Below we look at COVID fatigue, economic fatigue, rising markets and the Titanic’s dinner menu.

COVID Fatigue…

Traveling amidst temperature checks, painful COVID tests, masked strangers, angry fliers and just an overall sense of “ugh,” I’ve been thinking back to simpler times when airports used to be kind of exciting.

But the world has bigger problems than my travel reflections, and I’ll spare you the almost comical highlights of my latest dodge-ball-like dances of international travel and get to things, well… economic.

All of us, whether in an airport, a commuter train, home lockdown or a seating-restricted café from Paris to Battery Park are suffering from some form of “COVID Fatigue.”

The recent news of possible (and effective) vaccines emanating from places like Pfizer have certainly been welcome to most, including the markets.

But markets, as most of us now fully accept, rise and fall on Fed action and telegraphed hope, not sound balance sheets, deep value, sane PE multiples, healthy bond yields or even basic economic strength.

A trusted vaccine, however, would be nice for our collective COVID fatigue. We all need a break from the daily media hysteria, policy restrictions and macabre infection numbers.

Unfortunately, however, there’s no immediate cure for the economic damage already done by the questionable (and legitimately debatable) COVID policy reactions.

In Paris, a popular slogan is “Protect the minority, free the majority!”

That is, there is a growing sense that shutting down economic borders and private liberties in the name of a virus whose survival rate is greater than 98% makes less and less sense as the world goes more and more into a recession.

I personally believe there are much better ways to navigate COVID, but that’s just an opinion not an analysis.

Again, this is a touchy topic and I’m hardly an expert, but we can all agree to some version of, alas: COVID fatigue.

Economic Fatigue

The Economic fatigue unleashed by COVID, however, is less debatable and far easier to quantify.

GDP is down 10%, and not returning to anything resembling “normal” for quite some time, with or without a credible vaccine.

And as for economic strength, that’s a stretch for even the most optimistic forecasters to promote.

Here’s what we now know in the U.S.:

- 20% of small businesses are closed.

- Chain stores have closed 47,000 locations.

- Small business revenues were down nearly 50% by late October.

- New restrictions in various states are about to make these figures worse.

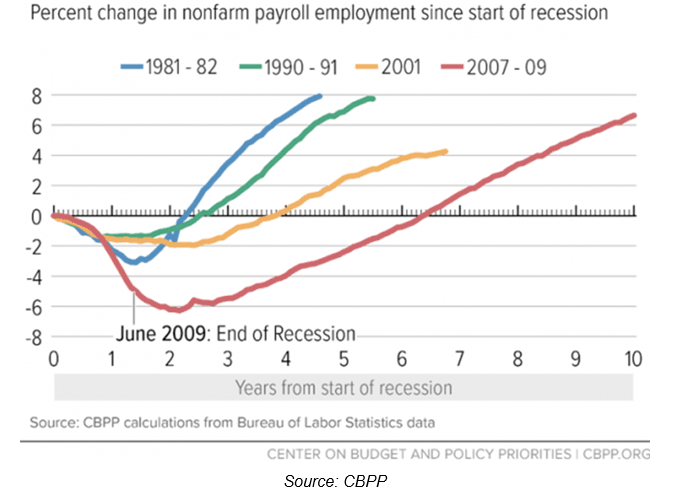

This chart, which I stole from a recent report from John Mauldin, offers a healthy bit of visual perspective as well:

In short, it’s unrealistic to expect any kind of “return to normal,” even if COVID were to vanish this afternoon. Those jobs above, and elsewhere, are gone.

The economic damage, again, has already been done.

Returning to What “Normal”?

Furthermore, I have no idea what “normal” even means anymore, as our Twilight Zone, Fed-supported “reality” was never even close to “normal” pre–Covid, and our economy was already sick well before the first Coronavirus headline made it to our inboxes.

The current recession in which we find ourselves is much worse in terms of its impact on jobs (and sanity) than prior ones.

This means the climb out of it will take longer than prior recessions, despite the massive government aid programs and care packages inspired by COVID.

Sadly, even the massive (and fully deficit-financed) stimulus aid has not prevented hundreds of companies from failing.

$525 billion has been allocated to over 5 million companies since April, but many of the big names on that stimulus list are heading for Chapter 11.

A recent Bloomberg report from Shane Shifflett confirms that 300 companies employing over 23,000 workers who received some of the largest amount of PPP loans (totaling upwards of $500 billion) have failed.

The hospitality and travel industries, of course, have been hardest hit.

Restaurants and hotels that filed for bankruptcy in recent weeks employed over 6,600 workers, all of whom are out of a job as of this writing.

The number of other companies failing is likely to be far higher, and their PPP repayments (likely to be no better than 5 cents on the dollar) will simply never get back to the SBA, whose inspector general is now reporting massive abuses by other borrowers and many cases of outright borrower fraud during the rapid underwriting policies earlier in the year.

In short, that stimulus money is gone and never coming back, adding more public debt to an already debt-soaked U.S. government.

Back in May, I discussed what a post-COVID world would look like here, and offered a few scenarios in terms of U, V and L-shaped recoveries.

As you might have guessed, I wasn’t too optimistic then about the economy and am no less so today.

But turning from the economy to the markets, the surreal disconnect just continues.

Markets Don’t Need Normal—They Just Need Uncle Fed

Sadly, in the open Fed-fraud now masquerading as free-market capitalism, the stock market has nothing at all to do with any of the economic realities outlined in that May report or in any of the data cited above.

Instead, and as I indicated in this November video here, or in my recent Zero Hedge piece, here, the madness of rising markets and tanking economies can continue despite the debt and bankruptcy cannon balls tied to the ankles of our crawling economy.

The bubbleheads, spin-sellers, and sell-side/fee-gatherer’s on Wall Street will continue to pitch vaccine-based growth narratives as well technological miracle moves to keep markets rising, and rise they will.

But if you think “tech” will save the markets longer-term, I addressed this fantasy in the following video, here.

Later this week, moreover, I’ll do a report specifically on the tech sector.

Headlines, in short, can send already over-priced risk assets even higher, and vaccines make for just such headlines.

The S&P could easily hit 3600 by year end.

Nothing would surprise us less. But then again, we invest on facts, not surprises, and need to focus on facts and preparation not hope and hype.

Most importantly, the Fed’s continued and insane “stimulus” tool of unlimited QE will be the real reason stocks and bonds will continue to defy gravity, rising higher and higher–until they collapse under their own weight upon a rotten foundation of unsustainable debt.

Such rot beneath the wings of this artificial market is made abundantly clear (yet continuously ignored) by the graph below.

The fact that Zombie firms (those with more debt than revenues who survive exclusively by rolling over old debt with new debt) are now sitting upon over $1.4 trillion in debt that will never get paid is horrific.

The Market’s Day of Reckoning—Does It Matter If It’s a Tuesday or Friday?

Everyone, of course, wants to know when this collapse will happen.

It’s a normal question.

But it’s the wrong question—akin to asking whether one should order lamb or duck on the last night of the Titanic rather than asking about that large iceberg approaching off the bow.

That is, informed, long-term investors need to be thinking about risk, not dinner or dessert, lamb or duck.

When (not if) the debt iceberg hits our artificial market bow is not nearly as relevant as the far more important question of whether you have a lifeboat available in the inevitable collision with reality.

I addressed this timing issue in far more detail here.

Preparation, in short, is a far more realistic endeavor than market timing, as no one can ever truly time something as vague as human behavior and the market fantasies it chases.

What We Do Know

Debt-based bubbles, however, always pop—that much we can know.

So, again, the real question is this: Do you have a lifeboat prepared for when the market Titanic hits the debt iceberg ahead?

At Signals Matter, we build portfolio’s which sail when the Fed is providing tailwinds yet which also come with lifeboat-like protections built into their allocations.

Toward that end, we will not chase tops or always beat the S&P (a horrifying benchmark, btw), but we will never find ourselves shivering in the market Atlantic whispering “come back” to our drowning portfolio.

For more on how we build such safe portfolios to navigate uncharted waters riddled with debt icebergs, simply click here and learn more.

Best,

Matt & Tom