Now here’s something on the mind of Warren Buffett that you may not have expected me to talk about today: The Association of American Railroads (AAR).

The AAR recently released its July data, and there’s a lot behind these reports, which just showed a 4.4% decline in Class I rail traffic compared to the same period last year. In June, the decline was over 6%.

The report covers carloads and intermodal containers (just over 534,000 of them) traversing the railways of our country. Nearly 70% of all carload commodity groups reported negative YoY (year-on-year) numbers with only petroleum and nonmetallic metals showing gains.

Weekly intermodal container volume was down 5.3% YoY.

Here’s what the railroads (of which Warren Buffett has a critical stake) are telling us, how it all plays into your money, and why one of the richest men on the planet (i.e. Warren Buffett) is worried…

It Doesn’t Stop at the Railroad

What does such a slowdown in industrial rail traffic mean? Well, it tells us manufacturing and industrial productivity – key components of our GDP and market strength – are also slowing down.

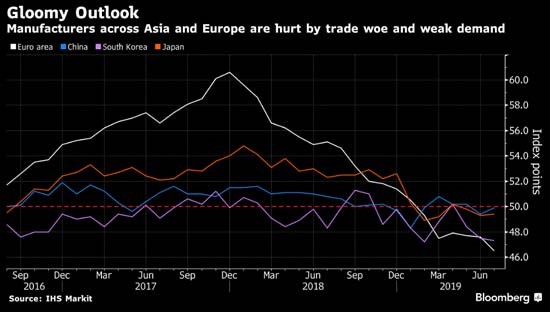

The U.S. Leading Index of Manufacturing PMIs has slipped to a three-year low, and Markit MPI (which polls specific business sectors) has hit a ten-year low. And this isn’t just isolated to the U.S. or interests held by Warren Buffett; it’s a global issue.

Here’s how manufacturing is faring overseas…

Ouch!

Such data suggests further declines in rail volume so dear to Warren Buffett through and into the fall months. Warren Buffett has a lot of interest in this data. As we press forward, he knows we’re going to see lots of market volatility, so, like Warren Buffett, brace yourselves for a bumpy ride – even a derailment.

Rail freight may not seem sexy, but this key data point – one otherwise ignored by the Fed, media bubbleheads, and sell-side spin artists – is in fact an insider’s way of getting infinitely more honest data as to what’s really happening in our real economy–the one the Fed has overlooked.

The Real Economy

Specifically, such freight declines are a frightening indicator that our so-called “mid-cycle” economy (in fact, the longest/Fed-spiked growth cycle in our history and nearing a tired end rather than “mid-point”) is weakening.

Unlike the markets, the Fed can neither manipulate nor address a falling economy. The faltering economy, in turn, can likely trigger our next recession, and hence a massive market sell-off from the bottom up thereafter.

You see, most investors (including Warren Buffett) are waiting for tanking markets to send the economy into a recession – as in 2008.

But with record-breaking Fed intervention to inflate markets, it’s equally likely that this time a Main Street recession will send the markets tanking.

As we’ve shown, the markets are totally rigged by central banks playing with interest rates and money printers as if a rising market can outlaw recessions.

But as fudged unemployment figures and record-breaking household debt numbers confirm, our Main Street economy is already on its knees.

The Fed serves Wall Street, not Main Street, and for years has conned most investors into confusing the rising stock market with a healthy economy. Big mistake.

And as I mentioned recently, trucking companies – a key part of our overall industrial pulse check – are dropping like flies, further confirming the ominous implications that our real economy is dropping too.

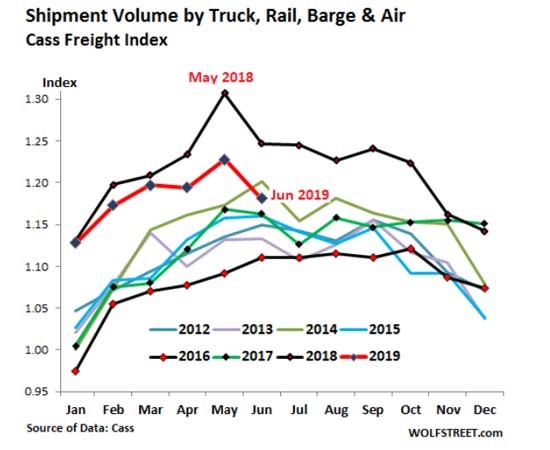

The Cass Freight Index, which tracks the shipment of industrial and consumer goods (the heartbeat of our already comatose GDP), has fallen below its prior boom periods and has now put the Transportation industry into its own recession.

Should Warren Buffett Be Worried?

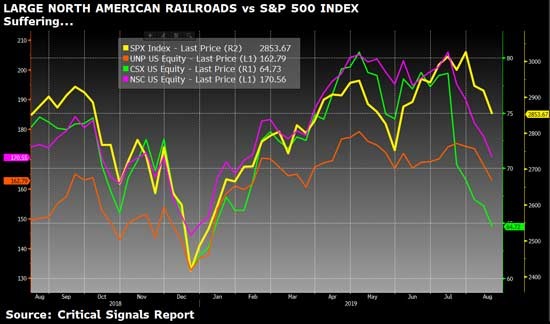

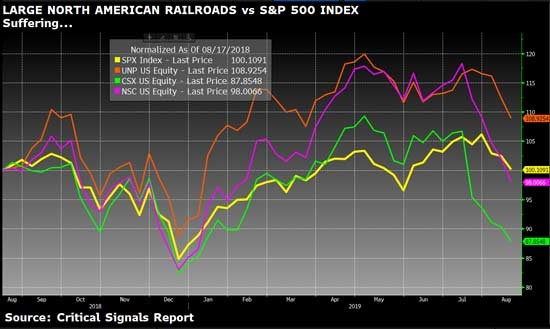

I would think so. Look what’s been happening to Union Pacific Corp. (UNP), CSX Corp. (CSX), and Norfolk Southern Corp. (NSC)…

North American railroads are going to have to work pretty darn hard to become more productive, to raise freight rates, and (sadly) to borrow more to buyback even more shares to prop up the stock and offset the hit from declining freight volumes as trade tensions mount.

Shorting opportunity? Perhaps, but note the stocks have already dropped. Normalized, Union Pacific may be your best short if this keeps up – the farthest to fall.

The great Warren Buffett has to be a bit concerned over BNSF railroad (not publicly traded), as earnings for Berkshire Hathaway’s manufacturing businesses have barely budged due to declining sales in the wake of continued tariff impacts.

Trade War Origins

These declines, in turn, are the direct result of a national and global downturn in industrial production that has poisoned American manufacturers with a virus originating in Europe and Asia – all directly tied to the synchronized decline in production and trade volumes germinating from our trade war with China. Warren Buffett knows this all too well.

The data confirms that tariffs are hurting more than just U.S. farmers, who are now seeing record high loan delinquencies in the green belt.

Manufacturing is taking big hits as well – and that never bodes well for the real economy.

It’s all connected. As we’ve argued long ago, no one really wins a trade war, and even if we were to “beat” China, we’d be shooting our own foot to save a toe, as China is 40% of global GDP. If China limps, the world trips.

Like it or not, we have to play with China, as game theory confirms that protectionism is far less effective than cooperation – even if it means cooperating with debt-soaked cheaters like China.

Furthermore, China’s recent currency moves (cheating) suggest they plan to outlast the U.S. in this game of trade “chicken.” Will they win? Will they try to hurt the White House (and even Warren Buffett) by refusing to “settle” before the 2020 elections?

It’s hard to say. Politics are difficult forces to time or measure, but regardless of this fact, we are already seeing clear signs that the tariff war is hitting global manufacturing in general, and U.S. manufacturing in particular.

Stocks Plummeting Indicate a Bumpy Autumn Ahead

As we head into late August, these forces, along with declining growth and earnings forecasts for Q3 and Q4, are already colliding with major hedge funds selling to cover bullish bets in June and July that went against them in early August. The Dow Jones fell 800 points on Wednesday, previewing what’s ahead.

In sum, a front just came through, and many weather patterns are converging to suggest more rain than sunshine for this autumn’s markets. This means the Fed will likely kick out the money printers again in Q4 to get things back on their artificial tracks…

Anticipating something bad in September or October, our storm tracker is currently blowing at 46 knots and recommends 46% cash allocations for those of you seeking to manage risk while sniper shooting optimal trades as we see them – both long and short.

Who’d have thought that a simple data point out of Warren Buffett’s rail freight industry could be so telling?

Fortunately, Signals Matter focuses on the facts, and no matter how fantastic the Fed says things are for the U.S. economy, the real numbers say otherwise.

Comments

10 responses to “Here’s What Warren Buffett Should Be Worried About”

- BRIAN BREWTONsays:

August 16, 2019

Thank you. I do some traveling around N GA and have yet to see any indication of a “great” economic recovery. One of my clients, a machine shop, has had to lay off about 40% of his labor. So, I am unsure that this recovery has extended past Washington, DC.

- Franksays:

August 16, 2019

Thanks for the great analysis. Something brokers and most investors don’t look at.

- George Mantersays:

August 16, 2019

Excellent article that really means something presently. However, I wonder if the tariff situation is resolved what will that mean over all to our economy as it relates to movement of goods via your subject matter. I am looking for a further drop in the stock market because of your out look as stated and a further drop in interest rates by the Fed’s. Thank you for your article and I will look for your next.

- Carl Rosenthal says:

August 16, 2019

Even if the Fed lowered the interest rate to “0”, the market will revel in only a temporary euphoria. The only two ways to spur the economy (and I’m aware of long run burgeoning deficit issues, is through massive infrastructure program. The second way is to apply the most advanced technology to make our industrial as well as other sectors globally competitive.

Many will cringe at the idea of advanced technology replacing large numbers of workers. But that is not necessarily a given. Many workers will be retrained and their advanced skills will translate to higher wages. Also, I can envision that higher productivity will enable reduction of the work week, eventually to a 32 hour work week. thus a 4day work week.

Appreciate comments on my vision1

- Zsays:

August 16, 2019

Please Please keep us posted. We are in uncharted territory with most aspects, not only markets but debts and economies. We are getting very very worried … but the FED will cut rates a couple of more times and Trumpy could have many many cards up his sleeve yet. But we are still very doubtful we could get another Melt Up !?!?!?! Don’t you think Storm Tracker should be at 55 ????? please answer THANK YOU.

- Edouard D’Orangesays:

August 16, 2019

Thanks, Matt. Thought I was staying “out of the fray” by buying some mutual funds with bond exposure, but I was mostly wrong. Still only about 40% exposed, so holding 60% cash.

- Alibabasays:

August 16, 2019

“nonmetal metals”… Hmm…interesting concept. Did you copyrighted it?

And on the main idea, Jim Rogers, when takes a look at Chinese economy, analyze only two factors in order to figure out if it expands or contracts, two factors which propaganda cannot fudge: electricity consumption and railroad traffic. Why that concept can be applied only to China and not to US?

- Melsays:

August 16, 2019

Good job, Matt.

- Timothy Dennissays:

August 16, 2019

How much of a plummet are seeing for fall or the 4th quarter.

- Tom Morgansays:

August 18, 2019

My email address has changed