Signals Matter News Letter: The Signals THAT Matter

Recession signals are everywhere.

Thomas Lott, Portfolio Manager

Broadly, the core and timeless principles behind the infrastructure and active management of Signals Matter Portfolio Construction are carefully discussed here and here.

As for WHAT’S HAPPENING NOW…

The Latest US Bond Signals:

As a portfolio manager, I always begin with signals from the bond market, as they inform behavior in the stock market and broader economy.

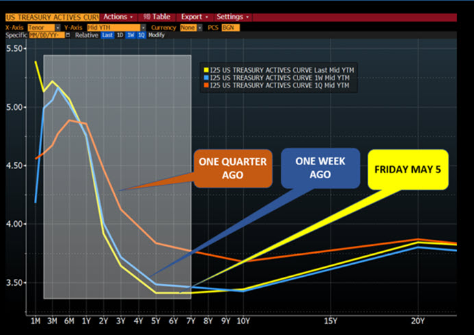

With the Fed Funds Rate now at 5.25%, it’s important to remind that bond prices fall as interest rates rise. Ongoing systemic pressure on USTs of all duration levels resulting from a hawkish Fed continues to confound traders as yields on short and long duration bonds gyrate at historical levels of extreme volatility, especially at the short end of the curve (4-week to 2-year sovereign bonds).

In effect, regional banks, which hold Treasuries as collateral, continue to face immense risk when the marked-to-market value of that collateral falls under the pressure of Powell’s rate hikes.

Besides bank data, the yield curve is full of recession signals.

Bond investors expect greater return—yield–for the greater risk of holding longer term bonds. In a normal credit environment, the yield is higher for longer duration bonds than for shorter duration notes.

In a completely distorted credit market, however, investors see an “inversion” of this curve, namely an environment wherein yields are higher for short-term holders and lower for longer-term bonds. Inverted yield curves are effectively and grossly abnormal as well as scary, and that’s precisely where we are today as recession signals increase.

The Latest US Stock Signals:

US stocks as measured by the S&P continue to remain rangebound, and will either pierce resistance or fall below support depending upon the market’s reaction to Fed policies into the summer and autumn.

Allegedly strong labor market data and the publicized stance that regional bank risk has been contained have kept US equity markets relatively stable, despite growing evidence that regional bank risk is anything but contained as recession signals increase. Unfortunately, much will hinge upon whether May’s rate hikes will be the last for 2023 or continue to climb higher under Powell’s tightening policy to raise rates in his alleged war against inflation.

As indicated below, however, all signs point toward a 2023 recession, which historically suggests massive drawdowns across stock markets.

Other Key Market Signals:

Spreads Scream Recession Signals

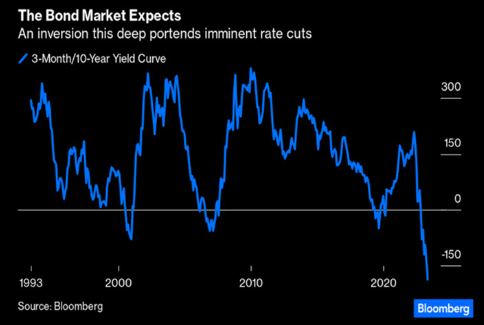

The inverted yield curve in the US sovereign bond market (above) is a compelling signal of recession ahead. Historically, for example, a large spread between the yield on a 3-month Treasury and 10-year Treasury has always been a sign of looming recession, as well as a sign of pending rate cuts to manage the same.

As of now, this spread is historically wide and steep. Over the last 30 years, the curve has never been this inverted.

The recession signals above suggest a looming recession which even Powell has said won’t be “soft,” but rather “softish.” I see that as Fed-speak for a hard-landing ahead across stocks and bonds, followed by a pivot toward inevitable rate cuts into the autumn months or sooner.

Trading within such a volatile environment marked by a dark horizon requires the daily review of sector flows, yield spreads and volatility signals. This active attention is what keeps SignalsMatter portfolios consistently above the standard 60/40 allocations, and further protects portfolios against the potential of another major sell-off akin to March of 2020 etc.

Labor Data

New job openings have witnessed a 20% YoY decline, which is yet another of many recession signals.

Inflation Data

Despite Powell’s headline efforts to raise rates and combat inflation, which he has previously declared as “transitory,” the data suggests otherwise. Over the last four months, core inflation remains in the 5.5% to 5.7% range.

Whether Powell will exploit such sticky inflation data as grounds for further rate hiking without recognizing the larger side-effects such hikes have on the markets and economy is the key question today.

The markets, of course, have already priced in a rate cut for 2023, but we must watch the Fed carefully, for it has effectively become the key driver in stock and bond pricing.

Global Signals:

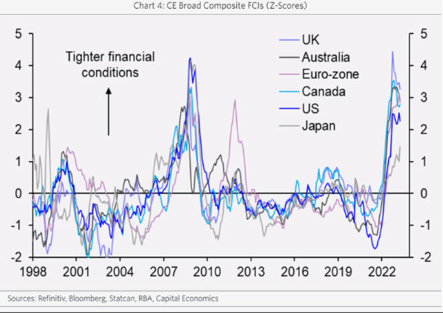

As indicated above, bond market signals are critical signals to both stock market direction and broader economic direction, both within the US and abroad.

From SVB to Credit Suisse, banks face increasing stress as depositors look outside of banks and their checking accounts for greater yield.

Banks, in the meantime, are reacting to lower margins and increased balance sheet stress coupled with growing recessionary indicators to tighten rather than expand credit.

Such credit contraction and tightening of financial conditions in a post-08 global economy increasingly dependent upon cheap debt will and does have obvious consequences on local financial conditions, economies and of course stock and bond markets. The evidence of such global contraction is beyond dispute and only suggests that US recessionary indicators are also global recessionary indicators.

Macro Thoughts & Gold:

SignalsMatter.com board member and Gold-Switzerland/Matterhorn Asset Management, AG Partner, Matthew Piepenburg, shares his latest insights on gold, currency and energy markets here:

Gold, Oil & Global Currency Markets Entering a Watershed Moment

So Many Open Signs of Financial Disaster Ahead and Gold Working

Even More

For greater detail on the signals tracked at SignalsMatter.com, including proprietary recession/”storm tracker” indicators, cash positions and, of course, specific portfolio allocations tailored to individual risk profiles, Signals Matter invites you to become a member here.

Signals Matter Market Reports generally reflect the company’s long-term macro views and are posted free of charge each week at www.SignalsMatter.com, on LinkedIn, and directly to your inbox by Signing Up Here. Our Portfolio Solutions are generally geared to shorter timeframes, may therefore differ from our longer-term perspectives, and are available to Subscribers that Join Here. For three ways to engage with SignalsMatter.com, please click: 3 Ways to Engage.