For Tom and I, the market’s future trend towards yet another “uh-oh” moment is clear, but the date of its fall south is, of course, impossible to perfectly time.

Such timing uncertainty is clear even now, despite every major macro indicator of a recession fighting against an “accommodated” stock market that currently defies the laws of gravity as well as earnings, productivity and growth—not to mention social unrest, a global health pandemic and historical distrust in just about everything.

No one, Tom and I included, likes market timers or folks who smugly pretend to know the precise timing of the market future.

Most financial advisors, for example, know that markets are up 70% of the time; hence they stick to a positive/consensus meme, with occasional reminders that everything will “recover.”

For reasons explained in greater depth elsewhere, we simply don’t think like most advisors.

Inevitable vs. Imminent

As Grant Williams so succinctly put, the stock market’s end-game, though inevitably a bad one, doesn’t have a start date posted on YouTube.

In short, there’s a great difference, Williams noted, “between the inevitable and the imminent.”

The Fed in particular, and central banks in general, will not let markets go down without a fight, as we are seeing now in historical fashion, and thus trying to time the “imminence” of the Fed’s expiration date (and the markets next and ultimate dive south) is a fool’s errand.

Unlimited QE, yield-curve management and direct bond purchases from the Fed have lifted an otherwise dead market with Lazarus-like effect from its March lows, as we enter the Great Lockdown Recession of 2020.

And the Fed still has other tricks up its sleeve as well to boost a sick market, such as caping Treasury yields, making direct stock purchases and the continued creation of money out of nothing going forward.

Each of these measures (i.e. tricks) can and will buy the stock markets more time and support as the Main Streets of the world become increasingly isolated, stressed and in decline.

Recently, many of those Main Streets are/were rioting (due to more than just racial tensions), from Seattle to Paris. I’ve seen it with my own eyes, and saw this from-the-bottom-up rage as “inevitable” over a year ago, as the following video link, HERE, confirms.

Again, precision was not my aim—just the bigger, inevitable picture: the middle class is financially stressed to its limit. Something was bound to give way.

In sum, timing the market future is impossible given the reckless, yet currently effective forces of an openly rigged financial system and all-powerful (for now) central bank.

Knowing the Outcome Rather than the Date

But there is something to be said about knowing the outcome even if one can’t predict the date of its occurrence.

Noah, for example, built his Ark before the rain, and it mattered not whether that rain came on Monday or Friday.

All that mattered was that his boat was ready before the storm came.

At Signals Matter, we too want to prepare your portfolios before the rain hits, and to be blunt: That rain ahead is as easy to see coming as an off-shore storm cloud.

Don’t believe me? I get it.

It’s hard to imagine rain when the sun has recently been shining on a totally doped stock market where stocks like Hertz can go up despite a bankruptcy filing or stocks like Apple can surge despite its board giving up on earnings guidance for the simple reason that there’s no real earnings ahead to “guide.”

Right now, markets don’t mind paying $1,000 dollars for a Snickers bar so long as there’s a greater fool who’ll buy it tomorrow for $1,200.

And how can we blame such trades; based on recent market surges, the fools are indeed out in full force, chasing tops and over-paying for horse-crap stock picks. This trend can continue for long periods, or come to a crashing halt.

No one can say.

Back to the Future

But let’s get back to the dismal, yet so hard-to-accept market future of which I speak.

To prove that the inevitable is actually easier to see coming than a tarot card expert, let me take you back just over a year to the end of 2018 and show you.

November 2018, Arlington Cemetery—Calling Out the Market Future

While visiting Arlington Cemetery in late 2018, I spoke about wars, rising deficits, tanking interest rates and sky-rocketing Fed money printing to come at a time when the Fed was tightening not easing and raising rather than lowering rates.

I warned that such policies would not last.

I also forecasted an inevitable recession in the next 12-18 months preceded by a rising rate “uh-oh” moment that would quickly send stocks lower, not higher.

Not surprisingly, such inevitable events then came to pass—as easy to see as a cavity to a dentist.

To confirm, just watch the video, and then follow the market’s path since. To make it simple, I’ve included that video right here:

Was I lucky? Psychic? A market timer? Did I guess at the market future?

Nope. I just followed two basic signals: Debt and GDP.

Debt & GDP—Fortune Tellers of the Market Future

At the time I recorded that November video, I warned that the US was quantifiably spending more than it was earning. This, I said, would inevitably end badly sometime, I surmised, within the next 12-18 months.

In 2018, I knew that our annual deficit spend was around $1T.

Today, year to date, that number is 3X’s as high, obviously attributed to COVID, but in my mind, COVID was just the pretext for a massive Wall Street bailout that was otherwise inevitable, as I warned in 2018.

In short, COVID literally saved Wall Street. Just look at the recent market surge in the backdrop of horrific fundamentals. But this was in fact easy to see coming.

Again, simply watch the video.

Already, debt levels in 2018 were irrationally high at $21 trillion (minute 5:10). And the Fed’s “secret” to surviving such debt levels was already obvious, namely, the Fed knew that absurd, record-high debt is sustainable only when the cost of that debt is low.

Thus, if rates, which are naturally determined by the bond market (minute 7:30), ever rose a nudge higher, Wall Street would tank and un-natural Fed support would thus follow.

Exactly a month later, by Christmas Eve, Wall Street then tanked…

Again, I got lucky on the “imminent” part, but the inevitability of that moment was not hard to see coming.

This was because the Treasury Department was (in 2018) increasing the supply of Treasury bonds (i.e. adding more debt), which would mathematically (not psychically) send bond prices lower and hence bond yields and rates higher.

Those rising rates (i.e. the cost of debt) would send the debt-soaked market into a tantrum weeks later.

I also warned in November of 2018 (minutes 7:10 and 7:30) that once this tantrum happened, the Fed would predictably step in yet again to lower rather than raise rates, which they, of course, did in early 2019, sending markets back up, once again, from a near-death in late 2018.

Furthermore, I observed that this cycle of Fed support would continue, as the Fed simply had (and has) no choice but to support an economy and market that produces no GDP (i.e. income), largely because most of our CEO’s had moved U.S. production, labor and supply to China rather than Texas or Michigan. (minutes 7:50, 8:50).

Frankly, shame on the Tim Cook’s of the US executive class. Really. Shame on them.

In short, a country that produces scant income has no choice but to resort to “faking it,” i.e. incurring more debt to solve a debt problem…This is not a market-timing trick, it’s just the common sense acceptance of such a tragic reality.

“It’s Gonna Be a Disaster”

Then, at minute 9:45, I warned that within 18 months the markets would hit another wall, as this mismatch between tanking GDP (i.e. national “income”) and growing debt obligations would force yet another “Uh-oh” trigger, and hence yet another pretext for more money printing.

Well, 15 months later, COVID came along in early 2020 and this openly obvious debt fragility revealed its naked self as America literally fell to its knees, along with its Fed-supported stock market.

And right on cue, the Fed (as I said they would at minutes 11:10 and 12:40) once again went wild with the money printers and the Treasury bonds (i.e. more debt to solve a debt crisis).

And right on cue, the market, once again, rallied despite having no real air in its lungs.

Which is where we are today—a respirator-driven stock market rally, one ironically saved by a respiratory pandemic and the emergency stimulus that followed.

As I also said at minute 14:00, the U.S. would then have no choice but to incur more debt, issue more bonds, and print more money to support (“monetize”/buy) those same and other bonds—thereby can-kicking (minute 14:40) rather than resolving our national and embarrassing mismatch (i.e. nightmare) between high debt and meager income/GDP.

This inevitable/predictable cycle, I said at minute 11:30, was mathematical, not psychic or political (minute 16:00). And the financial media, I noted at minute 19:35, would, as usual, be happy-idiot clueless as to debt risks.

I concluded the November 2018 video by warning of a rate-driven recession ahead and a can-kicking delay, or “solution” brought on by more money printing (now off the charts) and low to zero interest rates, which, again, is precisely where we are today.

“It’s gonna be a disaster,” I concluded at minute 20:00.

What Disaster?

But with the NASDAQ reaching for new highs and the money printers now in over-drive, many investors might rightly argue, “Matt, what disaster? The Fed just saved us yet again!”

Again, I’m no market timer, and I’m not even that gloomy by nature.

But facts are stubborn things, and Tom and I do know (and track) debt, rates, markets and the Fed.

So, let me/us make another “forecast” today: That same rinse-and-repeat cycle of “debt, disaster and print” we’ve seen above is still in play today, and once again, it will inevitably end badly.

Why so certain?

Because the Fed can’t fake the forgoing cycle-of-the-absurd forever. At some inevitable point, more debt no longer cures a debt disease

For every dollar the Fed prints and every dollar of debt we add to our deficit, the casino that is now the stock market gets less real and more risk-saturated with each passing day.

Thus, rather than precisely timing the precise dates of market future risk ahead, informed investors must simply brace for the inevitable.

Again, the inevitable is not the same as imminent, but all of us can at least prepare for the inevitable by taking common-sense measures in currency hedges like gold and realistic portfolio preparation like the kind we have outlined for you Signals Matter.

Does this mean we will pick every top and bottom with precision? That we will always win, beat the markets, and time the market future flawlessly?

Of course not.

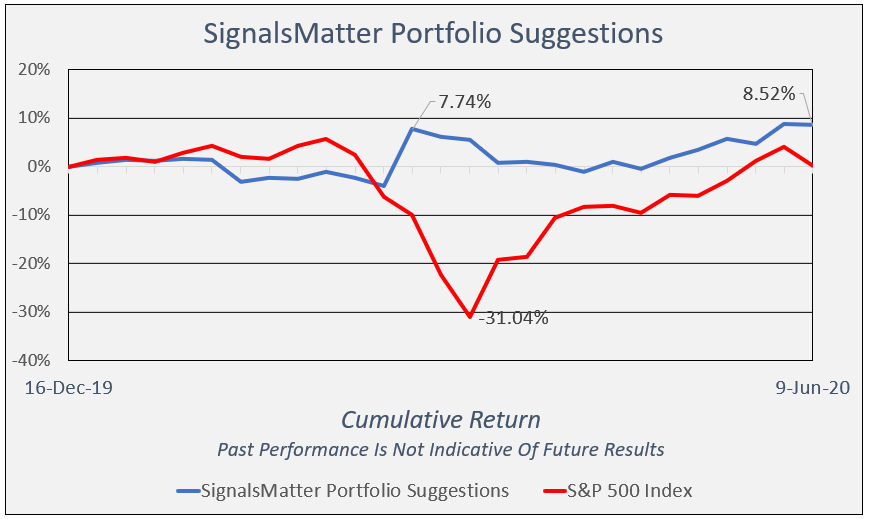

For now, however, we are beating the markets with far less volatility and keeping our eyes peeled on risk so that we avoid the big drops and ride the Fed waves with cautious realism rather than a gambler’s enthusiasm. The proof is in our pudding. We completely avoided the March 2020 market crash.

In sum, if you’d like to build your boat before rather than after the rain, then join us here and we’ll show you how, or just do it for you.

We’ll see you on the other side, with warm coffee rather than more Fed party tricks and casino chips.

Sincerely, Matt & Tom

The market doesn’t make any sense anymore. Economy is shot and market going through the Roof!!! Hang onto your shorts the 1929 crash will be here soon. Thanks to Trump and the GOP for spending way to much money. All a bunch of crooks who need to be locked up!!!! Before they kill us all!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

Hi Peter, Yes the market makes no sense, and hasn’t for quite some time. We certainly share your dismay. Truly, we do. I’ve been baffled by those so-called “experts” for quite some time, as my reports on the “anti-heroes” and “how capitalism died” etc make all too clear. For now, the crazy continues, but we are committed to offering as much transparent sanity as we can here at SM. Best, Matt