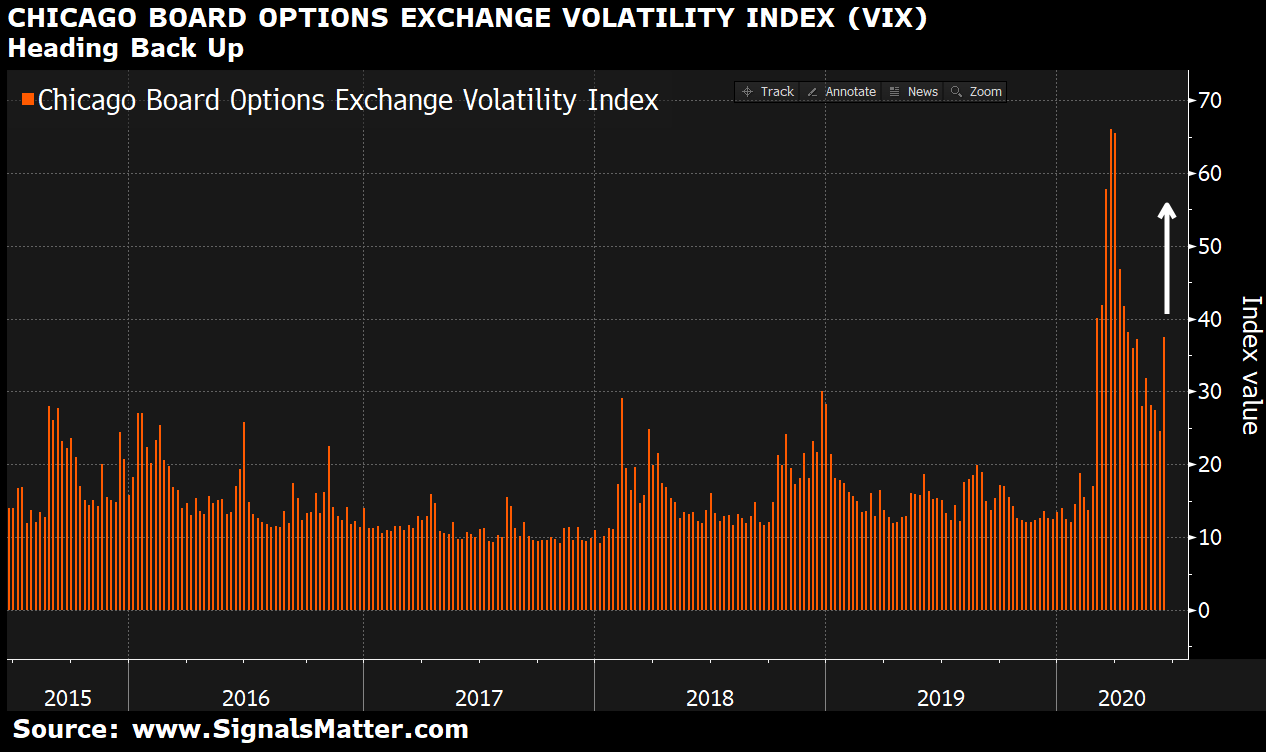

Market volatility, as we‘ve anticipated time and time again, has returned to US markets as the S&P, Dow and NASDAQ each lost more than 5% in a single-day on Thursday, with the S&P recording its steepest, one-session loss (5.89%) since March 16.

Needless to say, the Ken and Barbie media bobbleheads are attributing most of this to renewed “Coronavirus fears,” as if Covid-19 were the only reason/blame for otherwise grotesquely over-indebted, over-valued and over-stimulated markets.

Our readers know by now that the real threats to these markets and to your portfolio lie elsewhere, hiding behind the public curtain for years, not just weeks, days or months.

As we’ve repeated many times, these markets were already vulnerably sick long before the virus hit, and the recent market volatility merely confirms this sad reality.

That said, we’ve never denied the temporary power of the Fed to lift an otherwise crippled market to its shaky feet, as the post-March rally pushed 90% of the S&P stocks above their 50-day moving averages in a 40% climb, covering up its embarrassing March lows.

But for so many reasons, we’ve also reminded investors to not fully fight, nor trust the Fed’s powers, as they, like any doped athlete, will face a day or reckoning. The lows seen in March are by no means the lowest lows these markets will face going forward, nor were they any lasting to solution to market volatility.

Again, we have explained and anticipated the reasons for this realistic outlook, as well as current market volatility, on a near-weekly basis, and will not fully unpack those myriad details here.

The Bond Market is the Thing

What is worth repeating, however, and never stop repeating, is the singular insight that all veteran investors and professional portfolio managers know and understand (but rarely confess), namely: If you want to understand stock market volatility and risk, look straight to bond market for the answers.

Folks, the blunt fact is that stocks in the last weeks, as well as for the last decade+, have been rising on cheap debt (i.e. low rates) while corporations whistle past a graveyard of broken balance sheets, taking on grotesque levels of debt to purchase back their own shares and issue dividends, rather than investing productively.

Such debt-based “performance” is not only an embarrassment to common sense, it’s also an insult to sound corporate governance.

Take, by example, the embarrassing seduction we’ve seen among investors buying Hertz stock while in bankruptcy, a classic suckers-trap now playing out with predictably bad results.

For years and years, executive anti-heroes have been living in high cotton by boosting their share-price-based salaries through excessive borrowing to raise stock valuations artificially.

This otherwise fraudulent, yet SEC-sanctioned “trick,” has been encouraged by a complicit Fed, artificially depressing interest rates and encouraging more debt to totally distort risk transparency and honest price discovery, something honest historians and portfolio managers will one day scornfully admonish.

For now, however, such blunt condemnation is entirely absent from the happy-idiot media and consensus-driven, sell-side hype that masquerades for financial reporting at Reuters et al.

As to signals from the bond market, it goes without saying that with debt now driving everything in the US and around the globe, there will be even more (!) debt to come.

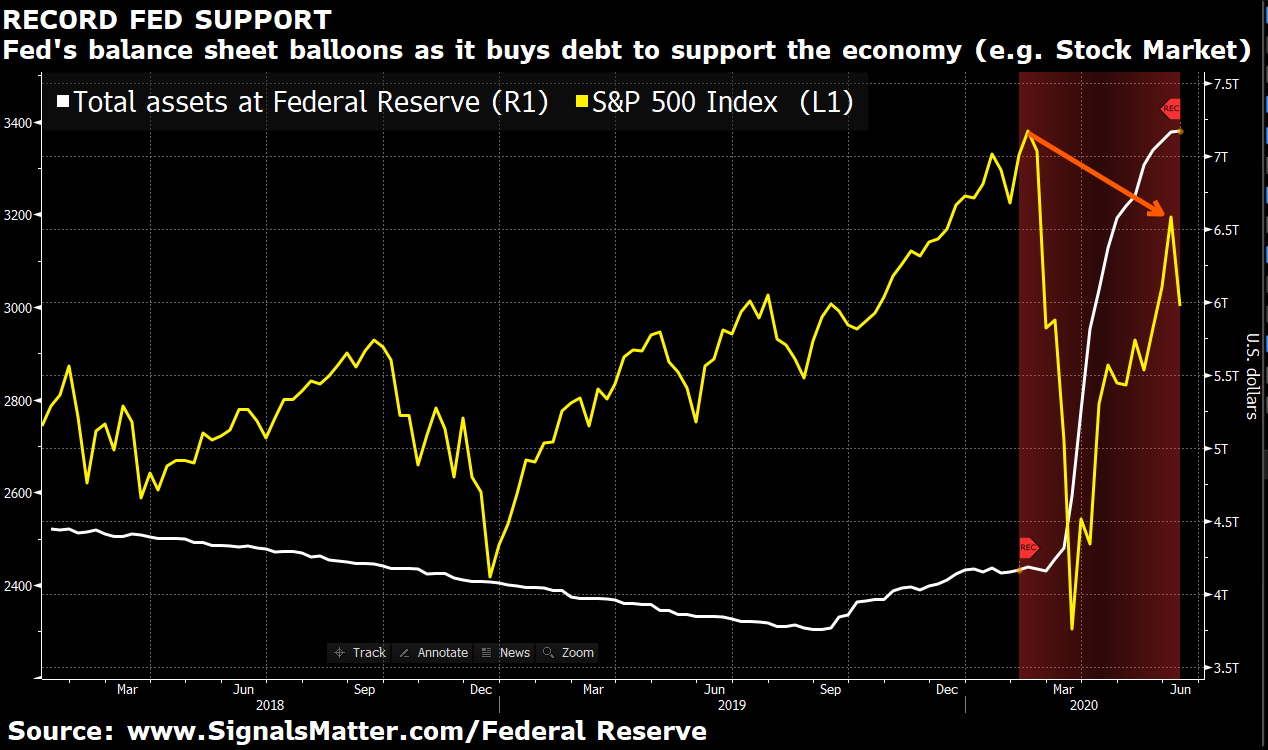

Take a look at the Fed’s own balance sheet below for a reality check in where we are and where we’re heading.

Namely, we are already officially in recession; Fed assets have nearly doubled; yet stocks are achieving lower highs. The “punch” is getting weaker in the Fed punch bowl…

Will More Debt Save a Debt Problem?

Debt, as we know, can temporarily “save” broken markets, and frankly, the tidal wave of debt allegedly justified by COVID-19 has been the perfect pretext to recently “save” the markets in May with, alas, more debt and fiat money.

Literally trillions in new Treasury bonds were issued to keep a locked-down economy on a national respirator, measures made farcical by the recent public riots. So much for social distancing.

But given that actual income, or GDP, is now a distant, fond memory of a now-dead capitalist past, we can assure you that more Treasuries (i.e. debt) will once again be issued in the coming months, as the Fed and other policymakers, in fact, have no choice but to survive on more debt rather than income.

As Bill Murray would say: “That’s a fact, Jack!”

The Next Bond Wave—as Simple as A then B then C

But here’s the rub: Piling more Treasury bonds (i.e. debt) into the market creates a supply wave; more bond supply means lower bond prices; lower bond prices mean higher bond yields; and higher bond yields means higher interest rates.

The buck stops here, literally.

Higher and higher interest rates, as I’ve warned over and over, are what kills a debt-driven stock market.

COVID may be complicit, but it’s not the main driver of the market volatility we are now experiencing.

Market volatility like we saw yesterday is driven by debt, a fearful Fed and the fear that the cost of that debt is about to get painfully-high rather than “free.”

Of course, when one tacks on a tanking GDP scenario with new waves of US “IOU’s” (about to be shot from another DC fire hose), forecasting the long-term trajectory of our now broken securities market does not require a crystal ball or a bearish bias.

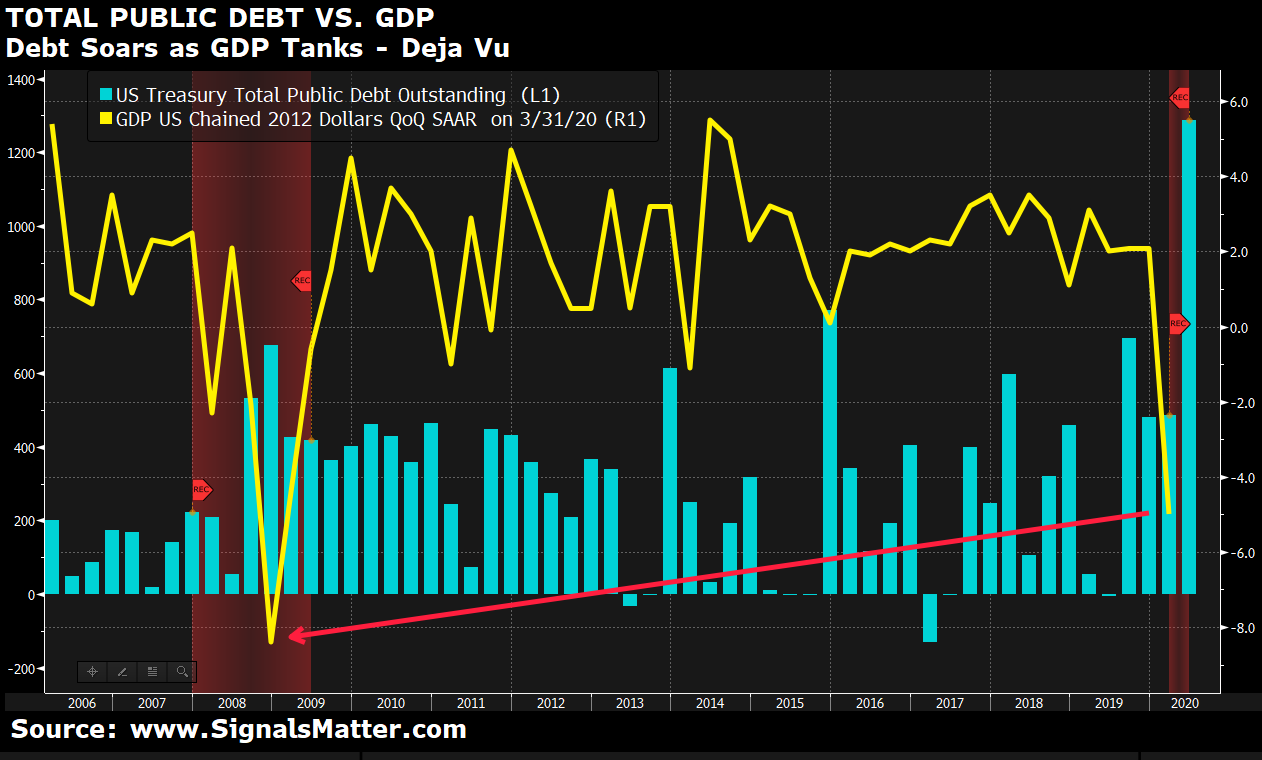

See for yourself. GDP (the yellow line) is tanking as it did in 2008, only this time it will fall far more this Q2 2020, to -34.4% Q/Q according to current Bloomberg Contributor forecasting.

That’s literally off our chart.

Meanwhile, US Treasury debt outstanding has already well-surpassed the debt build of 2008.

In other words, debt has already doubled from 2008, with GDP about to fall much, much further than in 2008. Not a pretty chart. Not a pretty picture for what’s ahead. Still want to buy Hertz stock?

Instead, all that is needed is the ability to track debt levels in general and credit markets in particular, a simple trick that almost no one teaches, to themselves or to their financial clients.

Informed Rather than Fantasy Investing

At Signals Matter, however, we believe informed clients make for the best clients. We don’t peddle hope, we offer the blunt.

That’s why our portfolio solution, explained in almost painful detail here, is worth getting your arms around, now rather than later, as the market volatility we see this week is just a taste of more to come.

Again, this is not fear-selling or doom-‘n-gloom preaching; it’s math, history and common sense bond tracking.

And yes, the Fed still has some tricks up its sleeve, as I’ve argued recently.

Powell can print more money (which is why owning gold as currency insurance is so critical); he can put a cap on rates (in the convenient name of a pandemic emergency), but in fact, all this horse-crap policy is due entirely to the Fed’s own decade+ run of money printing.

We are not here to smugly time the imminent expiration date of the Fed’s last, desperate and arrogant attempts to assume it has more power than natural market forces.

Powell is like a surfer paddling out to the North Shore of Oahu without a leash or the ability to swim.

A day of brutal reckoning awaits. The markets love to punish human-all-too-human Fed hubris of this magnitude.

Until that unknowable day comes, however, the best thing informed investors can do is manage reality with open eyes, which means managing risk far more critically than chasing fake market tops (or crazy stocks like Hertz).

Informed investors build portfolios for the long game, slow and steadily winning the race while watching top-chasers, already brutalized by 2020 market volatility, see all their meager (and bumpy) gains for the year erased in a single trading day.

But again: you ain’t seen nothing yet when it comes to market volatility.

Sure, there will be more dips, and more dips buying those dips. There will be more “juiced” rallies as well.

We sleep soundly knowing how this game will inevitably end, and knowing as well what signals and sectors make the most sense in today’s deformed, market backdrop.

Toward that end, we constantly adjust our investments and investment portfolios to the risks at hand. Years upon years of market analysis has taught us how to build portfolios for all weather conditions, and especially the conditions dead ahead.

The waves are rising. Market volatility is everywhere. If you’re looking for a safe ship to plow through those waves, then simply join us HERE. We’ll see you on the other side.

Sincerely,

Matt & Tom