Market facts are being ignored as daily headlines vacillate in sync with equally volatile market swings.

It’s Getting Harder to Watch

There’s something almost tragi-comical in watching markets, investors, and, of-course, prompt-reading pundits daily ignoring market facts while trying to make ratings hay upon a single day’s trading profile, such as Monday’s “surge” followed in tow by Tuesday’s tanking.

Up, down, up, down…bull this, bear that…up, down, up, down…headline this, headline that. You get the drift.

We are tired of this daily pulse checking and bull v. bear nonsense in an equally nonsensical financial media.

Instead, we wish investors could simply be given unalloyed market facts rather than click-bate hype, be it positive or negative.

After all, deep down we all know that if you lockdown an entire global economy in the backdrop of a health pandemic preceded by an already grossly distorted and debt-soaked market landscape, such daily swings and headlines are not only irrelevant, they are in and of themselves a warning sign of trouble ahead.

Volatility, as we’ve said so many times, is its own indicator, not some daily canvas upon which bulls, bears and spin-sellers can sling their opinionated pablum.

Meanwhile, Wall Street, the media or some YouTube guru de jour or other guest-speaking data-pusher will explain how all is well, or will be well as the COVID-19 numbers improve, as if a virus alone explains everything.

They’ll point to such useless updates like the recent rise in Carnival or American Airline’s stock, as if global markets and economies will instantly recover like some college drunk after his first, Freshman hangover.

But what the markets (and YOU) are experiencing in real-time is no ordinary recovery, nor ordinary hangover.

Deep down, you already know this.

If not, just step back from the media churn and noise and consider common sense, tanking GDP, murdered earnings forecasts and objectively verifiable debt and stimulus levels—i.e. market facts.

If you look at market facts, no crystal balls or nervous iPhone updates on the S&P’s hourly performance are needed.

Fortunately, Signals Matter deals with market facts, signals and data, not bull or bear agenda’s and sexy projections.

We prepare your portfolios so you are not having to constantly check the market’s daily and nauseating price swings.

In short, we tell it to you straight, and then confirm what we recommend with math and market facts, not hope or gloom.

And let me say this as bluntly as possible: These markets are heading down, not up.

The media’s obsession with the daily price action in “dip-buying” stocks is largely irrelevant, as trivial (and absurd) as focusing on the dessert options on the Titanic’s dinner menu rather than the debt iceberg floating off its bow.

And this iceberg, which has only been made more lethal by COVID-19 and the global (debatable) shut-down which followed, is something we’ve been signaling for months and months.

But in case you think this too is only an opinion or “market predicting hocus pokus,” let’s do what we always do at Signals Matter and support this straight-talk with facts and perspective so that you are not left without a lifeboat as the sinking continues.

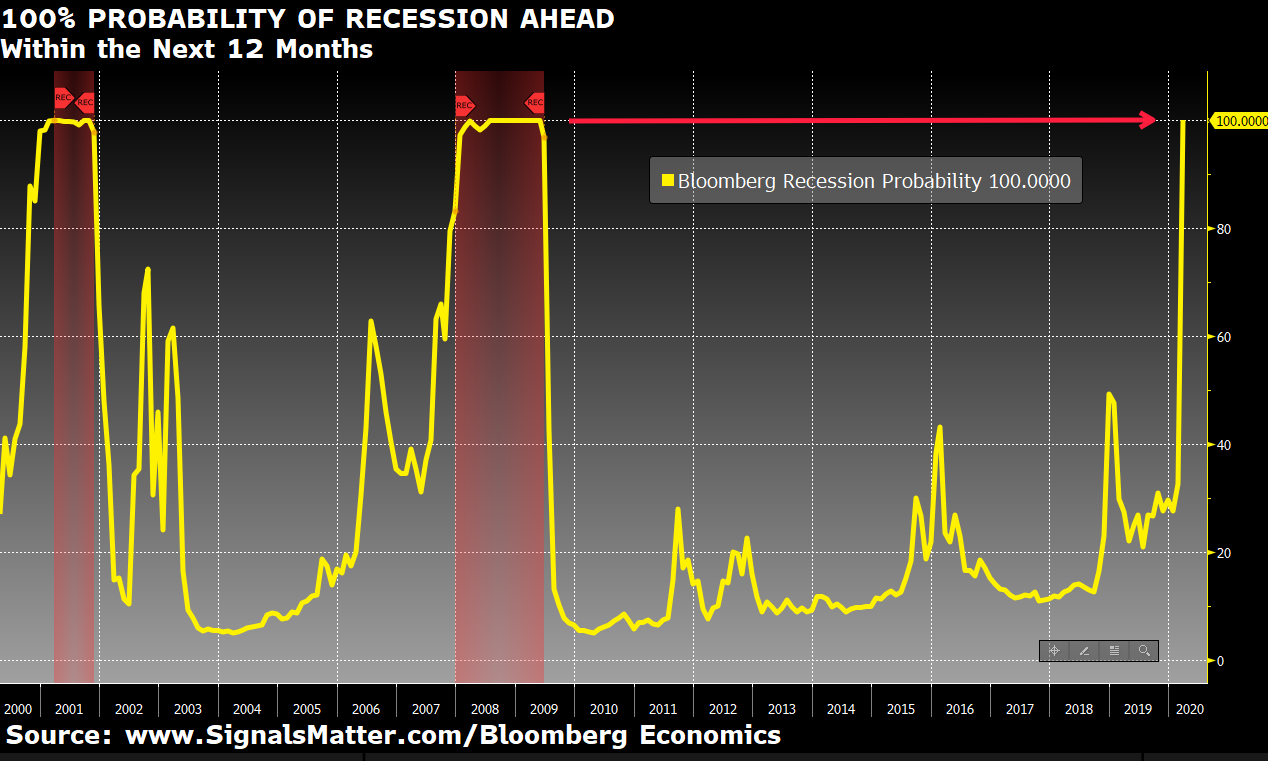

Bloomberg Recession Probability Hits 100%

Bloomberg Economics, for example, just raised the probability of a recession in the next 12-months to 100%, the highest reading in its history of probability forecasting.

Taking recent market pullbacks and the fast-deteriorating labor markets into account, Bloomberg projects that the U.S. economy will contract by as much as 9%-14% in this Quarter alone.

Folks: That’s a huge contraction ahead, and no time to be buying American Airlines on a one-day “dip.” In other words, we’re nowhere close to a bottom.

In fact, if airline and other balance-sheet-crippled stocks like Carnival do indeed rise to new highs in the backdrop of a 9-14% economic contraction, then even the most fervent bulls would have to confess that our markets are no longer markets at all, but merely the monster project of a mad Doctor Fed and his laboratory of endless stimulus.

Rising stocks in a future of tanking GDP and rising defaults would mean that everything we ever learned or knew about natural supply and demand, capitalism, EPS metrics, debt cycles or free markets is entirely gone, a tragedy whose longer-term implications far outweigh any short-term joy from seeing stocks rise like some Fed-Frankenstein creation with no vital signs other than a QE heartbeat and debt-backed blood stream.

But in case you think recessions have been outlawed or that double-digit growth losses are nothing to temper your bullish spirit, let’s look at some more stubborn market facts…

Labor is Getting Crushed

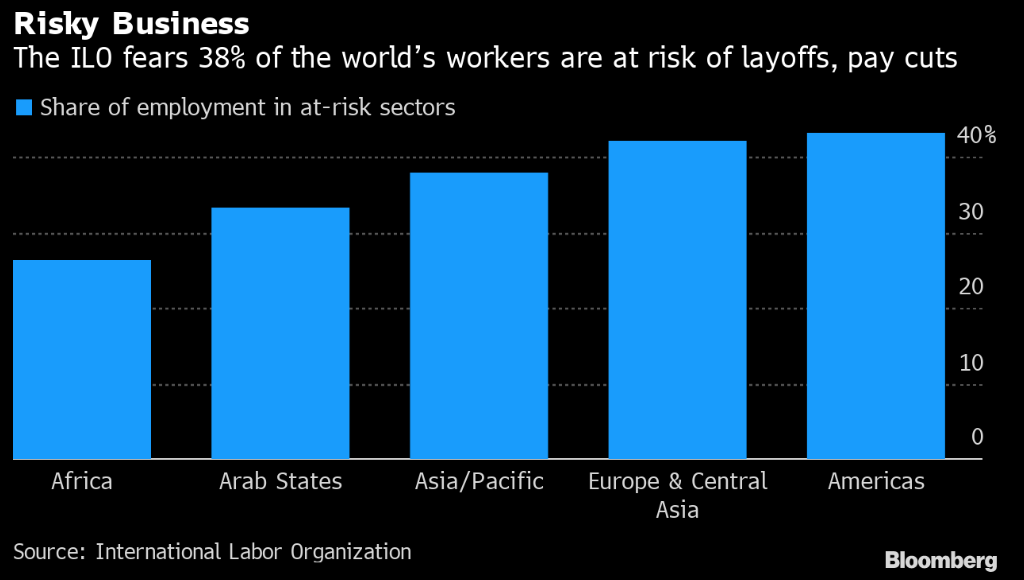

The International Labor Organization (ILO) reported recently that more than 1 billion workers are at high risk of a pay cut or losing their job. That’s 38% of the global workforce – completely unprecedented.

If the ILO is even half-right in its forecasting, how can anyone expect a return to February’s market highs once “normalcy” returns?

Even if the virus ended tomorrow, and everyone was back to “full employment,” earnings don’t just rise in an afternoon, and the tissue damage done to nearly every market sector will take months, not hours, to recover.

And There’s More…

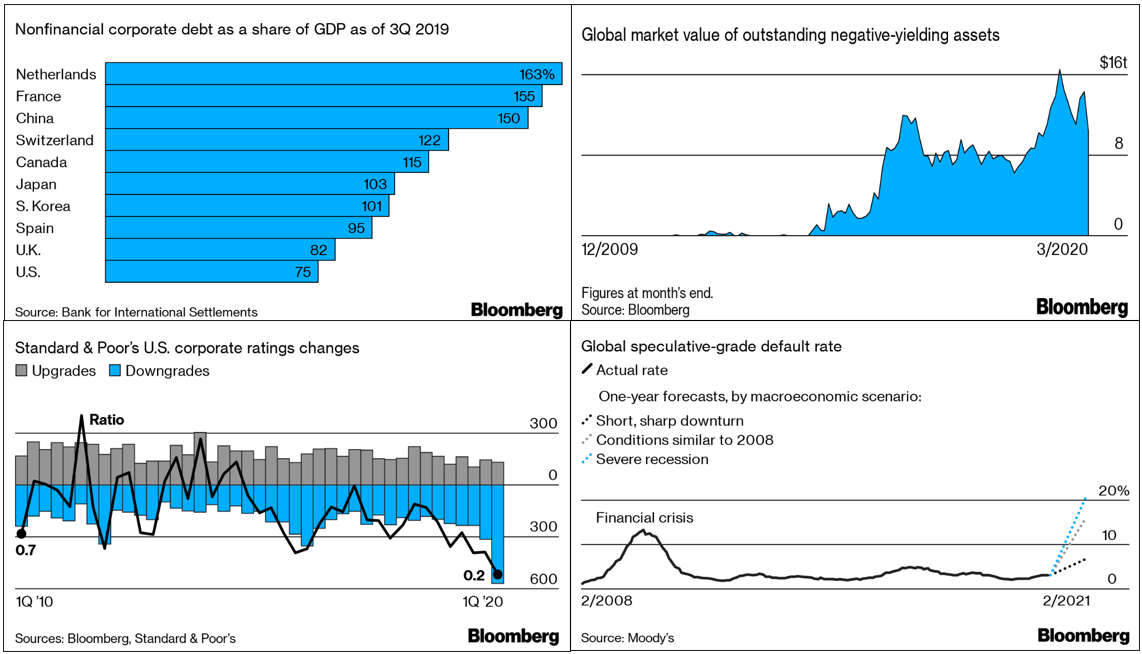

Have a look at this medley of Bloomberg charts and market facts below.

Upper-Left. Corporations globally have been piling on debt since 2008, thanks to perpetually-low interest rates. Thus, they’ve been leveraging GDP to unsustainable levels.

But GDP, remember, is about to plunge, which will lessen the denominator and take these debt to GDP percentages even higher.

Of course, some could argue that debt to GDP doesn’t matter anyway, as the Fed can just print away all debt concerns.

If you actually believe this is a viable and long-term solution as opposed to a short-term headline fantasy, just pause to read our MMT analysis here.

Lower Left. Given the foregoing, it should also come as no surprise that the credit ratings on U.S. companies are being slashed, as those debt-partying CEO’s who have been playing musical chairs with your bond investments are now discovering what happens when the music stops and the chairs are gone…

Lower Right. And if you want to see what a debt party with no chairs or music looks like, just take a look at the default rate projections for US junk bonds.

As I predicted in a seaside video months back, those junk bonds are tanking with Titanic panache, as expected.

Upper-Right. Finally, the number of negative yielding bonds are now reaching record highs, which means a record number of suckered credit holders are literally paying to lose money.

It’s Time to Act

There’s time for debating, time for bulls, time for bears and time for fancy market lingo and grandstanding one’s market savvy with sexy references to one’s favorite headline, stock or pundit.

But then there’s just time to act.

It’s time to act, folks. Everyone, after all, has a right to their own market opinions, but not their own market facts.

The macros are telling you to heed these market facts. In fact, they are screaming.

It’s time to heed the message and market facts, accept the mathematical severity of it all and to manage your portfolio actively, safely and accordingly.

That’s what we do for our Subscribers.

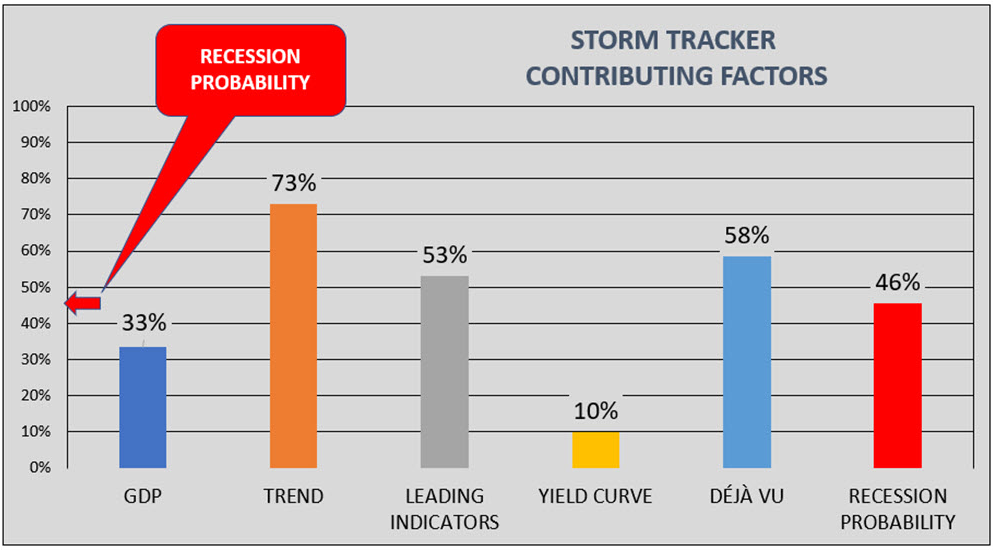

Each week, our updated Storm Tracker displays the macro market facts and breaks down recession probabilities data-point by data-point so that YOU can understand the components…and know what’s ahead without needing a translator to sift through the daily media noise.

What’s Storm Tracker? Storm Tracker is our own industry-leading recession indicator that parses GDP, trend, leading indicators, yield curves and our proprietary timing indicator, Déjà Vu, published each week For Subscribers Only.

If you want to know more about how it works, just have a free look. Download Storm Tracker Here and start protecting your portfolio now.

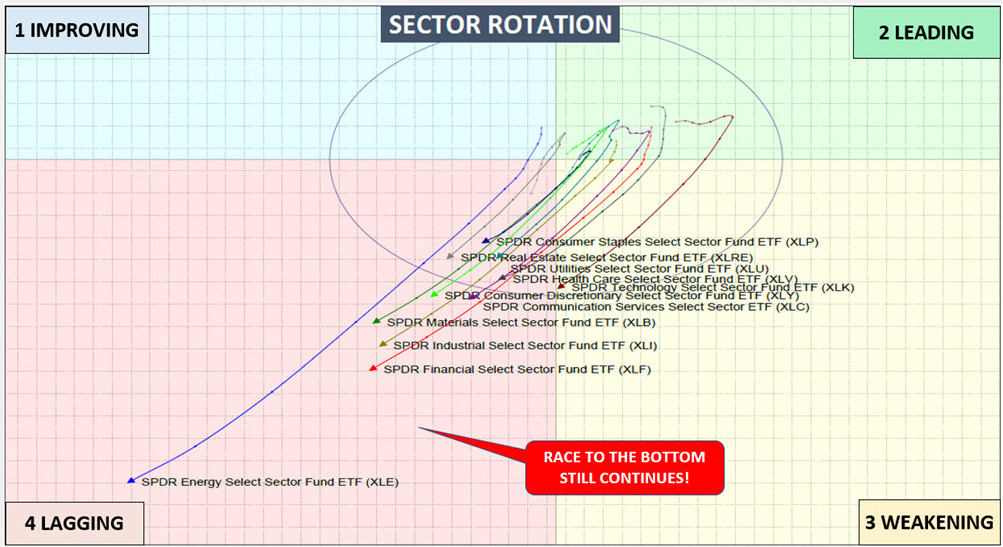

Each week, we also plot easy-to-understand Sector Rotation Charts so that YOU can see what’s coming and take action before this downturn seriously hits your portfolio.

Our Subscribers, for example, saw this downturn (as well as the December 2018 hic-up) coming, because WE saw it coming.

We graphed it, commented upon it, drew conclusions from it and then made the critical recommendations to get ourselves (and them) out of the pathway of these very destructive storms and icebergs.

As for these sector signals, take a look for yourselves below.

Do these tanking sector moves look “optimistic” to you? Do they look like an “opinion” to you? A “bearish bias”? Or do they just look like market facts?

Again, it’s amazing what blunt data and common sense can tell you…

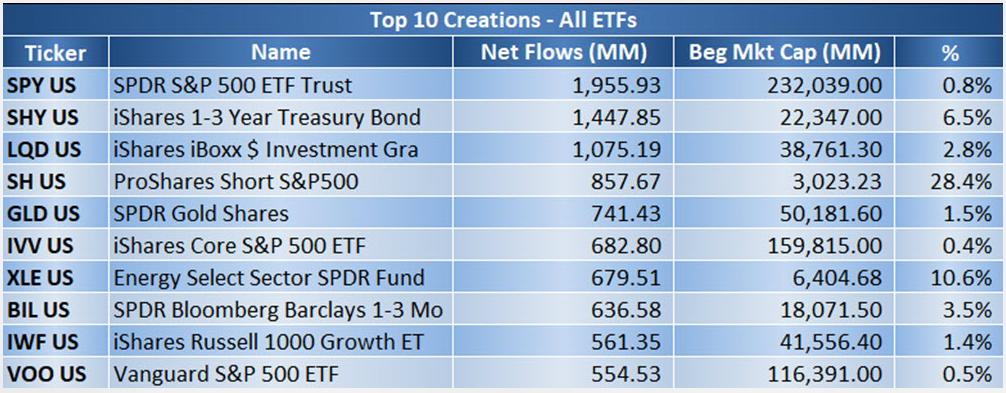

Furthermore, we’ve recently added a section on U.S. ETF Sector Flows for our subscribers, which informs them on what the crowd is doing and where the money is flowing. This matters-a lot.

In the sample table below, funds are flowing into short S&P 500 ETFs (i.e. those betting against the markets) and into oil ETF’s now that producer countries get it – they have to cut supply to get oil prices up.

In short: The smart money is beginning to position itself in oil.

How do we know? Well, it’s not because of a gut feel or bullish sentiment. We just see it in the flows. Tracking flows tells us where the puck is headed, not where it has been.

Helpful? You betcha.

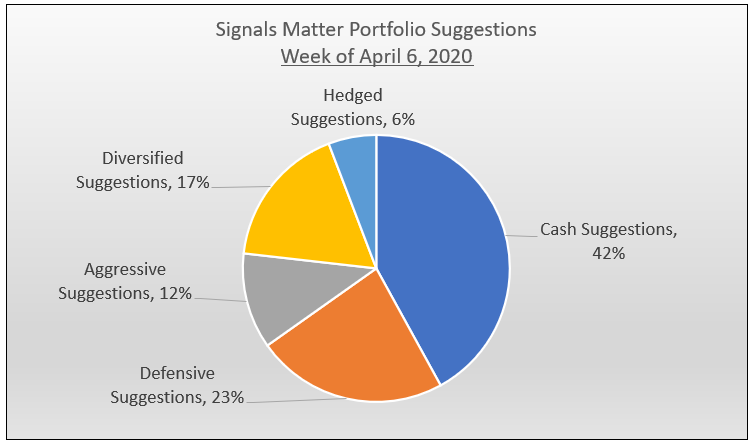

With all of this information and more at our finger tips, we ultimately design a portfolio of investment suggestions, based upon macroeconomics, math and market facts and signals that will keep you safe, diversified and risk aware in all market conditions.

(Suggestions are categorized but disguised as well to protect our Subscribers).

Don’t believe us? We’ve been doing this collectively for over 50 years for clients managing small IRA’s to literally billions in sexy hedge fund stuff.

In short: We get it.

Which means our subscribers do too.

Click here and read what our Subscribers are saying. We take enormous pride here at Signals Matter for the feedback provided and the blunt, safe signals we offer.

Here are some samples…of well over hundreds already posted…

Latif H. says:

“Awesome! I think I am informed only because I read your analysis every time, I have a chance.”

Wood R. says:

“Beautiful…. Just Beautiful…. thank you for the superior Modern update of true modern economics!”

Bob M. says:

“I devour your emails when they come in. I will be following your direction like a hawk. Keep it up!”

Peter K. says:

“I follow your comments faithfully. Your comments are insightful above all honest.”

Tom O. says:

“The clarity of all the explanations, especially the connection between money printing, bond prices and interest rates are far better than anything I have ever received from paid subscriptions.”

Larry F. says:

“Thank you for Report, one of the all too few true reality windows. it is at the top of my reading list. I don’t think it possible to overestimate its value.”

Giuseppe S. says:

“There is so much to learn from your weekly articles and the Monthly Charts that I study every day. Full time job. Thank You.”

L. Arnwine says:

“Great information BACKED by Factual Data.”

L. F. Silbaugh says:

“As usual, one of the finest brass-tack market commentaries on the internet. The “what” and the “when”, these articles are really a miniature trading/investment library. Thank you.”

Richard P. says:

“You obviously have a pulse on the market based upon indicators that appear to be spot on.”

Subscribe Now

The macro outlook is objectively horrible. We take subjectivity and hype out of the picture and report what is real, not what is favored by the media, DC or the click-bait fear and hope sellers out there in droves.

The recession is here. Get prepared. Sign Up Now.

At the very least, you’ll know what to ask your advisor. Do you and your advisor have a plan to exit or switch up your portfolio when the markets go down 10%, then 20%, then 30%, then 40%, then 50%, then….?

Will you know when to get back in and buy at bottoms, where the real money is made in the markets?

That’s our hope for you…but as we say, hope is not an investment plan, and if you want guidance through this market fog, we’ll do our best to give you a clear light, and clear data.

Come on aboard and start planning now.

Sure, markets will rise and surge on headlines and stimulus. And if the Fed starts buying stocks with printed money, well, then…wow, we’ll be in a whole new era of the absurd and will thus have to face those markets facts and adjust accordingly.

For now, however, and based upon the market facts before us, the long-term implications for these markets and portfolios (short of an all-out Fed monetization of the entire game) is objectively characterized by far more risk than reward ahead.

Again, just look at the market facts, not the face shots, promises or hype.

Your Guides, Matt & Tom

Matt/Tom, read this:

https://www.zerohedge.com/markets/just-how-cheap-market-here-shocking-answer

Thanks Alfonso, excellent link for others to consider, and fully supports our own data and view that we are not even close to a market bottom or “bargain sale” in equities right now. There’s more sinking to come. Again, this is not because we are perma-bearish; we just do the math, and the link you provided shares the same common sense valuation metrics (PE, EPS, Market-Cap to GDP data etc) used not only by market veterans like Gerry Minack, but also former Morgan Stanley strategists, or even analysts at Goldman Sachs, and Credit Suisse, two names not otherwise widely known for blunt speak realism. In short, the facts and data are just undeniable, and given the massive over-valuation in equities pre-COV, even the bloodletting seen in March has not made stocks “cheap” by any metric. Again, we need to see much lower lows before we start buying the bottoms rather than just the dips…Again, many thanks for sharing this link.