Below, we look at the regrets of being too soon and too deep in cash, as well as recent earnings and GDP spin, the trade war with China, tax cuts, and what rising rates will do to the everything bubble.

The Bittersweet…

Some encounters are bittersweet, and I recently had one.

Sitting across from an old love who has yet to forgive me for a myriad of real and imagined sins, I was subtly reminded, inter alia, of my terrible advice (over three years ago) to stay out of the markets.

In other words, she was basically trying to tell me: “I missed the Trump rally because of you.” Then she went on to describe her current life in high-end real estate sales.

The ironies do abound.

And as I sat there nodding, apologizing and wanting to cry or smile, I couldn’t help thinking of the Italian poet, Montale, who once wrote: “there is nothing more bittersweet than an author reviewed by one who has never read past the title page.”

This can be true in so many contexts…

Everyone, of course, hates a know-it-all, and I hardly know all of anything, especially the art of love or the timing of a market bubble.

The fact, moreover, that we are currently enjoying the largest and most destructive “everything” bubble in the empirical history of capital markets makes such “know-it-all-ness” all the more immune to proper timing or forgiveness.

But I know enough to know that the crisis ahead will be the worst in US history. I think my polite warning, however early it may have otherwise been, was at least well-intended, no?

And I also know this: 1) the pages of market history teach us that the fundamental secret to making money is not losing it—that is: it’s better to miss a rally, bubble or top than to be caught in a crash; and 2) that high-end real estate markets die when rates rise…

And so, I say to that bittersweet and beautiful real estate broker sitting across from me: please be ready for what lies ahead in these markets. And PS: you’re young enough to wait out this bubble and buy at a bottom, not a top, ok?

Time, after all, heals all wounds—including those of love or going to cash too soon 😉

The Markets

And as for these markets, I’ve noted in this video of mid-summer that there is indeed much upside ahead; however, and in this other video, I also suggested that despite such upside, the risks far outweigh the rewards for those wanting to join the herd and ride this crazy market wave while criticizing those who warned you to stay out of the water.

In short, what I want to tell any of you—including my bittersweet café companion—is this: if you are not a professional trader who can go long and short on signals rather than on hunches or groupthink, then all you have to do to make a decent killing in this market is to avoid it.

I.e.: Be in cash. Patience will reward you.

When the market bottoms (and it will)—then you can dive back in and go lonngggggg with all the cash you saved (and thank me later).

How do I know this?

Well, first—you can look here, here, here and here, or here, here and again here or here…

But for now, let’s just look at the current state of the world, the bubble, the markets, the politics, and the MSM pabulum and re-set our common sense to the planet earth.

Despite all the noise about kooks claiming “fake news,” one has to admit that between the MSM cheerleading and the internet fog-factory (See Ryan Holiday), there is something called “objective truth” (See Kakutani) that has completely been ignored and that, of which, we must occasionally remind ourselves.

As far as the current markets are concerned, they are by every objective and truth full measure (from the CAPE Index to GAAP Accounting), a horrific and historically unmatched bubble fed by bucket loads of hype, momentum trades, and sales-spin.

Supply and demand, as well as balance sheets and value-investing, mean nothing in this shark-filled swimming pool of central bank engineering, trade war disasters, dangerously-timed (yet politically expedient) tax cuts, and political civil war.

The perfect storm I’ve written about could not be more perfect. This is the biggest market bubble of US history—and all bubbles pop.

But let’s look at the facts and numbers, not my flippant (and intensely annoying “know-it-all”) prose.

Earnings and GDP Growth? Not Really…

The bubble-heads and prompt readers who serve as today’s “market makers” are ranting about earnings growth and GDP growth, thus adding more hot air into the current bubble with every investor dollar that follows their spin with another “buy” order.

And so, the markets continue to climb on wind rather than reality.

But as for earnings “growth” let’s see the math, not the make-up.

Four years ago, for example, LTM September earnings came in at $106 per share; today’s LTM earnings are at $117 per share, representing a “growth” of just 2.5% per annum, which is anything but booming and makes no sense against the record highs in these dangerously over-valued markets.

The same spin-doctors that fill the internet and newsrooms with hype disguised as data are also pushing the booming “GDP growth” meme as well and giving credit to the new tax cuts, tough trade deals, and “art-of-the deal” leadership at the White House.

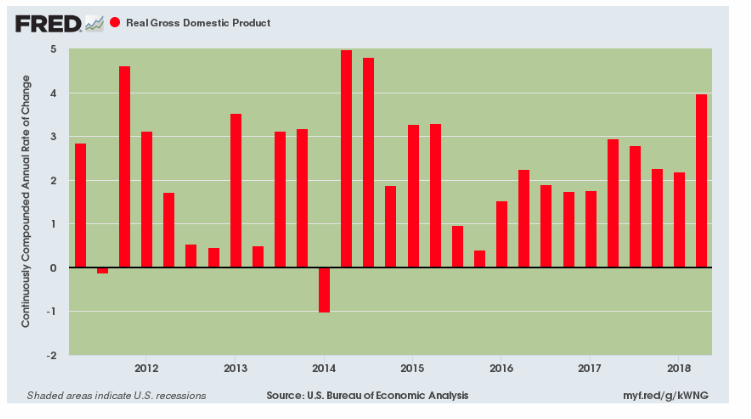

If that doesn’t seem believable, then just look at the graph below of real GDP growth. There’s nothing unique or booming at all about the facts. It’s just the headlines that lie.

In fact, the data literally says just the opposite of what the media tells you.

If you look a bit deeper under the hood (rather than at the TV screen or Reddit blog de jour), you’ll see that real GDP is anything but booming, and that even the recent (and brief) uptick was more of pre-tariff death spasm and one-time tax-induced wonder than it was the sign of a “new direction” in American productivity.

China

As for America, well, we sure are about to get tough on those darn Chinese, aren’t we? And it feels good, right? After all, we’ve been suffering trade deficits to them for years, and as of this year, we have imported over $505B worth of their goods, while exporting to them only $130B of our goods.

That’s pretty unfair.

So yeah, let’s stick it to the Chinese!

But here’s the rub: more than 90% of everything we buy from our patriotic American companies (and filling the shelves at Walmart and Amazon’s warehouses) is, well, made in China.

Is that China’s fault or that of the US C-suite and its cadres of grotesquely over-paid CEO’s (think Elon…)? After all, why would American executives pay workers in Michigan $25/hour when they can profit better from a Chinese peasant (slave) at $5/hour to work their factory floors?

Maybe the real bad guys are slumming it in Palm Beach, not Beijing…

And one more thing. Once we hit China with these tariffs, everything you buy in the grocery store is gonna cost a helluva a lot more tomorrow than today.

And as for trade wars, they are like all wars (hot or cold), namely: a disaster. In short, the little guy always ends up as cannon fodder—and that includes Main Street America too.

Think about China for a minute.

It’s an absolute Ponzi scheme built on $40T of debt, empty cities, corrupt SOE’s, and an autocratic government perpetually afraid of revolution and capable of crushing human rights faster than its totally unregulated and bloated markets are about to crash in the wake of US sanctions.

Let’s just suppose we win this trade war. Guess what? Nobody wins. The very trade deficit we complain of (and which makes for great political headlines and tough talk) is the very same trade market that provides buyers for our big, fat S&P companies.

China’s fall means our market falls.

During the cold war, we called this “Mutually Assured Destruction,” or MAD. But today, MAD has a whole new meaning—namely: DC crazy…

If any politician understood economics, diplomacy, or markets (as opposed to marketing), then we would not be biting the trade hand that feeds us. This trade war is a pure lose-lose scenario driven by bravado rather than brains.

Rates are Rising like Shark Fins

And in this backdrop of absolutely insane trade wars, we are also growing broke as a country to the tune of $1T a year in deficits. Solution? A revenue-killing (but headline-making) tax cut…

How do we pay for that? Easy, take on more debt. Which means issue more Treasury Bills.

Hmmm. The US Treasury is about to issue another $1.2T in US “IOU’s” to the world? That means more bond supply this fall.

But who’s gonna buy those bonds? The Fed? Not any more…

In fact, around the very time that the Treasury is planning to sell $1.2T in bonds, the Fed will be dumping another $600B off its autumn balance sheet.

Folks, that’s $1.8T in bond supply coming to a credit market near you. Roll the Jaws theme song…

For those of you who know yields and bond markets, you know that as bond supply increases, bond prices decrease. And as bond prices decrease, bond yields and interest rates increase.

And in a world driven by debt, the scariest thing in the water is a rate increase. Because rates kill bond and market bubbles faster than sharks eat chum.

(Oh, and the same goes for high-end real estate markets.)

Soon enough (and it matters not if it’s days, months, or a couple of years), we are heading into a recession and an epic market crash. Better to know that before you get burned, rather than later.

Ten years from now, when the pain of these markets is still crippling our economy and those who went long and right over the cliff, none of you who played it safe will care how early you went to cash—you’ll just be glad you did.