Below, we get philosophical and financial, looking back on the year that was 2018 and what its condition portends for the year ahead. In particular, we’ll revisit the common yet essential themes of the rich vs. the not-so-rich, the Federal Reserve, stock buy-backs, corporate debt, the dying bond bull and the dangerous implications of rising interest rates.

Musings on Another Passing Year…

Ah…2018. Another year passes, refilling each of us with recent and fresh experiences, impressions and lessons, each to be well-placed in our respective memories. Life: it offers the curious and the daring such variety—such inestimable passions, persons, and ideals to follow, reflect upon, learn from…

But markets? Hmmmm…I can’t say they are as comparably fascinating as the larger project of living, but as this is an economic rather than poetic blog, let’s not forget the lessons and impressions of finance, as that too, like it or not, is a part of life, and not one entirely lacking in its own interesting twists and turns, its own moments of what Napoleon described as the “fine line between the sublime and the ridiculous.”

Seeing the World from Outside Your Own

And markets, like one’s own life, often gain an extra clarity when observed from new angles, new zip codes—that is to say, new perspectives. One can learn more about one’s self, for example, when venturing into new lands, faces and languages.

The same is true of one’s country, and alas, one’s markets…

Same Struggles, Different Accents

After some traveling, and most recently through Europe, my take on the US and its markets gained new layers, new textures. I saw, for example, that the struggles Americans face—in particular its burdened and tired middle class—are part of a larger, more global struggle.

Everywhere I turned, I saw increasing numbers who feel their dreams passing like oar swirls against increasing pressures to just stay above water— you know: to pay rent, groceries—alas, to just get by.

The yellow vests on the Champs Elysees or at roadside protests throughout France, where just the most headline-grabbing examples, but they symbolize a growing and rising segment of the young and rural population who are not living the American dream, the Italian dream, the French dream… you get it.

In short, the majority of people, regardless of their nationality, are tapped out.

And as I, the truly spoiled and ugly American, was secretly tracking Hemingway’s steps on the Left Bank of Paris from the Deux Maggots to the Brasserie Lipp, a Federal Reserve study in the US reported that Americans have $1 trillion of credit-card debt, $1.5 trillion of student debt, $1.5 trillion of auto loan debt, and $13.5 trillion in mortgage debt.

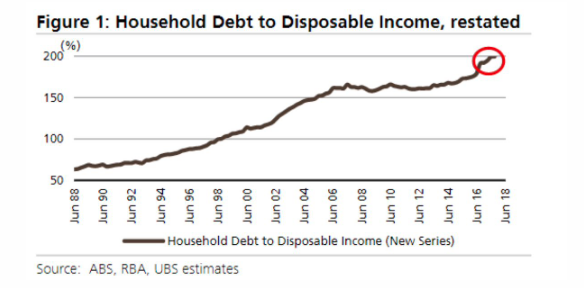

Folks, we are talking about trillions here… trillions. I don’t even think that number is “grasp-able,” to be honest, not even to the mind of Hemingway. To bring such figures closer to home, think of it this way: The average US household has $140,000 in total debt. Just look at the following chart of debt to disposable income…

This is, well, just sad.

The Rich and the Not-so-Rich—A Growing and Dangerous Divide

I also saw a growing divide between those who have more and those who have less. Just as there are “two Americas,” there are “two Europe’s” (as well as “two Latin Americas”).

In the UK, in France, Italy and Germany, I ate, drank and spoke with a wide spectrum of individuals, from wealthy restaurant owners and well-paid actors, art-dealers and athletes, to cash-stretched cattlemen in the Loire, apple farmers in the Dordogne and burned-out UBER drivers in the Place Vendome.

On the one extreme, the wealthy feel over-burdened by what they feel are unfair tax schemes in which they are obliged to pay for immigrants who live for free or a socialized system of entitlements which they feel others are just, well…not entitled to.

On the other extreme, I saw hard-working mothers, fathers, sons and daughters who worry how to make it through each month. Many live on a monthly salary that is less than certain bar bills one pays in the Upper East Side. In short: tensions are rising in all zip codes for many of the same reasons.

As one who has known both ends of the “wealth curve,” I will not take sides here or offer grandiloquent political excuses or solutions. Frankly, given the debt levels around the globe, I feel that there are no political solutions for the turmoil to coming our way, from St. Tropez to St. Louis.

The debt binge which each of the world’s major central banks have given us, will undeniably result in a recessionary hangover with global rather than local ramifications and pain.

US Markets—A Truly Unique Oddity

Yet despite these shared and common tensions here and across the pond, my view of the US markets remains particularly cynical, especially when one considers that despite the undeniable distortions and sickness that is the US economy and its disturbingly corrupted and over-valued stock market, there is a profoundly telling, as well as troubling, disconnect between the fake yet bullish run of the US markets when compared to the rest of the world.

I do not see this disconnect as proof of American exceptionalism. In fact, I see the precise opposite. As J.P. Morgan’s Marko Kolanovic recently (and rightly) observed:

“The recent divergence in the performance of U.S. equities versus the rest of the world is unprecedented in history. . .. This has never happened before . . . this is a market condition that will not persist.”

Symptoms of Profound Over-Reach, and Thus Trouble Ahead

That is, the very fact that US markets have seen such “growth without tears” for nearly a decade is less a sign of its strength than it is a sad symptom of its dangerous over-reach. By postponing our debt reality for so many years, US markets have simply set themselves up for a far greater calamity down the road.

And that road is getting shorter by the day.

How do I know this? Well, rather than just spout worldviews and opinions, I prefer to consult facts rather than personal pieties, and thus I offer below some data which will make my somber view of the coming cycle easier to see, though admittedly difficult to swallow.

I will therefore use this January 2019 moment to look back upon themes which our readers will recognize and which demand not only a revisit, but a few moments of somber reality-checking.

The Fed—Of Course

Where else to begin but with our central bank? By now, all our subscribers and readers understand how the Fed’s disastrous money-printing and artificially suppressed interest rate policies have given us the fakest “recovery” in the history of US markets.

After all, what else but an artificially, Fed-supported securities market could explain a decade run-up off the ’09 lows without a single 20% correction? Obviously, investors took the bait and could not help but buy into the euphoria.

But the fact that this aberrational and entirely abnormal run has been supported by an annualized GDP growth of only 2% is blatant and simply undeniable proof that our “recovery” has been 100% to the benefit of the stock market, and not the real economy.

I find this “boring” GDP fact unpardonable and alarming. It is the smoking-gun proof that the Fed experiment that began in the rubble of the 2008 crisis (which the Fed created) was a complete failure.

The Fed’s “stimulus” policies enriched a Wall Street class of anti-heroes (of whom I’ve written at length here) while leaving the rest of the country in a state of ruin, as the real employment, GDP and inflation figures I’ve shared elsewhere make obvious rather than just a matter of opinion.

I implore you to read the foregoing links carefully, as their numbers and data points speak mathematically for themselves and have nothing, and I mean nothing, to do with the pabulum of sell-side fantasy spat out daily by our Main Stream Media in the last 10 years.

I mean let’s be honest folks, how can any bubblehead financial journalist or sell-side, fee-hungry advisor watch equities run up 300% off their 2008 lows while our nation’s GDP tracked levels as weak as the “Great Depression” and call that a “recovery”?

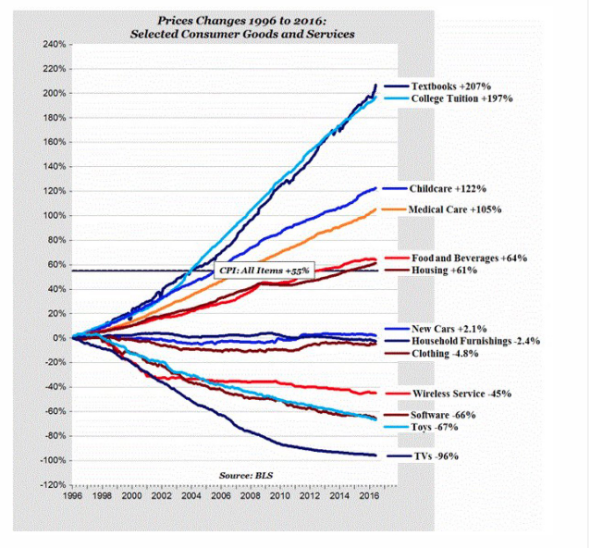

Or how can anyone look at the triple-digit rise in the cost of everything from school tuition to medical costs and yet believe a government “CPI report” that tells you inflation is averaging at only a 2% annual uptick in costs?

The Stock Market House of Cards

Yet when looking at even the record highs which 2018 posted on the S&P and other exchanges, we see that they are towers built on sand rather than cement. Some, of course, have a hard time seeing this. All they see (or saw) in prior years was an S&P that ran 14 months in a row without a monthly loss.

We already know that this was largely due to the Fed, but let’s examine further symptoms of the deadly virus behind this so-called healthy “recovery.”

Stock Buy Backs

I’ve written at great length about the false wind beneath such “runs” based upon US bogus stock earnings and profit reports many times. I will not repeat the math here, but simply remind ourselves again that a great deal of the power behind the 2018 rise (and prior years) was simply and directly due to companies (rather than natural demand) buying back their own shares.

The stock buy-back phenomenon (driven by low-rate debt engineered by the Federal Reserve) is a sham. Even Yale’s Robert Shiller recently described it as pure “smoke and mirrors.”

Indeed, the false confidence (and huge salary increases) such buy-back shams give otherwise weak markets (and greedy CEO’s) is so disturbing that there is even a legislative push to ban them again. (Stock buy-backs were legalized in 1982.)

Such shams, for example, explain how a company like Domino’s Pizza could add 35% to a 20-fold, 10-year run aided by a debt-funded stock-buyback program.

Corporate Debt

Speaking of debt…If one wants to see just how rotten and fowl-smelling the so-called wind beneath the American market “recovery” really is, one just has to turn off the TV and look at the numbers on US corporate debt rather than the faces of TV pundits.

Did you know, for example, that 60% of the corporate debt issued by companies in the Russell 2000 is rated as “junk’? I pointed out the disastrous implications and dangerous waters ahead in the US Junk Bond Market here as well as in video form here. I invite you to re-visit the facts rather than the hype.

But it’s not just the “junky” (i.e. risky) nature of the vast percentage of the US corporations that should alarm you. That is, even those few stock-market companies not otherwise classified as “junk” are still just debt-soaked by any other measure.

Since 2010, for example, US non-financial corporate debt has risen by 62%, whereas “earnings” for those same companies rose by only 27% in the same period.

Stated more simply, stock “earnings” in the US markets are driven by debt, not productivity, natural demand or a strong Main Street. Folks, markets built on the sand of debt always—and I mean always—collapse. Period. Full Stop. (See Market History).

Rising Interest Rates

And what kills a debt-driven market?

Simple, any force which causes the cost of that debt to go from sustainable to impossible. In short, when interest rates rise, the entire house of cards—or fake market “tower”—comes crashing down.

I’ve written about why and how interest rates are rising and what that means for your portfolio and our stock markets here, here and here, and talked about it at length here and here…

At first, many of the clients. subscribers, friends and Wall Street colleagues with whom I regularly swap thoughts thought I was being too bearish. But once they saw the data, they changed their tune.

Now, even the former market cheerleading squads at the big banks (where one is paid to be bullish and fired when bearish) are starting to realize that rising interest rates are going to be the death of the fake bull we’ve seen since 2009.

As Andrew Lapthornse, head quant at SocGen (Societe Generala) observed:

“Interest rates are already doing damage; people just haven’t noticed. Leverage in the U.S. is grotesque for this stage of the cycle. At the moment, you’ve got peak leverage at peak prices. It’s not like you have to dig deep to find a problem.”

In the One Market Chart That Explains Everything, you will see quite simply that such data regarding interest rates and a dying stock market (which takes an innocent Main Street economy with it) reveal facts rather than opinions about our financial future.

Folks, I simply cannot stress enough how important the otherwise “boring” topic of interest rates are to forecasting the future of these frothy markets—and your investment portfolio.

But in case you need confirmation from fancier bond jockeys than myself, let me remind all of you that Bill Gross, arguably one of the greatest and most well-known bond investors (the former “bond king”), openly admitted in 2018 that if yields on the 10-year US Treasury broke above 2.6%, then the US bond market will have begun a secular bear market.

Well, in 2018, we broke well past 2.6%…

Another smart guy in the room, Jeff Gundlach (the new “bond king”), has gone on record in 2018 saying that once the yield on the US 10-Year breaks and holds past 3% (which began in 2018), then it’s “bye-bye bond bull market. Rest in Peace.”

In short, the rising yields on US sovereign debt is yet another symptom of our distorted, and soon to be dead, securities “bull” in the US.

Tech Won’t Save You

Ahh, but what about all those flip-flop-wearing millennials and our tech-stock juggernauts? Surely, they can save the markets, surely, they have found the key to making America great…

Surely, you don’t still believe that.

If so, I beg you to look at the math beneath the hype and revisit our data on tech stocks in general here, or on Amazon here, or Netflix here, or Facebook here.

Better yet, if you just want to laugh out loud at the ultimate example of BS masquerading as genius, just do a semi-deep dive into Elon Musk’s Tesla sham here, and hopefully your faith in this sector and new generation of corporate leadership will acquire the perspective otherwise lacking from our West Coast…

I’ve written at some mathematical length about the FAANGs here, and even spoken at about them in podcast-form here. Again, I offer numbers not just smug opinions. I beg you to read/listen to those posts and do some simple math. It feels good to honor your common sense rather than just the instinct to burry a head in the sand…

If so, you’ll quickly see that today’s FAANGs are not the salvation the markets and sell-side pundits on Wall Street would otherwise want you to believe them to be. They cannot and will not create wealth for the 21st century the way Standard Oil, General Motors, U.S. Steel, and General Electric did for twentieth…

In Q3 of 2018, for example, as I was posting video warnings here, here and here about the dangers coming to Q4 (which the December 2018 markets confirmed), I had to endure market sheep breathlessly watching (and buying) Apple and Amazon race to be the first company to reach a trillion-dollar market cap.

It was as astonishing as it was absurd to see these broken balance sheet companies reach new highs on hype rather than honesty, but as the Tesla metaphor more than makes plain, that is precisely the way modern markets now behave…

But as a trader and market veteran of many years, I smelled more than one skunk in the Amazon and Apple wood pile. That is, in September of 2018, it was fairly clear to me (and many other momentum-trained stock traders) to recognize that “somebody” was artificially bidding these companies up like they were the last waterholes in a vast desert.

An almost cinematic finish gave the win to Apple on September 2nd followed by Amazon two days later. But I highly doubt that I was the only one who found this a bit, well… too coincidental. But I digress…

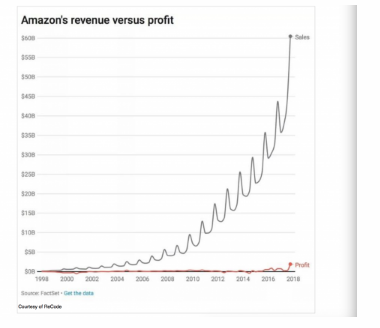

Let’s look again, for example, at Amazon…Of the five FAANGs, Amazon is the 1 trillion-pound elephant in the room. Amazon has essentially no earnings, yet trades at PE ratio of greater than 200 and with operating margins below 2%. yet its business model appears to be: (a) pay no taxes, (b) make no profits, (c) rise share-prices on hype and (d) use those inflated valuations to buy or destroy all its competitors.

A picture, we know, is worth a 1000 words… The graph below shows Amazon’s rising sales numbers. Impressive, no? Yet if you squint real hard, that tiny, flat line on the bottom of the graph tracks Amazon’s profits…Can you see any?

In sum, if Amazon is the model for the 21st century, then I (as I do often say) was born a century too late, as this is not the new world I’d like to trade, admire or profit from—though I do look forward to shorting the hell out of Amazon…

So, there you have it. A 2018 market built upon Fed steroids, stock buy-backs, corporate debt, increasing junk-bond issuance and a tech sector with historically inflated valuations yet no profits, free cash flow or honest reporting. Wow. Some year… Some “recovery.”

In 2019, I feel these kinks in the armor of our market “recovery” will finally face their day or reckoning. A party driven by low rates and easy debt will end as rates rise and debt becomes hard, rather than fun. Again: the hangover is going to be a B!&#$…

And so, I end this financial musing with a mix of philosophical sophistry. My advice?

Simple.

Hug your spouse, your lover, your kids, your dog…Jump in an ocean somewhere, enjoy a bottle of red or white. Ride a horse, roll a bowling ball. Indeed, embrace all the real wealth of life. But please, when it comes to the US markets, don’t look for any meaning there today, just get out while you can and get back in when they return to normal. That is, sell at tops and buy at bottoms. There’s no perfect way to time them, but for subscribers at SignalsMatter.com, we can help you far better than most…

Cheers then, and as always, be careful out there.