Below, we examine what we consider to be the four most important market questions every investor should be thinking about.

38 shares

Readers, clients, and market watchers across the bull-to-bear spectrum have joined our efforts here at Signals Matter to not only track the habits of the most distorted and openly rigged markets ever traded (nod to the central banks), but to also keep you ahead of the game as the most informed investors.

The logic is simple: Informed investors are better investors.

A key aspect of staying informed hinges upon asking the right market questions. And today, we want to explore the four most critical market questions that every investor should be asking.

By addressing market questions like these, we better equip ourselves to navigate the current and historically unprecedented battle between natural market forces and central bank intervention with open eyes and calm wallets.

Be you bear, bull, or somewhere in the middle, the information and answers to key market questions set forth below will inform your decisions with facts rather than guesswork.

Thereafter, and depending on your individual risk tolerance, income, and experience, what you do with this information and the answers to these market questions is up to you.

So, let’s hit those big market questions…

- How Long Can These Markets Sustain Themselves?

When markets began to implode last October, fears of another “2008 moment” ran high.

After briefly trying to raise interest rates and tighten its balance sheet by dumping Treasuries into the bond market (thereby causing yields and rates to rise), the Fed quickly realized this was a mistake…

By Christmas Eve, the markets were full-on tanking.

Our debt-driven and historically debt-soaked markets ($72 trillion and counting) simply couldn’t stomach rising rates.

Stomachs were churning. That ’08 nausea was coming back.

Fast forward to today, and we see a Fed in full pivot – lowering rates once again toward the zero-bound while expanding its balance sheet – i.e. a round-trip back to printing money.

This “loosening” intervention has successfully reversed the meltdown begun in late 2018.

In this bizarre Fed backdrop, a number of contrarians predicted a final and massive melt-up in the markets – a kind of “last hurrah” before a Titanic-like market dive and long, Japan-like recession to follow (to elaborate, it’s been 30 years since the Nikkei crashed, and Japan’s markets have yet to recover their losses).

The evidence was compelling.

In the past – leading up to the great market crash of 1929, the dot.com bust of 2000, the great Nikkei fall of 1989, or even the Tulip mania bust of 1637 and the French “Mississippi” disaster of 1720, otherwise doomed markets saw sudden and massive needle peaks (100% to 300% surges) in their final year before tanking.

Rather than seek refuge in cash, these contrarians thus recommended riding this melt-up “all-in” for its final and similar surge – especially (and rightfully) in the bubbling tech sector as seen in the Nasdaq 100 (QQQ).

They argued that investors would climb a wall of worry, panic-buy into the final fray, and that the Fed, much like the Japanese and Swiss central banks, would even print money to buy stocks – thus feeding a massive, final market rise.

We don’t fully agree.

Yes, we knew markets (especially tech) would and could rise after the Fed-pivot in early 2019, and even gave reasons here for a “melt-up.”

But we also remain in our melt-up stance when addressing such market questions.

The primary reason is that today’s markets, even “stimulated” by Fed intervention, also contain too many quantifiable risks and clear headwinds to warrant NOT going all-in to chase these nervous tops.

In an in-depth, five-part series, we introduced the signals we use in our “Storm Tracker” to mute the otherwise bullish stance taken by the melt-up proponents.

Thus, even recognizing a final surge, a key takeaway of Storm Tracker is to hedge the risks facing us in these distorted markets with wise allocations to cash, as dictated by risk percentages.

When addressing such market questions, we then outlined these risks by pointing out the equally clear signals of the meltdown to come, such as the Fed running out of credibility and impact, bond market vulnerability to rising rates, a Main Street recession outpacing a Fed-supported market, an overbought ETF bubble, robo-market insanity, and un-noticed risks in the overly complex derivatives markets.

In sum, even if a greater melt-up does indeed manifest, we feel that when answering such market questions, the risk-reward probabilities are too asymmetric, and that informed investors would be wiser to hedge rather than double their bets in this otherwise rigged market backdrop.

Why the hedge? Why the caution? That brings us to the second of the key market questions…

- What’s the Best Way to Make Money in Any Market?

As we made clear in this special report, everyone has heard the adage “buy low, sell high;” yet almost no one does this.

Really. It’s true.

In researching the fortunes made and lost throughout the history of capital markets, it became clear that the best way to make a fortune was not to lose a fortune.

In the last decade, more millionaires have been made by these Fed-doped markets than at any other time in history. Money printing and low rate steroids do work.

But here’s the rub: When these markets sink, the history of investor behavior confirms that the majority of those millionaires will go down with the ship.

Why? Because, as in every crash that has come before, they will fail to avoid the fall that always follows the rise.

Informed (smart) money doesn’t make this time-honored mistake. When evidence of market risk far outweighs reward, the informed get largely out of the markets and wait to buy at bottoms, not tops.

Given the equally historic power of reversion to the mean, when the next recession hits, we could see a repeat of the 2009 lows, and hence a massacre for those who stayed all-in all the time, and a boon for those who patiently avoided the fall.

But can investors seeking answers to such market questions ever really know when a top has “topped” and a bottom has “bottomed”? In short, can they avoid the fall?

That brings us to the third of these most critical market questions…

- Can Markets Be Timed?

The simple answer is that no one can perfectly time a top or a bottom. No one.

But armed with the right combination of technical, fundamental, and historical signals, as well as an ounce or two of common sense, informed investors can get much closer to these tops and bottoms than herd investors.

Recently, we addressed this timing issue in greater detail here, pointing out myriad critical indicators that clearly suggest this market is running out of gas.

Specifically, we pointed out such time-tested indicators as the inverted yield curve, PMI contraction, dangerously high price to earnings multiples, volatility spikes, Cass Freight declines, historical wealth disparity, and increased vulnerability to “black swans.”

In short, the evidence of a top, or near-top, is dispositive and clear.

But if such data isn’t clear enough, common sense always helps to answer such market questions.

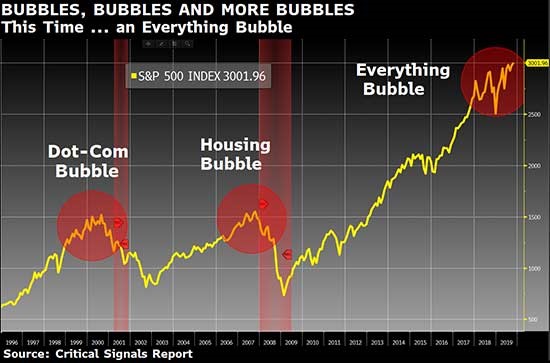

Look at the current bubble compared to prior bubbles and ask yourself, does this look like a topping bubble to you?

But there’s one MASSIVE caveat to even these otherwise glaring indicators of a topping (and tapped-out) market: the FEDERAL RESERVE.

That’s right.

In the post-’08 Twilight Zone that characterizes the “new abnormal” of Fed-supported market peaks, one cannot and should not underestimate the incredibly distortive power of our central bank to keep markets rising long past their natural expiration dates.

Heading into 2020, we expect the NASDAQ to rocket up on the tailwinds of a false confidence driven by more Fed support—even Tesla will ride this up…

Prior to the 2008 crisis and the greatest monetary intervention in history, normal markets saw a recession on an average of every four to seven years.

We’ve now gone over a decade with little more than an occasional hiccup.

With the ongoing power (and desperate will) to do “whatever it takes” to keep markets (confused with the economy) afloat, the Fed can print unlimited dollars and suppress borrowing costs to the floor of history with just a mouse-click at the Eccles building.

This means that even the best, most time-tested indicators of the past are fighting a powerful and un-natural “Fed force” when it comes to market tracking and market timing. This makes such market questions subject to open humility.

This also means that all that the best-informed investor can do in this current and totally distorted backdrop is watch the Fed and the markets simultaneously, as their combined signals are the most important ones to track.

Which brings us to the final, and most critical of the market questions: When and how will this bloated, monstrous and Fed-driven bubble finally “pop”?

- How Does It All End?

The answer is as simple as it is tragic: It all ends when the Fed’s magical steroids stop working.

There’s simply no more denying the unbelievable correlation between Fed support (i.e. money printing and low rate “accommodation”) and rising, historically high market moves.

By simple logic, if markets rise high on Fed steroids, then they will fall with equally violent panache once those steroids wear out.

OK, but how the heck does one track or measure that?

Well, the markets will tell us.

That is, as we once again see the money printers (quantitative easing) and rate cuts in full swing and now nearing exhaustion after a decade of implementation, all we have to do is monitor if, and for how long, markets salute each time the Fed introduces more of its “support.”

This requires patience and knowledge when concluding such market questions.

Crudely put, eventually even the most potent narcotic loses its “buzz power” overtime.

The “gateway drug” of QE1 to “temporarily” restore order in the self-inflicted banking crisis of 2008 has slowly morphed from an “emergency measure” into a gradual decades-plus addiction to stronger and stronger drugs.

We’ve seen this addiction unfold over years of prolonged zero-bound rates and QE2, QE3, QE4, and now the most recent Fed bailouts of the repo and short-term treasury markets.

In short, the markets are now full-on addicted to their Fed steroid-pusher.

The question (among so manymarket questions) before us now is how long will the “buzz” last before it tilts toward a fatal overdose?

There are some, of course, who say it can last forever… yes, really. Party on!

The rising popularity of the proponents of modern monetary theory (MMT) actually believe that we can print money to solve our debt problems without consequence.

But then again, common sense clearly says otherwise…

One just cannot solve a debt problem with more debt or fiat currencies.

Again, use that common sense.

If printing money were really that easy, then everyone would be doing it, and everyone would be fine. But from the U.S. to Italy, or Australia to Germany, we know that everyone is not fine.

Even the Fed knows this, which is why Powell spent most of 2018 trying to raise rates and reduce (“tighten”) his balance sheet, all of which ended in disaster by Christmas and confirmed forever more that the markets simply can’t survive without Fed “intervention”—i.e. more steroids…

In short, the jig is up. Again, even Powell himself was trying to tighten rather expand the Fed’s balance sheet. He knows the risks.

Our central bank, and those around the globe, are running out of steam, answers, clever speak, and “buzz.”

All we can do now in answering such market questions is track the increasingly muted reaction to further Fed “stimulus” – though we may indeed see some real high peaks before the troughs.

After all, steroids work – until they don’t.

In the end, however, everything ends when the Fed fantasy ends.

Until then, we recommend having reasonable levels of cash on hand to prepare for the inevitable, avoiding the Fed preempted crash, and buying at the bottoms.

As for melt-ups, as they come, you will still have some exposure to rise with them – albeit with a wise cash hedge.

For those worrying about the declining purchasing power of their cash positions, we further recommend a reasonable (not hog wild) allocation to precious metals like gold and silver to protect/hedge against the currency risks which face all owners of fiat currencies printed by central banks.

We address this currency hedge in greater detail here.

We hope these answers to the big market questions add a bit more clarity to the fog that otherwise pours down upon you on a daily basis.

As always, stay patient, stay calm, and stay informed.

Sincerely,

Matt Piepenburg

Comments

5 responses to “The Four Most Critical Questions Every Investor Should Ask”

- HASMET KANSIZsays:

So Matt?

How do we get this 12 critical signal report?

- Charles Morgansays:

In the mean time I have all my money in bonds. Most at 3.15%. How do I get to cash. Can I force the bond company to I’ve me back my money prior to the determined date?

- John P.says:

Go to the landing page to find the special report.

– JOhn

- Steven Brincefieldsays:

It seems to me inverse etf’s that pay a dividend would be a good place to be besides just gold and silver and cash.

- Mindysays:

AGAIN, THANK YOU!