Like many, we at Signals Matter see each New Year as an opportunity to look back, confirm best practices, learn from prior mistakes, add to our future goals, and generally tune our products and messaging to help the ignored 99% to make money by not losing it.

Serving ALL Investor Types: Better Options for Better Performance

While our messaging to the top 1% can be useful, the very wealthy among us have investment alternatives that amply diversify investment portfolios.

This is not so with the other 99%, who have few options to invest outside of stocks and bonds. This has always bothered us. In fact, it is what drove us to create Signals Matter over 5 years ago.

Traditional Models Won’t Protect You

In short, stocks and bonds—the traditional risk parity model—just won’t work anymore, as both equity and credit markets, after years of bubble distortion, sink together in a dangerous macro environment akin to the Titanic.

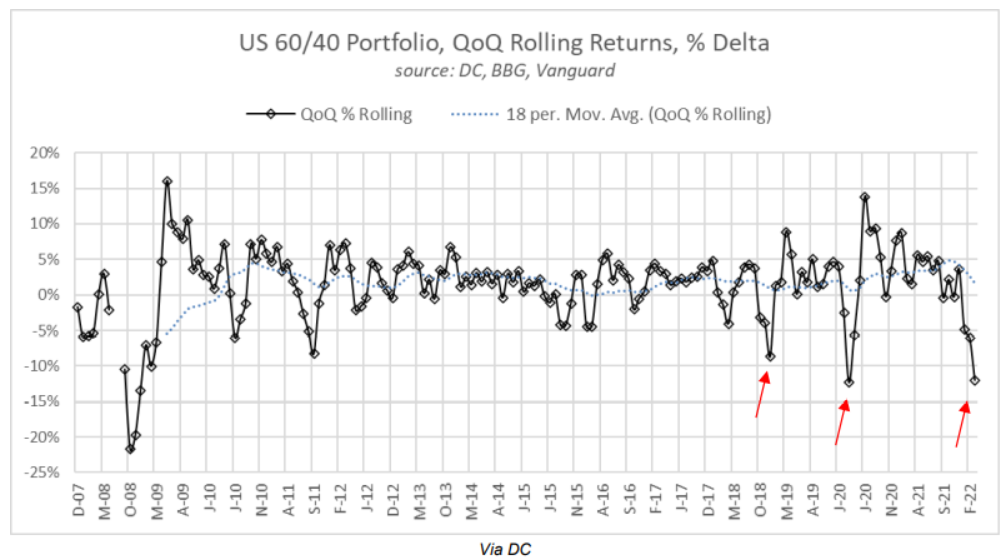

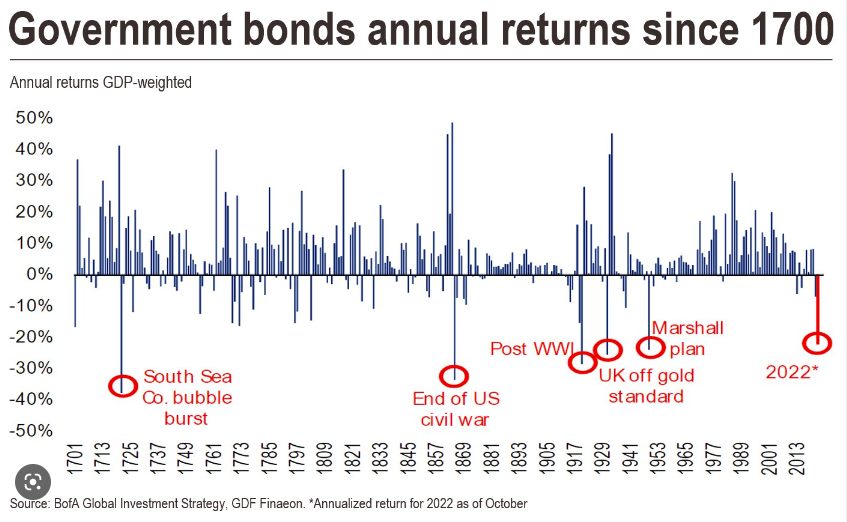

In the above and below charts, we see how global stocks and bonds performed in 2022. Not so well. The MSCI World Index and Bloomberg Global Aggregate Bonds fell in synch (below) as interest rates rose, clobbering plain vanilla investing (as shown above).

Rougher Weather Ahead

For years, we have warned of this dangerous correlation between stocks and bonds. Rather than hedge risk, such portfolio models add to risk as rates climb.

Like many others, we don’t see 2023 as performing any better than 2022. In fact, and as we have made bluntly clear, 2023 is poised to be even worse.

Much worse.

The cornered Fed has already “forward guided” a 5% interest rate setting which simply defies math and underscores the Fed’s impossible dilemma: Either they raise rates and “fight” inflation with a homemade and rate-driven recession, or they pivot and risk hyper-inflation.

It’s just that simple. Everything we have published in the last five years has forewarned the very scenario in which we now find ourselves.

No Good Scenarios Left

It’s not sensational. There are no good options left for our Fed-driven “capitalism” and broken markets.

This trade-off between a market implosion (deflationary) or more mouse-click QE (hyper-inflationary) is a fact of math, one which clever words from failed policy makers can’t mask for much longer.

And as we recognized years before launching this site, the top 1% will be more prepared, but the bottom 99% will get hit the hardest.

It has always been this way, and sadly, always will be.

Our Answer to Hard Facts: Democratizing Smart Portfolios

Signals Matter was created for all investor types, but especially for those who can’t afford access to the kind of truly sophisticated and actively managed portfolios which are absolutely essential in periods of severe volatility and drawdowns, as we foresee in the months ahead.

As charted above, 2022 was a bad year for the passive, stock-bond portfolios handed down to the vast majority of retail investors.

2023 will be a brutal year.

Again: Our primary goal is to protect this ignored class of investors, which the market whales have historically treated as easy-money plankton.

By pricing smart portfolios hitherto enjoyed by only the top 1% at levels affordable to the ignored 99% , we have taken a personal step in democratizing the retail markets to protect one Subscriber at a time.

Years of Easy Reward & Ignored Risk

In rising tides, all portfolio service models driven by QE tailwinds can boast of portfolio “success,” but it is only when those tides turn that we discover whose portfolios were best managed to navigate risk.

And with markets tanking, rates rising, inflation sticking, politicians panicking, debt expanding and “great resets” percolating, we have never seen markets poised for greater risk.

Never.

Our Commitment: Expanding/Streamlining Our Service

This 2023, we therefore reaffirm our commitment to acknowledge the 99% left without access to smart investing.

Here at Signals Matter, we help investors by actively measuring individual risk tolerance, appetite, and capacity, as well as the global market risk, and then match intelligently diversified portfolios accordingly.

In 2022, Subscribers to SignalsMatter.com could only mimic our five published portfolios. For many Subscribers, that turned out not to be so easy as portfolio selections changed frequently, as did the levels of overall cash we had suggested as a hedge based upon Storm Tracker, our internal recession indicator.

That is: Too many calls to your broker or too many hours at your trading screens.

Shortly this 2023, with the addition of SignalsMatterAdvisors.com, the ignored 99% will be able to let us do the trading as they do the watching. Investors will be able to open an account, select a portfolio and let us do the investing.

The entire process takes less than 15 minutes. The rest is up to us.

In 2022, we offered free education, free market reports, and free podcasts, as well as a Subscription Service that provided daily and weekly market commentary, along with five portfolios that Subscribers could mimic, at www.SignalsMatter.com.

This 2023, we are taking Signals Matter a step further. Shortly, Signals Matter’s affiliate www.SignalsMatterAdvisors.com will offer an Advisory Service for those who chose to leave the investing to us.

Bottom line: In 2023, we are enhancing our Business Model to enable Subscribers to leave the driving to us. Part and parcel, revenue streams will be enhanced, allowing Signals Matter to offer evermore content to Subscribers, and return to our equity investors.

Sharing in Ownership

As to equity investors, we also invite those members of our online community with the means to do so to take a partial ownership position in our service and unique vision while simultaneously enjoying the portfolio protections offered to our Subscribers.

The Business Model here at Signals Matter relies upon growing Subscriber revenue and periodic injections of private equity, e.g., ownership in the business, to a relatively small number of Accredited Investors to cover capital costs. Accredited Investors generally satisfy certain thresholds as to income, net worth, asset size, governance status, and/or professional experience.

For more detail on this equity opportunity, please contact info@SignalsMatter.com or call us at 844-545-5050 and ask to speak with a principal of the company if an ownership interest in Signals Matter appeals.

Looking Ahead at Signals Matter

2023 is poised to be a challenging year for global investors, but an exciting year for informed investors.

Since May of 2017, we have poured countless hours into hundreds of free market reports and thousands of actively managed portfolio adjustments to help investors manage melt-ups, melt-downs and all that fell in between.

We are proud of our candor, reporting and our service throughout those years and feel that much more will be required of us and investors in the months and years ahead.

We know, of course, that our unique service, experience and views at Signals Matter cannot stop the flow of history nor the consequences of markets and years distorted by failed monetary, debt and currencies policies.

What we can do, however, is prepare and protect our own Subscribers, readers and equity partners for and from what lies ahead with transparency, passion and commitment.

For those wishing to join this special community as a Subscriber or equity partner, we look forward to welcoming you.

Signals Matter Market Reports generally reflect the company’s long-term macro views and are posted free of charge each week at www.SignalsMatter.com, on LinkedIn, and directly to your inbox by Signing Up Here. Our Portfolio Solutions are generally geared to shorter timeframes, may therefore differ from our longer-term perspectives, and are available to Subscribers that Join Here. For three ways to engage with us, please click: 3 Ways to Engage.