Below we take a first look at the December 2018 markets.

Too Much Traveling…

First, apologies for the delay in getting something out. December was a crazy month not only for the markets, but for my travel schedule as well. I’ve been visiting a number of zip codes and people, taking a pulse of life while also listening to market moods from the UK north to the Mediterranean south. That, and we’ve been posting positive returns as the broader markets took a nosedive…

For a re-cap on what I’ve been seeing, I’ve summarized my take on the December 2018 markets in the following video, click here.

The December 2018 Markets

Well folks, where to begin? December certainly was an interesting month, but then again, so were the trading months of October and November… As to the recent volatility of December, the markets saw more intra-day moves of greater than 1% (up or down) in one month than they did in all the trading days of the prior year combined.

In short, volatility has returned after years and years of a market completely distorted (and falsely calmed) by an historically absurd combination of: 1) artificial Fed support; 2) dishonest/manipulated earnings and profit reports; 3) equally bogus GDP and employment data and 4) a main stream financial media that cheerleads good news yet negligently/deliberately ignored market reality.

And this reality, as we’ve been plainly and repeatedly demonstrating, simply boils down to a debt reality that makes the December volatility easy to understand and foresee for those who follow data rather than prompt-readers.

For Signals Matter subscribers, the December market was therefore no surprise. Even our public blogs and videos called the year-end volatility months in advance, including clear warnings here and here. Stated otherwise, and with all the annoying bravado I can muster and you can forgive, I can only say, well… we told you so. But I like the way Michael Scott says it better…

The Beginning of the End

At some point, the lie that is and was the post-08 “recovery” will show its true colors as unsustainable corporate, sovereign and private debt ushers in yet another debt-driven market crisis–the third since 2000. What we have seen in December is just the beginning of the end, but by no means the end of the beginning.

As for intra-day moves of 3-4% or a DOW that tanks by 1000 points on the day before Christmas only to rise (in-record breaking fashion) the day after Christmas by 1000+ points, do any of us need further evidence that these markets are anything but rational?

Man vs. Machines vs. Markets

In fact, given that the majority of traders today are algorithm-machines rather than human-driven thinkers, we can also thank a “terminator-market” traded by high frequency robots for much of the financial sea-sickness in December. After all, machines are neither rational nor irrational because they, are, well…machines.

Please don’t let machines (or equally mechanical talking heads) lead you deeper into these dip-buying markets. Computers gather data on rising bid orders and technical vacuums. They do not reflect upon balance sheets, politics or human greed and fear. As a result, they lack the nuance necessary to massage the art and science of portfolio risk management. In this respect, they create momentum upwards and feel no emotion when they eventually sell markets off into a downward spin.

That downward spin, the first glimpses of which we’ve seen in late 2018, has much further to go. In fact, there’s a rational aspect to necessary corrections and bear cycles. What was irrational, unfortunately, was the false hope that the markets had somehow found away to avoid pain…

What is irrational, in other words, is that investors and markets have been allowed to become this distorted, this bloated, this falsely-calmed and this surprised by what are (and were) otherwise obvious signs that we are nearing the end of debt party, and hence the end of the false recovery which our central bank put on a Visa card back in 2008.

That is, many have allowed themselves to believe that the Fed had “solved” a self-inflicted, sub-prime debt crisis (08) by creating an “everything” debt crisis in the years that followed. Stated otherwise, many have bought into the illusion that a debt crisis could be “cured” with, alas, more debt…

Earnings Driven by Debt are not Earnings

In the last 10 years, both US and global debt has more than doubled. As anyone who has a fully-loaded credit card knows, debt can buy a lot of short-term fun. Certainly, we’ve seen some of that fun in the last decade, a time in which markets effectively seemed to only go up. Yet if we look a bit more carefully at those markets, we see that the reward was minimal when measured against the cost.

The US stock market, for example, boasted of 27% earnings growth since 2010, yet forgot to mention that corporate, non-financial debt for that same period grew by 60%. Needless to say, “earnings” achieved by debt are not really earnings, they are just empty shopping sprees driven by debt…

Furthermore, even the “earnings” boom that everyone on Wall Street seemed so proud of, was nothing but the result of: 1) verifiably-proven bogus accounting tricks, 2) years of low-rate-driven stock buy-backs and 3) a one-time tax cut/repatriation trick.

Again, none of these “market forces” had anything to do with natural demand, genuine economic growth or a thriving Main Street. Instead, and as we’ve reported again and again and again—this “recovery” was debt driven, which means, it was not a recovery at all, just a classic case of smoke and mirrors in which our markets, central bankers and policy makers have merely been can-kicking reality for as long as they could.

As of December, we are now seeing some early signs of “buyer’s remorse.” That is, our national and market credit card is running out of juice…

December was the first real sign that the experiment of solving a debt crisis with more debt will fail. Now, all we can do is expect more volatility and an eventual recession on Main Street and a tanking on Wall Street.

Shark Fins

In November, I showed you the One Market Chart That Explains Everything. In a nutshell, that graph mathematically illustrates that as the cost of debt rises, the debt party unwinds, because the cost/pain of sustaining the debt becomes too great. And the cost of debt is rising. Remember this: rising rates are to debt bubbles what shark fins are to swimmers: bad news.

The Fed has been raising short term rates at the very same time it has begun reducing its balance sheet in the form of Quantitative Tightening. This is a double whammy for rising rates…In October, the central bank began dumping rather than buying bonds at the tune of $600B a year. It was no coincidence, therefore, that markets began to shake that very same month. I explained this in depth here.

With the Fed no longer (and un-naturally) buying bonds, bond prices will fall, and hence yields will rise—which means interest rates set by the bond market, rather than the Fed, will rise as well. Again, this is math, not tarot cards.

Add on to this sinking bond demand the Treasury Department’s simultaneous issuing of more US bonds/IOU’s to pay for our tax cuts, disastrous trade war (and consequent farm subsidies) and other rising expenses, and we see more bond supply giving more pressure to lowering bond prices and thus rising rates.

Please read this last paragraph again.

As we all should know from basic high-school economics, falling demand and rising supply means falling prices. Falling bond prices means rising interest rates. Rising interest rates means death to debt-driven market “recoveries.” It really is that simple, that well…mathematical.

The Fed Can’t Outlaw Math or Recessions

Folks, this is a real perfect storm for which the Fed has fewer and fewer options to resolve. They’ve effectively screwed themselves–and thus many of you as well. Their backs are against the wall … Since Greenspan jumped in bed with Wall Street in 1987 and unleashed his allegedly “magical” twin hammers of rate fixing and money printing, every problem looks like a nail to the Fed.

Unfortunately, one can’t solve a debt problem with these two hammers… A broke and historically debt-soaked country needs to grow its economy and cut its spending. Despite media cheerleading to the contrary, neither is actually happening today, and even if it were, it would be far too little, too late.

No Options Left but Pain

Yep. That arrogant, misguided and overly-relied-upon Federal Reserve cannot just print its way out of the ditch it has dug. Years of buying time on cheap debt and fiat money printing will have its day of reckoning no differently than a hangover follows a night of martini drinking. You just can’t have one without the other. Rising rates, like a raging headache, always put an end to the party. And again: rates will rise.

Just think about it for a second. In the bond market, we are seeing increased bond supply from the Treasury Department and decreased bond demand from the Fed. This means the bond market is putting the real pressure on (and fuel behind) rising rates. Meanwhile, the Fed itself is trying to raise short-term rates, much to the chagrin of Trump and Wall Street.

But despite this chagrin, we know that the Fed has really very few good options left. Powell, for example, knows that markets are inflated, over-heated and poised for a crash—which means poor Main Street—i.e. the US real economy–is about to get gut-punched yet again by Wall Street.

For the Fed to be able to react in the next recession, it will have to be able to lower rates by at least 4% to have any meaningful impact in slowing down a market slide. Unfortunately, the Fed doesn’t even have the playing space to reduce rates by 4%, as the current Fed-Funds rate is only at 2.5%.

That’s why Powell has been walking on egg shells trying to coyly raise rates. But as we all can see, even a measly 25 basis point rate hike (i.e. one quarter of one percent) sends these debt-bloated markets into a tizzy, which is just further evidence of how fragile, debt-burdened and dangerous our post-08 “recovery” really is.

Of course, the other lame trick (or hammer) the Fed has in its pathetic toolbox is to print more money and pivot back from Quantitative Tightening to Quantitative Easing. That, of course, may buy some time, but only at the expense of further inflation. In short, QE is not a long-term solution for a central bank that has taken itself hostage. If money printing truly could solve every fiscal problem, then why not just print a quadrillion dollars and buy every American a new home, car and virtual-reality pair of sunglasses?

Foreign Support?

Other factors which may post-pone, but by no means prevent, the inevitable disaster ahead in the US bond markets is the possibility of large foreign-inflows into US Treasury/bond markets. This would push bond prices up and take some pressure off rising yields and interest rates. After all, America is ironically still perceived as the best horse in the global glue factory as a safe-haven for foreign investors.

We’ll have to wait and see if these in-flows can have any lasting impact on preventing a yield-shock, and hence bond-market-driven rate hike.

In the end, however, the debt forces of a bloated US bond market cannot be avoided any more than gravity forces on a falling apple can be wished away. The world in general (at $247T in debt) and the US in particular (at $70T in debt) have long ago passed the debt Rubicon point of no return. In short, rates will rise and the Piper will have to paid. Rising rates will soon kill the post-08 “recovery” and markets with brutal force. Sadly, this is not “bearish” speculation—it’s basic math and basic history. Full stop.

The Bull S’ers…

And yet we still have sell-side folks like Andy Sieg over at Merrill Lynch declaring we are only 10 years into a 50-year bull market. Man, what is this guy drinking/smoking? A 50-year bull market in the backdrop to the greatest debt levels the US and the world has ever seen?

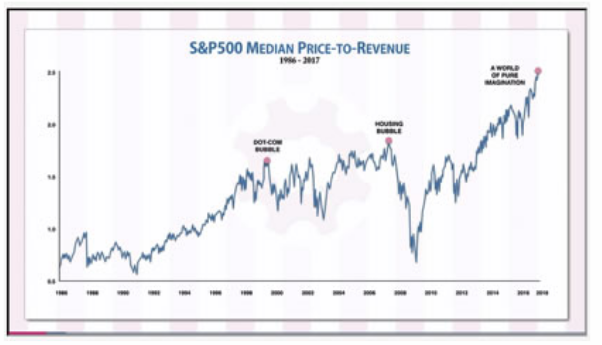

Is he still thinking there’s good value in a stock market where companies like Netflix, Amazon, Facebook and Tesla are seeing tanking free-cash-flow? Does he still think the wisest way to make money in a market is to buy at tops rather than bottoms? Most importantly, has he forgotten the single most important force in all markets throughout time—that is: reversion to the mean? Has he ever paused to consider that today the S&P’s median price to sales ratios are at all-time, empirical highs as to over-valuation?

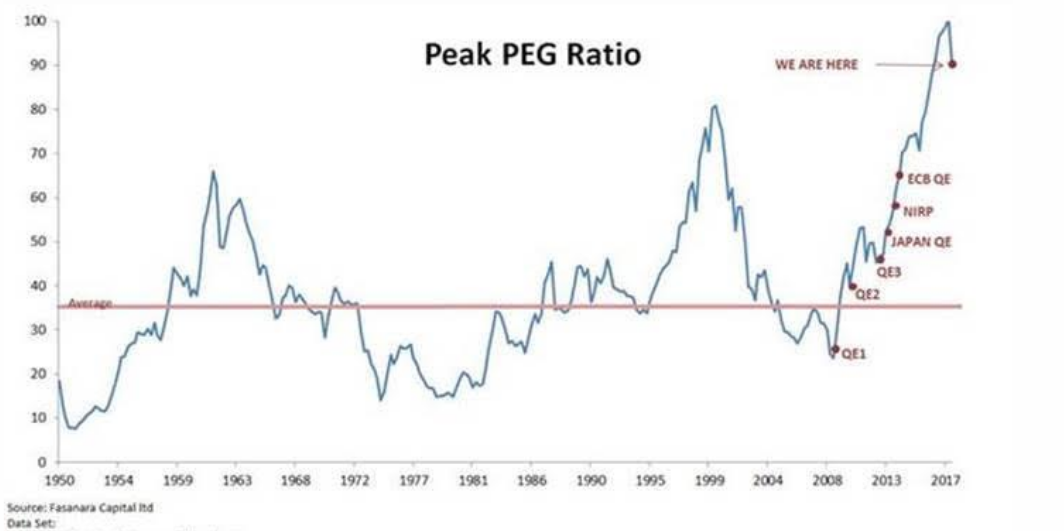

Has he ever paused from his sell-side hope-spinning (and fee-gathering) to take a gander at the S&P’s Price-to-Earnings Growth (PEG) ratio, which recently hit the highest mark of over-valuation in history?

Folks: never, ever, ever BUY at a market high. This, after all, should be common sense.

Sadly, and given the low cash levels of most investors today, that’s precisely what the majority are doing—and have done throughout history: buy in herds at precisely the wrong time.

At Signals Matter, we show you, as best and rationally as anyone can with the right tools, indicators and experience, when and how to get out of the way of overvalued market tops and when and how to get back into safely priced bottoms. It’s the oldest and simplest way to get rich as an investor, and it’s also the most over-looked: buy low, sell high.

And yet, again, no one does this. They say they do, but they actually don’t. In tracking market crashes from the 1929 America to 1989 Japan, from the dot.com 2000 debacle to the sub-prime disaster of 2008, the majority of investors were all fully-long and fully invested right up to, and then over, the market cliff. Like a herd of sheep, they marched right into their own slaughter.

Please, don’t be like everyone else. Don’t be a sheep. The smartest investors never are.