Below we look at what the Austrian School of Economics might have taught today’s embarrassed hedge fund managers and desperate central bankers–i.e. the “fancy lads.”

By the end of this report, you’ll know more than many of those fancy lads.

The Faux Era of Magical Fed Fairy Dust

In a world awash in $28 trillion worth of central bank “accommodation” and a US credit market essentially bought and paid for by a DC money printer, it’s of little surprise to informed investors that markets no longer trade on fundamentals.

As we’ll see below, a few hedge funds appear to have forgotten this point…

The Fed Is the Buyer of Last Resort

In case you wanted to know just how much the Fed (rather than actual market demand) is now the “buyer” of our bonds, note that the Fed has become a top buyer of the world’s largest ETF’s in just the last 2 months.

The Fed is the 3rd largest holder of the $54 billion iShares iBoxx $ Investment Grade Corporate Bond ETF as of June 16, and is also the second- and fifth-largest holder of the VCSH and VCIT ETF’s, respectively.

As I’ve said so many times here, as well as throughout the chapters of our Amazon No 1 release, Rigged to Fail, these are not securities markets, but “Fed Markets.”

Today, trillions in printed money to “support” otherwise broken (fat) credit markets and stagnate economies (to keep politicians of every stripe in office) are passively accepted by a world of financial sheep.

But we know what happens to sheep.

Nothing a Trillion Here and There Can’t “Solve”?

Trillions mean nothing to the prompt readers who fake the same expression whether talking about Tesla’s earnings or the latest gun violence in Atlanta.

But here’s a little fun fact: If you wanted to count to 1 trillion, it would take you 32,000 years without pausing for a beer, burger, or pillow.

In short, trillions, well…matter. They’ve quietly rendered the market a Ponzi scheme, one driven by abstract trillions that make supply, demand, hard data and economics less and less important—for now.

In many ways, this also means (sadly) that the once-trusted cycles, indicators and risk-valuation tools employed by the fancy lads in the fancy hedge funds just don’t work the way they once did before Alan Greenspan effectively made the Fed the most powerful (and corrupted) indicator on Wall Street…

An Ode to Hedge Funds of Days Past

Tom and I have certainly been around hedge funds, and as in any profession, 20% are worth more than the other 80% combined. In short: The fancy lads might be fancy, but they’re often not that effective.

Why is that?

I’ve got many opinions about hedge funds, and have written about this elsewhere.

From personal experience, I’ve sat before countless hedge fund managers. Many do more “leveraging” than long-short “hedging,” and thus look like heroes when the trend is their friend, but quickly turn to goats when they’re caught over-levered in the wrong direction.

Often, when that “goat moment” happens, the fancy lads have already been made rich off client fees, so their embarrassment is mollified by their enlarged bank account balances.

Folks—hedge funds are mostly about AUM—assets under management—not market guidance.

But even the smart hedge funds, the best in the game, are having a hard time accepting the new Twilight Zone market reality of bad stocks and bonds rising on Fed Fraud despite such silly, arcane signals like nosediving profits & earnings, sinking GDP, tanking employment data, or even an officially declared recession.

This might explain why most hedge funds assumed the markets would tank in April and thus bet against the markets, only to see them spike on Fed steroids.

But aren’t hedge funds supposed to go up when markets go down?

Isn’t that why the rich pay so handsomely to have the fancy lads protect (and “hedge”) them for a 2 and 20 fee structure (Managers take 2% of the invested dollars and 20% of the profits).

Aren’t hedge funds supposed to generate “alpha” (i.e. returns) regardless of market direction?

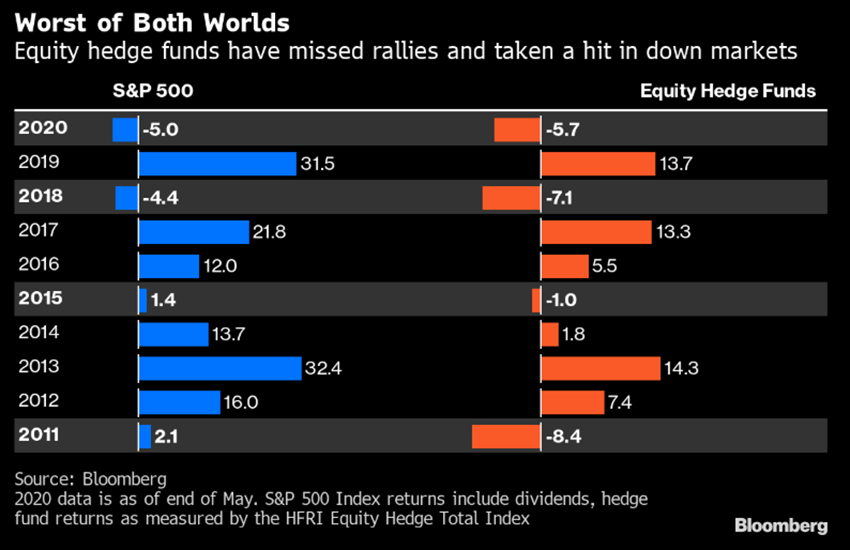

But as the data below confirms, the fancy lads have clearly missed the rallies and taken a hit in the downturns—effectively doing the opposite of what they were designed to do.

When markets tanked in March, 87% of the hedge funds lost money, half of them losing more than 10%.

In all fairness to many of these fund managers, they underestimated the signals in early Q2 and then totally underestimated the power of the Fed mid-to-late Q2.

Why “in all fairness”?

Because many of those fancy lads reasonably assumed that no market could withstand the string-cite of absolutely horrific fundamentals exacerbated by the COVID crisis.

Thus, they naturally used such data to short (bet against) those broken markets.

But broken markets driven by the Fed are dangerous to short, as these fancy lads are now fully realizing.

At Signals Matter, we realized this sad fact long ago, and as we’ve said so many times—”Don’t fight the Fed, but don’t trust it either.”

That’s why we look at so many indicators (and share the same with our Subscribers), including the Fed, to manage risk and neither fully fight nor trust those central bank magical wizards.

And by now you know why.

What the Austrian School Might Have Taught the Fancy Lads

All that magical Fed fairy dust which keeps dead markets breathing has a historical pattern.

As we recently wrote, eventually the end game is horrific, resulting in either a Titanic crash or a long, slow, Japan-like economic stagnation.

But there’s more to it than just that. There’s another end-game in currencies to think about as well…

That’s because $28 trillion in global central bank currency creation (“support”) is indeed fun…until it isn’t.

Sadly, many of the best fund managers still don’t fully embrace this. They try to ignore the “until it isn’t fun” part and seek to outsmart history.

Trained to Ignore Reality

This too is not entirely their fault, as most of the fancy lads were educated at Harvard, Wharton, Chicago, and all those other MBA-factories based upon Keynesian economics rather than Austrian economics.

Indeed, the U.S. has effectively censored Austrian economics from its curriculum.

Why?

In part, this is because magicians are no longer credible when the magic is revealed.

That is, the US “educational” system likes to keep the masses, and even many of those fancy lads in the hedge fund world, under the magical illusion that debt doesn’t matter, as long as a system can print money and outlaw inflation.

But as we who studied Austrian rather than Keynesian economics know, inflation, which is measured by money supply rather than a rigged CPI inflation scale, can’t be outlawed, despite what those clowns/magicians behind MMT would otherwise have the world believe.

Realism Spoils the Magic

The Austrian school, however, is written mostly in German, and Germans have long and realistic memories of what money-supply inflation can do to an economy and people made desperate when that currency-inflated economy breaks apart.

Here in the EU, a German high court is attacking the European Central Bank for printing too much money. In short, a few smart folks are catching on that such a monetary “solution” is effectively madness.

The Austrian school has no time for fantasy. As realists, they focus on history and realpolitik—i.e. hard lessons.

The core of their economic thinking—confirmed throughout history—boils down to the following three stages:

- First, an expansion of the money supply (i.e. money printing today) which leads to a magical (but unsustainable) “buzz;”

- During the “buzz phase,” all assets spike—from stocks and bonds to real estate, art and even celebrity autographs;

- Then comes the consumer price inflation, which hurts like hell when the economy is stagnating and folks have not seen a wage hike (or job) in years.

The Austrian school further reminds us that the bigger the debt party, the bigger the recession that follows.

Given that we are at the tail end of the biggest global debt party in history, the rising recession to come out the current one will be a doozy…

Realists (whether they speak German or not) therefore respect the final 3 stages of any debt-driven bubble, namely the following (and familiar) domino chain:

- First, some event creates a PANIC (think of the recent COVID trigger, zum Beispiel…);

- Then comes the magical “relief rally” (think of the recent Fed and fiscal steroid boost);

- Finally comes the death of currencies diluted by all that printed “relief money”.

When the currencies die, so too does faith in the markets, the market system and the economies built around them.

How It Plays Out

When stage 3 hits, the US and global economies won’t be just facing a financial crisis, but something far more cancerous, namely a monetary crisis—that is: A currency crisis.

In other words, the currencies on which the world operates, will be too weak to rely upon—and this includes the oh-so distorted US dollar, which is more of an international bully (and inflation exporter) than a friend of nations.

As currencies eventually and inevitably weaken, markets will see a “declining marginal utility” in the effects of unlimited QE.

In simple speak, this just means that all that printed money won’t save us anymore.

All Roads Lead to Gold

The subtle debt jubilee playing out right beneath our noses in the form of central bank bond support will end, as will the dollar’s reserve currency status as the global currency system recalibrates itself to a new world currency, one in which gold will have a new role in some manner.

Kurz gesagt: There’s another good reason for informed investors to hold gold as a currency insurance rather than speculative trade.

When will the currency re-set come?

Again, we don’t know. It won’t be this week or the next, but the markets will continue to gyrate until the end-game plays out, and smart investors need to be actively protecting their portfolios before rather than after the rain comes.

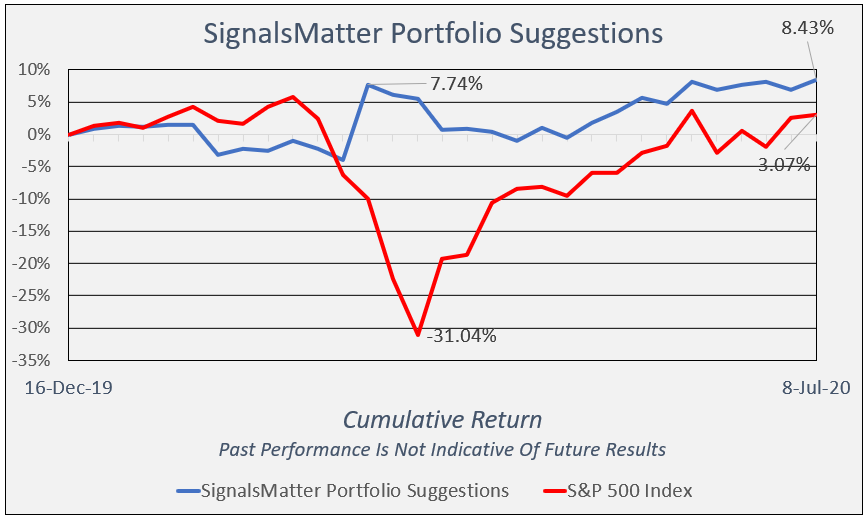

That’s why we are prepared over here at Signals Matter, as we track all kinds of signals to keep us ahead of this distorted curve, and do so better (and far cheaper) for our Subscribers than the fancy lads.

Postponing Creative Destruction—Bad Idea…

Schumpeter reminds students of the Austrian school of economics that “creative destruction” is in fact a necessary part of free markets. When debt gets too high, the system is designed to punish the sin—recessions follow.

That is, when individuals, corporations and nations get too fat on debt and too thin on income (or GDP), they are supposed to “destruct.”

At over 80 trillion in such combined debt (and not including unfunded liabilities like the VA, social security etc), and with tanking GDP below the basement of time, the US is entitled to (and headed for) such an “uh-oh” moment…

Politicians, central bankers and prompt readers, however, don’t like to face or confess such facts (or sins) and thus have tried to outlaw (or at least can-kick) these natural periods of creative destruction.

For a blunt (eye-opening) history of this can-kicking (and economic sinning) in action, just click here.

But by arrogantly postponing such “creative destruction,” all the central bankers have done is make the inevitable destruction ahead infinitely worse than it would have been had we left the markets to Mr. Supply and Mr. Demand rather than to Mr. Powell and Madame Lagarde…

Preacher of Doom?

Am I preacher of doom?

Hopefully not. Just a student of history, economics and blunt speak.

And that is why Tom and I build your portfolios at Signals Matter with one eye on opportunity and the other on risk. Get Started Here to take a peek behind our transparent curtain and monitor how we do this, free for 7-days.

We are a lot more transparent than the Fed.

Ultimately, the results speak for themselves, or as Henry J. Kaiser remarked: “When your work speaks for itself, don’t interrupt.”

Informed investors need to understand the big picture of debt as well as the smaller picture of daily opportunity.

Both pictures matter, and we invest with both in mind and thus outperform the markets, the fancy lads and ultimately the central banks themselves—but we won’t fight them until they are clearly dying.

That day is not here. Not yet. Instead, we face stagnating economies and gyrating markets which few –including the hedge funds—actually know how to trade. Central banks are strong, but again, not to be trusted, as history confirms.

In the interim, trust us to keep you bluntly informed and hence honesty prepared for what lies beneath the current period of magical fairy dust.

Now you know how the magic trick works, so it won’t fool you going forward. Be patient. Be informed. Be risk-averse. Remember: Money is made by a) not losing it and b) buying at bottoms not Fed tops.

Sincerely,

Matt and Tom

Hi Matt and Tom-

Gold certainly makes more and more sense in last 2-3+ years. Especially after watching all the fun and games being played out by Jay Powell in midst of the COVID crisis.

Some quick observations and questions for you.

1) I think CS and others have said historic Swiss model on PM (gold and silver) is to hold 5-15% in ones portfolio depending on storm indicators. With current signals and runaway money printing + FED “credit enhancements” back stopping ETF markets, should we hold more than 15% – and if so how much?

2) How would you think best way to deploy to that level of PM? For instance, if you had 10% PM position today and want to Increase up to 15% – would go buy that extra 5% now, or do something like DCA to allow for fluctuations in price of PM? I know Gold is on a tear and has broken $1,800 level, but if Market crash happens will that pull PM down (short term) before it goes back up – hence the $ cost average approach thought?

3) Why hold physical PM outside of Banking System? Are we thinking the outlaws may try and outlaw PM?

4) Finally, my CEO / Honey Bear (wife) wants to know how she will one day use PM to buy basic stuff, like groceries? Wonders if she will one day pay with PM coinage at Harris-Teeter. Have tried to explain to her that PM can be volatile, but it is real money and has ability to be both a medium of exchange + a store of value.

Hi Richie, all very good questions. Let’s look at them one at a time:

1. The historic Swiss model, which I know well, is generally between 5-15%, and frankly even 20% allocations, as the Swiss have long memories of broken currencies as well as less faith in the financial media/bankers than most Americans–thus they play the long game of common sense and see gold mostly as an insurance policy rather than speculative trade, an approach I strongly share. As to whether you should hold greater than 10-15% given the obvious reasons you pointed to (i.e. central bank over-drive and extreme currency printing), the decision will hinge largely upon your own individual level of gold conviction, which can be very subjective and vary from investor to investor based upon one’s own knowledge of the macros and level of faith (or lack of faith) in monetary “solutions.” Again, highly subjective. Gold can swing temporarily in price, causing lots of stress for those who don’t fully embrace the long-game/big picture. My own opinion is equally subjective, yet backed by genuine conviction and data. 10% is certainly a healthy allocation, and better than most US investor ranges. Another 5% is entirely up to you, and is not, in my opinion, too high, but again, 15% is already a solid commitment.

2. Should you ultimately decide to make another precious metal (PM) commitment of 5%, the price timing question is a fair one. Yes, gold can re-trace for any number of reasons, even significantly, especially during an equity drawdown when gold is sold off to cover other portfolio losses in risk assets, potentially sending its price lower. Those are obviously opportune moments to buy a gold “dip” to make a purchase. That said, timing and predicting is always a gamble, especially in the PM space. No one can know if gold will retrace significantly from here or simply keep trending up in this post COVID new abnormal, and thus waiting for a dip could cause some anxiety. My view is subjective but blunt: I don’t worry about the entry price for gold if my aim is to hold it as a currency hedge/insurance on a currency house that is already burning. In short, gold is not as much a matter of entry and exit price (to me) as it is an antidote to a globally broken currency system whose risks are largely (and I’d say deliberately) ignored by the press, politico’s and banks.

3. The banking system is fractured, so holding gold within banks is itself a fractured plan from day 1. Despite brochures to the contrary, gold held in banks is never directly owned by the investor, but rather co-mingled into non-segregated, unallocated accounts in which the gold investor is ultimately just a lien-holder rather than owner of his/her gold, standing in line behind any priority creditors to the bank itself. In short: lots of intermediary/counter-party risk. If one is thus buying gold due to a distrust in the overall financial system, owning and storing gold within that very system strikes an immediate note of irony, no?

4. Your CEO Mrs. H. Bear makes an excellent point. Lugging a 100 oz bar of gold around to buy basic goods is anything but practical. Smaller coins are easier for such uses–but still not ideal in such a backdrop. However, if you hold a sizable amount of gold in a private vault in the right jurisdictions with an affiliated broker, one can always broker smaller sales of the gold holdings into any currency at the the then-current price to make those Harris-Teeter purchases on an as-needed basis. IN that way, you’ll always get “liquidity” at the highest available prices without having to fully liquidate your PM holdings or carry gold bars/coins precariously in the glove box.

Hi guys, I agree with almost everything that you say. However, I have a real problem in that I have three jobs and just do not have enough time to do what is necessary to follow your recommendations to the letter. I invest in funds rather than ETFs. As you know far better than I do, these look at things with a longer perspective. So, how do I choose funds which do not need to follow your almost daily/weekly trading whilst being able to follow your ethos?

Hi Graham,

Although we update our portfolio frequently for precise active management, those with less time to do this (i.e. those working three jobs) can generally follow our cash, sector and ETF recommendations without a great deal of changing allocations daily or weekly, as the core of the portfolio remains consistent for many weeks at a time, failing a sudden and obvious signal to the contrary. That said, we fully appreciate your situation. By investing in funds, we’re assuming you’re talking about mutual funds, correct? We really don’t advise on which funds to select, as that is effectively selecting other fund managers, and our experience has been that those managers/funds once in the top quartile of Morning Star ratings are usually at the bottom quartile within a year or so. In short, they bounce about in performance and we can’t make a recommendation as to which funds are optimal. For conservative/risk conscious funds focusing on short-term government bonds/TIPs etc, such funds would at least be “safer” but the reality is we just don’t track or follow other mutual funds with any real attention, as we (subjectively, of course) feel our system is far better, although as you pointed out, requires more time and attention than you can give under your schedule. If you’d like, give us a call and we can walk you through our portfolio process and see if there is a way it can be executed with less daily attention given your situation.

Thanks for the replies back above.

Good feedback and advise.

Beside the price volatility aspect, the other struggle with physical PM is of course the storage aspect – where to keep it (if not at home under the mattress or in mason jars, or in your treasure chest at the bottom of Lake Michigan – LoL) with folks that you know possess and consistently practice a VERY high level of integrity. The organizations where you would park it. Am guessing MAM and a few others would fall into a high trust category – or is a standard safe deposit box at a bank OK? For sat smaller amounts?

Those concerns are real, as we live in a very corrupt culture today, where integrity itself is fast becoming a precious commodity.

Regardless – greatly appreciate the counsel – both the candor and integrity that comes through in what you and Tom say in your replies.

Have a great weekend!

Thanks Richie–yes, storage is a legitimate concern. My feelings about Matterhorn Asset Management are obviously biased, but for good reason: I know, trust and share the integrity and vision of its founder. Quite simply, Egon von Greyerz has built what I consider the best vaulting and service solution for PM in the world, and has gained this reputation for a reason–he has focused for decades on service not marketing, and has an exceptional respect for the same concerns we all share as well as a PM knowledge that he has earned and demonstrated in his straight-forward reports. PM is simply the natural evolution for all of us who understand the limitations and challenges which risk assets face as monetary policy has gone from “temporarily needed” to “temporary insanity.” Currency risk in no longer a debatable matter, but a undeniable fact. For those who consider wealth preservation a top priority, PM is effectively, well…a no-brainer.

Obviously, not everyone can afford Swiss vaulting, but there are many options for all income levels that are perhaps a bit better than the bottom of Lake Michigan, despite my love for its sunsets 🙂 For smaller amounts, safe deposit boxes are certainly preferable to mason jars or mattresses.

As for integrity, agreed, it’s critical, and not something that can be advertised but earned. The proof is always in the service and knowledge not in an ad campaign. Thanks again for the kind words.

Hi Matt and Tom,

Thank you very much, especially for this one. I have been very grateful for your consistently high content and highly informative writings. But this one in particular, at least to me, provides the most fully packed and yet highly succinct explanation of all of the most important points about our past, present and future situation regarding what to expect, and then how to rationally use that information to sanely invest our hard earned and hard saved capital, during these times when sanity has largely “left the building”.

This particular piece has served to bring me a much greater sense of a relaxed clarity, yet without diminishing the importance of continuing to remain attentive and vigilant.

I consider my prior questions to be fully answered, and I very highly appreciate your great efforts in doing so!

Please keep up the great works!

Thanks again and best,

GG

Thanks for the kind words Gary. Glad the piece, and its internal links, helped put things into one clear “package” for you–and addressed your very important and widely shared concerns. Indeed, sanity has left the building, but that can’t stop the rest of us from sharing our thoughts and insights. So true: Vigilance now is absolutely essential.