The repo market just imploded, and we answer your questions below.

54 shares

In the wake of last week’s repo market panic, I realized that there is much more to be said about its implications – and what it all means for you and your money.

First, let’s be clear that the repo market is not the bond market, but rather a clever little corner of the market casino designed to allow major banks and a few other non-bank and quasi-government entities to make short-term (often overnight) loans on an as-needed basis.

With this in mind, many readers have naturally asked why the big banks, so flush with post-2008 reserves, would ever need such “loans.”

Additionally, other readers, those admittedly new to the variant and rigged mechanizations between D.C. and Wall Street, have been pondering what all of this sudden (and narrow) repo noise has to do with their own money and the broader risks facing the markets.

Well, the answers will likely tick you off.

As to the first question, you are correct to ponder why the big banks, so flush with reserves, need a repo market’s overnight loans at all.

In fact, the blunt truth of the matter is they don’t.

Here’s why, and here’s what’s really happening…

The Scam Hiding Behind the Repo Story

Let’s back up to 2008. After the Fed bailed out the big banks with TARP (Troubled Asset Relief Program), the grateful (i.e. complicit) big banks then happily agreed to return the favor to the U.S. Treasury by purchasing trillions worth of otherwise unwanted government IOUs (i.e. U.S. Treasury bonds).

The big banks then kept these reserves on deposit with the U.S. Federal Reserve, a gesture which helps the Fed keep bond yields low due to all that grateful bank “demand” for U.S. sovereign debt.

Today, the value of those banks’ excess reserves is around $1.5 trillion.

Now, perhaps you’re thinking how kind that gesture was from the big banks – you know, helping Uncle Sam by purchasing otherwise unwanted sovereign debt.

But here’s the rub: In exchange for holding their Treasury reserves at the Fed, those “generous” banks receive billions in annual interest payments (paid by you, the taxpayer) under a fancy scheme called “interest on excess reserves” or IOER.

In fact, for doing nothing at all but sit on these reserves, banks like JP Morgan and Goldman Sachs received over $80 billion in interest payments over the last four years.

It’s no wonder college graduates want to work in banking…The TBTF banks and the Fed are in a nice comfy collusion.

So, no, the big banks really don’t need to worry about money for short-term, intra-bank lending. Not one dime of it.

Instead, and during that same period, a lot of non-bank financiers on Wall Street used this exclusive corner of the markets to make loans to the Fed (collateralized by U.S. Treasury bonds from the Fed’s “repo” program) for a guaranteed interest return of about $4.5 billion.

After all, the Fed has a money printer and therefore never defaults – so the interest payments are as sure as rain in Seattle.

It’s a nice deal, or more to the point, it’s an insiders’ deal. It keeps repo market rates low.

Or, even more bluntly, it’s a rigged deal.

So why does the Fed effectively bribe the big banks et al with these IOER payments just to keep their money dammed up behind the Fed moat?

That is, why did the Fed pay $38 billion last year in IOER payments (your tax dollars) to the U.S. banking system to not lend money cheaper than its “target range” for the Fed funds sector?

The answer is simple. The Fed doesn’t want that money flowing from the big banks into the system (the fancy folks call that a “velocity of money”), as it would cause the very inflation the Fed otherwise pretends to be “targeting.”

As we already know, the Fed’s target inflation meme is a lie. They need inflation low, not higher, in order to keep correlated interest rates (and the cost of their unpayable debt) low. Remember, what the Fed says and what it does are two very different things.

Furthermore, by keeping these private bank reserves dammed up at the Fed, this helps the Fed peg the infamous “Fed funds rate” (which we hear so much about) within their infamous “target ranges” which the big banks don’t even use.

Why? Because they don’t need the money nor use the Fed funds market anyway, especially after Bernanke bailed them out and then enriched them in 2008 – you know, right after those same banks gutted America and caused the 2008 crisis…

See why I keep calling this a rigged to fail market?

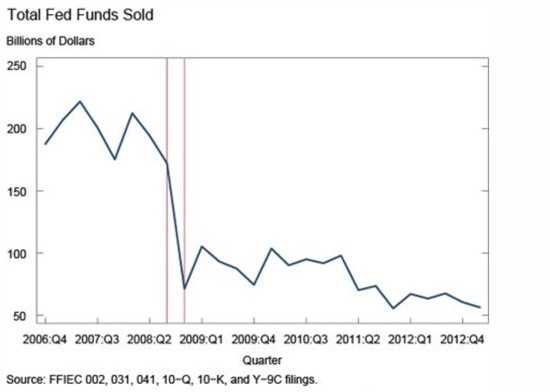

In fact, after Bernanke saved (i.e. paid) the very foxes who just raided our economic henhouse, the volume (averaging around a mere $60 billion) of big-bank buying and selling in the Fed funds market effectively vanished and currently comprises barely 6% of total bank liabilities.

So, who actually cares about the Fed funds rate and why does the Fed target it so carefully in the repo market and Fed fund markets?

In fact, “Government-Sponsored Entities” (or GSEs) loan more than 90% of the overnight Fed funds transactions – i.e. quasi-government lenders under the fancy title of “Federal Home Loan Banks” (or FHLBs) – you know, more of the same folks who got us into the subprime mess of 2008.

Oddly, however, as GSEs, these lenders are not legally entitled to earning the IOER by directly depositing their funds at the Fed.

Is that a pickle for the GSEs?

Nope, for what those clever government agents do is park their own reserves with the big banks (mostly foreign) who can earn the IOER payments. Those complicit banks then arbitrage those FHLB funds by lending the same at a slightly higher IOER rate above the Fed funds rate and pocket the difference.

Simply stated, this means the big banks (with the complicit support of U.S. GSEs) enjoy interest rate profits guaranteed by Uncle Sam that are effectively nothing more than free money provided to them by quasi-governmental agencies.

It’s one big insider scam that revolves around the Fed, the banks, and the GSEs.

What Does This Have to Do with You?

Well, if you put your hard-earned dollars into a money market fund, you already know what little return you are getting.

Worse yet, your dollars are then being used by GSEs to make overnight loans in the repo market, the paper of which is then legally “laundered” through the big banks who take a nice 10-20 basis point arbitrage/profit for temporarily holding the same under their IOER “deal” with the Fed.

Who wins? The banks. Who loses? YOU.

The Broader Implications for the Markets

Last week, the money in this otherwise rigged repo market suddenly went dry, and there was a panic at the Fed because there was a sudden glitch (i.e. lack of funds) in their “insider scam” that directly impacted the big banks. This caused repo market rates to skyrocket, which totally screwed the Fed’s plan of repressing rates to keep an otherwise dead bond market ripping north.

Needless to say, the Fed immediately pumped over $1 trillion in rollover facility money to keep this rigged Wall Street scam going.

And I’ll tell you right now, none of this “emergency liquidity” had anything to do with the broader U.S. economy and its Main Street woes and citizens.

Homeowners or small businesses are not entitled to these overnight, “as needed” loans. Nor will bailing out this niche market lift our country’s stalling GDP. It won’t expand our contracting productivity numbers or declining PMI figures. And it won’t forestall the looming recession.

Rather, it merely sends markets toward dangerous new highs (based upon low rates) and keeps the dangerous yield compression game of chicken going.

So, again, what’s the benefit or danger to you, other than rising your awareness (and anger) at the above rigged game between the Fed and Wall Street?

Actually, there’s a lot of danger, but no benefit – for despite being rigged, the repo market is indirectly critical to the Fed funds rate which influences the shape of the yield curve, and thus critical to the pricing of Uncle Sam’s increasingly rising (and outrageous) debt levels.

The Fed is Losing Control of Interest Rates

This is bad, because everything keeping our fake “recovery” going hinges on interest rates.

Last week’s sudden rate spike in the otherwise circular scam corner of the repo market was a shocking reminder that the Fed is losing control of the far more critical Fed funds rate, which is intimately tied to these repo market games.

The entire world watches the Fed funds rate, allegedly “controlled” by the Fed; but as we are now seeing, this control is less than perfect.

The Fed’s alleged “pegging” of the interconnected repo market and money markets to the “magical” Fed funds rate can only be controlled if the supply of money in those markets meets demand for the needed loans.

In the years after 2008, the Fed was able to maintain this precarious balance by printing money on one end (more money supply) while government borrowing (i.e. Treasury issuance and hence “demand”) declined to “controllable” levels on the other end.

In recent years, however, this balance is collapsing.

Uncle Sam’s debt ceilings and borrowing needs have skyrocketed, adding more Treasury bonds into the markets (dollar “demand”) yet with less and less a supply of dollars to meet that demand and buy those bonds, a situation made all the worse by Powell’s temporary 2018 attempt to reduce the Fed’s balance sheet by some $750 billion.

Last week, we saw the first warning signs of this gross imbalance between supply and demand – i.e. a liquidity crisis otherwise known as a crisis of not enough dollars in the repo market, one that the Fed can only “resolve” by more money printing, of which the markets are expecting – and will receive. Lots and lots.

Is Printed Money Safe Money? Nope, But More Is on the Way

That shouldn’t sound sustainable to you.

In fact, everything now boils down to how much (and for how long) money printing can sustain the demands of the current “everything bubble” and the various market niches, like the repo market, which survive on pumping printed money into their ever-thirsty wells.

The fact that markets and economies have come to the point where such measures are all that keep our financial systems afloat is, in and of itself, both depressing and alarming.

We really are in dangerously uncharted waters. If more “liquidity” (i.e. printed money) isn’t available, rates rise, as we briefly saw last week.

And as for the growing disconnect between the drying supply and over-demand for U.S. dollars, my next article on the extremely dangerous Euro Dollar phenomenon (i.e. U.S. dollars held overseas) will serve as just further (yet largely unknown to most) evidence that Fed is losing its control over this key dollar-supply source as well.

And given that the Fed has effectively become the market, once it loses control, the markets do as well…For now, however, the renewed money printing to come will spike a market rally, as we’ve been predicting all summer to arrive in the fall.

In any event, we recognize how otherwise complicated (and yes confusing) the above schemes between the banks and the Fed must seem, as scams like this thrive on (and hide behind) intentional obfuscation.

Such insider deals are meant to go unnoticed, but now you are noticing, yet again, how the sausage is truly made in the ongoing, yet slowly unfolding, disaster that is the post-’08 Wall Street/Fed “experiment.”

Knowledge is indeed power, and with this power, you will be better prepared as these scams slowly morph out of control.

For now, however, the Fed has all but confessed that it will be printing more money very soon, if the markets so require, which is effectively a green light for new market highs driven by QE “faking it,” and the now embedded moral hazard of “forever Fed support” of the markets.

Nevertheless, be careful, for such fake highs are loaded with real risk…

In the interim, stay informed, stay safe, and be patient, as Fed “miracles” are effectively just experiments, and someday soon, their tricks will be running out of magic. In the near-term, however, expect a note from us soon to “party on!” as the Fed just sent markets a fat pitch.

Sincerely,

Matt Piepenburg

Comments

13 responses to “The Ongoing Repo Question – More Proof of a Rigged to Fail Market”

- Robert Tompkinssays:

I truly appreciate your explanations of all these amazingly rigged, rather insane arrangements between the Fed and the big banks and other players. I may not like capitalism, but it sure as hell pays to have a “capitalist” like you who understands these insider schemes explain them to those of us who would never be able to figure them out our own!!

I read your articles regularly now and will continue to do so.

Yours truly,

Rob Tompkins

- Dimitrios Nivolianitissays:

Thank you for the information, this is an eye opener to me an good education.

Thank you again

- william simmonssays:

Its time to remove your savings from the banks and buy physical silver as an insurance against the inevitable collapse

- Richard haytersays:

So should one get out of the market and 2hat will be th3 impact on real estate?

- Craig Sallin says:

Matt: Once again, you pull back the curtain, and allow us to watch the beast devour us. Nonetheless, good to know. Keep us informed as to how the event occurs.

Thanks, Craig Sallin

- mike thompsonsays:

So when does it all hit the fan?

- Dsays:

Hi Matt, great informative article. I love reading them because I learn from you how this financial shenanigans work. I would like to suggest though if you can maybe make an animation or a flowchart of how these all works as it would be EASIER to understand if you can visualize. Just a suggestion as I know you’re busy. Thanks.

- George Anstadtsays:

Focus on the next quarter, rather than long-term goods such as fairness, threatens democracy. The stakes are high.

Arcane obfuscations such as this prevent the voter from fixing the problem. It seems that only an honest broker group of financially powerful sophisticates can save us, and so themselves. Hmmm…

Or, can our powerful new servant, big data analysis of entire financial system, save the day?

- Georgesays:

Is it true that a trust exist which President Trump is aware of which actually is the sole entity on the planet that can correct the entire financial system.?That Trust is called the Manna Trust.

I would like to know if you have heard of it’s existence and if so why has the President not allowed it to be brought out to the public.

Regards

- Georgesays:

That was Manna World Trust

- Edouard D’Orangesays:

Thanks, Matt. I must be asking the correct questions because you’re directly answering them. I’m concerned about all of the market and money rigging but feel like I can’t earn a decent return except to stay invested in markets. Is short term government paper even safe?

- Anthony J. Cohen says:

Great article Matt! I believe that you are, unfortunately, spot on in your analysis. The stock market has gone from an investment market to a casino with no regard for fundamental analysis. Black boxes dominate trading activity meaning that “investors” really have no idea of the balance sheets, business activities or management of the stocks that are trading. The Repo market is just such a dark corner of where another example of “market rigging” takes place under the noses of everyone.

- Gregsays:

Is there going to be an economic collapse and if there is when will it happen?