Below, we look at conditions in the EU economy and ask if things are better there than in the US. For those investors looking for a fat pitch and yet another reason to consider precious metals, read further…

The COVID Response—Better Over There?

Not too long ago it seemed that the Coronavirus was a “China thing” that had become an “Italian thing,” and then later a “European thing.”

Back in the US, the first chapters of this pandemic in early 2020 seemed far away and frankly wasn’t taken seriously enough.

America seemed poised to enjoy its own version of “splendid isolation” as COVID was hoped to be someone else’s problem.

By now, however, no one needs reminding of the recent U.S. COVID headline-data or images of freezers in the South and West to store virus victims. Today, and due to COVID “data,” there’s a literal travel ban on Americans. Unless you have a Visa or EU Passport, Europe simply won’t let you in, not even to visit the graves at Normandy…

In short: It’s crazy out there.

Alas, COVID has more than found our shores, unleashing a confused policy reaction and debatable shut-down which was financial suicide for the real economy but understandably humanitarian in its necessity and an absolute market-respirator for an otherwise dead credit market.

The Viral Costs

To backstop (i.e. pay for) this economic carnage, US government debt to date has risen to $27 Trillion and the Fed’s balance sheet of printed fairy-dust fiat dollars is now at $7 trillion and climbing. Such numbers seem to mean nothing anymore. Trillion here, trillion there. They are effectively just aberrations.

Speaking of numbers…In the States, 30 million folks are collecting unemployment benefits, which adds up to $72 billion per month, on top $216 billion already disbursed as companies like Apple and Google enjoy PPP benefits.

According to the University of Chicago, 68% of those receiving government benefits today are making more than they did before the relief program started.

Such factors have an obvious plus side for those truly impacted by the Virus (unlike, say Harvard University), but they also have a subtle way of killing the incentive for a work ethic, a phenomenon the French know all too well—and which I’ve seen first-hand, even from an annoyingly smug horse-back view.

In the EU, many make more money by deliberately NOT working while others work each day to pay for them. America is joining this trend.

Such spending, resignation and debt, of course, and for all the reasons touched upon here, here and elsewhere, is simply not a sustainable solution. Things, alas, are not looking good for the U.S. economy, regardless of what the “markets” say—as the markets are NOT the economy.

Now, we’ve even got Ray Dalio predicting the greatest depression ever as America, once thought to be the best horse in the global glue factory, is currently on its knees.

But as for horses, the one I rode last weekend with 8-Goaler Stephane Macaire in Medoc, France seemed a lot healthier than the future of the U.S.

After a little bit of stick-n-ball, we got to talking about the ironic fall of the U.S. vis-à-vis the rest of the Euro Zone, which up until early this year, was not on my list of “good news” scenarios.

But oh, how the times have changed. America is no longer the fastest horse on the pitch.

Who Needs Productivity?

As we noted last week, US GDP for Q2 tanked by grater than 30%, which ought to make the nation’s collective jaw drop to the floor, but for a doped stock and bond market now totally supported by a Fed money printer, causing markets to openly defy every single principal of genuine capitalism and free-market price discovery.

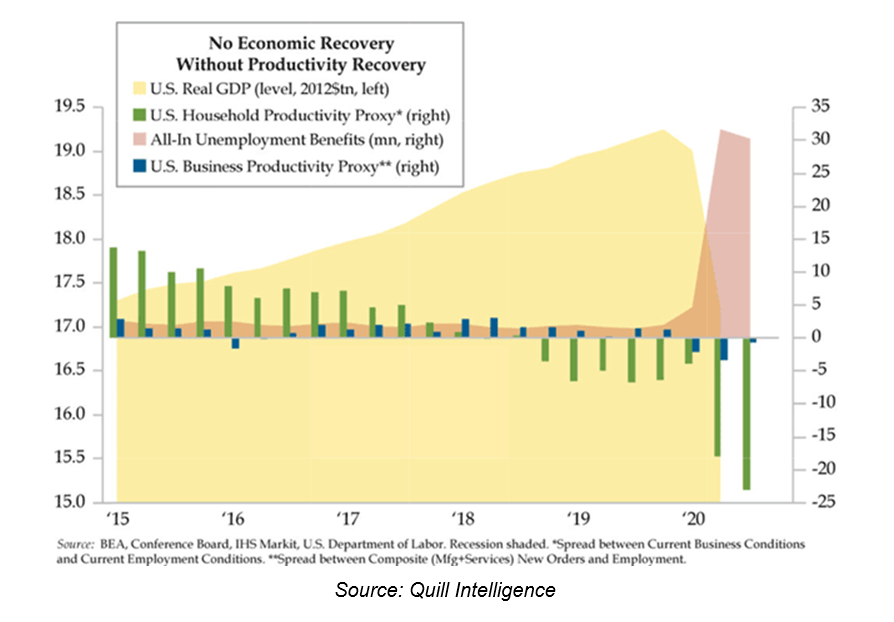

In case you think I’m just bashing my country with an annoying French twist, just consider this graph below on cratering US productivity, which, I’ll remind non-econ majors, is the only real way (as opposed to money printing and debt binges) to achieve a genuine economic recovery:

In the meantime, and despite such horrific real data, the stock market trots along at a comfortable cantor and is simply no longer a market, but a nationalized 401K program managed by Powell and the US Treasury Dept.

But the US is not alone in pretending that debt can solve a debt crisis or that a money printer can solve any crisis. To keep its GDP even at 2%, China has resorted to a full-on orgy of debt.

But as for the US, the powers that be and the media bobbleheads will try to twist such horrors into positives and focus investor attention (and gullibility) on “recovery” metrics which track data quarter by quarter (rather than genuine context) to keep people’s eyes off the big picture of just absolute disaster.

An American in Medoc—Will the EU Buy More Time?

Here’s what I told Stephane Macaire in France about my economy back in the US.

First, it will take years not quarters for the US economy to “recover.” Once again, I pointed to the horse droppings on the field behind us and said that’s what a debt-crisis funded by more debt looks like.

I told him that over 100,000 small businesses will be closed by year-end, and some big one’s too—but not before their CIO’s cash-out with some fat bonuses (and more money to buy polo ponies?)

Here in Europe, things are almost as bad, but not quite so grotesque.

After 2000 years of killing each other, the European decision to create a common Union sure seemed like a good idea when it started in 1999, both politically and economically.

But in my opinion, the cultural differences remain, and countries like Germany, driven in my own (German-American) opinion by war-guilt, are nevertheless slowly tiring of paying the debts (i.e. bonds) of debt-soaked countries like Spain and Italy.

Trying to sustain a common currency (the Euro) without a centralized authority, however, is difficult, which is just one of the many reasons the UK opted to drop out of this EU marriage.

Indeed, after Brexit, my prognosis for the future of the European Union was decidedly bad. I didn’t believe it would last for much longer.

COVID and Centralized EU Fiscal Policy: Salvation or Can-Kicking?

And then came COVID, which hit Italy and Spain particularly hard. Thereafter, the so-called open-border experiment of the EU ended abruptly in March and April, as every-nation-for-itself thinking kicked in along with medical supply hoarding and all-out cross-border finger pointing hit a new high.

In short, more bad news for the “bad marriage” that seemed to be the European Union.

But then something odd happened. I’ve seen it first hand in both the US and here in Europe, namely: One continent banded together to halt the viral spread and the other, well…didn’t.

As a result, and much to my admitted surprise, the EU is now recovering faster than the U.S.

Montaigne wrote that crisis makes a weak love weaker and a strong love stronger. Could it be, that after months of viral spreading, economic pain and social riots, the U.S. marriage is indeed weaker than that odd thing I once frowned upon called the European Union?

As a German-American in France, I spend lots of time in all three country-codes, and I can say that Europe’s largest two economies and exporters, Germany and France, suffered greatly during the opening phase of the viral shut-downs on this side of the Atlantic Ocean.

Both Merkel and Macron then stepped up the shutdown measures and laws in ways the US Congress and nation refused (rightly or wrongly, depending on your politics) to do.

Such dramatic and swift EU policy measures kept Italy from divorcing the EU—at least for now.

The EU even stepped in to give more help to Greece.

In short, the fate of the EU “family” was at stake, and the French and German leadership, whatever you think of it, was and is desperate to keep that family together.

But will they succeed?

The Future of the EU Economy and Experiment—Nothing a Little More Debt Can’t Buy

I think the jury is still out on the long-term future of the EU. Deep down, not many French or Germans I speak to, be they on fricking polo ponies or apple farms, want to keep paying for their Spanish and Italian family members.

But if the economically broken and debt-soaked Mediterranean countries like Spain and Italy were to ever leave the EU, their currencies would tank and the Euro would spike—which would be devastating to a country like Germany, which relies on exports for 50% of its economic strength.

In short, and whatever Germans, Frenchie’s or Americans think or say, the leaders behind the EU economy clearly see the European Union as an absolute economic necessity.

This explains the rapid speed by which France and Germany helped push through the recent pan-European finance plan, which finally granted the EU economy its own centralized fiscal policy (i.e. the ability to deficit spend and add more debt to the $10.7 trillion mountain upon which it currently stands).

Up until the COVID crisis, Germany and other north European countries would have never agreed to a centralized fiscal policy—yet now COVID has given the EU policy makers the green light–and more grease for conspiracy theorists who argue that COVID has been a well-timed Trojan Horse to sneak in more centralized control over European citizens…

Whatever your opinions on that note, one note that we can all agree upon is that the EU (with the consent of 27 nations) just added $750 billion in the form of debt and printed currency to act as a new care package for the EU economy.

If You Can’t Love Em, Bribe Em

Much of this magical money will go toward the poorer member states of the EU economy, which had hitherto seen the largest presence of populist, anti-EU sentiment.

Hey, if you can’t love em, why not bribe em to stay? I’ve seen more than one marriage or relationship hinge on such subtle “influences” …

In short, it might be that that the recent “stimulus” package just bought the EU economy and experiment a few more years of (love) life.

But here’s the rub, any marriage or union based on money tends to die when that money runs out. Aint true love grand?

Will a Centralized EU Fiscal Policy Save the EU Economy?

Well, as you can imagine, the EU economy will now continue to run off the same wretched play book used by the US—namely issue bonds (i.e. debt) like there’s no tomorrow, print money to pay that debt, and then declare a victorious “recovery.”

In short, get ready to see EU debt levels sky rocket.

Front-Running the EU Economy

But even for cynics like me, there’s always a temporary silver lining, as I see a fat pitch ahead—aka a “front run” aka a “spread trade.”

That is, given that markets no longer trade on fundamentals but just debt and “stimulus,” it goes without saying that the recent debt-stimulus announced here in the EU is likely gonna be a temporary tailwind for EU assets vs US assets.

In short, in order to profit today, forget things like earnings and balance sheets—just follow the stimulus. Go long the winners, short the losers.

And when it comes to COVID data, government “stimulus” and even pathetic GDP growth, the EU, at least for now, is emerging as the winner—or best glue horse…

There’s definitely more economic activity (and even polo matches) here in Europe than in the US, where shutdowns are increasing rather than declining, –again: At least for now.

Furthermore, the EU economy is not heading toward a stormy November election, the results of which are going to piss off ½ of the population (and markets) regardless of who wins the White House.

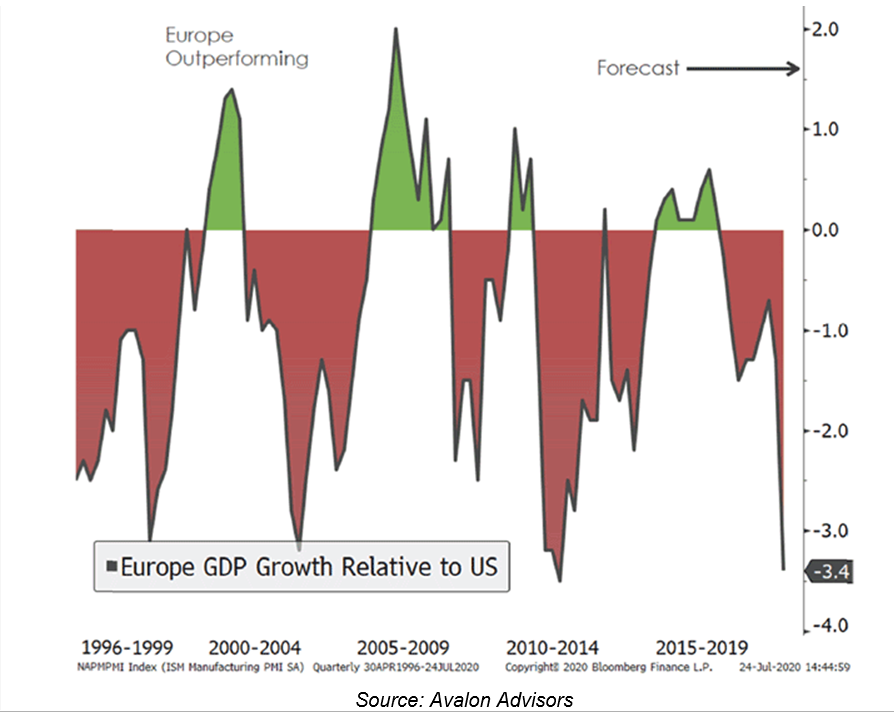

For now, and despite GDP growth projections in the US which are all over the map after the recent (and disastrous) Q2 GDP print, one thing is certain: Eurozone GDP is clearly outpacing Uncle Sam’s:

Equally obvious, however, is how the euro outpaces the US dollar whenever its GDP outpaces ours—another front-run idea for you currency traders out there.

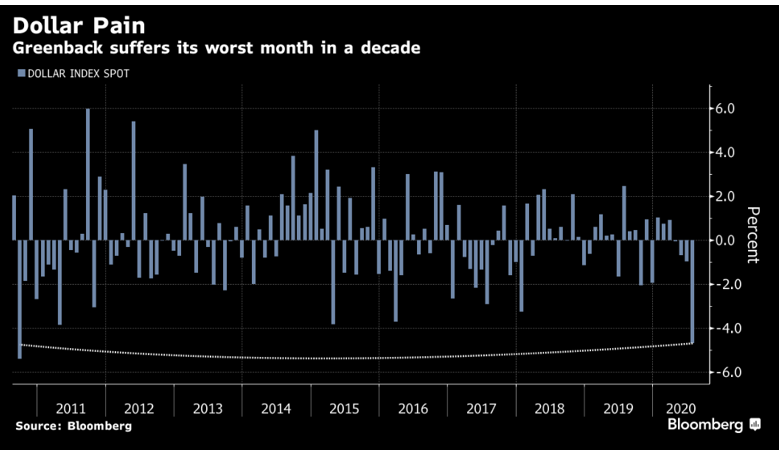

This might explain why the dollar has dropped considerably in recent days vis-à-vis the euro, a trend likely to continue as the Fed commits to zero percent interest rates, which when adjusted for inflation, are negative, as in the EU.

Dollar Down…

Euro Up…

U.S. Bulls, of course, will welcome a weaker dollar, as it makes our exports cheaper and hence more competitive, something our exporters desperately need.

But folks, as always, let’s keep all this complexity simple-stupid. The bottom-line is the same for the EU as it is for the U.S.: The only real solution going forward is more debt and more money printing, be it dollars or euros.

More currency creation, by simple logic, also means more currency dilution over time, which alas, just means more reasons to consider gold and silver as long-term fire insurance on a global currency market that is slowly and already burning to the ground…

For more detail on such strategies, trades, allocations and market opportunities, there’s a heck of lot more to see for those who subscribe to our back-end portal. If any of the foregoing raises an eyebrow, join us by clicking here.

In the meantime, stay informed, stay safe and stick to the signals not the headlines.

Sincerely, Matt and Tom