The market zombie and unicorn hunt are back in full swing as stocks flip and flop like a fish on a dock in the backdrop of a global depression—go figure?

If such nonsense had you wringing your hands in a classic FOMO (fear-of-missing-out) moment, just remember: Informed investors play the big picture not the headline crazy. Below, we’ll dive deeper

Making (Bad) Market History

Never in the history of the US stock market have risk assets plunged so quickly (-34%) into a bear market as was seen in the recent market bottom of March 23. And thereafter, history was made again as the S&P saw its best 50-day rise ever recorded.

The National Bureau of Economic Research (NBER) has made it official. We’ve been in a recession all this time, as we’ve suggested here and elsewhere.

The S&P’s V-like surge of 40% on the back of nothing more than massive money printing compliments of a now undeniably spiked Fed punch bowl is yet another moment in market history.

Meanwhile, the US finds itself officially in a recession and staring down the barrel of a list of known disasters (i.e. record-breaking GDP dives, supply chain disruptions, a trade war with China) as well as wide-open questions (will jobs return, the pandemic lessen or lockdowns end or resurface?).

If you’re wringing your hands, bowing your head, or rubbing your eyes, you’re hardly the only one. After all, you are experiencing market history.

In short, as doped markets race to recover old highs, we are seeing what Chris Lowe described as “a bubble in a depression,” which is yet another (bad) historical market signal in a long list of other historical markers.

Of course, watching stocks fall, rise, fall and then rise again in such a depression-oriented backdrop is all the evidence one needs to recognize just how artificial, rigged and totally disconnected these Fed-driven markets are from economic, historical or capitalistic reality, a point we’ve made countless times.

Here are some other historical stock market facts to consider while wringing your hands…

- 22 million Americans have lost their jobs.

- 80 million Americans got a relief check.

- Oil prices tanked to negative levels once thought unthinkable.

- Riots raged across the nation’s largest cities, evidencing the worst social unrest since the 1960s.

- The Covid-19 virus is still amongst us.

- Seattle, WA has a new “country” of unemployed “summer lovers,” according to its mayor…

And yet markets have surged…Again: Go figure?

On the bright side, the US economy is slowly re-opening with dramatic increases in infections or deaths largely contained.

That said, uncertainty as to a redux of the virus remains essentially at 50/50 depending on which health expert gets on TV or in the ears of a policymaker de jour.

Profits and Earnings? What’s That?

What really ought to matter to normal rather than rigged markets is a silly old concept called profits and earnings, an almost distant thought to these totally distorted stock markets.

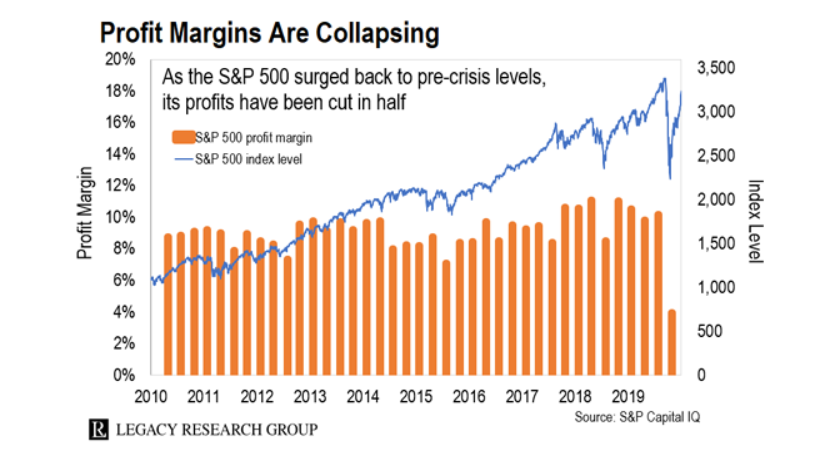

The current spread between the Fed-spiked S&P and actual profits and earnings is staggering, as current profit numbers are now half of what they were at the S&P’s pre-crisis levels as markets(and market zombies) gasp for another high.

The Market Zombies Rise from the Dead

Add to that what Lowe also described as the “zombie rally” in bankrupt stocks, and the hand-wringing continues.

Folks, companies enter bankruptcy precisely because they can’t make a profit—hardly a robust “buy signal,” and yet market zombies like a bankrupt Hertz, that was trading at $20.29/share on February 20, fell 97.3% in 3.2 months to $0.56/share on May 26, only to surge to $5.53 on June 8 after it won approval to offer potentially worthless stock. Go figure.

If you feel bad for missing out on this brilliant Hertz trade, please don’t. Buying stock in bankrupt market zombie companies is a risky business. Bondholders, suppliers and other creditors come first. Hertz pledged to alert potential buyers of a potential wipeout. Crazy.

Meanwhile, JC Penny, another member of the bankruptcy club of market zombies, trading at $10-$11/share back in early 2016, is now on life support, a penny stock priced at $0.32/share. Does JC Penny really need to exist? Another bailout?

Then there’s my old and not-so-favorite oil company, Whiting Petroleum, the market zombie with crude on its face, which traded at $17.68 a year ago on July 31, hit its bust moment on April 3rd of this year falling to $0.29/share, yet surged over 1,000% on June 8 thanks to little, shall we say, “bond support” from the DC.

Such market zombie exuberance in the backdrop of a fundamentally bad market reminds me a lot of my first days as a lucky (and yes, stupidly lucky) hedge fund manager in the late 90’s dot.com bubble or the pre-08 days of weird (see my “prophetic” video), a time in which valuations didn’t matter at all—everyone just piled into a pile of stupid and made big returns…

…until they got crushed a few months later.

Market Unicorns are Galloping Along Side the Market Zombies

Lowe further reminds investors of the current electronic vehicle (EV) craze which smells a lot like those dot.com days of yore, as current EV bubble valuations for names like Nicola wreak of a high followed by a bigger low to follow…

Tread carefully.

Right now, investors are buying these stocks like water in a desert. Nikola, by example, has yet to sell a single truck.

Nevertheless, Nikola’s market value is $28 billion, which is a billion more than Ford, who, by the way, brought in $150 billion in actual sales last year.

Such staggering spreads between reality and fantasy astound me, and yet the market roller-coaster of crazy continues.

Defenders of Nikola will argue it’s all about tomorrow’s growth, not yesterday’s dinosaurs like Ford…

But I’ve seen this movie before.

Investors convince themselves that start-ups are the future and companies that actually produce sales are part of the past—as if anything but the latest batch of tech-sexy is just one big pile of Polaroid or Blockbuster Video stock.

It’s in absurd times like these that investors seeking immediate gratification, go further and further out on the risk branch in search of yield (junk bonds) or return (market zombies and unicorns).

Keeping It Real

As for Signals Matter, we are a portfolio service not a unicorn hunt club or market zombie tracker.

We’ll leave the speculating on market zombies to the speculators and continue to play the real game rather than fantasy league.

Why?

Because given all the rises, falls, hope, insanity and uncertainty out there that I mention here, this is no time for informed investors to be experimenting with market zombies and unicorns unless you truly understand, accept (and can stomach/afford) such highs and lows.

Again, to each his own.

But if you’re an investor rather than a unicorn trader or market zombie poacher, and if you can’t afford to gamble on your future, your retirement, or your portfolio, Tom and I are here to guide you safely through this rigged-to-fail market of a Twilight Zone flirting with ever-increasing danger zones.

All you need to do is Sign Up here. We’ll take care of the rest.

In the interim, the crazy continues…and it’s only Monday.

Sincerely,

Matt and Tom