Below we unpack the implications behind central bank gold purchases (rising), negative real yields (falling) and Stanley Fischer’s Fed-speak (cringing).

What Bankers Do, Rather Than Say

By now, the open farce as to “central bank transparency” has been made abundantly clear; looking for plain-speak honesty in such circles is akin to looking for a dope free cyclist on the Armstrong team.

Thus, rather than just follow what central bankers say, it’s often far wiser to watch what they do.

Central Bank Gold Purchases

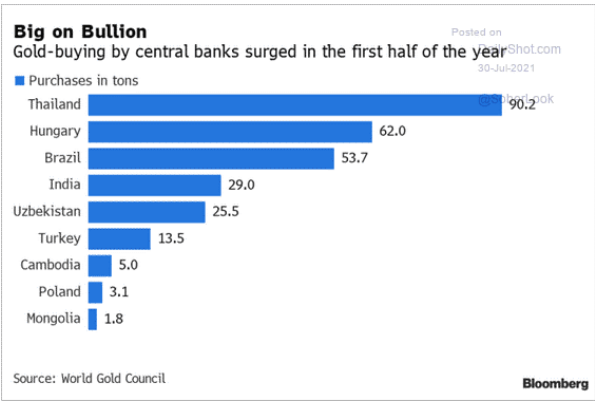

Toward this end, it’s worth noting that central banks have been buying gold lately, and at significant levels.

In the first half of 2021, global gold reserves at the central banks expanded by 333 tons, which is almost 40% above the five-year average.

The big buyers were Thailand, Hungary and Brazil, countries all-too familiar with the pain of importing U.S. inflationary policies and hence thirsty for real stores of value outside the increasingly surreal U.S. dollar.

The current pace of post-World-War-II central bank gold buying is already set to surpass the previous record set in 2018 (651 tons).

The COVID Excuse/Joke—So Convenient

Needless to say, the growing flight to gold by central bankers is and will be attributed to growing concerns about the latest COVID variant and its economic threat to financial security.

Rather than enter the rabbit hole of the COVID policy debate (fiasco—SEE HERE) and its impact on markets, jobs, psychology, science, math, political courage or basic honesty, I’ll simply remind readers that the U.S. dollar’s threat to global financial security existed long before COVID arrived, as pre-COVID global debt ($250+T) to GDP ($85T) levels were already more deadly than a virus.

As we’ve indicated elsewhere, there’s no “going back to normal,” as “normal” died long before COVID arrived.

But again, rather than debate the disastrous results of shutdowns, debt expansions, monetary expansions and individual freedoms killed by COVID policy makers (rather than a convenient virus), I’ll avoid that math or those facts.

Besides, and as a now popular joke reminds: “There’s a 99.696% chance you won’t get it.”

Negative Real Rates—No Joke at All

What’s not a joke, however, is the growing (yet unspoken) belief among increasingly nervous central bankers that inflation rates are going to continually outpace interest rates.

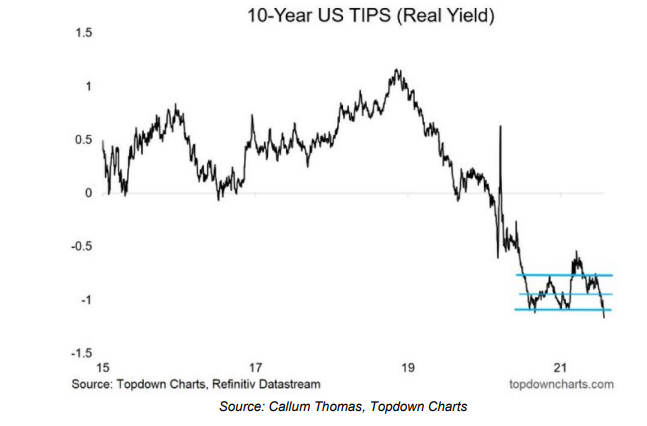

In other words, the trend toward increasingly negative real rates is growing, and as we’ve explained in detail elsewhere, gold (as well as BTC and mining stocks) loves negative real rates.

The evidence of declining real rates is particularly obvious in the U.S., where US 10-Year Real Rates (Real Yields) are breaking new lows:

Looking forward, unless real (i.e., inflation-adjusted) rates rise measurably, gold prices will rise sharply, despite last week’s price hits, which were (manipulations from the bullion banks, plain and simple–themes I will address in more detail in a later report.

For now, we don’t see real rates rising anytime soon. The trend is negative not positive, despite the hit to precious metals of late.

Why are we so confident of this?

Simple Math

First: Inflationary policies (a true gut-punch to Main Street) are the new normal for debt-soaked sovereigns seeking to inflate away their unsustainable debt levels.

Secondly: Those same debt-soaked sovereigns need to keep rates low to meet interest expenses on their unsustainable national IOUs.

Thus, when you combine: A) rising inflation with B) increasingly repressed interest rates, voila: You get inflation rates outpacing interest rates and hence more negative real rates and thus more positive tailwinds for gold, despite what the paper gold tape is showing.

In fact, the level of negative real rates we are seeing since August of 2020 (-1.1) is just the beginning.

Those rates can fall far, far more toward the negative in the backdrop of global economies drowning in debt and commercial banks already “derivatively” neutered by Basel 3 and being prepped for more centralized controls and the well-telegraphed “re-set” toward a central bank digital currency.

In this backdrop, gold will see un-natural headwinds as gold-poor banks crush the price before buying more of the same, but the tailwind north is natural, as is the trend south for real rates.

As a reminder, real rates–after a very real World War II–went as deep as -14%; and real rates after the not-so-real “war on COVID” could fall much further tomorrow.

Investors who ignore this trend are ignoring a massive opportunity in physical precious metals. The “flash crash” in gold is a buyer’s opportunity not a reason to fall back in love with a debased dollar.

The Most Critical Market Force: Debt

Our confidence in growing inflationary trends as well as our disdain for central bankers attempting to describe the same as “transitory” is not a matter of intellectual pride but a simple consequence of common sense and blunt-speak.

The key to this common sense is accepting the historical as well as mathematical importance of one very singular yet powerful force: DEBT.

As we’ve underscored so many times before: Debt matters.

Once the ratio of national debt to national GDP crosses the Rubicon of 100%, economic growth becomes factually impossible.

What The Bankers Say and Do…

Even the not-so-honest central bankers know this.

This may explain why former Fed Vice Chair, Stanley Fischer, himself observed in 2019 that, “it would not take much of a shock to growth…for the debt ratio to balloon and spark concerns about debt sustainability.”

When Stanley Fischer spoke these words in 2019, the US debt to GDP ratio was at 105%. Since then, it has grown to 130%.

In other words, if Fed-heads were worried about a growth “shock” in 2019, they must be downright terrified today.

Stated even more simply, the central bankers are running out of time.

Actions Matter, and Are Predictable

So how can and will the central banks address the growing problem of “debt sustainability” (i.e., the ability to pay their bills/bonds)?

The answer is as obvious as it is both comical and tragic: They’ll create even more fiat money out of thin air. You know, a bit more “accommodation,” “stimulus” and “QE.” This can send zombie markets even higher—until they fall in commensurate failure when the jig is up on faking it.

And toward this end, they’ll buy even more time (as well as dangerous asset bubbles and volatility) by eventually creating even more debt paid for in Central Bank Digital Currency (CBDC)—i.e. more fake “central bank” money. Basel 3 is and was a part of this plan. But it’s a rotten plan overall, as well as a fantasy.

Imagine how much easier all our lives would be if we had a money printer in our basement and the legal right to use it? But dies that sound like financial policy or financial fraud?

Poisons Masquerading as Solutions

As informed investors already know, such solutions are poisons, for expanded monetary policies (from QE to CBDC) simply equal debased currencies and rising, toxic inflation—which, again, favor real stores of value like gold over fake stores of value like mouse-click-created dollars or the new and inevitable CBDC “super solution.”

In March of 2020, when stock markets tanked past the 30% level in the backdrop of rising rates/10-Year yields and rising COVID headlines, the Fed stepped in with a firehose of liquidity (trillions in “unlimited QE” and massively repressed rates) to triage the stock bleeding.

More “Stimulus” Ahead

Over a year later, with frothy markets now artificially “recovered” yet again thanks to itchy trigger fingers at the central bank money printers, the trillion-dollar question is: Will the Fed save this latest crop of top-chasing investors from yet another deflationary fall in the current market bubble?

Or will they “taper” and send markets to the floor of history as rising rates kill debt-made bubbles like a knife through butter.

My view is simple: The “experts” will buy more time and create more havoc and control over our personal and economic lives.

I think figures like Stanley Fischer are dangerous abominations and architects of the greatest piece of financial fraud in the history of capital markets. The un-natural is replacing the natural. Full stop.

But such opinions are ultimately irrelevant, because regardless of being stupid or dangerous, figures like Stanley Fischer are insiders with great power, and their words (and actions) are signals nevertheless.

This is especially true of Stanley Fischer, a former Governor of the Bank of Israel and Fed Board Member who is as “insider” as any “insider” can get.

In short, and like it or not, central bankers matter and more centralized controls are around the corner.

What we can therefore expect in the backdrop of the aforementioned “concerns of debt sustainability” boils down to more of what those central bankers and stimulus-addicted markets call “liquidity”—i.e., lots and lots of more printed/mouse-click dollars to come in the near-term, and CBDC fantasy longer-term.

As we’ve said before, the central banks favor markets not people or currencies—when forced to chose between a market crash or fatal inflation, they’ll pick inflation, as inflation get’s them out of their own self-inflicted debt disaster at the expense of citizens rather than truth.

The Madness of Counting Profits with Debased Dollars

Of course, more printed dollars just mean weaker dollars, and weaker dollars just means investors are counting their inflated market profits with less meaningful measures of value.

Think about that.