As of this writing, we are carefully bullish, but haven’t forgotten the sharks swimming beneath the bullpen.

19 shares

As January comes to a close amidst a seesaw of bullish macro and monetary tailwinds against bearish manufacturing headwinds, our outlook for the near term remains carefully bullish, with certain key recommendations set forth below.

Of course, as authors of reports entitled “Rigged to Fail,” we are long-term cynics as to the over-all destiny of these Fed-corrupted markets, but this has never stopped us from being openly bullish whenever the Fed sends us a fat pitch.

Today, we are at least carefully bullish.

The unusual optimism we showed for Q4 2019, for example, was by no means subtle, as I essentially shouted from a river bank in October that it was time to party.

Reasons for Being Carefully Bullish

Such bullish fervor, of course, was driven exclusively by the Fed’s decision to print money-what the fancy lads call a “liquidity-driven asset purchase trend.”

But let’s stick to the plain and simple folks: Where Fed steroids go, the markets go, and for now, there’s still a little bit of juice left in those steroids. Hence the only reason we are carefully bullish.

This quantitative easing (QE)-driven tailwind in Q4 was bolstered by the fact that global tensions had decreased, and that black swan we saw in Saudi Arabia never morphed into a world war with Iran.

But black swans, despite being rare, are by no means extinct, and we are bracing for more of them…

But then again, almost nothing can keep a QE-doped stock market from trending upwards, not even the impeachment trials of a sitting U.S. president or a potentially pandemic Chinese virus, which I will address as well below, which may make us less carefully bullish as it unfolds/spreads…

But let’s not get too excited. For now, our less nervous Storm Tracker still advises a 30% cash allocation, and we hope you’ve stuck with that, despite our bullish calls over the recent months.

This is because certain indicators continue to raise concerns, even when carefully bullish.

Reasons to Modestly Calm Your Enthusiasm and Remain Carefully Bullish

For the first month Q1 2020, the trend of continued optimism out of late 2019 was driven by lowering borrowing costs (i.e. lowering interest rates and money printing) both in the U.S. and around the globe.

But now we are seeing certain reasons to calm down a bit, despite carefully bullish and even consensus views that markets will only go up without a meaningful dip.

Actually, we bearishly see dips ahead, yet “carefully bullish” feel it will still be worth buying those dips, as the Fed is still in full-on doping mode. More on that below as well.

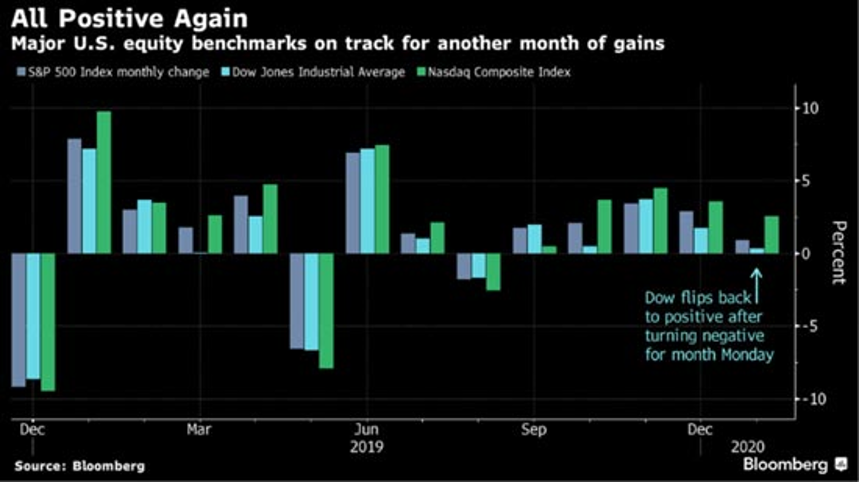

As for dips, last week saw a meaningful one here…

Followed by an equally fast rebound here…

As to carefully bullish concerns, first, let’s recall the warning signs from the manufacturing sector, which our recent report on the PMI declines made alarmingly clear.

Stocks on finished goods have settled down considerably to an average trend, and thus a major tailwind for 2020 manufacturing health has essentially been removed.

On top of that, much of the previous carefully bullish optimism for manufacturing and PMI growth in 2019 was driven by Asia in general and China in particular.

But the recent viral outbreak now making headlines around the world has added to this slowdown, fairly or unfairly. Again, more on this below.

For now, however, we know as a matter of objective fact that in January new orders fell against rising inventories in China, which is a critical PMI indicator suggesting that global manufacturing levels are tanking as of the end of January.

In addition, we are seeing some striking new signs from the credit markets.

That is, despite Fed-driven rate suppression and lowering costs of debt, credit activity (i.e. lending) has noticeably slowed by month end. This is telling, and perhaps a reason to be even less carefully bullish.

Why? Well, there are a number of reasons, but the key theme here is that parts of Wall Street are finally, albeit very slowly, catching on to the fact that there is a major disconnect between a rising stock market and the health of the real economy.

That is, investors are discovering that the Fed can save Wall Street, but it can’t save manufacturing or Main Street.

Or stated more bluntly, the Fed can print money, but it can’t print workers, wages or exports-i.e. the things that make a real economy thrive.

Today, of course, the disconnect between this real economy and the stock market has been effectively glossed over by the media prompt readers and click-bait hunters.

For example, despite the surge in asset prices in Q4 of 2019, data on the services sector, which should have been thriving on the back of more QE, confirms that corporations are not buying the recent sugar high handed down by the Fed.

The PMI’s “business expectation” component is in fact lagging right now despite the “easing” of financial conditions.

It seems the corporates are catching on that the Fed can boost stock prices but it can’t prevent a manufacturing slowdown, a core driver of actual economic strength.

Then again, who needs GDP anyway? We have a money printer.

But keep in mind, the Fed’s magical powers are starting to wear off.

Over the long term, of course, this is an alarming signal.

Even more alarming, the banks are catching on as well.

That is, the big banks are starting to see through (and past) the recent QE trick–this is grounds for caution ahead, despite being carefully bullish today.

Recent G4 bank lending surveys, moreover, show a broad trend of credit tightening in the G4 countries despite the low rate fat pitches from the world’s central banks.

This is bad sign particularly for emerging market stocks.

Lending to corporates is slowing down, as is loan demand. This is because more lenders are realizing that just because stock prices are surging, the underlying “health” of the borrowers is not as sexy as their rigged share prices.

Are We Thus Headed Toward an Imminent Credit Crunch and Recession? Nope. Not Yet.

The recent data from the banks does not mean a recession driven by a credit crunch is imminent.

Nevertheless, such a gradual tightening of credit (i.e. reduced lending) is an important and telling trend, as credit channels (i.e. banks and lending) are the main needle through which central bank steroids flow.

This slowdown in the steroid flow raises compelling concerns for later in 2020, hence our cautionary Storm Tracker recommendations.

We’ll be watching this trend carefully in the coming months.

Carefully Bullish Despite the Bearish Indicators?

Yes, economic reality is slowly starting to fly increasingly in the face of irrationally rising markets and increasingly bad fundamental indicators like the PMI, manufacturing and lending data above.

But, remember folks, these are still Twilight Zone markets, and despite the meltdown that is inevitable, we still face melt-up support from central banks, the kind of support that makes nearly every normal indicator used in past (and normal) market cycles less reliable today.

In short, past indicators of a recession are less linked to today’s central bank-doped and rigged markets, and thus less reliable today as clear (or timely) indicators.

QE may become less effective, but its powers should not be underestimated, at least not yet.

As we’ve said before: “Don’t fight the Fed,” especially when it’s in overdrive mode.

And so, turning toward the stock market… we anticipate a soft landing, at worst, for the near-term, not a meltdown.

And then more dips, followed by more buying of the dips.

In other words, same-ol, same ol, as there remains a lack of uncertainty which still keeps markets trending up, as investors know the Fed will keep reducing rates toward zero and printing more dollars to keep the repo markets alive and the fatal threat of dollar illiquidity at bay, at least for now.

Why such market confidence?

Again, because QE, as we’ve shown over and over, goes into assets prices not Main Street-i.e. the real economy.

This is now becoming more and more clear even to Wall Street pundits.

This foul (yet market-fun) tailwind will accelerate, and since the Fed really has its eyes on markets rather than the real economy, this fully explains why we’ve seen little inflation in the price of goods (i.e. the bogus CPI inflation indicator) yet outrageous inflation in stock prices ever since march of 2009 to today.

But traders and the robots that trade on algorithms and dangerous Index ETF’s don’t worry (for now) about such pesky realities like declining manufacturing, exports or economic strength.

Instead, they take their signals from a doped bond market.

And such central bank impotence for Main Street does not and will not prevent central bank doping from fueling the current everything bubble.

This is because markets know that as Main Street worsens, the headline-conscious Fed, as well as the politicos who pressure it, will ironically (and wrongly) respond by pushing rates even lower, and thus sending markets even higher.

In other words, the Fed policies to help the “economy” will only help the markets. As absurd as this policy irony is, we cannot and should not discount the absurd nor fight the absurd Fed.

What We Recommend for February

For now, we’re therefore recommending that investors going into February avoid the cyclical stocks and emerging market (G4) sectors, and look to buy more defensive US stocks.

I’m also long the U.S. dollar and short the Yen, copper and other commodities hitherto driven by Chinese growth, which is slowing dramatically. Real estate stocks, as tracked by the Real Estate Select Sector SPDR ETF (NYSEArca: XLRE) are also showing signs of an uptick.

Even stocks like Tesla, which I don’t like… are going to fly high on more steroids.

As for gold, it too may see a pullback, but as my readers know by now, I look at gold as a long-term play not a near-term speculation, and thus am holding it tightly as insurance for the inevitable day when the Fed’s experimental control over these markets comes to a dramatic end.

For now, however, that day is not yet here-just inching closer against a powerful Fed. Hence carefully bullish…

I know this, because interest rates, and countless other Storm Tracker indicators from the markets (rather than the media) tells me so. For now, risk is still relatively muted.

The bond traders I speak with are already pricing in (i.e. discounting) the fact that US rates are going to hit zero, which will fuel our already absurd asset bubbles even more, and not even the Chinese virus will stop this bubble from rising (choppily ) in the near-term on the backs of a cheap-debt tailwind.

A Side Note on the Coronavirus

As to this headline-making “Wuhan coronavirus,” as scary as it might seem, and as ubiquitous as the bobbleheads in the media are in raising your fear levels, it is not as important to market direction as falling emerging market data or credit tightening trends.

In other words, the forces of pandemic viral fears or ongoing market greed are not nearly as strong as central bank forces (at least for now) to keep rates low-as everything hinges on that alone.

Yes, the virus complicates things as a tail risk for global activity. We’ll be tracking its progress carefully.

And assuming the data out of China and elsewhere is accurate (a big assumption, admittedly), 9,900 people in China now have the virus, with 130 cases in 22 other countries; 40,000 are under observation. At least 213 people have died.

The World Health Organization reports seasonal flu kills between 290,000 and 650,000 worldwide every year.

Should you be worried about your health or that of your portfolio?

Heaven knows I’m no virologist, I’m a market veteran. These numbers could climb much, much higher. We just don’t know yet.

But as a market guy, I look at the data behind such world health trends with cold regard to their bald impact on markets not health forecasts, and here’s what the available data tells us.

First, the coronavirus, unlike the far more deadly (for now) SARS virus of 2003, can become contagious even before symptoms appear. This, unfortunately, makes the coronavirus much harder to contain.

On the fortunate side, however, the data also indicates that there is an inverse relationship between how contagious a virus is and how deadly it is.

That is, based on available data, this virus is statistically far more contagious, but also far less lethal, than the SARS virus, which killed 774 individuals in over 17 countries years ago.

But again, the data we have today can change on a dime, so have to watch these numbers as they develop.

Summing Up

Faith in the Fed’s ability to boost the real economy may be slowly dwindling, as per above, but its ability to support markets still remains, and as jaded as I am, I won’t fight that support until I see a shock to the bond markets.

Portfolios need to change with these ever-changing market signals, and the strongest signal in these rigged markets remains the central bank.

For now, I hope the above offers continued clarity for those of you seeking to become more and more informed investors by the day.

Sincerely,

Matthew Piepenburg

Comments

One response to “Carefully Bullish For Now: Here’s Why & What We Recommend”

- Jeffrey Wollersays:

January 31, 2020 at 6:56 pm

Good read & well thought out and clear in a very tough trading enviornment.