Market questions are often far more important than simple answers. We respect good market questions. Voltaire remarked that questions say more than answers. Je suis d’accord.

As Tom and I bury our heads in market signals, we enjoy coming up for air and reading correspondence and market questions form our readers and subscribers, which are always extremely thoughtful as well as thought-provoking.

Recently, GG sent us a detailed set of market questions that we feel all investors could benefit from, and which we address below.

As a subscriber, GG benefits from our back-end data, which is far more detailed and portfolio-focused than the free content of our public market reports.

If you’d like a look at the back-end portal, it’s free for the first 7-days. You can Sign Up Here.

That said, GG fully grasps the themes we open to all readers, namely the odd balance of neither fully-trusting nor fully-fighting the Fed.

In this admittedly ironic backdrop, a primary question we often receive, is quite simply this: What is the end-game in all this central bank driven support and how does one prepare/position one’s portfolio?

Subscriber Market Questions—Getting More Juice?

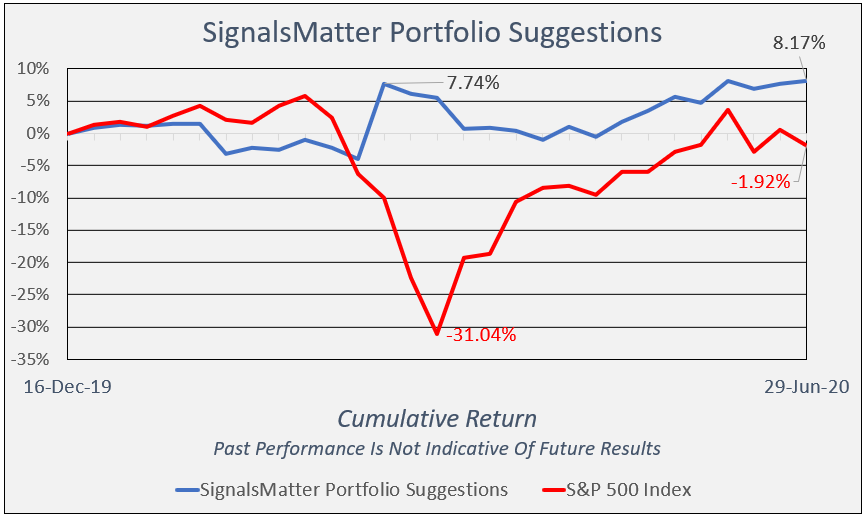

For our subscribers like GG, I feel we answer the portfolio questions each passing day, as we update risk-adjusted allocation suggestions which have kept our subscribers well out of danger and well into the green regardless of our fickle Fed and precarious macro reality.

As far as getting more “juice” from the markets during the current, and long-standing battle between horrific economic fundamentals and a trigger-happy Fed money printer, we feel that those seeking more reward will have to accept more risk, and in the end, that is a personal question.

Subscribers can take any of our recommendations on the back-end and over-allocate for more return, but we don’t personally recommend such an approach unless one can afford the added risk, which we manage through position-sizing.

Boring but Effective…Then Comes the Fun

Our view is always the same: 1) make money by not losing it 2) patiently wait for this rigged to fail market to crash (not “dip”), and then 3) buy at a mean-reverted bottom, not a Fed-doped top.

As to each of these three steps, we bluntly signal subscribers along the way as to precisely what to do and when, and we do this well, as we’ve been doing it for over 5-combined decades.

We created Signals Matter on our own dime without a marketing budget to compete with the wealth management arms of our alma maters at the big banks and hedge funds for one simple reason: We want all investor and income types to get better service, effective market updates, and blunt advice.

Our motives are just that simple and that genuine. The real fun will come when this postponed market crash one day bottoms and those who were patient and smart get the last laugh.

When Will Karma Hit the Fat Cats?

GG gets this, but naturally wants to know just when this brazenly rigged market of over-levered insiders and top-chasing Fed front-runners will get their wings clipped in a moment of hubris-crushing reality?

In short: When will natural forces replace bogus forces—i.e. when will “Fed faking it” end and natural price discovery return?

This is a seminal question. We have addressed it in many direct and indirect ways here, here, and here, but the bottom line is this: We don’t know.

Why?

Because: a) no one does and b) we’ve never seen distortion at such levels.

We’ve never seen such a concurrence of unlimited QE, total yield-curve controls, a completely busted repo market and Fed Fraud taken to such astronomical levels in which our central bank is buying bond ETF’s while the Ken and Barbie media whistles right past grotesque debt realities and transparent blunt-speak.

“How” More Important than “When”

As for how it ends, rather than when it ends, we can say this much: It ends when the debt time bomb ticking behind the DC and Wall Street curtain can no longer be “extended and pretended” away—i.e. when rates rise or some black swan sends this fragile market one day to its knees.

For now, the Fed can attempt printing every problem away for possibly years to come.

MMT is no longer a stupid theory, but now a stupid reality. This buys time at best, but not miracles. Nor does it prevent volatility, which we manage quite well for our subscribers.

Perhaps most importantly, and in terms of long-term thinking, we also know that the money printer is now the final trick left up the sleeves of increasingly discredited and desperate central banks.

Again, with Gold…

To us, money printing is a cancer that slowly sickens, and finally kills currencies as the deflation to inflation cycle slowly plays out.

The purchasing power of every global currency is weakening daily which each fiat dollar created, and the return of every major exchange cannot solve for this, but precious metals can, and they have out-performed the major exchanges for years.

After all, what good is a million dollars today if it can’t buy as much tomorrow?

We are not gold bugs, but we are realists. Our sober analysis of gold here, here and here are definitely worth re-reading for subscribers like GG and other investors asking the same sane questions.

Silver, btw, is also about to break glass ceilings, as we posted for subscribers this Tuesday. (Charts like Pattern Watch are posted each and every day on the back-end of www.SignalsMatter.com, with our own commentary.)

Remember as well: Precious metals are not about price appreciation for us—they are about hedging against (i.e. insuring for) the currency risk that is now undeniably obvious and only positioned to get worse (and currencies weaker vs precious metals) with each passing (and panicked) reversion to money printing.

Abandon Common Sense?

GG also asked that with such monetary printing forces at play in the world today, is it “now high time for us to at least strongly question our quaint old common-sense beliefs to figure out the best way forward for prospering out of the manipulation mayhem which now seems to be virtually impossible to stop?”

My response is again simple and blunt; 1) Don’t ever abandon common sense; 2) there’s no way to beat the manipulative Fed, but there’s also no point in going down with its ship—whenever that day comes, and 3) natural forces will STOP the central bankers—they always do.

Again, we are agnostic as to the timing and concerned only with the signals and facts we trace each day, and they are definitely informing the portfolio’s and cash hedges we apply, which incidentally, have beat the market through the first half of 2020 hands down, without being down a whopping 31% during the journey. Sign Up for full portfolio access here, free for 7-days.

Market Questions—Scenarios Ahead

One scenario going forward is a long, slow Japan-like stagnation as the Fed prints and buys painful time while Main Street rots from within, and the real economy thinks of GDP with the same fond memory one thinks of Polaroid cameras or drive-in movie theaters.

The other scenario is just one big Titanic moment, where the weight of the debt, here and globally, simply sends markets tanking in a matter of weeks or days—often triggered by some kind of unforeseen event like a war, virus, or political disaster.

Moral Hazard Rewarded—For Now

GG, however, specifically asked about one set of market questions likely on a lot of minds, I quote him in part below,

“If the elected/appointed officials and their cronies now have no option to maintain their positions, power and personal prosperity (no matter how ill-gotten), except to “print” more and more USD. It will not stop until such time as price inflation takes hold and becomes so rapid, that the friction and drag that it imposes on the real economy becomes untenable.

While the safest plays in such a scenario would most likely be gold and bitcoin, do they really represent the best opportunities for growing a portfolio?”

Well GG, I think you know my position on gold from above, so yes, I feel it is definitely worth considering as common sense insurance on a “global currency house” that is already on fire.

GG also wrote that the “phrase that keeps ringing in my head is ‘moral hazard.’ It seems that the less principled but perhaps more practical majority around us, are comfortably soaking in the warmth and comfort of the current vast ocean of moral hazard, all while the magic fountains are turning that ocean water into wine and vast fortunes.”

Well GG, again, I couldn’t agree more with you. The so called “elites” are indeed just anti-heroes of the highest order.

The embarrassing wealth gap in the US is now historical in its dis-proportion as I’ve written about here and here, and spoken about here.

The fact that 3 American billionaires now have more wealth than half the US population is not a sign of healthy capitalism, which is dead, but more a sign of psychopathy, and reminds me of the kind of decadence seen in France just before that entire system imploded from within in the 1790’s.

Toward that end GG, please read here.

If You Can’t Beat Em, Join Em?

But GG reasonably asked the next set of market questions, namely, should he consider the possibility “that if we can’t beat ‘em, perhaps we should just join ‘em,” all the while confessing that those are “words of capitulation that are most often heard just before the biggest sea changes in markets.”

And as GG further inquired as to market questions:

“What if this party is just now getting started in earnest, and has far further to run? What if the end only arrives when price inflation and dollar depreciation become so rapid that the dollar loses its position as the primary world reserve currency, and with that end being long-delayed and kept at bay by a multi-trillion-dollar short position in Eurodollars???

What if in the meanwhile, the Feds (via both fiscal and monetary interventions) are still able to virtually eliminate the usual negative effects of the current and looming recession(s)?

Would it then be prudent to join in with the revelers for now, while staying near the back door to make a quick exit when the inflation cops (in the form of the dollar death spiral) finally come?

If so, then would our best party attire be to cover ourselves in of all of the notes of all of the borrowings and credit that we are able to muster to acquire and leverage hard assets that will likely rise dramatically (at least in nominal terms) as inflation rises and the dollar declines?

And if so, since the most easy and highly leveraged hard asset is residential real estate, would we be well advised to throw all caution to the wind and use as much leverage as we can find to gain as much exposure as possible to that particular asset class?

I noticed in your most recent article about residential real estate, that you brought up the crucial aspect of affordability, which (especially in these pandemic times of record unemployment) would logically indicate that prices should now be closer to a peak. A key point well-taken!

But what if excess unemployment benefits are extended indefinitely? What if basic universal income arrives to keep every household afloat at its previously accustomed standard of living? And finally, (gasp) what if negative interest rates were to come to the mortgage market?

Yes, up until March 2020, those crazy what-ifs posed immediately above would have been quickly dismissed as pure insanity, and rightly so!

But now in July 2020, may they well merit our very sober and most serious consideration as possibly having actually become the most likely scenarios?

Should we then also seriously consider deploying some of our recession-protection cash into INVH as opposed to BIL?

Would very much appreciate hearing your most wise and articulate thoughts on all of that.”

Again—all excellent market questions.

GG, each of the foregoing examples of insanity are indeed possible.

Like I’ve said, elsewhere, the dumb has gotten so much dumber. This extended debt party can postpone a hangover longer than anything Tom and I ever studied in school or traded in real-time.

The historic struggle between risk, uncertainty and fantasy is a minefield of unknowns today. In short: We feel your pain.

Certainly, real-estate, farmland and other hard asset commodities will make sense once the crap hits the fan and inflation (currently postponed by blatant lies as well dollar demand in the repo and Euro Dollar markets) rears its ugly head.

But as you’ve noted, the “when” is much harder to gauge than the inevitable “if” during this last hurrah of central bank over-kill.

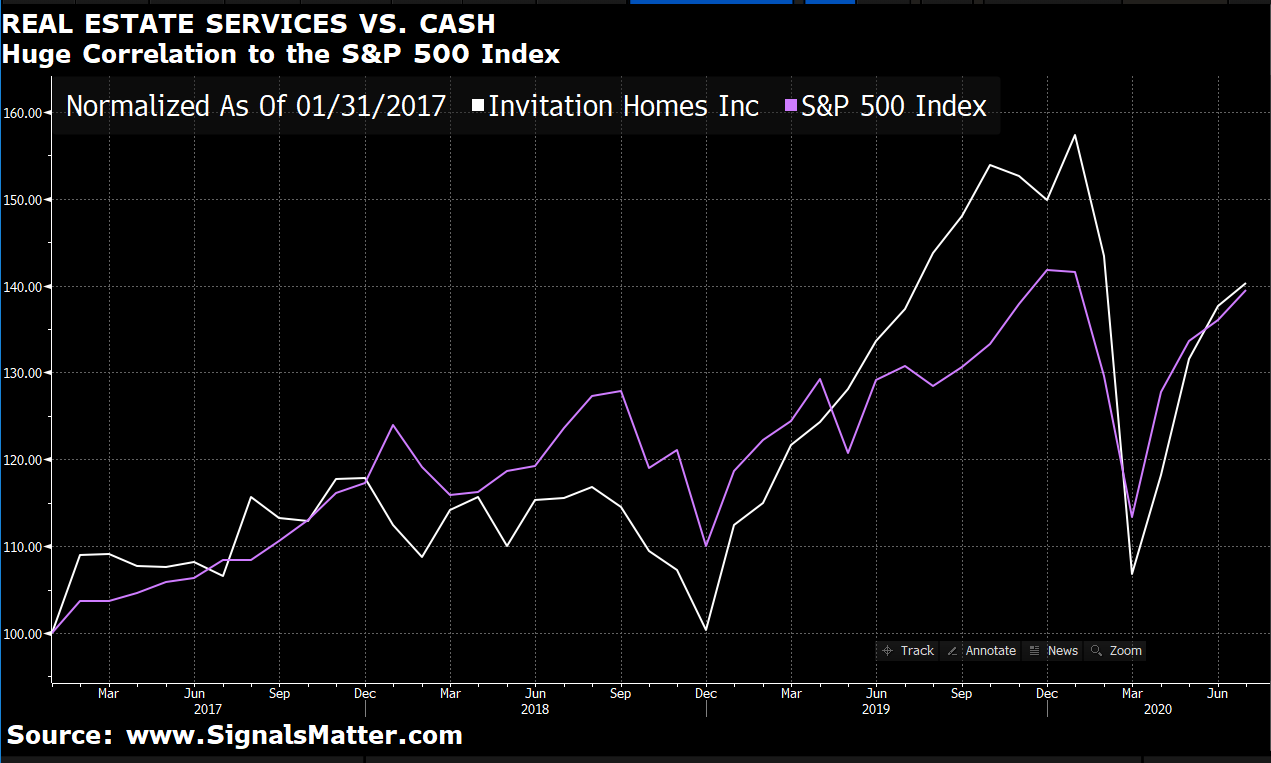

As for INVH (Invitation Homes Inc, a real estate services company that operates single-family rentals/acquisitions) vs. BIL (Bloomberg Barclay’s 1-3 Month T-Bill ETF cash equivalent ), we think the risk doesn’t warrant the reward for a number of reasons.

Housing and companies that service them, like stocks, are cyclical, and though the Fed has seemingly killed cycles, it hasn’t outlawed them.

The correlation INVH has to the S&P 500 Index is simply too scary for us to fully put our recommendation behind.

As you might expect, GG, our most honest answer to each of your extremely thoughtful and important market questions simply boils down to how we actively manage risk and portfolios based on what we know now—and even what’s ahead.

Stick to Signals—They Matter

The problem is that “what’s ahead” is extremely bad—so bad in fact that the Fed will fight it with everything it can print—which means we are all in this together as to precise timing.

Timing involves uncertainty, which no one can trade confidently—only with good luck or bad luck, and we leave luck to the speculators and gamblers, not long-term portfolio investors.

Any service that claims it can perfectly time an end-game is the wrong service. And people who say they will hit the exit door just in time almost never do, for the never see the signals.

That said, we can at least see it coming once the signals so inform us. We track the near-term quite well, and see the long-term end game even better—but timing that end game right now is for psychics, which we are not.

What we can predict is that our portfolio will keep you safe until the end-game is obvious, and then signal a generational opportunity to buy at a bottom when the Fed runs out of fairy dust and the gamblers are bowing their heads.

To your excellent point, however, that fairy dust is strong, and the dumb today is even dumber/stronger.

All that honest and informed investors can do—and it’s harder than it sounds—is be patient, be smart and stay out of harm’s way, as there is more harm than opportunity ahead, which means actively managed portfolios are a must.

Our service is designed to avoid the harm and wait for the opportunity. We’ve done well so far, and can only promise to do our best again tomorrow.

Matt and Tom

Gentlemen,

Thank you very much for your thoughtful analysis, sober judgements and kind answers. I will be looking forward with great anticipation to capitalizing upon (of course with your continued guidance in Signals Matter) the “generational buying opportunity” that will be due to arrive after the house of cards finally falls, when the Feds finally run out of their “fairy dust”.

Best,

GG