Below, we look at Canadian Bank risk.

25 shares

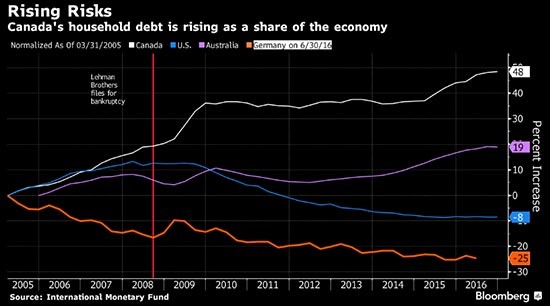

Recently, we reported on Deutsche Bank’s headline-making balance sheet risks. We looked as well at the cracks in the ice of Australia’s credit woes with regard to residential mortgage and consumer debt, all of which bodes for continued trouble ahead as country after country lines up for a credit cycle domino fall.

Earlier this week I was in London talking to investors about Brexit, which is a political and economic hot potato worthy of its own, separate report as we head closer to the October deadline.

For now, however, I want to turn our attention toward another country close to my heart yet often overlooked by the talking heads on the financial media, namely Canada and Canadian bank risk.

So let’s get to it…

What About Canada and Canadian Bank Risk?

In particular, I want to focus on Canada’s banking sector as a potential setup for a tempting short trade as Canadian bank risk rises.

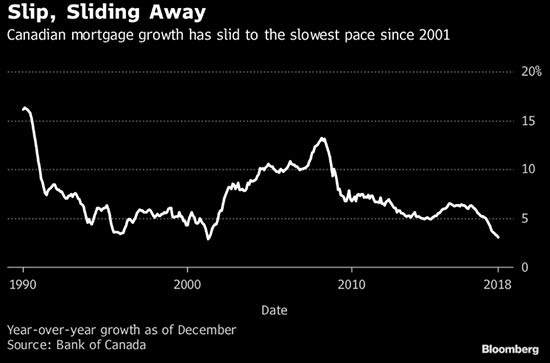

Like Australia, Canada has a far saner history of private and government debt management than its U.S. and E.U. financial peers. For years, Canadian bank risk was not much of a risk at all.

For decades, Canadian banks have been a relatively brighter star in maintaining superior credit quality standards on their loans.

Sadly, however, this paradigm is slowly starting to shift, as the numbers below make all too clear: Canadian bank risk is rising.

Canadian Bank Risk: Staring at Scary Levels of Impaired Loans

The Q2 reports from banks like the Canadian Bank of Imperial Commerce (CBIC), the Royal Bank of Canada (RBC), and The Bank of Montreal (BOM) have recently come out and the math is a bit troubling for Canadian bank risk..

Specifically, there is now an undeniable deterioration in Canadian commercial loans, and it’s gaining momentum.

At CBIC, for example, the level of impaired commercial loans on its books has risen by an astounding 77% Y/Y (year-on-year) for the latest quarter.

Folks, read that again: a 77% increase in impaired commercial loans.

For now, the deterioration in consumer loans has increased by only 2.8%, but the overall number of total impaired loans on this bank’s books has risen by a remarkable 34% Y/Y. That suggests we need to look more carefully at Canadian bank risk.

What’s Hurting Canada and Increasing Canadian Bank Risk?

So, what the heck is happening in Canada’s debt market and why? More importantly, what does this mean for some of you traders looking for a fat pitch (to use an American term)?

Credit jocks like myself understand that credit cycles typically play out gradually, and creep up on investors like a slow bleed rather than a sudden shock.

Even the great subprime crisis in the States took years to metastasize into a full-on “uh oh” moment.

Nor, moreover, do the numbers coming out the Canadian bank risk data suggest a financial Armageddon just around the corner. In fact, Canada’s banks are nowhere near the danger levels of the U.S. banks heading into 2008.

Nevertheless, what’s happening north of our financial borders is compelling evidence of Canadian bank risk, and ought to be on the minds of informed investors like you.

Canada as a country relies heavily upon a commodity-driven economy, one steered by oil in particular.

Over the years, however, U.S. oil production has successfully managed to become cheaper in the States, which has had a gradual yet negative impact on Canada.

Bank managers in Canada are now seeing the sting of this trend on their once safe balance sheets as the levels of impaired commercial loans rises dramatically along with Canadian bank risk.

Bankers Behaving Badly

As American, European, and even Australian readers and investors have known all too well, deteriorating credit can send banks into a tailspin as the loans they hold make the slow, then rapid, fall from the sublime to the ridiculous.

Of course, we saw this in epic form during the subprime disaster of 2008.

Bad loans, alas, have a direct and undeniable impact on bank earnings in general and on bank health in particular.

As loans begin to show weakness, one would expect bank management (and of course bank regulators) to significantly increase reserve levels to intelligently brace for the inevitable shock of increasing loan defaults.

Rising levels of impaired loans, after all, are a clear and obvious warning signal to prepare for a rainy day and thus increase a bank’s level of safety reserves. This is known as counter-cyclical earnings management.

Sadly, however, experience confirms that banks and their so-called “regulators” (who are just other bankers) don’t like to act intelligently.

After all, increasing a bank’s reserves requires a re-allocation of capital and thus a direct, yet cautious hit to bank earnings, and by extension – stock prices.

And bank managers, like CEOs across an increasingly drunken spectrum of stock-driven decision making in the C-suites, hate to see earnings decline for even a nano-second.

This short-term obsession with earnings has made bank executives less attentive to the longer-term importance of preparing for a rainy day in the credit cycle.

Such lack of prudence, however, just makes the storm ahead infinitely worse for their share prices.

That is, reserve levels should rise in pace – in fact even faster – than the rising pace of impaired loans. And with a 77% annual increase in such impaired loans, one would hope the banks’ reserve levels are rising as well.

Ahh, but hoping for bankers to act reasonably is not enough. In fact, most of the major Canadian banks haven’t increased their reserve levels at any meaningful rate. This raises concerns for Canadian bank risk.

To model this out, as we do at the hedge fund level, one simply needs to create a ratio of the reserve allowance (i.e. the rainy-day fund for loan losses) and divide it by level of impaired loans on the books.

The bigger the ratio, the safer the bank. But keep in mind, the bigger the ratio, the greater the short-term loss to bank earnings and stock prices. And remember, banks hate to see a drop in earnings, even if it’s the smartest play in the long run.

Thus, at precisely the time that one would expect to see these reserves and ratios going up in Canada, we are, in fact, seeing them go down.

Folks, that’s a bad thing for Canadian bank risk..

Ironically, at some point very soon, these myopic banks won’t be able to manage earnings because they were trying to prop them up too long at the expense of sound risk management (i.e., rising reserve levels).

In other words, by ignoring risk today, they are only putting their earnings at greater risk for tomorrow. The ironies do abound.

Betting Against the Banks

But what’s bad for bad bankers can be very good for informed investors. In short, there’s a compelling signal to short Canadian banks in the backfrop of increased Canadian bank risk…

Right now, we are seeing clear and mathematical (not theoretical) deterioration in the quality of commercial loans across the books of the Canadian banks. Residential loans, however, have yet to show similar impairment. But the operative word here is “yet.”

Again, credit cycles move slowly, then all at once. At some point, there can be a convergence of impaired commercial AND residential loans on the books of these banks, which means earnings will tank, and with them, the share prices of Canadian financials as Canadian bank risk turns toward a drop in Canadian bank share prices.

In other words, get ready to short the Canadian banks, like Steve Eisman, money manager for Neuberger Berman Group. This “Big Short” money manager foresaw the collapse of the U.S. housing market, and back in April was predicting a “20 percent plus” decline for Canadian bank stocks as credit conditions “normalize” and loan losses jump.

“Canada has not had a credit cycle in a few decades and I don’t think there’s a Canadian bank CEO that knows what a credit cycle really looks like,” he said. “I just think psychologically they’re extremely ill-prepared.”

As with any good trade, the key is to know where the hockey puck is headed, not where it is now. And for now, the Canadian bank stocks are up despite growing signs of Canadian bank risk.

But where the Canadian banks are headed, however, is straight for the penalty box.

As impaired loans turn toward defaulting loans, Canadian banks could easily drop by 20% or more in share price value.

Again, this is a classic setup and opportunity to bet against the Canadian banks.

For those of you who are investors rather than traders, such a play may not be for you. We totally understand. That said, you might want to scrub your portfolios now from any Canadian bank risk exposure.

But for those readers who like a nice setup for a short on the Canadian banks, we like this one, for all the reasons listed above.

We hope this raises an eyebrow. Whether or not such a trade meets your liking, it’s always important to keep your eye on the bankers, for they typically start doing increasingly risky things as the markets approach a recession. Canadian bank risk is just one of many warning signs we are tracking into the summer and beyond.

Furthermore, bankers like to ramp up the “deny, deny, deny” game just as the news gets bad. Brian Porter, the Bank of Nova Scotia’s CEO, is fervently denying that there’s much risk at all in Canadian banks, reminding one and all that those who try to short them typically get squeezed.

What we, however, are seeing in Canadian bank risk, just as we are seeing in Japan, Australia, China, and of course the U.S., is just more of the same: a slow-drip fall from grace as debt levels everywhere blow toward a perfect storm, one kept at bay for now by very powerful central banks with very powerful tools.

Until then, stick with Signals Matter. We’ll keep you dry when the rain comes. But as for the 4 of July, we hope you all get lots of sun. Enjoy!

Comments

11 responses to “Canadian Banks – Buyer Beware”

- Edward Macksays:

July 4, 2019

Nice analysis, Matt. Thanks for keeping us abreast of coming developments and an actionable investment. Happy 4th.

- Mic Welchsays:

July 4, 2019

Could you list the Canadian banks you would start watching? Are there any banks in Canada that are considered “too big to fail” like we had in the US in 2008 and 2009?

- Richard Hillarysays:

July 4, 2019

Thank you for your thoughtful analysis of the emerging debt risk trends amongst the Canadian Banks. This type of assessment is very important but as usual will be ignored by those with the power to change course. But then, just remember the lessons of the Titanic: too late, too slow and even worse – too confident.

Keep up the good work!

- Thomas G Slavik says:

July 4, 2019

Am looking to for a excellent Canadian bank for a large deposit in near future as i do not trust US financial system which soon will confiscate bank customer deposits. Can you recommend any banks that have good to better bank ratios for a US depositor to open a bank account in Canada.

- Ramirez de Arellanosays:

July 4, 2019

Which Banks Are More Depending on financing Exports?

- Didier ali Mbabazi says:

July 5, 2019

merci

- Siggi M.says:

July 5, 2019

Thank you Matt for your report on Canada. I find nearly all US financial newsletters seem to neglect their Neighbor to the North in their reports and analysis. Keep up the good work and your unique Global Outlook on what is happening.

- Briansays:

July 5, 2019

So impaired loans are rising 77%, what is the actual % of impaired loans? Are they really high enough for us to take cover?

Just like dividend raises, a 100% raise is spectacular until you realize the divvy went from 1 cent to 2 cents per qtr.

- Jamessays:

July 5, 2019

What do you call this play? A BIG SHORT?

- Roger Britton says:

July 6, 2019

Can You tell Me which canadian bank is the safest My daughter lives up there and is currently with bank of Motreal!

- Richie Bsays:

July 10, 2019

Hi Matt-

I am a 37 year US commercial banker and starred back in the early 1980s when Banking was still done right. In those days I was taught by old school bankers, some of whom started in the later stages of the Great Depression. They were conservative and disciplined in there lending decisions and knew about credit cycles and rainy days. I like your analysis here on the Canadian Banks, and I think US will see another 2008 crisis – possibly beginning to unfold in next 12-24 months. The smaller regionals banks have much poorer credit quality in their portfolios today and I suspect even some of the larger Banks do too. In a stagnant post 2008 economy there are still too many banks chasing after to few good credit quality deals. It must come home to roost in the near future and will only make the storm picture you are projecting worse. Have lots of antidotal evidence to support what I say above.

BTW – how do we set up a short play on the Canadian Banks Any particular stocks or indexes you would use in a short