Below, we look once again at inflation…

As the Divided States of America engage in an endless and ongoing game of blame the other, you already know where my frustration lies…

The Fed.

But what does this have to do with inflation?

For many folks currently chasing Tesla and Bitcoin or tracking the latest and highly charged political headlines, inflation may just seem like an academic abstraction.

You know, complicated, esoteric or even worse: Boring and irrelevant.

As for Tom and I, inflation matters. A lot.

Why?

Because inflation kills the dollars you own.

We’ve written about this topic in countless contexts, from Fed number-fudging to gold pricing.

Inflation, in general, is a largely misunderstood, mis-reported and oft mis-labeled concept.

What is Inflation?

The mainstream typically associate/define inflation as rising prices (from stocks to home prices), while the real definition is tied to money supply, as explained elsewhere.

Ultimately, and in terms of consumer pricing, long periods of deflation are followed by inflation, and thus the inflation debate is itself a bit silly, as inflation and deflation aren’t at odds in a zero-sum game, they simply cycle—one against the other in a macro dance.

Of course, some just believe inflation has been outlawed. But then again, some still believe in Santa Claus.

Where’s the Inflation?

In terms of the money supply definition, with unprecedented trillions being shot out of a Fed fire house (or dropped from the sky as “helicopter money”) many have been asking where is the fricking inflation?

After all, if inflation is tied to a rapidly increasing money supply, then in a world of unlimited QE and MMT (Modern Monetary Theory—aka “Magical Monetary Theory” or “Marxist Monetary Theory”) why aren’t we now experiencing Weimar-like images of wheel barrels of cash to buy a Big Mac?

In short, why aren’t we suffering hyper-inflation?

Well, the answer is sad and simple.

A Closed Loop—Asset Price Inflation Rather than CPI Inflation

The vast majority of those trillions in printed dollars went from the Fed to the Treasury and then from the Treasury to the primary dealer banks—which, alas, went straight to Wall Street and the stock & bond markets.

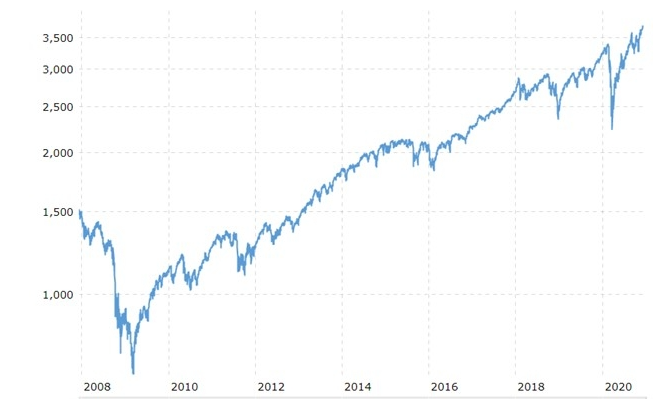

Thus, if you want to know where inflated prices went, it went directly into risk assets like stocks (with average PE multiples above 30) and bonds (with real yields below zero), which explains how a rigged market saw stocks rise to the moon and bonds to the next galaxy as Main Street fell to its knees.

Printed Money—One Big Airbag Under a False Market

The markets today are so thoroughly false and Fed-supported by trillions in printed dollars that not even a headline event like a riot in the nation’s capital caused the DOW or S&P a moment’s concern.

But as I’ve also quipped, a nuclear bomb could destroy Cleveland and markets would hardly flinch– so long as the Fed keeps printing fiat dollars by the millisecond.

Folks, this ain’t our father’s stock market anymore…

Printed Money—Changing Society

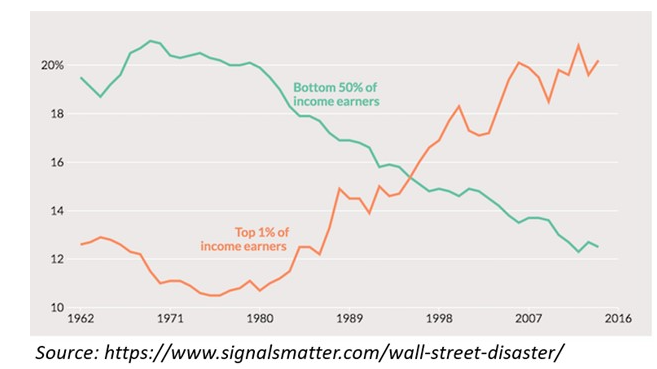

Meanwhile, the absolute charlatans at the Fed still hold the openly comical opinion that their monetary policies have had no impact on the wealth disparity in the US, where more than 80% of the securities market players represent the top 10% of American wealth.

As I’ve said before, the Fed has created a feudalistic rather than capitalistic paradigm for our country and, in my opinion, are beyond forgiveness. The evidence is simply undeniable: America is a two-class society of “haves” and “have-nots,” which never bodes well for social unrest.

Today, left and right, and from Portland Oregon to Central Florida, most Americans are stressed, broke and frustrated.

Depending on the media’s (and our own) political bias, the broken left are called Social Justice Warriors or Communists and the broken right are called liberty seekers or domestic terrorists.

The irony is that both groups are equally broke, angry and rising like a volcano in a zip code near you.

Meanwhile, the Fed pretends it has had no role in this slow drip toward social unrest as Tucker Carlson and Anderson Cooper fan the flames of left vs. right instead of pointing their cameras at Greenspan, Bernanke, Yellen and Powell…

So, how will the next administration calm the angry masses?

More Money Printing Ahead, More Fed Lies and More Misunderstood Inflation

The angry mobs have a choice now between pitchforks or handouts (aka “relief packages”), and it would appear the next administration will be mailing out checks to citizens in order to avoid pitch forks in DC.

Some will call this socialism, but the amount of money already printed to artificially bailout and support Wall Street for the last 12+ years is Wall Street socialism, so the socialism taint is already here.

In short, we went “socialist” a long time ago.

Going forward, it’s just a question now of who will be the next beneficiaries of the next handout, Wall Street, Main Street or both?

Either way, the “new socialism” is gonna cost money the U.S. doesn’t have, which just means the Fed will print more of it, lots more of it in the years to come, and debt levels will soar to levels once thought unthinkable—again, all paid for with more printed dollars.

Of course, more printed dollars means more inflation, right?

Reported vs. Real Inflation

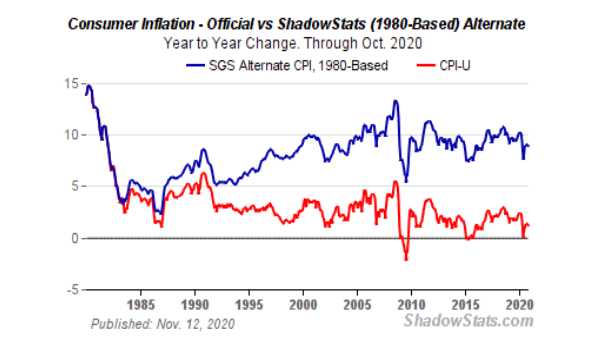

As most know by now, the 2% inflation reported out of DC is a fiction.

Real inflation (using the truer scale once used in the 80’s and 90’s) is much closer to 10% than the fictional data spoon fed to us by the Fed and BLS.

In this backdrop of high (yet misreported) inflation, the Fed pretended for years that it was “targeting” 2% inflation.

But now, with combined public, household and government debt levels past $80T, they need to do more than “target” inflation; they need to create it without, well, reporting it honestly.

Over the summer, as if in a moment of pure and open admission of doublespeak, the Fed suddenly decided to “allow” rather than “target” marginally higher inflation—essentially confessing that they can do whatever they want when they want—and in the interim engage in false reporting of inflation while pursuing more of it.

Confused yet? Me too.

So why does the Fed suddenly want more inflation now?

Inflated Dollars to Pay Down Debt

Easy.

To pay down the cancerous and society-dividing US debt levels which they alone created, the Fed’s best way to do that is with inflated (i.e. debased) dollars. Hence the Fed’s sudden policy shift in 2020.

Of course, inflation helps debt-soaked countries, but it guts the middle class and Main Street.

And thus, once again, the Fed’s new pro-inflation policy is just a sucker punch to the real America as DC debases the dollar to pay off its own unpayable debts—now at $27.7T and counting.

Inflation Today

For now, inflation talk is still in the minority, but some informed investors and economists are already rolling up their sleeves and facing the facts rather than translating the double-speak of charlatans like Powell.

With vaccines (rightly or wrongly) suggesting a sudden (and questionable) end to the equally sudden and questionable pandemic policy restrictions that could bring consumers roaring back, talk of inflation is equally returning.

The fancy lads teaching Econ call this “pent-up demand.”

With the Biden administration and Democratic Senate coming in 2021, we can expect more consumer spending driven by more financial aid, all paid for with more deficits (i.e. unpayable debt) and more printed (i.e. increasingly worthless) fiat dollars. Blue or red, this is nothing new.

Of course, more dollars into the real economy in the form of mail-in checks and direct government state support increases the “velocity of money,” which increases the rate of inflation, regardless of how accurately or inaccurately it will be “reported.”

In the markets, such factors have pushed bond-market measures of expected inflation higher.

The so-called breakeven rate on 10-year Treasuries climbed above 2% this past week to the highest in more than two years.

(That yield on the 10-Year is important, as I’ve said countless times. Watch it carefully.)

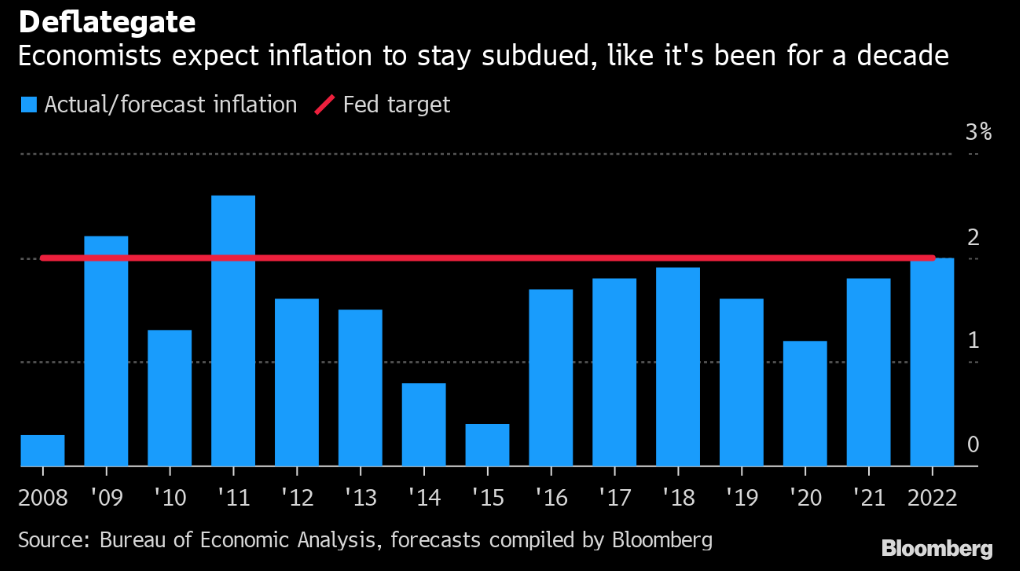

As for the Fed and its cast of fiction writers and academy-award winning actors, their view is that it will be years before the U.S. has to worry about “really bad” inflation.

Although the Fed lies about CPI inflation measures, their “official fiction” of postponed inflation is worth heeding, regardless of how false it may otherwise be.

That is, inflation data will continue to be misreported as debasement of the dollar, driven by extreme money creation, rages forward—much to the delight of gold and Bitcoin owners, regardless of the recent and volatile price swings in both camps.

Although the Fed may be powerfully dishonest, they are still powerful, and one can’t fight a dirty cop or a dishonest Fed and the economists who publish white papers to flatter them.

Thus, we can expect the “experts” to calm the masses with talk of muted inflation, even as actual inflation rises and rises and rises.

This week’s data is expected to show that consumer prices increased 1.3% in 2020. With production costs rising, blunt-speakers are forecasting higher rates this year.

But according to Powell and other economists, the Fed’s preferred (i.e. totally bogus) CPI measure won’t exceed its 2% target. No surprise there from the “be calm” camp…

The Disconnect Between Truth and Lies

Why the disconnect between how expensive (i.e. “inflationary”) real life is vs. what the experts tell us?

Again—the answer is easy. The Fed lies about inflation data and whistles past the debt bomb they planted under our nation’s feet—far more dangerous than any riot in DC.

That is, Fed officials say they want to see inflation calmly stay above the 2% level for a while before they’ll raise interest rates.

But that’s, well, not the full story. The Fed will not raise interest rates. They can’t.

With public debt so grotesquely high, any rise in Fed rates would kill the bond market in seconds, so the Fed knows it can’t afford higher rates.

Thus, they play around with fictional inflation data and inflation excuses to justify keeping rates stapled to the floor of un-natural history simply because they are cornered in a debt trap of their own making.

That is, they need to keep printing money and increasing the US debt bubble, but also know that rising rates and rising (reported) inflation would pop that bubble. Hence the trap they made for themselves and the lies they tell to escape the inevitable.

Eventually, of course, they will blame COVID (rather than the mirror) for a debt disaster (and re-set) ahead only to be resolved by some IMF new fiction of more debt and more fiat digital bank currency (not Bitcoin) to further game the system and control your spending.

Does the Inflation Debate Matter?

But that re-set is still down the road. For now, the inflation fiction, and inflation debate, crawls forward, led by false data, false slogans and false expertise…

So, what will the official story be? More or less inflation?

My view is already plain as per above.

Inflation is already here—it is simply and intentionally misreported.

But as I’ve said, we can’t fight a dishonest Fed and BLS. So, for now, let’s enjoy the almost comical inflation debate…

With this is mind, worry less about what the BLS and Fed tells you and think more carefully about what you already know.

Trust Common Sense

Keep it simple.

A nation can’t print trillions and trillions of dollars and avoid inflation; instead, they can simply lie about it.

But printed dollars just means debased dollars, and the solution to that lies in precious ideas and precious metals.

Of course, some may believe the solution lies in digital coins, but coins that rise by 5X in less than a year and then drop by 20% in a day are not a stable solution, at least for now.

With trillions and trillions in overbought bonds, where will that money go once bond investors jump ship?

The answer is hard assets, commodities and precious metals not yield-less bonds and frothy stocks.

Until that time, let the crazy continue and the total avoidance of risk and the chasing of fantasy continue.

But where will your portfolio be when the music stops?

If you’re looking for sound solutions in all conditions, simply take a look here and decide for yourself.

Best,

Matt & Tom