We are now seeing markets in uncharted territory as the tariff war worsens.

22 shares

In our last column on compressed yields, we prefaced the long Labor Day Weekend with a sour note that recession risk is ramping up as the U.S. Treasury Yield Curve further inverts and as the monthly change in U.S. Treasury 10-year yields dropped to pre-recession lows.

With bond yields compressed to the floors of history, we warned that this tightly “coiled spring” could rapidly unwind, inflicting hurricane-like damage to the global economy.

The tariff wars is now adding to the uncharted mix, prompting consumer sentiment to prepare for a turn South as the NY Fed to ramps up the probability of a recession 12 months out.

In other words, this tariff war thing is getting worse…

Let’s discuss…

Tariffs Join Uncharted Waters

The great Fed Experiment of 2009-2019, which includes lowering interest rates to the floor, has placed us in entirely uncharted waters when it comes to knowing what’s going to happen next and when, where, and how that coiled spring will unleash its fire and fury.

U.S. trade policy uncertainty has added to Fed uncertainly, thus churning those uncharted waters into a recessionary storm ahead, which we track in Storm Tracker.

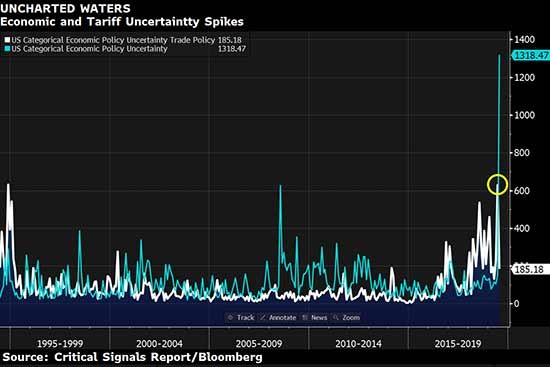

When it comes to tariffs, what started as a blow to China to get a trade discussion going has morphed into a full-fledged tariff war, spiking economic uncertainty to a quarter-century high.

Plotted below (based upon data provided to Bloomberg by the economic policy firm Baker, Bloom, and Davis) are twin uncertainty indexes, with and without trade policy in mind, namely A) an economic uncertainty index and B) an economic uncertainty index as it relates specifically to tariffs.

The tale of A + B is telling… economic uncertainty (thanks largely to a broken yield curve) has spiked (practically off the chart) while economic uncertainty relating to the tariff war has spiked to highs not seen since 1995.

In short, the tariff war has joined the Fed as a potential recession trigger.

A tariff war, of course, has a habit of raising the price of goods, including consumer goods, thereby impacting consumer sentiment.

That, too, is happening now.

Peaking Consumer Sentiment

There are plenty of indexes out there that track consumer sentiment, and these have been steadily bullish. Indeed, consumer sentiment, even as tracked in Storm Tracker, has been one of the last few indicators to soldier on and remain in the bullish “green.”

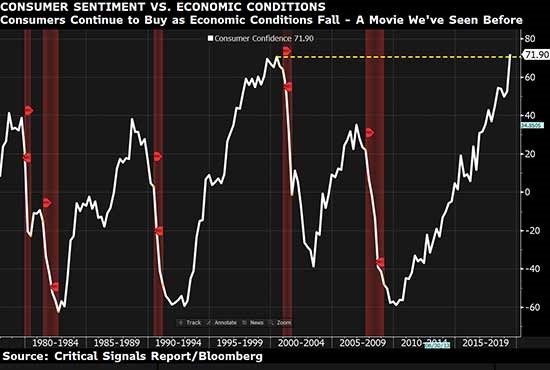

We need to keep a watchful eye on consumer sentiment though, for when it peaks, that would be quite telling. There are two ways to track a turn. One, just track a reversal; or two (smarter), track a spread between rising consumer sentiment and tanking economic conditions.

The spread, in fact, is where we get the real pulse check and leading indicator punch regarding the impact of the tariff war.

Right now, we’re looking for a spike in that spread, for when the spread spikes, consumer sentiment vastly (and unrealistically) exceeds economic reality/conditions.

As we show you below, when consumers blissfully whistle in the wind (keep buying… buying… and buying) at the same time economic conditions are falling (as they are now), recessions typically ensue.

In fact, Bloomberg brilliantly drew attention to this spread last week, using the Conference Board Consumer Confidence Index as a proxy for consumers, and the University of Michigan Current Economic Conditions Index as a proxy for economic conditions. We tilt our hats to them.

Have a look. Pretty reliable, wouldn’t you say? The last time we saw spikes like this, well, we saw recessions in tow. In fact, we saw it every time, as the red columns confirm…

Uh oh.

Here’s another indicator that you may find pretty reliable… one which ironically comes straight from the horse’s mouth, namely the…

NY Federal Reserve Forecast of Recession 12 Months Out

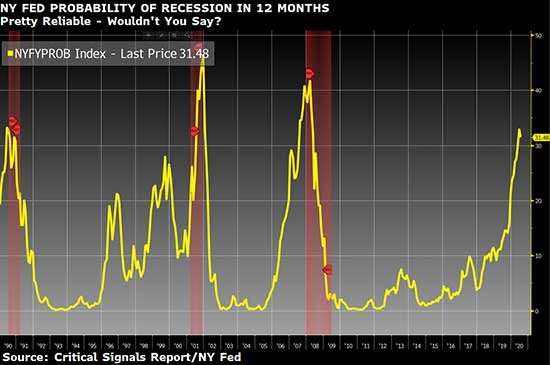

The NY Fed Recession Indicator is getting even more bearish. Since 1990, recessions have occurred each time this Index exceeds 30%. The latest reading: 31.48%.

Uh oh.

September Storm Tracker

In other words, the dark stars are continuing to align in the skies above this tariff war. Failing a headline-making truce, tariffs are increasing, and consumer confidence is about to crumble under the weight of higher prices, tariffs, and the coming recession.

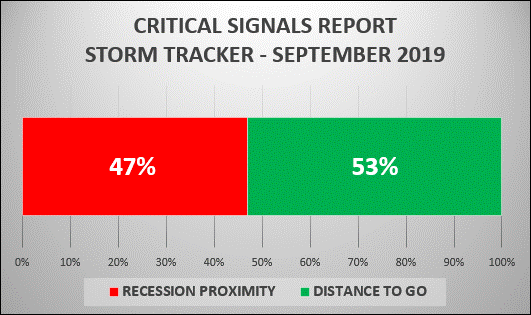

As for Storm Tracker, there is no change from August. Gale force winds remain at 47 knots heading into autumn. Like Hurricane Dorian, bearing down on the Bahamas and the U.S. coastline as we pen this note, steady recessionary winds can be destructive yet hard to predict landfall with precision. Besides, the worse conditions get, the more the Fed steps in to distort reality and create market rallys rather than necessary corrections. We thus expect a melt-up in the final months of 2019.

Like Hurricane Dorian, Storm Tracker can track this recessionary storm brew with relative accuracy. Toward this end, it’s the best tool we’ve seen in the industry.

The Week Ahead

As refreshed vacationers return from a long holiday weekend, Fed Presidents and Governors will be back at refreshing their thoughts on interest rates – seven of them, in fact!

A whole lot more Fed Speak (ranging from useless fluff to occasional insights, if you know how to translate their language) is on the docket this week, including Boston Fed President Eric Rosengren speaking today, Tuesday; New York Fed President John Williams, St. Louis President James Bullard, Fed Governor Michelle Bowman, Minneapolis Fed President Neel Kashkari, and Chicago Fed President Charles Evans all speaking on Wednesday; and then capping off the week, Fed Chairman Jerome Powell himself on Friday.

But while Americans are settling back into their routines, bond markets in Europe have taken a turn from the crazy to the just plain absurd. You may not think such things matter to U.S. markets, but think again.

Tomorrow, we have a special column that will show you precisely why problems in the Eurozone mirror problems in our own zone, namely the Twilight Zone of beyond sight, sound, and reason that characterizes our rigged to fail markets.

Your Questions

Before taking a question or two, many thanks to the nearly 100 of you that so quickly and kindly responded to our question last week on the topic of gold, “Are you in or are you out?” A whopping 75% of you are in gold, one way or another. Bravo!

Many comments came from individuals familiar with this commodity trade or otherwise well versed with gold investing; their insights are equally appreciated. Check them out.

And now to some questions…

Mindy H. asked what we see happening after the next recession, as this will be her first recession as a retiree, and hence she’s worried about her (and her family’s) ability to make up any losses and maintain a standard of living without a full-time job.

Mindy, you’ve raised an extremely important point. In fact, much of the motivation behind our warnings are aimed at retirees, for we feel they are the most at risk if following the standard approaches used by traditional investment advisors.

We warned about such risks here and recommend you consider the themes we addressed, for we anticipate a long rather than quick recession this time around.

We further touched upon such concerns in our 12 Ways to Protect and Grow Your Wealth Today report, so take a look there as well.

Bottom line: Given the risks facing these Fed-distorted markets, we are all sailing in uncharted waters, for the simple reason that we’ve never before experienced a market cycle so thoroughly managed by a central bank rather than natural supply and demand.

So yes, markets could melt-up for reasons addressed here, but despite such possible moves, the over-all risk probabilities embedded in these markets are simply too high today for retirees to be “all-in” at these dangerous highs – hence our strong opinion that older investors in particular should take chips off this casino market and be deeper in cash – 47% as of our most current Storm Tracker reading.

Reversion to the mean also tells us the next crash could result in losses of 37% to 77%, and take decades rather than months to “recover.” Retirees simply can’t afford to take such risks or wait decades to recover such losses. Again, we strongly believe it is far better to be safe than sorry down the road, however twisted and capricious its direction may be.

Leon B. asked about how inflation, hitherto confined to securities markets, will one day hit the real economy when the velocity of money (and the forces it unleashes) results in genuine price inflation.

Well, Leon, you’ve asked a whopper of a question.

First, we feel that inflation has in fact already arrived – but is just not accurately reported. That is, we are already living in a world of 10% actual inflation, despite the fictional reports coming out of the Fed and D.C.

As to the larger inflation down the road, the kind in which the velocity of money (currently held in the reserve accounts of the too-big-to-fail banks and/or on the Fed’s balance sheet), that’s an entirely different story, and one that demands pages (if not chapters) to fully unpack.

For now, however, let me say that when the day comes when bonds (which yield next to or below zero when adjusted for inflation) are no longer believed in (or bought by central banks), the sell-off in bonds will be extreme, and hence the spike in yields and rates no less so.

Money in both bonds and stocks will then either go to “money heaven” (i.e. simply vanish) or flow out of the markets and into the real economy – at high velocity.

At the same time, banks sitting on reserves will start lending money at higher rates to the few borrowers who can qualify for the loans, thus opening the currently closed reserves sitting dormant at the banks – and hence adding to the velocity you spoke of.

Finally, there are the central banks themselves – here and around the world. In order to postpone the inevitable (yet now delayed) crash in sovereign bond markets and keep their debts payable, nations around the globe will continue to print gobs of money as conditions worsen.

MMT is just one such desperate example of things to come.

Printing trillions since 2008 was one thing – it all went to the markets. But in the next iteration, trillions more of printed money will now dilute currencies around the world at an even greater pace.

As currencies continue their diluted race to the bottom, prices have nowhere to go but up, which means inflation will rise in lockstep.

The foregoing process, however, won’t happen overnight, and inflation has not reared its ugly head in a meaningful way in the U.S. since the 1970s, which is why most investors have deluded themselves into thinking inflation is obsolete.

Sadly, that’s just pure crazy. You’re right though. Inflation is muted, but like recessions, it has not been outlawed, and contrary to Fed hubris, it will rise again…

In the interim, keep your eyes peeled on your inbox for our next column, in which we will take a more critical look at why central banks are running out of arrows to fight off the bear coming toward them, here and around the world.

And that’s what makes the next recession we are tracking so compelling, for it’s not confined to one country code. Instead, and unlike the hurricane above, it will be global rather than local. Ouch.

Sincerely,

Matt Piepenburg

Comments

2 responses to “You’ve Entered Uncharted Territory – Here’s Why the Tariff Situation is Getting Worse”

- La Barge says:

Do you think fixed indexed annuities will be a more solid solution to keep money safe.

- Lessays:

If all central banks just continue to print unlimited amounts of money eventually everyone gets to worry whether their money is slowly becoming worthless…..The truth is that the money you have is becoming worthless.

We are now experiencing hidden inflation in that instead of prices rising the goods you purchase are getting smaller. …..When that peters out prices will start rising again and the government must print even more money……Inflation will hit gold and silver and prices of these commodities will skyrocket just like everything else……Buy some American eagle gold and silver coins now ! Invest in your future……….NOW!