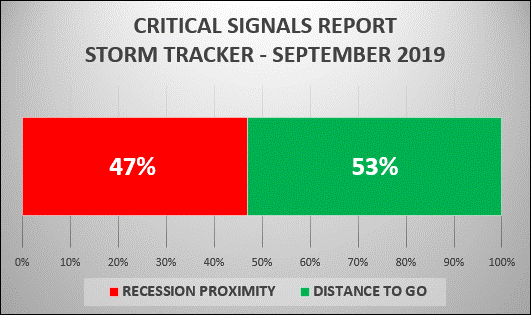

Storm Tracker, with current sustained winds of 47 knots as we head to a close for Q3 2019, has been unwavering in its path while building in intensity.

Components of Storm Tracker change every week. And if the Fed comes back into the game in a meaningful way, this percentage can drop quickly.

That’s just how distorted our once “free” markets have become. At some point, however, the Fed won’t be able to prevent a global recession any more than a sailor can prevent a hurricane. And based upon the correlated facts outlined above, whenever central banks lose their punch, the recession to come will be a global recession rather than a local one.

Fortunately, our storm tracker will get you safely to shore before the real pain hits.

Here’s What Else is Happening Now

Emerging Market Debt…

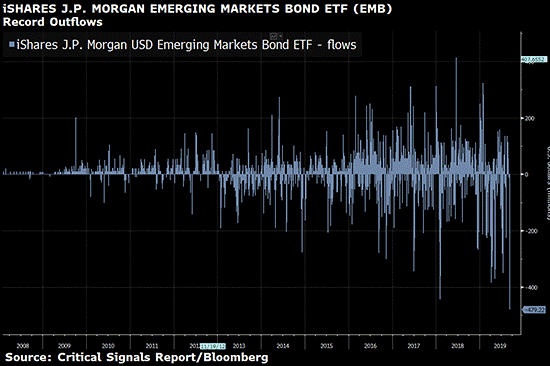

To our point of the next global recession coming ashore from offshore, take a look at this record withdrawal of almost $500 million from J.P. Morgan’s U.S. Emerging Market Debt ETF:

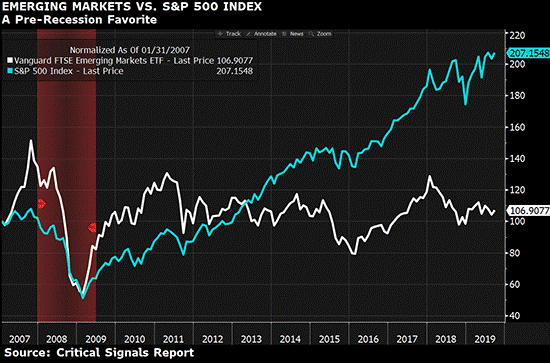

Back in 2008, emerging markets (below) did phenomenally well ahead of the Great Recession… and then they plunged. Canaries everywhere.

We’ll be telling you what TO DO as we get closer, but for now, just know that tumbling GDPs across developed and emerging markets alike are taking us in a direction of global recession. Investors are watching. The flows tell us so. When all the water is sucked out of an above-ground pool (like the Emerging Market ETF mentioned), the pool generally implodes, one wall at a time. In the meantime…

Prepare – Another Potential Fed Red Day this Wednesday

We have a concept which we call a “Fed Red Day” (i.e. markets falling on supportive “good news”) and what it means for recession timing. In a nutshell, Fed Red Days occur when 1) the Fed lowers rates yet markets fall rather than rise in the same day; and 2) Fed Red Days are a marker that we are already in a recession.

Thus, keep a sharp eye on the markets this Wednesday, for at 2:00 p.m. the Fed will release its decision whether to lower rates and by how much. Keep an especially close eye on how stocks react if we get another rate break.

If we get another Fed Red Day on Wednesday, whether for all the reasons we’ve mentioned or even for last weekend’s oil shock, that would be two Fed Red Days in a row – and that would not be good. Not good at all. It’s not about why it occurred. The fact that it did occur is what counts.

If, on the other hand, stocks salute in a major way, then optimism over a prospective trade deal and a now dovish Fed could push these markets higher, despite the fact that:

- Manufacturing is cutting back;

- Residential investment has been negative for six quarters now (despite lower rates);

- The U.S. yield curve is sustaining its inversion;

- U.S. factory orders are tumbling;

- And non-financial corporate profit margins have been steadily slipping since 2015.

Global GDPs, of course, are also tumbling. We know that now. Central Banks responding with low and negative interest rates have completely distorted the landscape, providing artificial hope that stimulus alone can do the trick. But as we also said above, bad news is now often good news for the markets. Pure crazy.

Nevertheless, we are confident that at some point the very central bank strategies that have kept us whole since the Great Recession will slowly run out of both credibility and steam.

Think about it. If negative interest rates were working, the Eurozone and Japan would not be ailing. Desperate central banks are borrowing time, not solving systemic flaws.

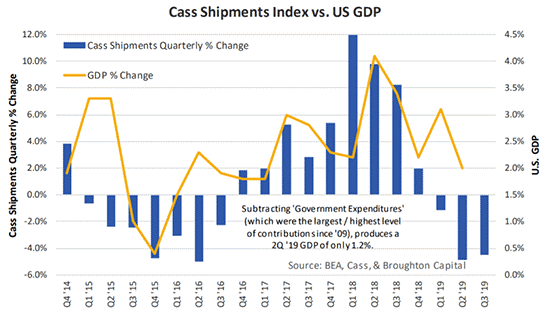

To drive the point home here in the U.S., if low interest rates were working, then we wouldn’t be seeing the falling Cass Shipments Index data. The Cass Index, which measures rail, trucking, and airfreight volume, is considered a vital sign of the U.S. economy.

Sadly, the Index is in its ninth consecutive month of decline and suggests we could see negative growth here in the U.S. by year-end.

This Week…

This week, the Central Banks of Japan, England, Indonesia, Brazil, Switzerland, South Africa, and Norway all revisit rates. Now we know what’s going on offshore when it comes to growth – namely, it’s not happening. Expect continuing cuts and balance sheet stimulus, like the ECB did last week… more canaries.

As we pen this note this Monday morning, markets globally are opening in some disarray following airstrikes over the weekend on Saudi Arabian oil facilities, although equities are reacting calmly with a willing Fed just two days away. As countries globally edge toward recession, higher oil prices (should they persist) is not what the world needs right now. Heightened global risk is a negative.

Stay tuned. More on oil in this Wednesday’s column!

Your Questions

Your questions just poured in last week.

In our piece on pension funds, David H., who teaches statistics, asked about using our “median” vs. “average” data regarding household net wealth for his own students and asked where we sourced the same. David, we took that data from ex-Goldman Sachs macroeconomist Raoul Pal, whose pension fund analytics can be found online.

Responding to the second piece of our two-part series on Pension Fund risks, Mike S. noted that we might be part of something akin to “project fear.”

We get this. Although we like to think of ourselves as merely blunt, our data on declining GDP, inverted yield curves, declining PMI, contracting industrial production, tanking Cass Freight trends, empirically overvalued stock markets alongside a corporate bond market which even Morgan Stanley analysts confess is 44% “junk” (based upon leverage ratios) is indeed, well… “fearful.”

But we are not seeking to spread fear in some kind of bearish feedback loop, but simply to display the data and share its implications. Again, they are fearful, but sadly, they are true. Furthermore, we actually expect the Fed to induce a new rally on bad news by year end.

In the past, and even in this very e-letter, we’ve made numerous cases for melt-ups and/or temporarily bullish moves in the market. For example, if we see a resolution of the trade war any time soon, we humbly concede that such a headline-event would be a powerful catalyst for further new market highs. Or if bond markets implode, the Fed will print money and send markets higher. For now, we just watch the signals rather than make blanket predictions

Yet despite such potential and bullish catalysts, the overwhelming weight of evidence and probability metrics confirm that risk far outweighs reward in the market backdrop we’ve elsewhere described as rigged to fail. The day will come when a global recession humbles central banks here and around the world.

That said, we have received so many questions as to WHEN we anticipate the next recession (or global recession) and market sell-off that we’ve decided to write a special piece exclusively addressing this issue. You should see in your inbox later this week.

In the meantime, stay informed and stay prepared. We’re here to guide you. The market’s reaction to this week’s Fed rate moves will be a critical signal to watch.

Sincerely,

Matt Piepenburg

Comments

6 responses to “It’s Not Just the U.S. You Should be Worried About”

- Dan Walsh says:

Very good analysis….

- Wally Gomezsays:

Interesting times, wish I knew how to capitalize on these financial ups and downs?? Wally

- Rich Waltonsays:

Great analysis! I wish it could be more positive, but one needs to call them like they see them. It begs this question: Is there enough dry powder at the Fed to lift the world out of these economic doldrums?

- RD Pascosays:

The whole world economy is slowing. Manufacturing is declining as are residential properties with rates at 3 year lows! GDP is declining. Rates don’t need to go to Zero definitely not negative rates. Bonds 2year and 10 year keep inverting! Signs are everywhere of Recession!

- Patrick Valesays:

Watch the smart money. It leaves first. Watch where it goes. It strongly signals what portends up or down and who and where. I think it heads to safety. The market could go higher short term. Thats NOT the smart money! Beware the Fool in markets. The Fool is always late and usually wrong.

- chas wilsonsays:

Al Capone allegedly stated quite some time ago why fight the government when we can be the government I feel we have well passed this point in time